- Home

- »

- Alcohol & Tobacco

- »

-

UK Nicotine Pouches Market Size, Industry Report, 2030GVR Report cover

![UK Nicotine Pouches Market Size, Share & Trends Report]()

UK Nicotine Pouches Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Tobacco-derived, Synthetic), By Flavor (Original/Unflavored, Flavored) By Strength, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-254-3

- Number of Report Pages: 93

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UK Nicotine Pouches Market Size & Trends

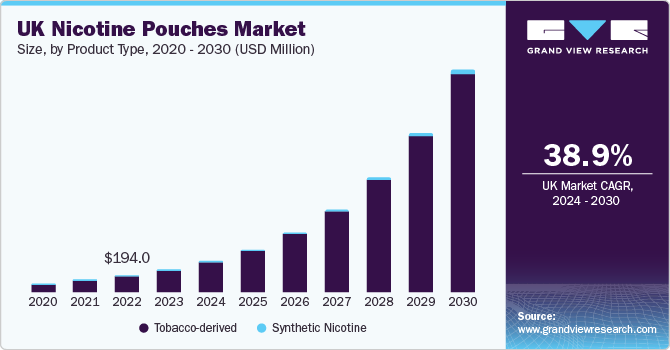

The UK nicotine pouches market size was estimated at USD 247.6 million in 2024 and is projected to grow at a CAGR of 7.6% from 2025 to 2030. The market is experiencing growth due to increasing demand for smoke-free alternatives among health-conscious consumers. The rising popularity of these products over traditional smoking is driven by their convenience and perceived health benefits. Rising innovation in flavors is also expected to contribute to the market's expansion.

The increase in the consumption of nicotine products has been a significant driver of the UK market’s growth. As consumers become more aware of the harmful effects of smoking, many are turning to alternative products, such as nicotine pouches, which provide a similar experience without the risks associated with the use of tobacco.

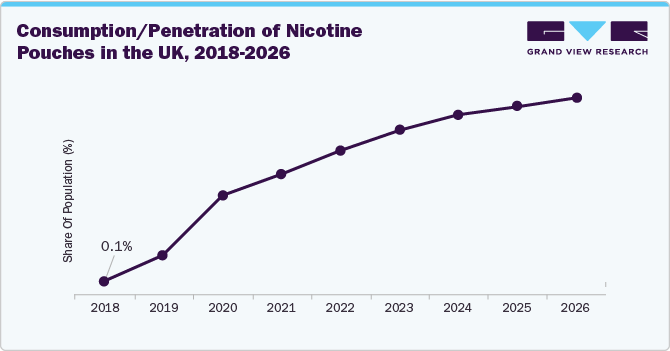

According to research conducted by the Institute of Psychiatry, Psychology & Neuroscience (IoPPN) at King’s College London in collaboration with Action on Smoking and Health (ASH), the proportion of adults in Great Britain who have used nicotine pouches has doubled from 2020 to 2024, reaching 5.4%. This indicates a growing shift toward these alternatives, with health-conscious consumers seeking a cleaner and more discreet way to consume nicotine.

A key factor driving the growth of the market is its convenience and ease of use. Unlike smoking, which requires a lighter to light a cigarette and can be impractical in public, nicotine pouches are discreet and do not need accessories. This appeals to younger adults and busy professionals with on-the-go lifestyles. In addition, the smokeless features makes nicotine pouches the preferred alternative in areas where smoking is banned. An article in H&N Magazine (2024) reports a 289% increase in nicotine pouch sales in the UK, attributing the surge to their discreet nature, emitting no smoke, vapor, or odor, unlike vapes. The article also highlights their convenience, as nicotine pouches are portable, compact, and require no maintenance, unlike vapes that need charging or refilling.

Regulatory Insights

Guide to Nicotine Pouch Regulations in UK: Key Compliance Requirements

Regulation Aspect

Requirements

Regulatory Body

- General Consumer Protection Laws

- Not subject to specific regulations like the Tobacco and Related Products Regulations (TRPR)

- Regulated under the General Product Safety Regulations (GPSR)

Product Classification

- Nicotine pouches are classified as a "general product"

- Potential future classification as tobacco/nicotine product

Taxation & Pricing

- Nicotine pouches are subject to 20% VAT.

- No excise duty applies.

Age Restrictions & Sales

- The Tobacco and Vapes Bill makes it an offense to sell tobacco products, herbal smoking products, and cigarette papers to anyone born on or after January 1, 2009. People born on or after this date will never be legally permitted to buy tobacco products.

- It is illegal to sell nicotine pouches to anyone under 18 in the UK

- Retailers must verify their age to comply with the law.

Licensing & Registration

- No specific licensing is required.

- Follows general product safety regulations.

Marketing & Advertising

- The Advertising Standards Authority (ASA) recommends responsible advertising of nicotine pouches.

- No explicit ban on content, endorsements, or promotions beyond factual information.

- Nicotine pouches can be advertised on social media platforms.

Medical Claims

- Nicotine pouches are not marketed as a medical product. As a result, they are not subject to regulation by the Medicines and Healthcare Products Regulatory Agency (MHRA)

Packaging & Labeling

Packaging

- Must be child-resistant.

- Must protect consumers.

Labeling

- Must be labeled in English.

- Must include health warnings.

- Must provide clear instructions.

- Must list ingredients.

- Must include safety guidelines.

- Must provide contact information in case of issues.

- Must specify actions if swallowed.

- Must indicate safe usage limits.

Compliance & Enforcement

- Enforced under consumer protection laws.

- Possible involvement of MHRA if reclassified.

Potential Future Regulations

- Potential regulations on content, packaging, and advertising.

- Possible introduction of taxation and stricter laws.

Consumer Insights

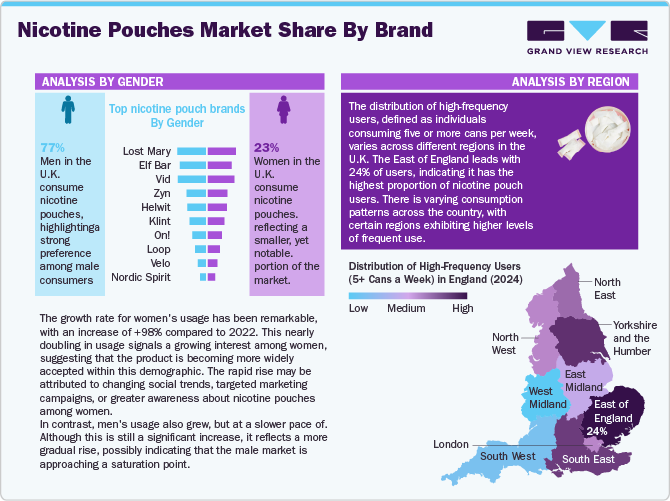

The consumption of nicotine pouches in the UK has been steadily growing over the past few years. These tobacco-free products, which provide a discreet and clean way to consume nicotine, have seen a rise in adoption among various demographics.

Initially, nicotine pouches were a niche product, but as consumer awareness and acceptance have increased, they have gained a foothold in the market.

Looking ahead, it is expected that the market for nicotine pouches will continue to expand, though at a gradual pace. This trend reflects a broader shift in the way people consume nicotine, with newer, potentially less harmful alternatives emerging as the dominant options.

The nicotine pouches market in the UK is expected to experience significant growth, driven by increasing adoption and penetration among consumers. By 2025, it is projected that the penetration of nicotine pouches in the UK will range between 1-2%, resulting in the market reaching a value of USD 268.2 Million. However, ongoing regulatory scrutiny aimed at restricting access to minors (under 18) may slow the market’s growth. As a result, the market is anticipated to see a year-on-year growth of 8.34% in 2025 compared to 2024.

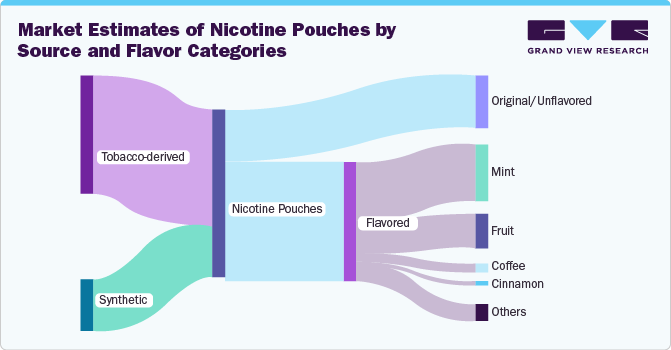

Product Insights

Tobacco-derived nicotine pouches held a revenue share of 97.81% in 2024, owing to its established consumer base and the perception of reduced harm compared to traditional smoking. The increasing number of smokers seeking alternatives that allow them to maintain nicotine intake without the harmful effects of combustion associated with cigarettes has also driven the industry. The familiarity of flavor and aroma in tobacco-derived products appeals to consumers who are transitioning from traditional tobacco products.

For instance, according to Haypp UK report in 2023, more than half of users (56%) reported that they started using nicotine pouches to quit smoking. In addition, nicotine pouches help many users (23%) to quit other tobacco and nicotine products, such as e-cigarettes and chewing tobacco, with almost all of those who switch from cigarettes to nicotine pouches (95%) feel better after the change. In addition, 5% experience no improvement at all, and none feel worse.

The synthetic nicotine pouches segment is expected to grow at a CAGR of 14.4% from 2025 to 2030. The convenience and discreet nature of synthetic nicotine pouches contribute to their popularity. These products can be used in various settings without the stigma associated with smoking, making them particularly appealing to younger demographics who prefer products that fit into their lifestyle. The absence of tobacco also eliminates concerns about second-hand smoke, further enhancing their attractiveness. For instance, in 2024, British American Tobacco (BAT) announced its plans to launch Velo Plus, a new line of synthetic nicotine pouches in the United States, set to debut in 2025.

Flavor Insights

Flavored nicotine pouches held a revenue share of 94.04% in 2024. This is owing to its ability to attract a diverse consumer base, particularly younger demographics. Flavored nicotine pouches offer a wide range of enticing options, including fruit, mint, and dessert flavors, which appeal to individuals who may not have previously considered using tobacco products. For instance, in April 2024, Scandinavian Tobacco Group (STG) launched its XQS range of nicotine pouches in the UK, with flavors including Blueberry Mint, Tropical, Cool Ice, and Arctic Freeze, with varying nicotine strengths specifically targeting consumers looking for enjoyable and novel experiences while using nicotine products. This variety not only enhances user satisfaction but also encourages experimentation among potential users.

The original/Unflavored nicotine pouches segment is expected to grow at a CAGR of 8.3% from 2025 to 2030. Sales are driven by the growing preference for discreet, smoke-free alternatives to traditional tobacco products, which offer a more socially acceptable option. Consumers are also drawn to unflavored pouches due to their perception of fewer additives and a cleaner, more natural experience. This appeals to those looking for both practicality and sustainability.

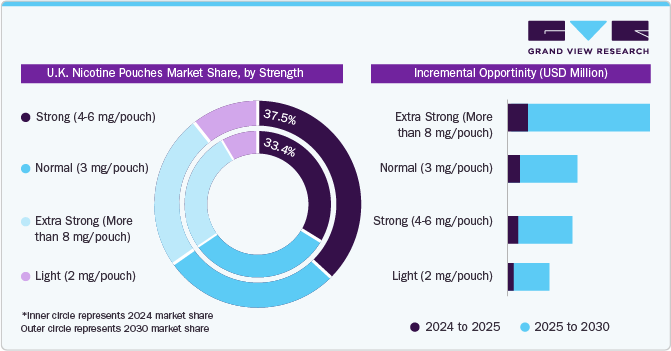

Strength Insights

Extra Strong (More than 8 mg/pouch) strength nicotine pouches held a revenue share of 33.41% in 2024. This can be attributed to the high demand from experienced nicotine users and former heavy smokers seeking a stronger alternative. These pouches provide a more intense nicotine hit, making them particularly appealing to individuals transitioning from cigarettes or high-nicotine vaping products. The preference for higher-strength pouches is also driven by their longer-lasting effect, reducing the need for frequent use and offering greater satisfaction per pouch.

The Light (2 mg/pouch) strength nicotine pouches are anticipated to grow at a CAGR of 11.0% from 2025 to 2030. The growth is driven by a growing preference for lower nicotine intake, particularly among new users and those seeking to reduce dependence. These pouches offer a controlled, discreet, and tobacco-free way to consume nicotine, catering to health-conscious consumers who prioritize cleaner alternatives. In addition, their convenience, minimal odor, and increasing availability are expected to further fuel their demand in the coming years.

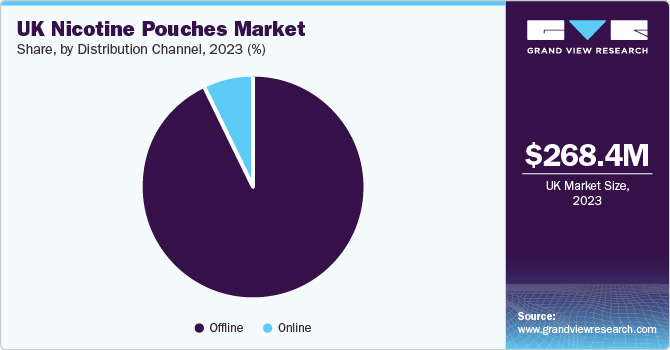

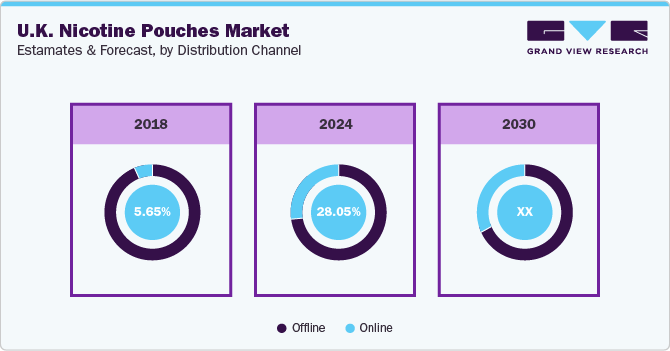

Distribution Channel Insights

Sales of nicotine pouches through offline channels accounted for a revenue share of 83.36% in 2024, owing to convenience, wider product variety, and cost savings. Consumers prefer online shopping for discreet purchases, subscription options, and better deals.

Brands are also driving growth through direct-to-consumer sales, loyalty programs, and exclusive online promotions. According to a 2023 article by William Reed Ltd, 45% of nicotine pouch sales in the UK come through the convenience and independent channel.

Sales of nicotine pouches through online channels are expected to grow at a CAGR of 11.0% from 2025 to 2030, due to convenience, wider product variety, and cost savings. Consumers prefer online shopping for discreet purchases, subscription options, and better deals. Brands are also driving growth through direct-to-consumer sales, loyalty programs, and exclusive online promotions.

For instance, in February 2025, Nic Pouches officially launched its online store, offering over 300 high-quality nicotine pouches designed for adult consumers seeking a healthier alternative to smoking. The store features a variety of products made from plant-based fibers, flavorings, and nicotine, allowing users to experience nicotine without the harmful effects associated with traditional smoking.

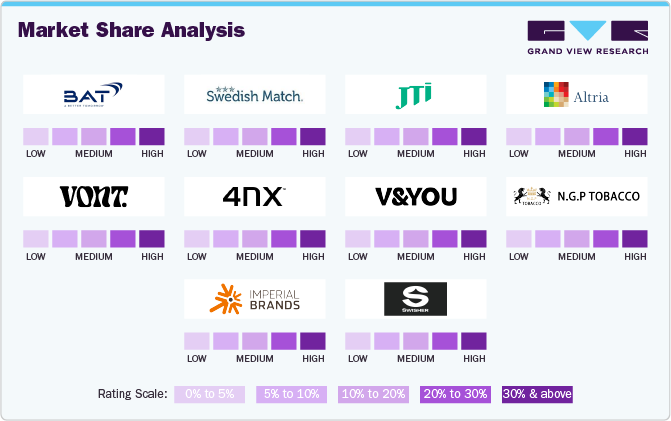

Key UK Nicotine Pouches Company Insights

The UK nicotine pouch industry is characterized by the presence of both established tobacco giants and specialized brands that focus on smokeless nicotine alternatives. These companies dominate the market by leveraging strong brand recognition, innovative product offerings, and widespread distribution channels.

With increasing consumer demand for discreet, tobacco-free nicotine products, the market is highly competitive, with major players constantly improving product strength, flavor options, and user experience. As the market continues to grow, both global and emerging local brands are expected to vie for gaining market share, targeting health-conscious consumers and those looking to reduce or eliminate traditional smoking habits.

Key UK Nicotine Pouches Companies:

- British American Tobacco PLCO

- Swedish Match AB

- Japan Tobacco International

- Altria Group, Inc.

- Vont AB

- 4nx Nicotine Pouches

- V&YOU

- N.G.P Empire

- Imperial Brands plc

- Swisher

Recent Developments

-

In January 2025, KLAR, a Swedish nicotine pouch brand, was launched in the UK through selected Sainsbury's stores and Moto outlets. The brand introduces innovative bioceramic nicotine pouches using patented Seratek technology, which employs calcium-compound granulate for more efficient nicotine delivery. The product line features mint and citrus flavors in three strengths: Regular (3mg), Strong (6mg), and Extra Strong (9mg).

-

In January 2025, Scandinavian Tobacco Group UK expanded its XQS nicotine pouch range by introducing two new flavors: Black Cherry and Citrus Cooling. Both flavors are priced at £5.50 and contain 8 mg of nicotine. The Black Cherry variant offers a unique dark cherry taste, while Citrus Cooling combines citrus with a mint effect.

-

In October 2024, British American Tobacco (BAT) launched synthetic nicotine pouches, marking a significant shift in their product portfolio. This move involves using lab-made nicotine instead of tobacco-derived nicotine, representing BAT's first venture into synthetic nicotine products. The company initially aims to introduce these new products in Europe and Africa, targeting markets where traditional nicotine pouches are already established.

UK Nicotine Pouches Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 268.2 million

Revenue forecast in 2030

USD 386.2 million

Growth rate (Revenue)

CAGR of 7.6% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, flavor, strength, distribution channel

Key companies profiled

British American Tobacco PLCO; Swedish Match AB; Japan Tobacco International; Altria Group, Inc.; Vont AB; 4nx Nicotine Pouches; V&YOU.; N.G.P Empire; Imperial Brands plc and Swisher

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Nicotine Pouches Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UK nicotine pouches market report based on product, flavor, strength, and distribution channel.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Tobacco-derived

-

Synthetic

-

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Original/Unflavored

-

Flavored

-

Mint

-

Fruit

-

Coffee

-

Cinnamon

-

Other Flavors

-

-

-

Strength Outlook (Revenue, USD Million, 2018 - 2030)

-

Light (2 mg/pouch)

-

Normal (3 mg/pouch)

-

Strong (4-6 mg/pouch)

-

Extra Strong (More than 8 mg/pouch)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Frequently Asked Questions About This Report

b. The UK nicotine pouches market size was estimated at USD 247.6 million in 2024 and is expected to reach USD 268.2 million in 2025.

b. The UK nicotine pouches market is expected to grow at a compounded growth rate of 37.6% from 2025 to 2030 to reach USD 386.2 million by 2030.

b. UK tobacco-derived nicotine pouches market accounted for the revenue share of 97.81% in 2024 owing to high demand for nicotine products coupled with increased public awareness campaigns encouraging people to quit smoking.

b. Some key players operating in the UK nicotine pouches market include British American Tobacco PLCO; Swedish Match AB; Japan Tobacco International; Altria Group, Inc.; Vont AB; 4nx Nicotine Pouches; V&YOU.; N.G.P Empire; Imperial Brands plc and Swisher

b. Key factors that are driving the UK nicotine pouches market growth include the growing awareness among the U.K. population regarding tobacco-free products will stimulate the demand for nicotine pouches in the country. For example, buynicotinepouches.co.uk is a website based in the U.K, that creates awareness regarding the ill effects of tobacco consumption and works directly with leading tobacco manufacturers to sell the best and fresh products available in the category of tobacco-free oral products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.