- Home

- »

- Clothing, Footwear & Accessories

- »

-

UK Shoe Insoles Market Size, Share, Industry Report, 2030GVR Report cover

![UK Shoe Insoles Market Size, Share & Trends Report]()

UK Shoe Insoles Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Full Length, Heel Cup), By Application (Casual, Athletic), By Material (Foam, Gel), By End-user, And Segment Forecasts

- Report ID: GVR-4-68040-226-0

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UK Shoe Insoles Market Size & Trends

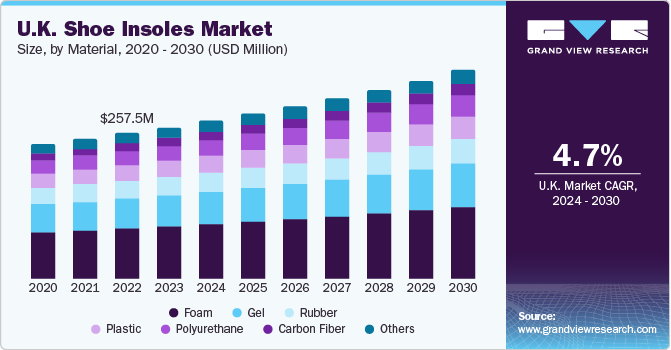

The UK shoe insoles market size was estimated at USD 268.0 million in 2023 and is projected to grow at a CAGR of 4.7% from 2024 to 2030. The market’s growth can be attributed to the growing consumer participation in sports and other physical activities as part of their healthy lifestyle choices, along with the aging population in need of comfortable footwear options.

The UK market accounted for a share of 4.4% of the global shoe insoles market in 2023. In order to decrease waste and promote sustainability, the UK government has been putting policies and programs into action. Enertor, England Athletics' official partner, reportedly introduced the world's first insole recycling program in December 2020, according to England Athletics Limited. Given that an astounding 300 million pairs of shoes and insoles are thrown away in landfills every year, mostly in the United Kingdom, Enertor is currently making major efforts to help protect the environment.

Superfeet Worldwide LLC, a prominent leader in the worldwide insole market, introduced the ADAPT Run Collection of insoles in the United Kingdom in May 2022.These insoles, which offer an alternative to the traditional hard base, represent a development in Superfeet technology and are designed for comfort and seamless running. They feel soft and flexible and fit right into running shoes, making them comfortable to wear and run in. More sophisticated, long-lasting, and personalized insoles will be created as a result of developments in material science, 3D printing, and manufacturing processes, drawing in customers looking for high-performance solutions.

Following its acquisition of Texon and Rhenoflex GmbH in 2022, Coats Group PLC, a prominent industrial thread maker, established a new footwear segment in June 2023. After a seamless integration, the group launched Coats Footwear, providing a wide range of parts and material solutions to manufacturers of shoes and accessories worldwide. The division's position in the market is further reinforced by its recognition for unrivaled experience and technical understanding. The recently established division offers a comprehensive range of more than 450 unique goods designed just for manufacturers. This extensive selection includes all of the materials and parts required for shoe assembly, such as threads, insoles, upper materials, and structural elements.

Two major technological developments in the insole market are wearable technology and smart insoles. The incorporation of sensors and electronics into shoe insoles has led to the creation of smart insoles. These insoles can monitor numerous metrics, including as temperature, pressure distribution, step count, and gait analysis. Smart insole data can be utilized for performance enhancement, health-related analysis, and physical activity tracking. Many insole systems that are sensitive to pressure but not shear have previously been developed for use in laboratory research as well as for monitoring foot pressure in daily life. Among others, Tekscan, Inc. and XSENSOR Technology Corporation are two significant producers of these systems.

Novel insole technologies are the result of developments in materials science, biology, and production techniques. Technology has made insole performance and personalization better in a number of ways, including gel-based polymers, 3D printing processes, and responsive foams. Manufacturers who fund R&D to integrate these technologies can obtain a competitive edge.

Market Concentration & Characteristics

Given the wide range of brands and alternatives available, the market for shoe insoles may be quite competitive. A well-planned product launch makes a business stand out by emphasizing the special qualities and advantages of its insoles, enabling it to set itself apart from rival products. In order to increase its market presence, improve its product offerings, and achieve strategic growth, the shoe insole business has engaged in a number of merger and acquisition (M&A) transactions.

In the shoe insole business, regulations have a big impact on things like product safety, quality standards, technical innovation, and market rivalry. Regulatory authorities frequently establish standards for the strength, longevity, and material composition of insoles for shoes. Adherence to these guidelines guarantees that insoles fulfill the basic safety prerequisites, an essential aspect for safeguarding consumers and fostering trust in the industry.

Customers may take into account a number of product alternatives in the shoe insole market, depending on their unique requirements, tastes, and usage scenarios. Customers may choose to change the entire shoe instead of simply the insoles in some situations, especially if the current shoe is worn out or no longer offers sufficient support.

Application Insights

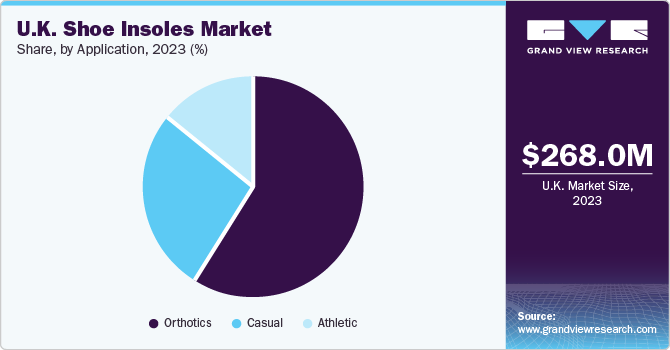

Orthotic insoles segment dominated the market with a revenue share of 59.1% in 2023. The market for bespoke orthotics is expanding as a result of consumers being more aware of their advantages. As they provide additional cushioning, support, and pressure redistribution, custom orthotics are especially helpful for people with arthritis or long-standing job duties. Insoles for orthotics are also frequently used to avoid diabetic foot deformities and pressure sores, which helps to preserve the segment's long-term growth.

The casual insoles segment is projected to grow at a CAGR of 5.7% from 2024 to 2030 as consumers are looking for comfort, proper fit, and arch support from casual shoes. The rise of athleisure and casual footwear trends has further fueled the demand for shoe insoles. Consumers are increasingly looking for ways to enhance the comfort of their favorite casual shoes, from sneakers to loafers, without compromising on style. Shoe insoles that cater to these casual styles and fit seamlessly into various footwear have become increasingly popular.

Material Insights

The foam insoles market in the UK accounted for a revenue share of 34.3% in 2023. Foam insoles are a popular alternative for people looking for breathable and lightweight shoe insoles because of their lightweight design. Athletes and fitness enthusiasts are among the key target consumer groups who focus on these attributes of shoe insoles.

The carbon fiber insoles market in the UK is projected to grow at a CAGR of 5.8% from 2024 to 2030. Carbon fiber is a lightweight yet incredibly strong material that offers excellent durability and resilience, making it an ideal choice for enhancing the performance and comfort of shoe insoles. Additionally, carbon fiber insoles offer superior shock absorption and energy return capabilities, enhancing overall athletic performance and reducing the impact on joints during physical activities. Athletes and active individuals seek footwear that can provide better support and minimize the risk of injuries, making carbon fiber insoles an attractive choice.

Type Insights

The full-length shoe insoles segment accounted for a revenue share of 84.8% in 2023. For improved arch support, more and more consumers are choosing to use these insoles for their shoes. By stabilizing and supporting the foot, insoles lessen the strain on the back, knees, ankles, and feet. For increased comfort, customers are choosing full length shoe insoles more frequently. Furthermore, a growing number of women are choosing to use insoles for their feet's extra comfort and cushioning because they spend so much time in stylish footwear and high heels.

The ¾ length shoe insoles segment is expected to grow at a CAGR 4.4% from 204 to 2030. The growth of athleisure and casual footwear trends has therefore augmented the demand for these shoe insoles.

End-user Insights

The shoes insoles category for women accounted for a revenue share of 50.8% in 2023. Their increased need for personalization possibilities, along with their fashion-conscious choices and active lifestyles, further contributed to their prominence. The notable presence of women in the market may also be attributed to the convenience of online purchasing, wellness trends, and customized insole solutions.

The men’s shoe insoles category in the UK is projected to grow at a CAGR of 5.0% from 2024 to 2030. An increasing number of men are choosing to use specialist shoe insoles that can offer targeted support and comfort for particular foot conditions as a result of the growing prevalence of foot issues, such as plantar fasciitis, flat feet, and various forms of foot pain.

Key UK Shoe Insoles Company Insights

The UK shoe insoles market is characterized by the presence of international and regional players. The increasing significance of e-commerce is a key factor shaping the industry’s dynamics. Online retailers can offer products at reduced prices, attracting more customers to their platform. As a result, manufacturers are leveraging this trend by promoting their products online and providing detailed descriptions of their technology, quality, and features to appeal to consumers.

Key UK Shoe Insoles Companies:

- Bauerfeind AG

- Foot Science International

- Superfeet Worldwide, Inc.

- Texon International Group

- FootBalance System Ltd.

- Sidas

- ENERTOR

- YONEX Co., Ltd.

- Asics Corporation

- New Balance Athletics, Inc.

Recent Developments

-

In March 2023, a new range of products from Dr. Scholl's includes insoles, a foot file, and a foot mask. The insoles aid in preventing pain from a variety of sources, including weight gain, poor posture, uneven pressure, flat feet, and running on hard terrain.

-

In October 2022, Superfeet Worldwide announced the introduction of two distinct categories of removable insoles specifically designed for snowboarders and skiers. These new insoles are tailor-made to cater to the needs of snowboarders and skiers, taking into account the unique demands of these winter sports. The specialized insoles come with Superfeet’s trademarked cushioning and foot stability characteristics, along with a thermal top cover for warmth and moisture-wicking features.

-

In September 2022, Texon launched a new insole called Ecostrobe, which is made using 100% recycled content, specifically, recycled PET (polyethylene terephthalate). The insole is produced using a fusion-bonding technology that eliminates the need for chemicals or water during the manufacturing process. Moreover, the production of Ecostrobe requires 50% less energy and it is 20% lighter.

-

In November 2021, Spenco introduced two new shoe insoles as part of its performance series, the Propel and Propel + Carbon. These insoles incorporate the latest advancements in running technology and are designed to enhance running shoes. The insoles are created to enable runners to experience superior propulsion without purchasing racing-specific shoes.

UK Shoe Insoles Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 279.3 million

Revenue forecast in 2030

USD 368.5 million

Growth rate

CAGR of 4.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in million units, Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue and volume forecasts, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, material, end-user, type

Country scope

UK

Key companies profiled

Bauerfeind AG; Foot Science International; Superfeet Worldwide, Inc.; Texon International Group; FootBalance System Ltd.; Sidas; ENERTOR; YONEX Co., Ltd.; Asics Corporation; New Balance Athletics, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Shoe Insoles Market Report Segmentation

This report forecasts revenue & volume growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the UK shoe insoles market report based on application, material, end-user, and type.

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Casual

-

Athletic

-

Orthotics

-

-

Material Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Foam

-

Gel

-

Rubber

-

Plastic

-

Carbon Fiber

-

Polyurethane

-

Others

-

-

End-user Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

-

Type Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Full Length

-

3⁄4 Length

-

Heel Cup

-

Frequently Asked Questions About This Report

b. The UK shoe insoles market size was estimated at USD 268.0 million in 2023 and is expected to reach USD 279.3 million in 2024.

b. The UK shoe insoles market is expected to grow at a compound annual growth rate of 4.7% from 2024 to 2030 to reach USD 368.5 million by 2030.

b. Orthotic insoles dominated the UK shoe insoles market with a share of 59.1% in 2023. This is attributable to the aging population in the country and the resultant need for comfortable footwear that helps avoid diabetic foot deformities and pressure sores.

b. Some key players operating in the UK shoe insoles market include Bauerfeind AG, Foot Science International, Superfeet Worldwide, Inc., Texon International Group, FootBalance System Ltd., Sidas, ENERTOR, YONEX Co., Ltd., Asics Corporation, and New Balance Athletics, Inc.

b. Key factors that are driving the market growth include growing consumer participation in sports and other physical activities as part of their healthy lifestyle choices, along with the aging population in need of comfortable footwear options.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.