- Home

- »

- Electronic & Electrical

- »

-

UK Smart Toys Market Size & Share, Industry Report, 2030GVR Report cover

![UK Smart Toys Market Size, Share & Trends Report]()

UK Smart Toys Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Interactive Games, Robots, Educational Toys), By Distribution Channel (Online, Offline), And Segment Forecasts

- Report ID: GVR-4-68040-241-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UK Smart Toys Market Size & Trends

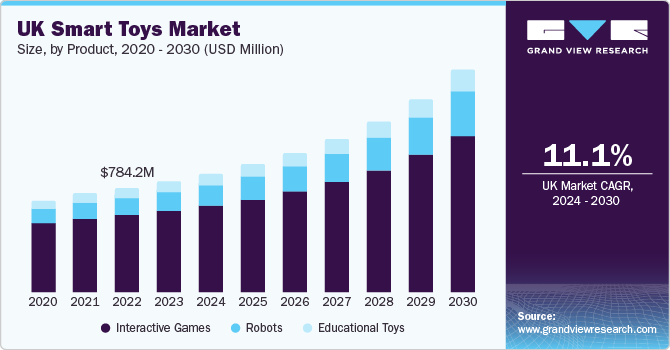

The UK smart toys market size was estimated at USD 834.5 million in 2023 and is expected to grow at a CAGR of 11.1% from 2024 to 2030. The rising adoption of smart devices and the growing popularity of digital platforms among children fuel the demand for smart toys in the U.K. With the increased access to smartphones, tablets, and other connected devices, there is a natural inclination toward smart toys that interact with these gadgets. This trend is further fueled by integrating augmented reality (AR) and virtual reality (VR) technologies in smart toys, providing children with an immersive and engaging experience.

UK smart toys market accounted for the share of 6.75% of the global smart toys market revenue in 2023. The growing integration of the Internet of Things (IoT) in toys is also driving the growth of the smart toys market in the U.K. As more household items connect to the internet, the potential for innovative and interactive play experiences expands. Smart toys often leverage IoT capabilities to communicate with other devices, enhancing functionality and providing a more immersive play environment.

Moreover, environmental consciousness and sustainability concerns are influencing consumer choices. Some smart toy manufacturers are responding to this trend by incorporating eco-friendly materials and promoting sustainability in their product design and packaging. As more consumers prioritize environmentally responsible options, smart toys that align with these values gain a competitive edge in the market. As per the 2021 Kids & Family Industry Report, 69% of European toy companies are integrating sustainability into their manufacturing processes. The brands implementing environmental strategies encompass LEGO, Hasbro, Mattel, MGA, Playmobil, and Clementoni.

Integrating smart toys with larger smart home ecosystems drives their adoption in the UK. As homes become more connected, smart toys are designed to seamlessly integrate with other smart devices and platforms, enhancing the overall user experience. This incorporation provides users with added convenience and establishes smart toys as integral components of a larger ecosystem.

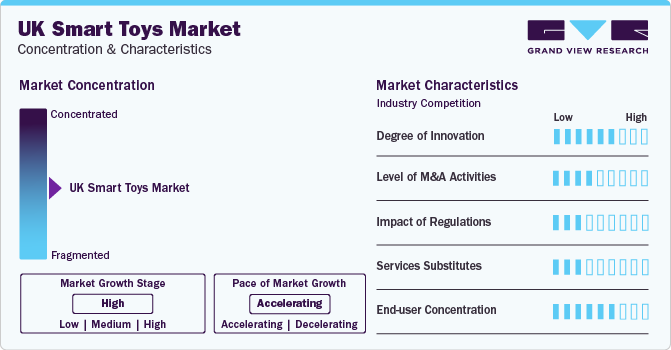

Market Concentration & Characteristics

The UK smart toys market is characterized by high degree of innovation, with businesses continuously focusing on differentiating themselves through unique experiences and offerings.The rising adoption of artificial intelligence (AI) and Internet of Things (IoT) technologies drives the growth of the smart toys market. AI and IoT technologies contribute to the development of voice-activated smart toys. Voice recognition systems powered by AI enable children to interact with their toys through natural language, fostering a more intuitive and responsive play experience. This trend is driven by the convenience of hands-free interactions and the desire for smart toys to provide more lifelike and conversational interactions.

Collaborating with technology companies and content creators can open new innovation and product development avenues. These partnerships can lead to the creation of comprehensive smart toy ecosystems that offer unique and diversified features, enhancing the overall value proposition for consumers. For instance, in February 2024, FoloToy collaborated with Yomiplanet to develop an exclusive AI-enhanced companion toy, Frank Murphy. This unique, multilingual interactive figurine can engage in conversations in six languages, such as English, Chinese, and Japanese.

End-user concentration is a significant factor in the UK smart toys market. Educational alignment with STEM subjects is increasingly important to consumers in the smart toys market. Parents prefer toys that entertain and contribute to their child's development in key areas. Smart toys that integrate STEM learning elements, such as coding activities, science experiments, or engineering challenges, align with this trend, providing valuable educational content that prepares children for future skill requirements.

Product Insights

The interactive games market in the UK held the revenue share of over 73.67% in 2023.The integration of augmented reality (AR) drives the growth of the interactive toys segment. AR technology enhances the real-world environment with computer-generated elements, providing a unique and immersive play experience. Interactive toys leveraging AR can transport children to fantastical worlds, overlay digital content onto physical objects, and create interactive storytelling experiences.

The demand for educational robots in the UK is anticipated to grow at a CAGR of 13.6% from 2024 to 2030. Advancements in technology, particularly in robotics and artificial intelligence, have created more sophisticated and interactive educational robots. These robots often feature programmable elements, allowing children to learn coding and problem-solving skills in a hands-on method. Integrating educational content with play enhances the overall learning experience, driving the adoption of educational robots by educational institutions.

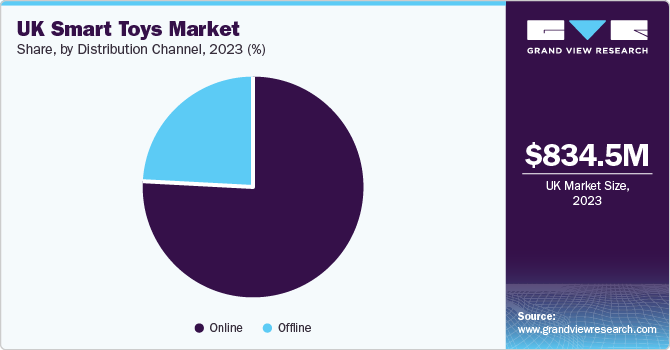

Distribution Channel Insights

Sales of smart toys through offline channels accounted for a market share of 75.69% in 2023. Try-before-buy opportunities contribute to the offline segment's growth. Unlike online purchases, physical stores allow children to physically interact with smart toys before making a decision. This hands-on experience provides a tangible connection with the product, helping children and parents evaluate factors like size, features, and ease of use. The ability to try before buying enhances the overall shopping experience, offering reassurance and reducing uncertainties associated with online purchases.

Online sales of smart toys in the UK is expected to grow at a CAGR of 14.1% over the forecast period of 2024 to 230. The growing global connectivity and cross-border trade facilitated by e-commerce platforms drive the online segment's growth. Consumers access a wide array of smart toys from different regions, providing them with exposure to diverse cultural and educational experiences. This globalization of product availability drives the growth of the online segment. Furthermore, smart toys often require a certain level of understanding and demonstration, which can be facilitated through online platforms via multimedia content, tutorials, and interactive demonstrations. The online space allows manufacturers to showcase innovative features and functionalities, creating a more engaging and informative shopping experience for consumers. The online segment propels the market's growth with technological advancements such as augmented reality, artificial intelligence, and Internet of Things integration.

Key UK Smart Toys Company Insights

Some of the key players operating in the market LEGO System A/S, LeapFrog Enterprises Inc. and Sphero, Inc.

-

LEGO System A/S, a subsidiary of Kirkbi A/S, designs, manufactures, and promotes an inclusive range of games and toys. Lego’s products focus on the theory of development and learning through play. Its collection comprises brick-building sets, traditional toys, games, and educational products. The company sells products under the LEGO brand name. It has a business presence in the Americas, Europe, Asia-Pacific, the Middle East, and Africa.

-

LeapFrog Enterprises Inc. is an educational entertainment company. LeapFrog's product range includes a variety of interactive learning toys and devices that cater to different age groups. LeapFrog's LeapStart system provides interactive books and activities that support core skills, while the LeapReader pen helps children with reading and writing skills through interactive books. LeapPad tablets offer kid-friendly tablets with educational games and activities, providing a safe digital environment for learning and exploration. The company also provides a digital learning platform called the LeapFrog Academy.

Mattel, Inc., Hasbro, and MindWare, Inc. are some of the other participants in the UK smart toys market,

-

MindWare, Inc. is a manufacturer, creator, and distributor of Brainy Toys for kids. The company adopts a direct-to-consumer model to deliver its unique collection of toys and games to customers worldwide. MindWare's product line includes coloring books, educational toys, games, brainteasers, building sets, robot toys, and creative play activities. The company is developing its own line of products, which were initially offered exclusively in the MindWare catalog.

-

Hasbro is a global toy and game company. The company functions through three business segments: Consumer Products, Entertainment, and Wizards of the Coast and Digital Gaming. The Consumer Products segment involves the marketing, sourcing, and selling of game and toy products. This segment also advertises & promotes its brands through the obtainable authorization of trademarks and other brands by selling recognized consumer products, including apparel and toys. The company trades its goods to retailers, wholesalers, distributors, drug stores, discount stores, catalog stores, department stores, mail order houses, and other traditional retailers, as well as e-commerce retailers & directly to customers through Hasbro PULSE, an e-commerce website.

Key UK Smart Toys Companies:

- LEGO System A/S

- LeapFrog Enterprises Inc.

- Sphero, Inc.

- Mattel, Inc.

- Hasbro

- MindWare, Inc

- Dynepic

- Neurala

- Lego System A/S

- Arduino

Recent Developments

- In February 2024, Sega Toys launched KIMIT Ragdoll, a cat-like robot pet that uses AI technology to act like a real cat. It was developed in collaboration with Elephant Robotics, an industrial robot manufacturer. The robot cat has cat-like movements, such as wagging its tail and looking up in response to sound.

UK Smart Toys Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 893.5 million

Revenue forecast in 2030

USD 1,681.6 million

Growth rate

CAGR of 11.1% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Country scope

UK

Key companies profiled

Playmobil; Pillar Learning; LeapFrog Enterprises Inc.; Mattel, Inc.; Hasbro; MindWare, Inc; Dynepic; Neurala; Lego System A/S; Arduino

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

UK Smart Toys Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UK smart toys market report based on product and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Interactive Games

-

Robots

-

Educational Toys

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Frequently Asked Questions About This Report

b. The UK smart toys market was estimated at USD 834.5 million in 2023 and is expected to reach USD 893.5 million in 2024.

b. The UK smart toys market is expected to grow at a compound annual growth rate of 11.1% from 2024 to 2030 to reach USD 1,681.6 million by 2030.

b. Interactive games dominated the UK smart toys market with a share of around 73.6% in 2023. The integration of augmented reality (AR) drives the growth of the interactive toys segment. AR technology enhances the real-world environment with computer-generated elements, providing a unique and immersive play experience.

b. Some of the key players operating in the U.S. smart toys market include Playmobil; Pillar Learning; LeapFrog Enterprises Inc.; Mattel, Inc.; Hasbro; MindWare, Inc; Dynepic; Neurala; Lego System A/S; Arduino

b. The rising adoption of smart devices and the growing popularity of digital platforms among children fuel the demand for smart toys in the U.K. With the increased access to smartphones, tablets, and other connected devices, there is a natural inclination toward smart toys that interact with these gadgets.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.