- Home

- »

- Communication Services

- »

-

Ultra Wideband Market Size, Share And Growth Report, 2030GVR Report cover

![Ultra Wideband Market Size, Share & Trends Report]()

Ultra Wideband Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (RTLS, Imaging), By Positioning System (Indoor, Outdoor), By End-use (Residencial, Manufacturing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-418-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ultra Wideband Market Summary

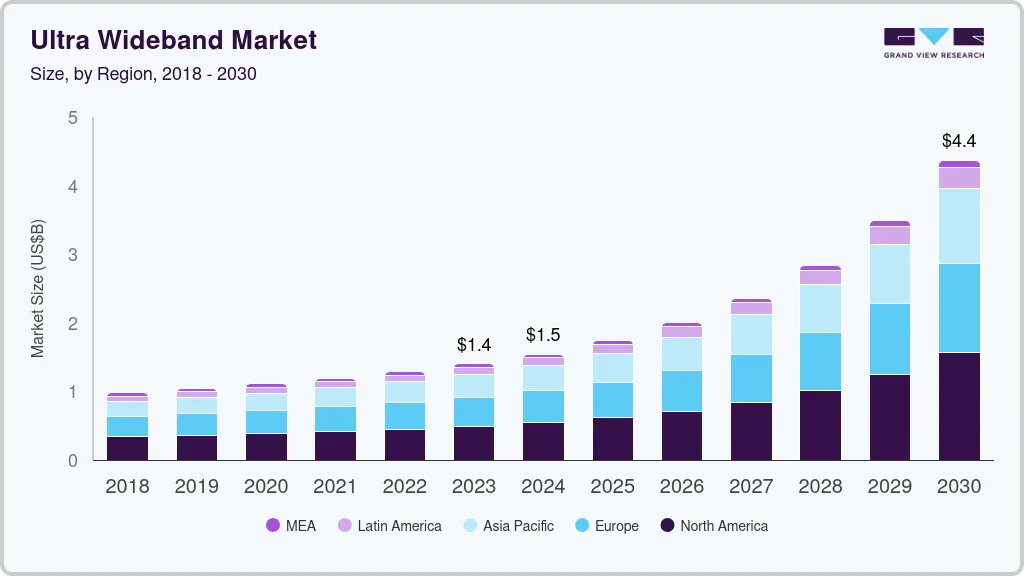

The global ultra wideband market size was estimated at USD 1.40 billion in 2023 and is projected to reach USD 4.37 billion by 2030, growing at a CAGR of 18.9% from 2024 to 2030. The market growth is attributed to several factors, such as increasing demand for precise location tracking and real-time data transmission in various industries such as healthcare, automotive, and consumer electronics.

Key Market Trends & Insights

- The North America held a market share of 35.03% in 2023.

- Based on the application, the RTLS segment held the largest market share of 52.36% in 2023.

- Based on the positioning system, the indoor positioning system segment held the largest market share in 2023.

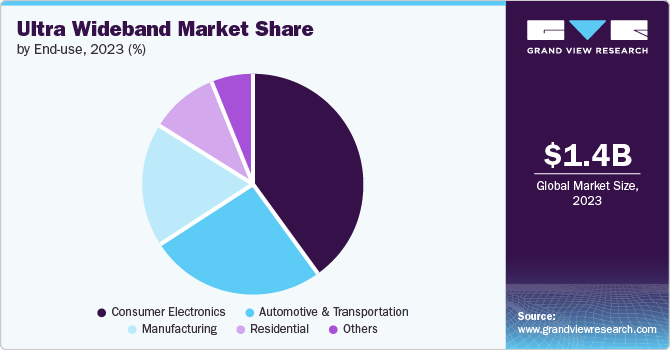

- Based on end-use, the consumer electronics segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.40 Billion

- 2030 Projected Market Size: USD 4.37 Billion

- CAGR (2024-2030): 18.9%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The proliferation of IoT devices and smart infrastructure projects is significantly boosting the adoption of ultra wideband (UWB) technology, as it offers superior accuracy and low power consumption compared to other wireless technologies. In addition, the rising trend of contactless payments and secure access systems is further propelling the market, with UWB being a preferred choice due to its enhanced security features.

UWB technology rapidly evolves and focuses on improving accuracy, range, and power efficiency. One significant trend is the miniaturization of UWB chips, enabling their integration into smaller devices such as wearables and IoT sensors. In addition, the convergence of UBW with other technologies is also gaining traction. For instance, combining UWB with Bluetooth Low Energy (BLE) enhances device discovery and pairing processes. Furthermore, integrating UWB with artificial intelligence (AI) and machine learning (ML) algorithms improves location prediction and context-aware services.

This miniaturization is coupled with advancements in low-power designs, extending battery life in UWB-enabled devices. The evolution of ultra wideband technology is also marked by its growing interoperability with other wireless communication standards such as Bluetooth and Wi-Fi. This interoperability enhances the versatility of UWB applications, allowing seamless integration into existing communication networks. Furthermore, advancements in UWB antennas and signal processing algorithms improve the range, accuracy, and reliability of UWB systems, making them more attractive for a wider range of applications, from smart home automation to precision agriculture.

Regulatory trends are playing a significant role in shaping the UWB market landscape. Governments and regulatory bodies across the globe are increasingly recognizing the potential of UWB technology and are establishing guidelines to ensure its safe and efficient deployment. The Federal Communications Commission (FCC) has allocated specific frequency bands for UWB use in the United States, facilitating its adoption in commercial applications. Similarly, the European Telecommunications Standards Institute (ETSI) has been working on standardizing UWB technology to promote widespread usage across Europe. These regulatory efforts are crucial in creating a conducive environment for the growth and commercialization of ultra wideband technology.

However, compared to other wireless communication technologies, the high cost of ultra wideband technology is hindering the adoption of UWB, especially in cost-sensitive markets. Moreover, the complex nature of ultra wideband systems requires significant expertise in deployment and maintenance, which can be a barrier for smaller companies or those with limited technical resources. Interference with other wireless technologies and the need to comply with stringent regulatory standards also pose challenges that must be addressed to ensure the smooth deployment and operation of ultra wideband systems.

Application Insights

Based on the application, the market is segmented into Real-time Location System (RTLS), imaging, and communication. The RTLS segment held the largest market share of 52.36% in 2023, driven by the increasing demand for precise indoor positioning across various industries. UWB-based RTLS offers superior accuracy to other technologies, with positioning precision down to a few centimeters. This high level of accuracy makes it particularly valuable in industries such as healthcare for asset tracking and patient monitoring, manufacturing for inventory management and workflow optimization, and logistics for warehouse management and supply chain visibility. The automotive sector is also a significant contributor to the RTLS segment, with UWB technology being used for keyless entry systems and parking assistance.

The imaging segment is expected to grow at the highest rate during the forecast period. The UWB’s ability to penetrate various materials and provide high-resolution imaging drives its adoption in multiple sectors. In addition, technological advancements in UWB technology have enabled its application in radar systems for various purposes, including short-range object detection, obstacle avoidance, and gesture recognition.

Positioning System Insights

Based on the positioning system, the market is segmented into indoor and outdoor positioning systems. The indoor positioning system segment held the largest market share in 2023 and is expected to be the fastest-growing segment throughout the projection period. This dominance is primarily driven by UWB's superior accuracy in indoor environments, where traditional GPS signals are often unreliable. The UWB’s high precision and accuracy in indoor positioning have fueled adoption across various sectors, including retail, logistics, healthcare, and manufacturing. The increasing demand for real-time location tracking and asset management within indoor environments drives substantial growth in this segment.

The outdoor positioning system segment is anticipated to grow substantially throughout the projection period. The growth can be attributed to the growing advancements in UWB technology and the need for precise location data in outdoor environments, which are creating new opportunities. Applications such as autonomous vehicles, smart cities, and industrial automation are driving the expansion of the outdoor UWB market.

End-use Insights

Based on end-use, the market is segmented into residential, automotive & transportation, manufacturing, consumer electronics, and others. The consumer electronics segment dominated the market in 2023 and is predicted to grow significantly during the forecast period. The segment's growth can be attributed to the rapid adoption of smartphones and other personal devices. This segment's dominance is largely due to major tech companies such as Apple, Inc., Samsung Electronics Co. Ltd., and Google LLC integrating UWB chips into their flagship devices. In smartphones, UWB enables precise indoor navigation, improved device-to-device file sharing, and enhanced augmented reality experiences. The technology is also incorporated into smartwatches, tablets, and laptops for seamless device interaction and spatial awareness. Smart home devices are another significant contributor to this segment, with UWB facilitating advanced home automation, secure access control, and precise indoor positioning of various IoT devices.

The automotive & transportation segment is emerging as the fastest-growing segment during the forecast period. This rapid growth is driven by the increasing demand for advanced driver assistance systems (ADAS), autonomous vehicles, and smart transportation infrastructure. In addition, growing demand for UWB technology in autonomous vehicles enhancing vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication and improving safety and navigation accuracy is expected to propel the segment's growth.

Regional Insights

The North America ultra wideband market held a market share of 35.03% in 2023. The market is experiencing robust growth, driven by the widespread adoption of UWB technology in various industries, including healthcare, automotive, and consumer electronics. The region's strong emphasis on research and development and significant investments in IoT and smart infrastructure are propelling the demand for UWB solutions. In addition, the presence of major UWB technology providers and the early adoption of innovative technologies contribute to the market's expansion.

The U.S. Ultra Wideband Market Trends

The ultra-wideband market in the U.S. is expected to witness significant growth, with major tech companies such as Apple, Inc. and Google LLC incorporating ultra wideband technology into their devices. The automotive industry is a key growth driver, with UWB used for keyless entry systems and in-vehicle positioning.

Europe Ultra Wideband Market Trends

The ultra-wideband market in Europe is growing steadily, with a focus on industrial and automotive applications. The European Union has been proactive in standardizing ultra wideband technology, with the European Telecommunications Standards Institute (ETSI) playing a key role. Countries such as Germany, France, and the UK are leading the adoption, particularly in the automotive and industrial sectors. The European automotive industry is incorporating ultra wideband for advanced driver assistance systems (ADAS) and vehicle-to-everything (V2X) communication.

Asia Pacific Ultra Wideband Market Trends

The ultra-wideband market in Asia Pacific is witnessing the highest CAGR, fueled by rapid technological advancements and growing investments in smart city projects. Countries such as China, Japan, and South Korea are at the forefront of adopting ultra wideband technology for applications in consumer electronics, automotive, and industrial automation. The region's expanding middle-class population and increasing demand for advanced electronic devices further accelerate the adoption of ultra wideband technology, positioning Asia Pacific as a key growth market in the coming years.

Key Ultra Wideband Company Insights

The key market players focus on various strategic initiatives, including new product development, partnerships & collaborations, and geographic expansion to gain a competitive advantage over their rivals.

Key Ultra Wideband Companies:

The following are the leading companies in the ultra wideband market. These companies collectively hold the largest market share and dictate industry trends.

- Qorvo Inc.

- NXP Semiconductors

- Inpixon

- Texas Instruments Incorporated

- Apple, Inc.

- Samsung Electronics Co., Ltd.

- nanotron Technologies GmbH

- Fractus S.A.

- Humatics Corporation

- Johanson Technology Inc.

Recent Developments

-

In February 2024, Ceva, Inc., a leading provider of ultra-low-power IP, introduced a new low-power Ultra-Wideband IP solution compliant with FiRa 2.0 standards. This advanced IP is designed for consumer and industrial IoT applications and offers highly accurate and reliable wireless ranging capabilities.

-

In October 2023, Infineon Technologies AG announced the acquisition of 3db Access AG (3db), a Zurich-based startup, a leader in secure, low-power ultra wideband technology. The acquisition strengthened Infineon Technologies AG’s portfolio for enhanced sensing, precise localization, and secured smart access. In addition, the company added ultra wideband to its connectivity range, including Bluetooth, Wi-Fi, and NFC.

Ultra Wideband Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.54 billion

Revenue forecast in 2030

USD 4.37 billion

Growth rate

CAGR of 18.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Application, positioning system, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Qorvo Inc.; NXP Semiconductors; Inpixon; Texas Instruments Incorporated; Apple, Inc.; Samsung Electronics Co., Ltd.; nanotron Technologies GmbH; Fractus S.A.; Humatics Corporation; Johanson Technology Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

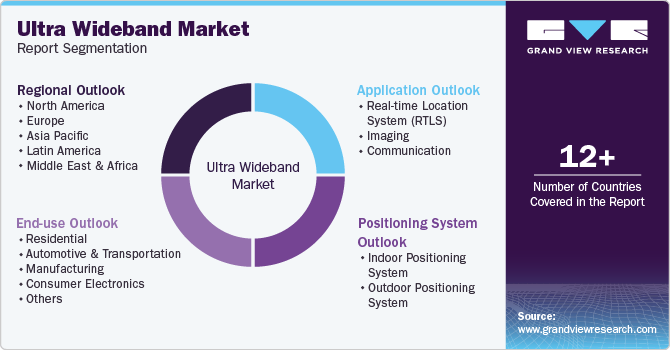

Global Ultra Wideband Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ultra wideband market report based on application, positioning system, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Real-time Location System (RTLS)

-

Imaging

-

Communication

-

-

Positioning System Outlook (Revenue, USD Million, 2018 - 2030)

-

Indoor Positioning System

-

Outdoor Positioning System

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Automotive & Transportation

-

Manufacturing

-

Consumer Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ultra wideband market size was estimated at USD 1.40 billion in 2023 and is expected to reach USD 1.54 billion in 2024.

b. The global ultra wideband market is expected to grow at a compound annual growth rate of 18.9% from 2024 to 2030 to reach USD 4.37 billion by 2030.

b. North America dominated the ultra wideband market with a share of 35.03% in 2023. The ultra-wideband (UWB) market in North America is experiencing robust growth, driven by the widespread adoption of UWB technology in various industries, including healthcare, automotive, and consumer electronics.

b. Some key players operating in the ultra wideband market include Qorvo Inc.; NXP Semiconductors; Inpixon; Texas Instruments Incorporated; Apple, Inc.; Samsung Electronics Co., Ltd.; nanotron Technologies GmbH; Fractus S.A.; Humatics Corporation; and Johanson Technology Inc.

b. Key factors that are driving the market growth include increasing demand for precise location tracking and real-time data transmission in various industries and the proliferation of IoT devices and smart infrastructure projects.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.