- Home

- »

- Next Generation Technologies

- »

-

Ultrafast Laser Market Size, Share & Trends Report, 2030GVR Report cover

![Ultrafast Laser Market Size, Share & Trends Report]()

Ultrafast Laser Market (2024 - 2030) Size, Share & Trends Analysis Report By Laser Type (Fiber, Solid-State), By Pulse Duration (Picosecond Lasers, Femtosecond Lasers), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-480-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ultrafast Laser Market Summary

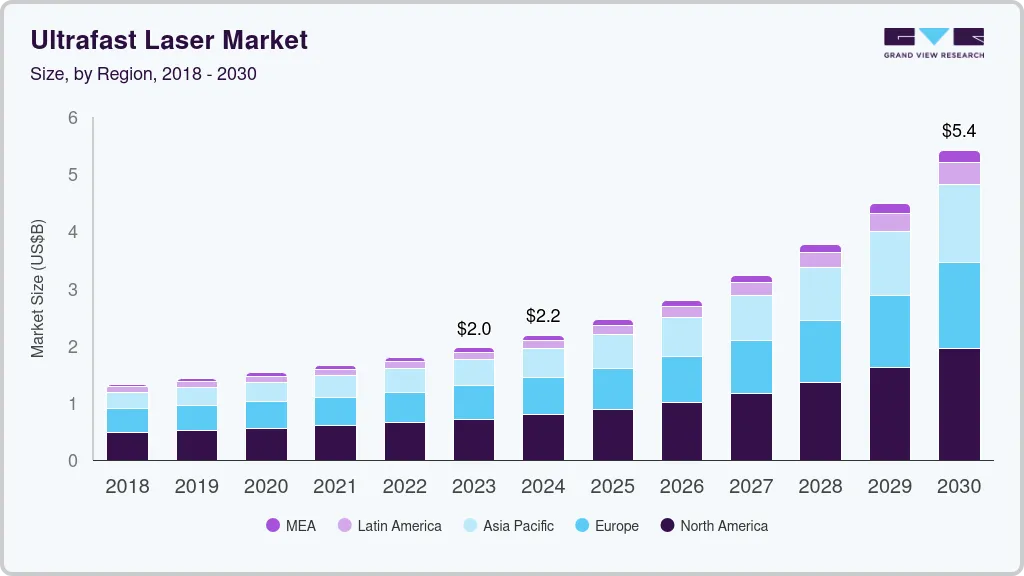

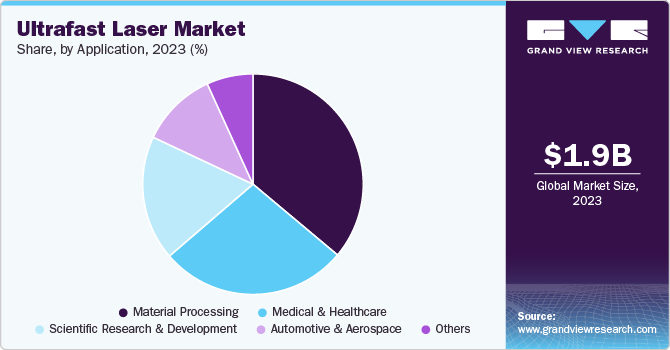

The global ultrafast laser market size was estimated at USD 1,963.6 million in 2023 and is projected to reach USD 5,419.7 million by 2030, growing at a CAGR of 16.4% from 2024 to 2030. The increasing demand for medical and healthcare applications drives market growth.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- In terms of segment, fiber lasers accounted for a revenue of USD 1,963.6 million in 2023.

- Fiber Lasers is the most lucrative laser type segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 1,963.6 Million

- 2030 Projected Market Size: USD 5,419.7 Million

- CAGR (2024-2030): 16.4%

- North America: Largest market in 2023

Ultrafast lasers, particularly femtosecond lasers, are crucial in precision medical procedures, such as LASIK eye surgery, where their short pulse durations allow for highly accurate and minimally invasive treatments. These lasers are also gaining traction in dermatological applications, tissue surgery, and biomedical imaging.

Moreover, the growing need for high precision in material processing fuels market growth. Industries like electronics, semiconductors, and manufacturing increasingly rely on ultrafast lasers for micromachining, cutting, drilling, and surface structuring applications. Ultrafast lasers' capability to process a wide range of materials, including metals, glass, and ceramics, with extreme precision and minimal heat-affected zones makes them ideal for industries that require delicate and accurate work. As industries aim to improve product quality and reduce waste, ultrafast lasers are becoming indispensable in manufacturing.

The increasing adoption of ultrafast lasers in the automotive and aerospace sectors drives the market's growth. These lasers' precision and efficiency make them ideal for producing lightweight components, essential for improving fuel efficiency and performance in vehicles and aircraft. In addition, ultrafast lasers are used for marking, engraving, and developing advanced sensors and electronic systems within these industries. As manufacturers prioritize high-precision production and the use of advanced materials, the adoption of ultrafast lasers is expected to grow rapidly.

The growing investments in scientific research and development drive the market's growth. Ultrafast lasers enable scientists to study atomic and molecular dynamics on incredibly short timescales, allowing breakthroughs in understanding complex physical processes. Government and private sector investments in research institutions and advanced laboratories have significantly increased demand for ultrafast lasers.

However, the high technical complexity and maintenance restrain the market's growth. Ultrafast laser systems are highly complex and require precise calibration and maintenance. The intricate technology and the need for specialized knowledge to operate and maintain these systems can deter potential users. Technical difficulties and the need for regular upkeep can lead to increased operational costs and downtime, impacting these lasers' overall efficiency and attractiveness.

Laser Type Insights

The fiber laser segment dominated the market in 2023 and accounted for a 42.2% share of global revenue. The segment's growth is driven by its superior beam quality and precision. Fiber lasers produce high-quality, near-diffraction-limited beams that enable precise cutting, engraving, and drilling. Their excellent focus ability makes them ideal for applications that demand extreme precision, such as micromachining, medical device manufacturing, and electronics fabrication.

The mode-locked laser segment is projected to grow significantly from 2024 to 2030. The increasing demand for ultrafast spectroscopy applications fuels market growth. This technique is vital for understanding chemical reactions, biological processes, and physical phenomena at the molecular level. As industries such as pharmaceuticals, biotechnology, and materials science invest in advanced analytical techniques, the use of ultrafast lasers in spectroscopy is increasing. The growing importance of ultrafast spectroscopy in academic research and commercial applications significantly drives the segment's growth.

Pulse Duration Insights

The femtosecond lasers segment dominated the market in 2023. Due to their ability to deliver high-precision results with minimal thermal damage, femtosecond lasers are increasingly utilized in industrial micromachining and material processing applications. Semiconductors, electronics, aerospace, and automotive industries use femtosecond lasers for delicate cutting, drilling, and engraving materials like glass, metals, and ceramics. These lasers are particularly valuable in microelectronics manufacturing, where precision and cleanliness are paramount.

The attosecond lasers segment is projected to grow significantly from 2024 to 2030. The growth of the photonics industry propels the growth of the segment. Attosecond pulses are used to study and develop new materials with unique optical properties. These lasers allow scientists to explore the interaction of light and matter at the quantum level, opening new possibilities for innovation in ultrafast signal processing, quantum computing, and optoelectronics.

Application Insights

Medical and healthcare dominated the market in 2023. Advancements in dermatology and cosmetic procedures fuel market growth. Ultrafast lasers are employed in skin resurfacing, wrinkle reduction, scar treatment, and tattoo removal due to their ability to precisely target tissues without causing excessive heat damage. Femtosecond lasers are used for photo rejuvenation and skin tightening treatments, offering patients effective results with minimal downtime.

The scientific research and development segment is projected to grow significantly from 2024 to 2030. The expanding application of spectroscopy drives market growth. Ultrafast lasers are widely employed in spectroscopy, particularly in time-resolved and pump-probe spectroscopy techniques. These lasers enable researchers to study the ultrafast dynamics of electrons, molecules, and chemical reactions, providing invaluable insights into the fundamental nature of materials and processes.

Regional Insights

The North American region held a significant share of the ultrafast laser market in 2023. Numerous world-class research institutions and universities in the region drive demand for ultrafast lasers, which are crucial for high-precision experiments and advanced scientific investigations. The continuous investment in R&D and the push for innovation fuel the growth of ultrafast lasers as researchers seek to explore new frontiers and develop cutting-edge technologies.

U.S. Ultrafast Lasers Market Trends

The ultrafast laser market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030. The shift towards precision medicine and personalized healthcare is significantly boosting the demand for ultrafast lasers in the U.S. Ultrafast lasers are increasingly used in high-resolution imaging, tissue ablation, and targeted drug delivery applications. The growing emphasis on customized medical treatments and the need for advanced medical devices contribute to the expanding use of ultrafast lasers in healthcare.

Europe Ultrafast Lasers Market Trends

The ultrafast laser market in Europe is expected to witness notable growth from 2024 to 2030. European governments and the European Union (EU) actively support advanced laser technologies research and development (R&D). The EU’s Horizon Europe program provides funding for science and technology innovation and includes initiatives promoting laser research.

Asia Pacific Ultrafast Lasers Market Trends

The ultrafast laser market in Asia Pacific held a significant share of 23.2% in 2023. The electronics and semiconductor industries in the Asia Pacific region are key contributors to the global economy. Countries like South Korea, Taiwan, and Japan dominate the global semiconductor market, and ultrafast lasers are increasingly used to produce microchips and electronic components. These lasers provide the high precision required for intricate microfabrication and wafer processing in semiconductor manufacturing.

Key Ultrafast Laser Company Insights

Key players in the ultrafast laser market include Coherent Corp, TRUMPF, IPG Photonics Corporation, Ekspla, Light Conversion, Clark-MXR, Inc., and Thales. To gain a competitive advantage over their rivals, companies focus on various strategic initiatives, including new product development, partnerships & collaborations, and agreements.

Key Ultrafast Laser Companies:

The following are the leading companies in the ultrafast laser market. These companies collectively hold the largest market share and dictate industry trends.

- Coherent Corp

- TRUMPF

- IPG Photonics Corporation

- NKT Photonics A/S

- Newport Corporation

- Amplitude Laser

- Ekspla

- Light Conversion

- Clark-MXR, Inc

- Thales

Recent Developments

-

In June 2023, Edmund Optics partnered with Chromacity to introduce a new line of ultrafast laser systems, significantly enhancing the capabilities available for photonics applications. This collaboration aims to provide researchers and engineers access to simple, compact, high-performance laser systems essential for various applications, including medical diagnostics, scientific research, and industrial processes.

Ultrafast Laser Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.18 billion

Revenue forecast in 2030

USD 5.42 billion

Growth rate

CAGR of 16.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Laser type, pulse duration, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Coherent Corp; TRUMPF; IPG Photonics Corporation; NKT Photonics A/S; Newport Corporation; Amplitude Laser; Ekspla; Light Conversion; Clark-MXR, Inc; Thales

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ultrafast Laser Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ultrafast laser market based on laser type, pulse duration, application, application, and region:

-

Laser Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fiber Lasers

-

Solid-State Lasers

-

Mode-Locked Lasers

-

Others

-

-

Pulse Duration Outlook (Revenue, USD Million, 2018 - 2030)

-

Picosecond Lasers

-

Femtosecond Lasers

-

Attosecond Lasers

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical and Healthcare

-

Material Processing

-

Scientific Research and Development

-

Automotive and Aerospace

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ultrafast laser market size was estimated at USD 1.96 billion in 2023 and is expected to reach USD 2.18 billion in 2024.

b. The global ultrafast laser market is expected to grow at a compound annual growth rate of 16.4% from 2024 to 2030 to reach USD 5.42 billion by 2030.

b. North America dominated the ultrafast laser market with a share of 36.4% in 2023.The presence of numerous world-class research institutions and universities in the region drives demand for ultrafast lasers, which are crucial for high-precision experiments and advanced scientific investigations.

b. Some key players operating in the ultrafast laser market include Coherent Corp; TRUMPF; IPG Photonics Corporation; NKT Photonics A/S; Newport Corporation; Amplitude Laser; Ekspla; Light Conversion; Clark-MXR, Inc; Thales.

b. The increasing demand for medical and healthcare applications drives the market's growth. Ultrafast lasers, particularly femtosecond lasers, are crucial in precision medical procedures, such as LASIK eye surgery, where their short pulse durations allow for highly accurate and minimally invasive treatments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.