- Home

- »

- Electronic & Electrical

- »

-

UK Smart Home Security Camera Market, Industry Report 2030GVR Report cover

![UK Smart Home Security Camera Market Size, Share & Trends Report]()

UK Smart Home Security Camera Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Wired Camera, Wireless Camera), By Application (Doorbell Camera, Indoor Camera), And Segment Forecasts

- Report ID: GVR-4-68040-233-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

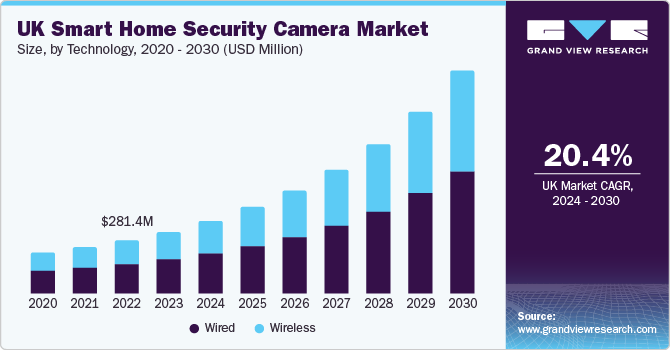

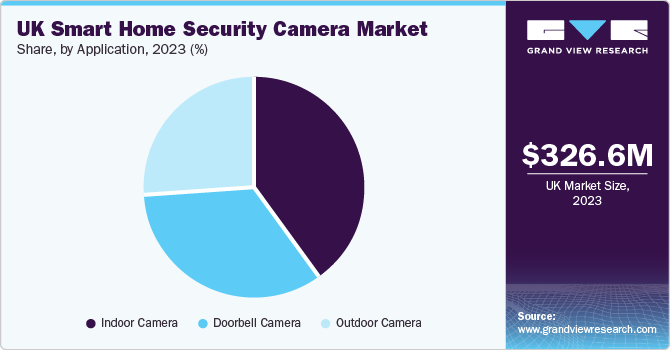

The UK smart home security camera market size was estimated at USD 326.6 million in 2023 and is anticipated to grow at a CAGR of 20.4% from 2024 to 2030. Growing concerns about safety, security, and public convenience may limit the growth of the UK smart home security cameras market during the forecast period. The UK smart home security camera market accounted for a share of 4.4% of the global smart home security camera market in 2023.

Emerging technologies and applications such as multi-dimensional perception, UHD, low light imaging, artificial intelligence, and cloud technology open new possibilities for the security industry. At the same time, millions of cameras and other security devices are being connected into networks, making the security industry in the UK a very important part of the future UK IoT world. According to a U.S. News article in 2020, globally, there are 770 billion closed-circuit television surveillance cameras in use, with London being the only city out of China to be featured in the top 10 most surveilled cities in the world. The capital of the U.K. has 627,727 cameras for a population of 9.3 million—equal to one camera for every 14 residents. This scenario bodes well for the smart home security cameras market in UK.

Another feature of connected devices that drives the market is the ability for users to monitor and operate office and home appliances remotely from their smartphones or tablets. The smart home market benefits from rising investments, rapid urbanization, changing lifestyles, and rising consumer spending.

As concerns about burglaries, vandalism, and other security threats grow, so does the necessity of home security, and homeowners are actively looking for ways to make their homes safer. By enabling real-time home monitoring and notifications in the event of suspicious activity, smart home security cameras provide a contemporary and practical solution.

The emergence of smart cities is causing the following industries to integrate IoT solutions more tightly: waste, economic development and housing, mobility, healthcare, security, water, energy, and engagement and community. Certain cities have advanced more in the development of these services than others; cities in Asia Pacific and Europe are leading the way, with significant, iconic infrastructure and building projects that incorporate IoT built right into their blueprints.

There are several choices for smart home security cameras in the UK. A variety of smart security cameras, both indoors and outdoors, with cognitive features that can change to meet changing needs are available from Google Nest. These cameras come equipped with capabilities like night vision, HDR video, motion detection, event-based recording, and Google Home app compatibility.Blink provides small and reasonably priced plug-in smart security cameras for interior use. These cameras are straightforward to install and operate, and they offer piece of mind. A variety of security cameras and systems, such as IP NVR, DVR, and wire-free systems, are available from Lorex.

A poll carried out in 2021 in Germany and the UK found that Germany has a lower rate of use of smart home security cameras than the UK. Approximately 7% of Germans currently use apps that allow smart cameras to transfer pictures from their house to a tablet or smartphone. Thirteen percent of British citizens now use these apps, and thirty-six percent more say they plan to use them in the future.Market Concentration & Characteristics

There is constant innovation in the UK smart home security camera market, with new techniques and technologies being created and released on a regular basis. Continuous technological progress is a factor in the development of smart home security cameras, especially in fields like artificial intelligence (AI), machine learning, and image processing. These technologies improve the overall capabilities of security cameras by enabling features like object detection, facial recognition, and better video analytics.

Many companies in the market are engaged in merger and acquisition activity, including ADT Inc., Brinks Home Security, Wyze Lab, Inc., and SimpliSafe, Inc. These businesses can reach new markets and increase their geographic reach through M&A activities.

Regulations often establish rules and specifications on the privacy of individuals photographed by surveillance equipment. Regulators may impose features such as facial blurring, user permission processes, or placement restrictions on smart home security cameras in order to safeguard privacy rights. For manufacturers and users alike to stay out of trouble legally and guarantee ethical use of surveillance technologies, compliance with privacy regulations is essential.

Since smart home cameras offer improved security and convenience, real-time monitoring and interaction with smart home ecosystems are only two of the sophisticated features that make these essential. There are several options for home automation sensors, dummy cameras, webcams, DIY surveillance systems, smart doorbells without cameras, baby monitors, and motion-activated outdoor lights. With regard to cost, functionality, and convenience of use, these choices vary in terms of features and restrictions, meeting a range of needs and preferences.

Technology Insights

In 2023, wired smart home security cameras market accounted for revenue share of 55.6%. Because wired security systems require less maintenance, they are more affordable in the long run. This is why their popularity is growing. Their adoption is mostly being driven by this economic advantage. Because wired systems don't have to worry about problems with WiFi connectivity or battery life, they are more reliable. These cameras record locally and continue to operate even in the event of a WiFi loss, providing continuous surveillance.

Over the course of the projected period, wireless smart home security camera market is expected to grow at a CAGR of 20.5%. One of the biggest developments in IoT and home security solutions are wireless technology-enabled security systems, which are preferred by many homeowners for efficient protection.

Application Insights

The indoor smart home security camera accounted for a share of 39.7% in 2023. A growing number of theft and break-in incidents have brought attention to the significance of safeguarding one's home from criminal activities. Indoor smart cameras are widely used in many different applications because to their many features, which include quick messaging in the event of theft, alarm activation, and movement and behavior recognition. While on vacation or during business hours, these cameras are essential for keeping an eye on residences. By enabling homeowners to monitor their property's security and receive notifications about package delivery or any unexpected events, they reassure homeowners.

Doorbell cameras are anticipated to grow at a CAGR of 20.8% over the forecast period. The growing desire to live in smart homes, facilitated by rising internet penetration, is positively impacting the demand for doorbell cameras.

Key UK Smart Home Security Camera Company Insights

ADT Inc., Vivint Smart Home, Inc., Nest Labs, and Samsung Electronics Co, Ltd. are some of the dominant players operating in the market.

-

A variety of smart home products are offered by Vivint Smart Home, Inc.; these include garage door control, car protection, security sensors, lights, cameras, thermostats, smoke and carbon monoxide detectors, and locks. They also provide complete home systems with ongoing support services, expert installations, and in-home consultations.

-

ADT Inc. is a marketing and operations company that works in three reportable segments: solar, consumer and small business, and commercial.

-

Samsung Electronics Co, Ltd. operates at several facilities across the U.S., Asia Pacific, Europe, and Central & South America. It has reached more than 74 markets through direct sales and distributors.

Wyze Lab, Inc., blink, Skylinkhome, and Frontpoint Security Solution, LLC are some of the emerging market players functioning in smart home security camera sector in the UK.

-

Wyze Labs, Inc., known simply as Wyze, specializes in smart home products and wireless cameras.

-

Frontpoint Security Solution, LLC invented do-it-yourself (DIY) home security systems, which completely changed the home security market. Frontpoint serves homeowners all across the country and specializes in the installation, monitoring, and upkeep of security technology solutions, such as home security systems and fire alarms. Frontpoint sets itself apart by giving clients the resources and direction they need to set up a personalized home security system quickly and easily.

Key UK Smart Home Security Camera Companies:

- Vivint Smart Home, Inc.

- ADT Inc.

- SimpliSafe, Inc.

- Brinks Home Security

- Skylinkhome

- Samsung Electronics Co, Ltd.

- Frontpoint Security Solution, LLC

- Wyze Lab, Inc.

- Blink

- Ring LLC

Recent Developments

-

In May 2022, Vivint Smart Home, Inc. launched a suite of technologically advanced products intended at uplifting its unique smart home experience and presenting intelligent solutions that redefine the benchmarks for smart homes. The product offering includes the Doorbell Camera Pro, Spotlight Pro, Outdoor Camera Pro, and Indoor Camera Pro.

-

In September 2023, eufy, the smart home security brand owned by Anker Innovations, launched a series of dual-camera devices, inaugurating a home surveillance mesh powered by local AI. The advanced lineup comprises cameras with wide-angle and telephoto lenses, boosting the surveillance capabilities of devices.

UK Smart Home Security Camera Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 382.2 million

Revenue forecast in 2030

USD 1,161.5 million

Growth rate

CAGR of 20.4% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Technology, application

Country scope

UK

Key companies profiled

Vivint Smart Home; ADT Inc.; SimpliSafe; Brinks Home Security; Skylinkhome; Samsung Electronics Co; Frontpoint Security Solution; Wyze Lab; Blink; Ring LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Smart Home Security Camera Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UK smart home security camera market report based on technology, and application.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Wired

-

Wireless

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Doorbell Camera

-

Indoor Camera

-

Outdoor Camera

-

Frequently Asked Questions About This Report

b. The UK smart home security camera market size was estimated at USD 326.6 million in 2023 and is expected to reach USD 382.2 million in 2024.

b. The UK smart home security camera market is expected to grow at a compounded growth rate of 20.4% from 2024 to 2030 to reach USD 1,161.5 million by 2030.

b. Baby cosmetics & toiletries dominated the market with a share of 33.5% in 2023 This is attributed to the increased purchase of products that contain anti-bacterial, anti-fungal, and antioxidant properties that are beneficial to baby skin driving the growth of the segment.

b. Some key players operating in the UK smart home security camera market include Vivint Smart Home; ADT Inc.; SimpliSafe; Brinks Home Security; Skylinkhome; Samsung Electronics Co; Frontpoint Security Solution; Wyze Lab; Blink; Ring LLC

b. Key factors that are driving the UK smart home security camera market growth include growing concerns about safety, security, and public convenience may limit the growth of the UK smart home security cameras market during the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.