- Home

- »

- Next Generation Technologies

- »

-

Ultralight And Light Aircraft Market Size & Share Report, 2030GVR Report cover

![Ultralight And Light Aircraft Market Size, Share & Trends Report]()

Ultralight And Light Aircraft Market Size, Share & Trends Analysis Report By Platform (Light Aircraft, Ultralight Aircraft), By Operation (CTOL, VTOL), By System, By Technology, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-392-2

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Ultralight And Light Aircraft Market Trends

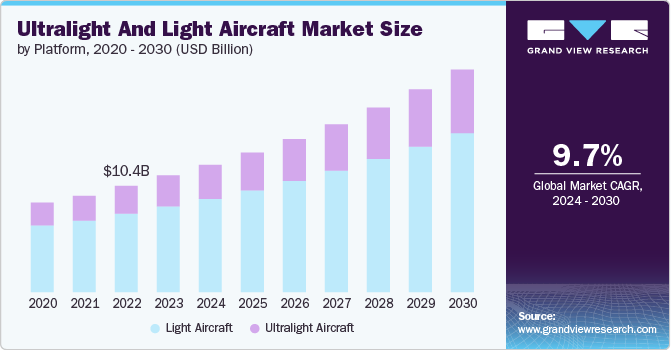

The global ultralight and light aircraft market size was estimated at USD 11.45 billion in 2023 and is expected to grow at a CAGR of 9.74% from 2024 to 2030. The growth is attributed to the increasing demand for ultralight and light aircraft in various applications expanding beyond recreational flying. They are used for training, sightseeing, and experience flights, contributing to their heightened demand. Besides, aircraft are used for various commercial purposes, including surveying, crop monitoring, aerial photography, etc. They are also being deployed for search and rescue, firefighting, and disaster relief, which offers a significant growth potential for the market in the coming years.

The growth of the ultralight and light aircraft market is being largely influenced by technological advancements in terms of improved materials and aerodynamics, providing safer, more efficient, and more comfortable features. Moreover, the integration of advanced avionics systems has enhanced flight safety and navigation capabilities, driving the demand for these aircraft. Besides, favorable regulatory scenarios pertaining to ultralight and light aircraft in various countries are accelerating the market growth.

The market benefits from the development and adoption of innovative aircraft designs. For instance, in June 2023, Honda Aircraft Company, LLC announced to commercialization of its HondaJet 2600 concept light jet, which was launched at NBAA-BACE 2021. The aircraft is equipped with a Garmin G3000 avionics suite and two Williams International FJ44-4C turbofans that share the company’s original over-the-wing engine-mount design. Such developments are positively influencing the market.

A considerable rise in defense expenditures and modernization of aircraft fleets with advanced capabilities across several countries is creating lucrative growth avenues for the market. For instance, in July 2024, Embraer Group delivered six light attack aircraft A-29 Super Tucano to the Paraguayan Air Force. This multi-mission aircraft provides versatility for armed reconnaissance, light attack, close air support, and advanced training missions, which exponentially increases the institutions' operational flexibility.

Market Concentration & Characteristics

The ultralight and light aircraft market is characterized by a high degree of innovation, driven by advancements in technology, catering to commercial, military, and private sectors. The ongoing expansion of commercial aviation coupled with increasing military expenditure on aircraft is instigating the demand for these aircraft.

The number of merger and acquisition (M&A) activities in the market is increasing with the growing inclination of market players toward strengthening their product portfolios, gaining greater market share, and expanding their customer base.

Regulations have a significant impact on the ultralight and light aircraft market as they drive innovation, shape market trends, and influence the design and development of aircraft. Moreover, regulatory norms that promote fuel efficiency are stimulating the development of aircraft with optimized performance and reduced fuel consumption.

While ultralight and light aircraft have a niche market, they do face competition from various alternative modes of transportation and technology. For instance, drones can perform many tasks traditionally done by light aircraft, such as aerial photography and surveillance. However, the unique advantages of these aircraft, such as accessibility, affordability, and personal freedom, continue to drive demand in specific market segments.

The market for ultralight and light aircraft has a significant end user concentration. While the market is characterized by a large number of individual owners, the rising popularity of flight training, commercial applications, and increasing military capabilities is gradually leading to consolidation among end users.

Platform Insights

The light aircraft segment accounted for the largest revenue share of more than 73.0% in 2023 and is estimated to witness considerable growth in the coming years owing to increasing demand for these aircraft for a wider range of purposes, such as business travel, flight training, aerial work, and private use. In addition, these aircraft typically have a longer range, making them suitable for longer distances. Moreover, improvements in avionics and navigation systems enhance safety and efficiency. Innovations in materials, such as carbon fiber composites, have made aircraft lighter and more robust which is driving their demand and contributing to segmental growth.

The ultralight aircraft segment is expected to record the fastest CAGR of over 9.0% from 2024 to 2030. The growth is ascribed to growing interest in using light aircraft for urban air transportation amid increasing traffic congestion in various cities. These aircraft can provide efficient point-to-point travel within cities. Besides, ultralight aircraft are finding practical applications beyond recreational flying to be used for aerial surveillance, agricultural operations, wildlife conservation, emergency medical services, etc. Their ability to access remote areas and operate from short runways makes them versatile, leading to increased demand.

Operation Insights

The CTOL segment accounted for the largest revenue share of more than 50.0% in 2023. Conventional Take-Off and Landing (CTOL) aircraft are designed to operate from existing airports and airstrips, providing wider accessibility. The availability of a well-established infrastructure for maintenance, repair, and overhaul supports application of CTOL aircraft in general and commercial aviation. Furthermore, these aircraft can be used for a wide range of purposes, such as private use, flight training, and commercial applications, which increases reference for them and further fuels segmental growth.

The VTOL segment is expected to record the fastest CAGR of over 9.0% from 2024 to 2030. The growing significance of urban air mobility solutions is expected to role the demand for vertical takeoff and landing (VTOL) aircraft. As cities explore air taxis and short-distance urban flights, the demand for VTOL platforms is likely to witness increased demand due to their ability to take off and land vertically, making them suitable for congested urban areas. The segment is expected to grow significantly in the coming years as these aircraft are part of the aviation industry’s efforts to reduce environmental impact. Electric and hybrid-electric VTOLs emit fewer pollutants, aligning with sustainability goals.

System Insights

The engine segment accounted for largest revenue share in 2023. Increasing focus of airlines to deploy engines with higher fuel efficiency and reduced weight to enhance overall aircraft performance and reduce operating costs is favoring the segmental growth. Manufacturers are developing advanced engines, including electric or hybrid options, to meet these demands. The considerable rise in the demand for commercial airline fleet and increasing investment in defense aircraft is creating substantial demand for fuel efficient engines, thereby expediting the market expansion.

The avionics segment is expected to record the fastest CAGR from 2024 to 2030. Modern aircraft increasingly incorporate advanced avionics systems. These systems enhance safety, navigation, and performance. As avionics evolves, manufacturers integrate them into new aircraft models, driving segmental growth. Moreover, the rising demand for commercial aircraft is also contributing to the segmental growth as avionics play a crucial role in ensuring efficient operations, passenger safety, and compliance with regulations.

Technology Insights

The manned segment accounted for largest revenue share in 2023. While unmanned aircraft technology is advancing rapidly, pilot-based light aircraft continue to hold a significant market share. Manned aircraft are essential for pilot training. Aspiring aviators learn to fly on these aircraft, gaining experience and certifications. Besides, pilots can adapt to changing conditions and adjust flight plans accordingly, and can make complex decisions based on experience and situational awareness. These factors are largely contributing to the manned technology and providing positive growth prospects for the segment.

The unmanned segment is expected to record the fastest CAGR from 2024 to 2030. These aircraft are designed for specific tasks and can follow predefined flight paths, capture high-resolution imagery, and perform repetitive actions consistently which is expected to drive their demand in the coming years. Moreover, they offer higher potential for military applications as they provide intelligence, surveillance, reconnaissance, and even combat capabilities, essential for modern warfare. In addition, unmanned aircraft can operate in hazardous environments without risking human lives, which expands their applications and is expected to create significant growth opportunities for the market in the coming years.

End-use Insights

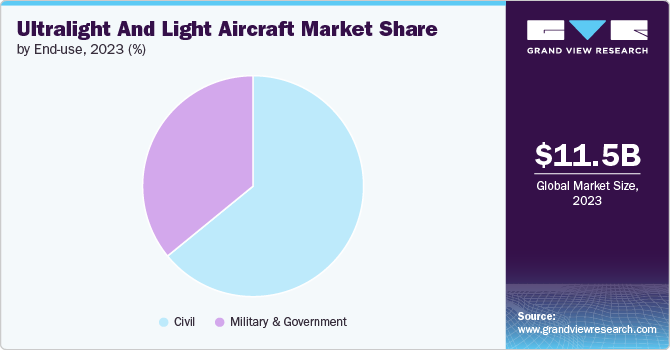

The commercial aviation segment accounted for largest revenue share in 2023. Ultralight and light aircraft are witnessing increased demand applications like crop monitoring, spraying, and aerial seeding. Moreover, they are also being employed for land surveying, mapping, and infrastructure inspection. In addition, these aircraft are used for sightseeing and aerial tours, especially in regions with scenic landscapes. The increasing number of commercial applications of these aircraft is accelerating segmental growth.

The military aviation segment is expected to record a notable CAGR from 2024 to 2030. The growth is credited to the increasing usage of ultralight and light aircraft in military operations. These aircraft offer several advantages such as low operating costs, versatility, and ease of deployment. Moreover, they are being employed for tasks such as surveillance, reconnaissance, and border patrol. In addition, the production and deployment of light combat aircraft in defense forces across various countries is further fueling the segmental growth.

Regional Insights

The ultralight and light aircraft market in North America accounted for the largest revenue share, around 36.0%, in 2023 owing to the robust commercial aviation industry in the region, with airlines constantly expanding their fleets. In addition, the presence of a strong aerospace industry in the region, with the availability of major aircraft manufacturers, is further contributing to the market growth. Moreover, increasing demand for these aircraft among military and government agencies for training, surveillance, and other purposes is enhancing the market outlook.

U.S. Ultralight And Light Aircraft Market Trends

The U.S. ultralight and light aircraft market is estimated to witness a considerable growth rate of nearly 9.0% from 2024 to 2030, with the mature commercial aviation sector creating significant demand for these aircraft.

Asia Pacific Ultralight And Light Aircraft Market Trends

The ultralight and light aircraft market in Asia Pacific is expected to record its highest growth rate of over 8% from 2024 to 2030. The ongoing expansion of the aviation sector amid government initiatives to improve infrastructure, including airstrips and flying clubs, is driving the market growth. Furthermore, increasing investment in the defense sector and military aircraft in the region is also providing ample growth opportunities for the regional market.

The ultralight and light aircraft market in India is estimated to record a notable CAGR from 2024 to 2030. The country offers potential for agriculture aircraft that can be used for crop monitoring, pest control, and aerial seeding.

The China ultralight and light aircraft market held a significant revenue share in 2023. The government has prioritized the development of the aerospace industry and the required infrastructure which is supporting the manufacturing of ultralight and light aircraft in the country.

The ultralight and light aircraft market in Japan is expected to witness a significant growth rate from 2024 to 2030 due to growing government investment in military aircraft fleets to strengthen defense capabilities.

Europe Ultralight And Light Aircraft Market Trends

The ultralight and light aircraft market in Europe accounted for a significant revenue share in 2023 and is expected to witness notable growth over the coming years. The demand for faster and more flexible travel options has led to an increase in business aviation, including light aircraft. Besides, Europe has been at the forefront of sustainability, which has led to increased interest in electric and hybrid aircraft within this segment. The market growth is being further driven by the development of airport infrastructure and air traffic management systems in the region.

The ultralight and light aircraft market in the UK accounted for a sizeable revenue share in 2023. The growth of business aviation has led to increased demand for smaller aircraft for executive travel and charter services, which is offering lucrative opportunities for the market.

The Germany ultralight and light aircraft market is estimated to record a considerable growth rate from 2024 to 2030. Germany is a major center for aircraft manufacturing and has an established network and supply chains for aerospace industry.

Middle East & Africa (MEA) Ultralight And Light Aircraft Market Trends

The ultralight and light aircraft market in the Middle East and Africa (MEA) is estimated to register a notable CAGR from 2024 to 2030.Investments in airports and aviation infrastructure are favoring market growth. Moreover, investments in aviation infrastructure, including airports and airfields, are also creating significant demand for these aircraft in the region. Increasing military expenditures in the region to strengthen defense capabilities is also contributing to the growth of the regional market.

The ultralight and light aircraft market in Saudi Arabia accounted for a notable revenue share in 2023 owing to increasing product demand driven by the heightened popularity of recreational flying in the country.

Key Ultralight And Light Aircraft Company Insights

Some of the key players operating in the market include Textron Aviation Inc.; Bombardier Inc.; and Embraer Group.

-

Textron Aviation Inc. is dedicated to designing and manufacturing a wide range of aircraft solutions. It offers Beechcraft King Air, Citation business jets, Cessna Caravan turboprops, Beechcraft, and Cessna piston-engine aircraft. The company has a wide range of products and an efficient service network, delivering brands including Bell, Beechcraft, Cessna, Pipistrel, Kautex, Jacobsen, Lycoming, Arctic Cat, E-Z-GO, TRU Simulation, and Textron Systems.

-

Embraer Group is a global aerospace company manufacturing aircraft for Commercial and Executive, Agricultural, and Defense & Security sectors. In addition, the company offers after-sales services through its global network of authorized agents and wholly owned entities. It has offices, industrial units, service and parts distribution centers across Europe, Americas, Asia, and Africa.

-

Bombardier Inc. designs and manufactures business aircraft with cutting-edge cabin design, reliability, and performance. The company has a global fleet of over 5,000 aircraft, with a wide variety of multinational corporations, governments and private individuals, charter and fractional ownership providers. It is steadily expanding its defense portfolio through the development of a diverse portfolio of specialized aircraft platforms.

Piper Aircraft, Inc.; Air Tractor Inc.; and Aviation Partners, Inc. are some of the emerging market participants.

-

Piper Aircraft Inc. offers efficient and reliable single and twin-engine aircraft and is the Garmin Emergency Autoland certified general aviation aircraft manufacturer. The company delivers single-engine M-Class series - the M700 FURY, M350, and M500 to businesses and individuals. It offers an advanced range of pilot training aircraft, such as Trainer Class Pilot 100i, Archer DX, Archer TX, and Seminole. Its Personal Class provides Archer LX and Archer DLX offers efficiency, simplicity, and performance in a piston-powered aircraft.

-

Aviation Partners, Inc. designs and manufactures advanced-technology winglet systems. The company formed a joint venture with Boeing to offer the latter with Blended Winglets for its 737NG airliners as well as the Boeing 737 classic, 767-300ER aircraft, and 757. Most recently, the company delivered the Split Scimitar Winglet for the 737NG.

Key Ultralight And Light Aircraft Companies:

The following are the leading companies in the ultralight and light aircraft market. These companies collectively hold the largest market share and dictate industry trends.

- Textron Aviation Inc.

- Bombardier Inc.

- Cirrus Design Corporation

- Piper Aircraft, Inc.

- Pilatus Aircraft Ltd

- Lancair Aerospace

- Vulcanair S.p.A.

- Honda Aircraft Company, LLC

- Advanced Tactics Inc

- Embraer Group

- Evektor Aerotechnik

- Air Tractor Inc.

- Flight Design General Aviation GmbH

- Pipistrel D.O.O

- Aviation Partners, Inc.

Recent Developments

-

In May 2024, Embraer Group, Groupe ADP, and Eve Air Mobility signed a memorandum of understanding aimed at innovation and sustainable development to enable low-carbon aviation in and around the Airport of Paris-Le-Bourget. This initiative will optimize and strengthen Embraer Group’s operations and its facility at the airport, one of the prominent business aviation airports in Europe.

-

In March 2024, Pipistrel D.O.O extended its global presence in Mexico with its collaboration with Wulf Aviation, which will be responsible for the sales and distribution of the former’s wide range of light, ultralight sport and type-certified aircraft in the country. As a part of this deal, Wulf Aviation placed an initial order for a 2-seat EASA certified plane Pipistrel Explorer to operate as a demonstration aircraft.

-

In January 2024, Cirrus Design Corporation launched SR Series G7, the latest single-engine piston aircraft featuring large high-resolution displays, touchscreen interfaces, advanced safety systems, increased legroom, improved visibility, and enhanced convenience. It comes with the Cirrus IQ mobile app to provide access to real-time health and readiness of the aircraft to enable faster and safer travel.

Ultralight And Light Aircraft Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.52 billion

Revenue forecast in 2030

USD 21.86 billion

Growth rate

CAGR of 9.74% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, operation, system, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Textron Aviation Inc.; Bombardier Inc.; Cirrus Design Corporation; Piper Aircraft, Inc.; Pilatus Aircraft Ltd; Lancair Aerospace; Vulcanair S.p.A.; Honda Aircraft Company, LLC; Advanced Tactics Inc; Embraer Group; Evektor Aerotechnik; Air Tractor Inc.; Flight Design General Aviation GmbH; Pipistrel D.O.O; Aviation Partners, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ultralight And Light Aircraft Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global ultralight and light aircraft market report based on platform, operation, system, technology, end- use, and region.

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Light Aircraft

-

Ultralight Aircraft

-

-

Operation Outlook (Revenue, USD Million, 2018 - 2030)

-

CTOL

-

VTOL

-

-

System Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerostructures

-

Avionics

-

Engine

-

Cabin Interiors

-

Landing Gear

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Manned

-

Unmanned

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Civil

-

Military & Government

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ultralight and light aircraft market is expected to grow at a compound annual growth rate of 9.7% from 2024 to 2030 to reach USD 21.86 billion by 2030.

b. The North America region dominated the industry with a revenue share of 36.2% in 2023. This can be attributed to the presence of a strong aerospace industry in the region with the availability of major aircraft manufacturers.

b. Some key players operating in the ultralight and light aircraft market include Textron Aviation Inc., Bombardier Inc., Cirrus Design Corporation, Piper Aircraft, Inc., Pilatus Aircraft Ltd, Lancair Aerospace, Vulcanair S.p.A., Honda Aircraft Company, LLC, Advanced Tactics Inc, Embraer Group, Evektor Aerotechnik, Air Tractor Inc., Flight Design General Aviation GmbH, Pipistrel D.O.O, and Aviation Partners, Inc.

b. Key factors that are driving ultralight and light aircraft market growth include increasing applications such as training, sightseeing, and experience flights as well as various commercial purposes, including surveying, crop monitoring, aerial photography, etc.

b. The global ultralight and light aircraft market size was estimated at USD 11.45 billion in 2023 and is expected to reach USD 12.52 billion in 2024.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."