- Home

- »

- Processed & Frozen Foods

- »

-

Umami Flavors Market Size & Share, Industry Report, 2030GVR Report cover

![Umami Flavors Market Size, Share & Trends Report]()

Umami Flavors Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Natural, Synthetic), By Source (Mushroom, Glutamates, Inosinates), By Product (Product, Liquid, Paste), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-404-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Umami Flavors Market Summary

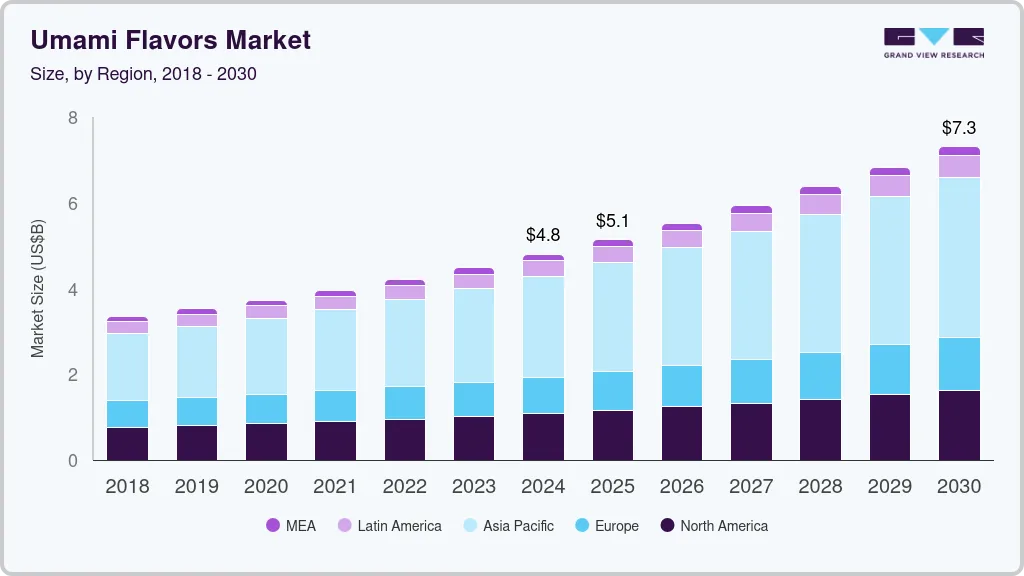

The global umami flavors market size was estimated at USD 4.79 billion in 2024 and is projected to reach USD 7.30 billion by 2030, growing at a CAGR of 7.3% from 2025 to 2030. The demand for umami flavors is on the rise, driven by a combination of health and wellness trends.

Key Market Trends & Insights

- Asia Pacific umami flavors market dominated the global market with the largest revenue share of 39.9% in 2024.

- Based on source, the glutamates segment led the market with the largest revenue share of 31.8% in 2024.

- Based on product, the powdered segment led the market with the largest revenue share of 50.9% in 2024.

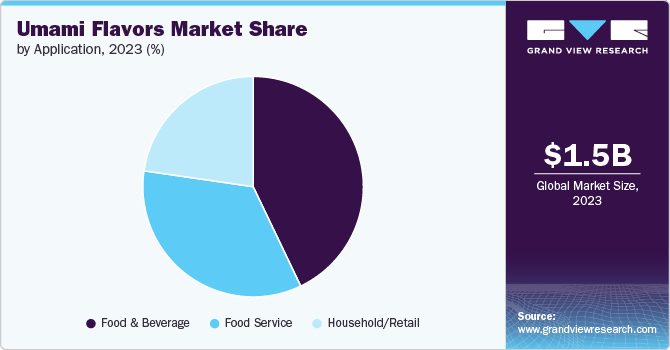

- Based on application, the food & beverages segment led the market with the largest revenue share of 91.2% in 2024

Market Size & Forecast

- 2024 Market Size: USD 4.79 Billion

- 2030 Projected Market Size: USD 7.30 Bllion

- CAGR (2025-2030): 7.3%

- Asia Pacific: Largest market in 2024

Consumers today are more health-conscious, seeking natural flavor enhancers over artificial additives. Umami flavors, often derived from natural sources like mushrooms, tomatoes, seaweed, and fermented products, fit well with this preference. In addition, these umami-rich ingredients offer nutritional benefits, providing essential nutrients and antioxidants, which further boosts their appeal.Culinary innovation and the globalization of food culture are also key factors. The widespread popularity of Asian cuisines, rich in umami flavors, has introduced more people to dishes like sushi, ramen, and miso soup. The rise of gourmet cooking at home and the influence of cooking shows and food blogs have increased awareness and appreciation for umami flavors. Home cooks are now more willing to experiment with new flavors and ingredients, incorporating umami into their culinary repertoire.

In the food industry, product innovation plays a significant role in increasing umami flavor consumption. Food manufacturers are incorporating umami into a wide range of products, including snacks, sauces, and ready-to-eat meals, to enhance taste and appeal. This meets consumer demand for more flavorful and satisfying foods. In addition, the clean label movement, emphasizing transparency in food ingredients, has led consumers to prefer natural umami sources over synthetic additives.

The sensory appeal of umami flavors is another driving force. Umami enhances the overall taste of foods, making them more palatable and satisfying. This flavor profile is particularly appealing in savory foods and can reduce the need for excessive salt and fat, making products healthier. Umami flavors also increase the feeling of satiety and satisfaction, which can help with portion control and reduce overeating, aligning with the goals of health-conscious consumers.

Market dynamics, including the growing middle-class population and urbanization, further boost demand. The rising middle class, particularly in developing regions, leads to increased consumption of processed and convenience foods that utilize umami for taste enhancement. Busy lifestyles and urbanization drive demand for convenient, ready-to-eat, and ready-to-cook meals, where umami flavors ensure these products are flavorful and appealing despite being processed.

Cultural and regional preferences play a crucial role in the umami flavors industry. In regions like Asia, umami has always been a central flavor in traditional cuisines. As these culinary practices gain global popularity, the demand for umami flavors follows. The rise of ethnic and fusion foods blending different culinary traditions often incorporates umami-rich ingredients, further boosting their demand. These factors collectively contribute to the growing demand for umami flavors, reflecting broader trends in health, culinary innovation, market dynamics, and cultural preferences.

Type Insights

Based on type, the synthetic flavors segment led the market with the largest revenue share of 61.2% in 2024. The synthetic umami flavor industry is significantly influenced by the growing consumer demand for enhanced and unique flavor experiences. As consumers increasingly explore diverse culinary options, they are drawn to indulgent and savory taste profiles, particularly those that offer a rich umami experience. This trend aligns with the increased consumer demand for flavorful meals that do not rely heavily on unhealthy additives like excessive salt or fat. Umami flavors are particularly appealing in this context, as they can enhance the palatability and satisfaction of foods while potentially reducing the need for less healthy ingredients.

The natural flavors segment is expected to grow at the fastest CAGR of 8.7% from 2025 to 2030. The market is being driven by several key factors. Primarily, there is a growing consumer demand for clean-label products, i.e., foods and beverages that are free from artificial additives and preservatives. Natural umami flavors, derived from sources like mushrooms, seaweed, tomatoes, and soy, align with this trend as they offer a way to enhance taste naturally without the need for synthetic ingredients. This demand is particularly strong among health-conscious consumers who are looking for foods that are both flavorful and perceived as healthier.

Source Insights

Based on source, the glutamates segment led the market with the largest revenue share of 31.8% in 2024.One of the primary drivers is the increasing demand for convenience foods and ready-to-eat (RTE) meals. Consumers are increasingly seeking quick and easy meal options, leading to a rise in the consumption of processed foods that often utilize glutamates to enhance flavor. Glutamates, particularly monosodium glutamate (MSG), are known for their ability to intensify umami flavors, making them a preferred choice in various culinary applications, including soups, sauces, and snacks. This trend is particularly pronounced in regions like Asia Pacific, where traditional dishes often integrate glutamates to achieve authentic flavors.

The mushrooms segment is expected to grow at the fastest CAGR of 9.2% from 2025 to 2030. The market for mushrooms as a source in the global market is experiencing significant growth due to a combination of health, culinary, and sustainability factors. Mushrooms have long been valued in traditional medicine, particularly in Umami practices, for their various health benefits. They are rich in bioactive compounds, such as polysaccharides, proteins, and antioxidants, which are believed to enhance immune function, reduce inflammation, and promote overall well-being. As consumers increasingly seek natural and functional foods, the integration of mushrooms into Umami flavors aligns with a broader trend toward wellness-focused eating.

Product Insights

The powdered segment led the market with the largest revenue share of 50.9% in 2024. Powder umami flavors come in several variants, as they are made from various umami-rich foods. Examples include Porcini Mushroom Powder, Tamari Soy Sauce Powder, Fish Sauce Powder, Tomato Flakes, Tomato Powder, Organic Red Miso Powder, and Organic White Miso Powder. The convenience and shelf stability of powdered umami flavors makes them attractive to both home cooks and food manufacturers. Powders are easy to store, have a long shelf life, and can be incorporated into a variety of recipes, from soups and sauces to snacks and seasonings. This adaptability makes them a valuable ingredient in both domestic kitchens and commercial food production.

The paste segment is expected to grow at the fastest CAGR of 6.2% from 2025 to 2030. Umami paste is favored for its convenience and ability to add rich, complex flavors quickly, appealing to consumers with busy lifestyles seeking flavorful, easy meal solutions. Recognized as the fifth taste, umami enhances dishes across cuisines, from marinades to sauces, boosting the flavor of both meat and plant-based dishes. Its versatility and bold taste make it popular among chefs and home cooks, positioning it as a staple in global kitchens.

Application Insights

Based on application, the food & beverages segment led the market with the largest revenue share of 91.2% in 2024. Umami, often described as the "fifth taste," enhances the overall taste profile of snacks, making them more appealing. This flavor is particularly sought after in savory snacks, where it can provide a rich, mouthwatering experience that enhances the product's taste. One of its key drivers is the increasing consumer demand for more flavorful and satisfying food experiences. As consumers become more adventurous with their taste preferences, they are actively seeking snacks that offer unique and indulgent flavor experiences, with umami flavors at the forefront of this trend. Culinary innovation and the globalization of food culture have also contributed to the rise of umami in snacks. The popularity of Asian cuisines, which are rich in umami flavors, has introduced many consumers to dishes with this taste, such as sushi and ramen.

The pet food & supplements segment is expected to grow at the fastest CAGR of 8.3% from 2025 to 2030. Pets can taste umami, and both dogs and cats have the ability to perceive this savory flavor. Dogs possess taste receptors similar to humans that allow them to detect umami. Although dogs have fewer taste buds-around 1,700 compared to humans' 9,000-they can still appreciate umami flavors, which are often associated with protein-rich foods like meat and fish. Observations from dog owners suggest that dogs show heightened interest in umami-rich foods, such as meaty treats and broths, indicating a potential preference for this flavor profile.

In June 2024, Friends & Family Pet Food Co partnered with UMAMI Bioworks to develop cultivated fish cat treats, which are designed to be high in protein and provide a rich umami flavor. These treats are part of a sustainable approach to pet nutrition, aiming to reduce reliance on traditional fishing methods while enhancing pet health and nutrition.

Regional Insights

The umami flavors market in North America is expected to grow at the fastest CAGR of 7.0% from 2025 to 2030. Consumers are increasingly seeking healthier meal options that don’t compromise on taste. Umami flavors, often derived from ingredients like mushrooms, tomatoes, or soy, add depth and richness without the need for added sugars or unhealthy fats, aligning well with health trends.As the interest in global cuisines grows, especially Asian dishes rich in umami (such as Japanese, Korean, and Thai), North American consumers are becoming more familiar with and inclined toward umami-rich ingredients and products.

U.S. Umami Flavors Market Trends

The umami flavors market in the U.S. is expected to grow at a significant CAGR during the forecast period. As more people adopt plant-based or flexitarian diets, umami flavors help enhance the taste of plant-based dishes, adding a savory depth that appeals to those missing the richness typically associated with meat-based dishes. Umami pastes and seasonings are convenient for adding bold flavors to dishes quickly, fitting well with Ameriliquid’s preference for quick, easy-to-prepare meals that don’t sacrifice taste.

Asia Pacific Umami Flavors Market Trends

Asia Pacific umami flavors market dominated the global market with the largest revenue share of 39.9% in 2024. Umami flavors have deep cultural roots in Asia Pacific cuisines, where ingredients like soy sauce, miso, and fermented fish have long been used to enhance taste. This foundational familiarity has led to a heightened appreciation and demand for new umami-based products that can add layers of flavor.As fusion and experimental cooking gain popularity, especially in urban areas, there is a rising demand for versatile ingredients like umami paste and seasonings that can be used across traditional and modern recipes, enhancing both regional and international dishes.

Europe Umami Flavors Market Trends

The umami flavors market in Europe is expected to grow at a significant CAGR of 6.5% during the forecast period. European consumers are increasingly exploring Asian and other international cuisines known for their umami-rich profiles. Ingredients like miso, soy sauce, and seaweed have become popular in European cooking, encouraging the use of umami flavors across various dishes.Health-conscious consumers in Europe are looking to reduce salt and sugar while retaining rich flavors in their meals. Umami flavor enhancers offer a natural way to achieve a savory taste, making them attractive for those aiming to eat healthier without compromising taste.

Key Umami Flavors Company Insights

The global market is characterized by numerous well-established and emerging players. Manufacturers in the global market are engaging in a variety of strategic initiatives to keep pace with evolving consumer demands and market trends.

Key Umami Flavors Companies:

The following are the leading companies in the umami flavors market. These companies collectively hold the largest market share and dictate industry trends.

- Givaudan

- Urban Platter

- Ajinomoto Co. Inc.

- Kerry Group plc

- Sensient Technologies Corporation

- Symega

- International Flavors & Fragrances Inc.

- The MANE Group

- Jeneil Biotech Pvt. Ltd.

- Keva Flavours

Recent Developments

-

In June 2024, Lesaffre fortified its position in the savory ingredients market through the acquisition of DSM-Firmenich’s yeast extract business, which will boost the demand for umami flavors. The acquisition is expected to propel Lesaffre’s growth in the savory ingredients sector, further enhancing its offerings and capabilities.

-

In February 2024, Japan Airlines (JAL) took a significant step in enhancing its in-flight dining experience by introducing a pioneering vegetarian meal developed in collaboration with Finnair Kitchen and the Finnish FoodTech company BioMush. The new offering is a Soyless Umami Sauce-based yuzu dressing, crafted entirely from natural ingredients sourced from the food industry’s side-stream.

-

In October 2023, T. Hasegawa U.S.A. introduced its "Flavor Flash" line, featuring new product developments in trending snacks and bowls with Asian influences. This release highlighted the growing popularity of umami ingredients, such as sesame, fish sauce, seaweed, and shiitake.

Umami Flavors Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.14 billion

Revenue forecast in 2030

USD 7.30 billion

Growth rate

CAGR of 7.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, source, product, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; Argentina; & South Africa

Key companies profiled

Givaudan; Urban Platter; Ajinomoto Co. Inc.; Kerry Group plc; Sensient Technologies Corporation; Symega; International Flavors & Fragrances Inc.; The MANE Group; Jeneil Biotech Pvt. Ltd.; Keva Flavours

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Umami Flavors Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segments the global umami flavors market report based on the type, source, product, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural

-

Synthetic

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Mushroom

-

Glutamates

-

Inosinates

-

Guanylate

-

Vegetables (Excluding Mushroom) & Yeast

-

Animal Source

-

Fermented Products

-

Soy Sauce

-

Miso

-

Fish Sauce

-

Natto

-

Others

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder

-

Liquid

-

Paste

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Snacks

-

Dairy Products

-

Bakery & Confectionery

-

Sauces

-

Condiments

-

Ready-to-Eat Food Preparations

-

Beverages

-

Others

-

-

Pet Food & Supplements

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global umami flavors market size was estimated at USD 4.79 billion in 2024 and is expected to reach USD 5.14 billion in 2025.

b. The global umami flavors market is expected to grow at a compounded growth rate of 7.3% from 2025 to 2030 to reach USD 7.30 billion by 2030.

b. Umami paste are preferred for their ease of use and ability to impart deep flavor quickly. Consumers with busy lifestyles prefer pre-made pastes as they provide a practical solution for enhancing dishes without extensive preparation time. This convenience aligns with the increasing demand for quick yet flavorful meal solutions.

b. Some key players operating in umami flavors market include Givaudan, Urban Platter, Ajinomoto Co. Inc., Kerry Group plc, Sensient Technologies Corporation, Symega, and others.

b. Key factors that are driving the market growth include rising umami flavor consumption and increasing health consciousness among consumers

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.