Ultra-thin Glass Market Size, Share & Trends Analysis Report By Application (Flat Panel Displays, Semiconductor, Automotive Glazing), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-037-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Ultra-thin Glass Market Size & Trends

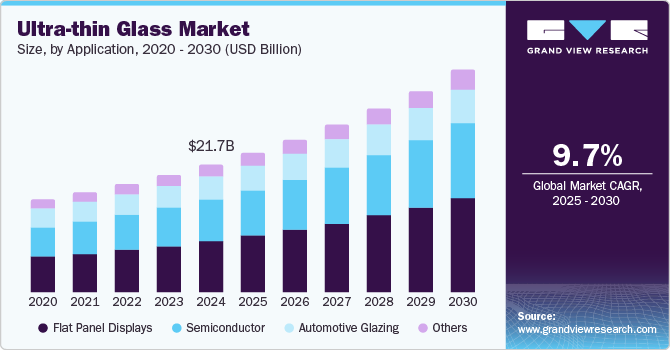

The global ultra-thin glass market size was estimated at USD 21.7 billion in 2024 and is projected to grow at a CAGR of 9.7% from 2025 to 2030. Ultra-thin glass, used in consumer electronics, architectural, and automotive glass, has potential in automotive displays and touchscreens. As cars evolve with more connectivity and autonomy, the demand for high-quality displays grows. Ultra-thin glass offers benefits such as flexibility and durability, making it ideal for automotive use.

With the growing demand for smartphones, laptops, and other electronic devices, particularly as displays get larger and more advanced, the demand for ultra-thin glass is also rising. In 2024, the global smartphone market grew by 7%, reaching 1.22 billion units, driving increased demand for ultra-thin glass, a crucial material for creating sleek, durable, and high-quality smartphone displays. The ultra-thin glass allows for the development of flexible, foldable, and curved displays, which are gaining popularity in both consumer electronics and wearables.

The increasing use of ultra-thin glass in the semiconductor industry is driven by its high-frequency electrical properties. Additionally, its growing application in the automotive industry for interior design and sensors, along with its expanded use in solar products to enhance cell efficiency, are key factors driving market growth. The rising focus on renewable energy sources is boosting the demand for solar panels, which in turn is propelling the growth of the ultra-thin glass market.

Application Insights

Flat panel displays dominated the ultra-thin glass market and accounted for a revenue share of 39.5% in 2024. The growth of the flat panel display market is driven by increasing demand for high-resolution displays in consumer electronics, such as smartphones, smartwatches, and smart TVs. The automotive industry is adopting flat panel displays for infotainment and autonomous vehicle systems. Additionally, the rise of healthcare applications in diagnostic equipment such as MRI and digital X-rays, along with advancements in OLED and micro-LED technologies, further supports the expansion of the market.

The semiconductor segment in the ultra-thin glass market is expected to grow significantly at a CAGR of 10.2% over the forecast period. Ultra-thin glass is vital for semiconductor packaging, enabling miniaturization, low dielectric loss, and thermal stability. It boosts signal performance, supporting the growing demand for compact, high-performance components in electronics and automotive industries. Consequently, key players are accommodating emerging technologies such as AI and quantum computing with the help of ultra-thin glass to offer durability, energy efficiency, and reliability in high-speed, high-frequency applications. For instance, in August 2024, SCHOTT unveiled low-loss glass, a material with a low dielectric constant for advanced semiconductor packaging, enhancing high-frequency applications and energy efficiency.

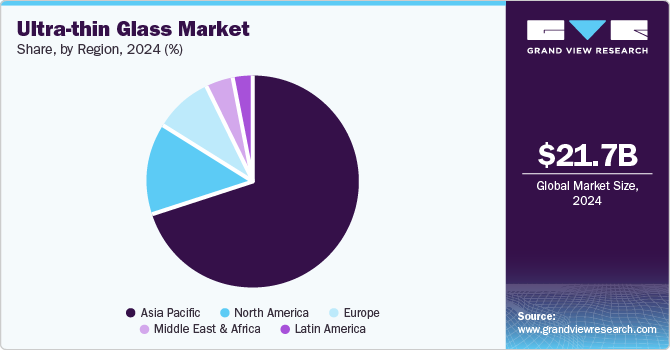

Regional Insights

TheAsia Pacific ultra-thin glass marketdominated the global market and accounted for the largest revenue share, 38.9% in 2024. Japan's investment in ultra-thin, flexible perovskite solar panels exemplifies the region's commitment to renewable energy. These panels, significantly thinner than traditional ones, can be applied to various surfaces, enhancing energy generation capabilities hence driving the ultra-thin glass market demand in the region. For instance, Japan’s USD 1.5 billion fund aims to advance ultra-thin, flexible perovskite solar cells driving global market shifts. Furthermore, with high-speed communication systems such as 5G and 6G developing in the region, the demand for ultra-thin glass is rising as it is used in high-frequency electronics due to its low dielectric loss and excellent electrical properties, enhancing signal integrity and energy efficiency.

China Ultra-thin Glass Market Trends

The ultra-thin glass market in China led the Asia Pacific market with the highest revenue share in 2024. China's robust manufacturing infrastructure supports the scaling up of ultra-thin glass production, meeting the rising demand across various industries. China's leadership in the ultra-thin glass market is backed by its vast electronics manufacturing infrastructure and growing automotive sector. As the world’s largest electronics producer, China caters to both domestic and export demands, particularly in smartphones and TVs. Government policies and rising investments in semiconductor manufacturing further bolster its market position.

Middle East & Africa Ultra-thin Glass Market

The Middle East and Africa ultra-thin glass market is expected to grow significantly, at a CAGR of 8.1% over the forecast period. Most Middle Eastern countries are major hubs for electronics manufacturing. Therefore, there is a great demand for ultra-thin glass in display applications. The UAE’s growing electronics and display industries are driving demand for ultra-thin glass in OLED displays, touchscreens, and flexible electronics. With the rise of smartphones, tablets, and wearables, as well as adoption in the architectural and automotive sectors for their lightweight and aesthetic qualities, the demand for ultra-thin glass is expanding.

North America Ultra-thin Glass Market Trends

The North America ultra-thin glass market held a substantial market share in 2024. The growth is fueled by technological advancements in display technologies such as OLED and QLED, rising demand for high-resolution screens, and increasing adoption in consumer electronics. The adoption of large-screen TVs, curved screens, and high-resolution displays in both consumer electronics and commercial applications is driving the demand. Multiple programs that encourage domestic manufacturing, such as the U.S. CHIPS and Science Act, are increasing investments in advanced materials such as ultra-thin glass.

The U.S. ultra-thin glass market dominated the North America market, with the highest revenue share of 79.5% in 2024. The potential joint venture between Intel and TSMC, including TSMC’s U.S. expansion under the CHIPS and Science Act of 2022, drove significant growth in the country’s ultra-thin glass market. TSMC’s investment in U.S. semiconductor manufacturing plants and packaging technology, especially in Arizona, is expected to increase demand for advanced materials such as ultra-thin glass, essential for semiconductor packaging and display applications. As the U.S. strengthens its semiconductor production capabilities, the need for high-performance materials, including ultra-thin glass, will expand, bolstering market growth.

Key Ultra-thin Glass Company Insights

Key companies in the global ultra-thin glass market include AGC Inc., Corning Incorporated, CSG Holding Co., Ltd., and Nippon Electric Glass Co.,Ltd., among others. Leading companies invest heavily in R&D to develop ultra-thin glass with improved performance, durability, and flexibility, including advanced coatings, optical properties, and scratch resistance. To meet growing demand, they expand manufacturing capacity and form strategic partnerships. Companies adapt to global trends, such as 5G, flexible displays, electric vehicles, and IoT, by offering products with enhanced flexibility, strength, and transparency to stay competitive and meet industry needs.

-

AGC Inc. produces ultra-thin glass used in electronics, including flexible displays, touchscreens, and OLED panels. Their products include flexible ultra-thin glass, high-strength ultra-thin glass, optically clear ultra-thin glass, scratch-resistant ultra-thin glass, eco-friendly ultra-thin glass, and ultra-thin glass for automotive applications. It is headquartered in Tokyo, Japan.

-

Corning Incorporated’s ultra-thin glass solutions are used in consumer electronics, automotive, and other high-tech industries due to their durability, optical clarity, and flexibility. Their products include solutions for OLED displays, flexible touchscreens, and high-performance cover glass for smartphones, tablets, and wearables. Their product offerings are gorilla glass and willow glass, among others. It is headquartered in Corning, New York, U.S.

Key Ultra-thin Glass Companies:

The following are the leading companies in the ultra-thin glass market. These companies collectively hold the largest market share and dictate industry trends.

- AGC Inc.

- Corning Incorporated

- CSG Holding Co., Ltd.

- Nippon Electric Glass Co.,Ltd.

- SCHOTT

- Xinyi Glass Holdings Limited

- Luoyang Glass Company

- Changzhou Almaden Co., Ltd.

- Emerge Glass

- Nippon Sheet Glass Co., Ltd.

Recent Developments

-

In February 2025, Apple advanced further to launching its first foldable device after securing a significant deal with the Chinese supplier Lens Technology for ultra-thin glass (UTG). Lens Technology will provide 70% of Apple's UTG orders, with Corning supplying the raw materials. The ultra-thin glass will be used in the center to enhance flexibility around the device's hinge. South Korean suppliers such as UTI and Dowoo Insys are also involved. Samsung Display will supply the screen. The foldable device, likely a book-style iPhone, is expected by late 2026.

-

In April 2024, Glass Acoustic Innovations Ltd. (GAIT), collaborated with Nippon Electric Glass Co. (NEG) to revolutionize the audio industry with cutting-edge ultra-thin glass diaphragm technology. This collaboration will integrate glass diaphragms into Hi-Fi speakers, headphones, and automotive audio systems, offering enhanced strength, rigidity, and sound propagation. Along with GAIT’s expertise in glass diaphragms and NEG’s high-quality glass production, the partnership aims to reshape the audio market, valued at USD 756 billion, by advancing acoustic glass technology and delivering superior audio experiences.

Ultra-thin Glass Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 23.7 billion |

|

Revenue forecast in 2030 |

USD 37.7 billion |

|

Growth Rate |

CAGR of 9.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Volume in million square meters, revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; Italy; China; India; Japan; Brazil |

|

Key companies profiled |

AGC Inc.; Corning Incorporated; CSG Holding Co., Ltd.; Nippon Electric Glass Co.,Ltd.; SCHOTT; Xinyi Glass Holdings Limited; Luoyang Glass Company; Changzhou Almaden Co., Ltd.; Emerge Glass; and Nippon Sheet Glass Co., Ltd. |

|

Customization scope |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Ultra-thin Glass Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global ultra-thin glass market report based on application and region:

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million; 2018 - 2030)

-

Flat Panel Displays

-

Semiconductor

-

Automotive Glazing

-

Others

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."