- Home

- »

- Next Generation Technologies

- »

-

U.K. New Energy Vehicle TIC Services Market Report, 2030GVR Report cover

![U.K. New Energy Vehicle TIC Services Market Size, Share & Trend Report]()

U.K. New Energy Vehicle TIC Services Market Size, Share & Trend Analysis Report By Service Type (Testing, Certification), By Sourcing Type (In-House, Outsourced), By Application, By Vehicle Type, By Industry, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-159-5

- Number of Report Pages: 106

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

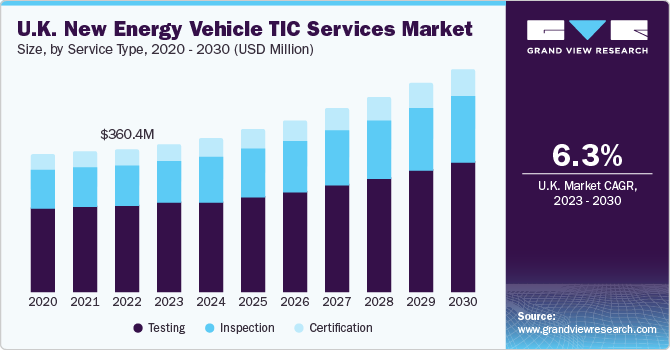

The U.K. new energy vehicle TIC services market size was estimated at USD 360.4 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. UK's commitment to reduce greenhouse gas emissions, coupled with international climate agreements, has provided a favorable environment for the growth of NEVs. Government incentives, emission standards, and a growing awareness of the environmental impact of traditional internal combustion engine vehicles are driving demand for NEVs. As a result, the market for NEV TIC (testing, inspection, and certification) services in the UK has witnessed exponential growth, with a surge in the number of TIC facilities across the country.

The UK NEV TIC services market is characterized by a diverse range of offerings, encompassing testing, inspection, and certification services across various aspects of NEVs, including batteries, charging infrastructure, and vehicle components. As demand for NEVs continues to increase, there is a greater need for stringent testing and certification to assure the safety and reliability of these vehicles and increase trust among clients.

As NEVs continue to gain importance, TIC services are expected to become essential for ensuring the safety, quality, and compliance of these vehicles. Battery testing, charging infrastructure inspection, and vehicle component evaluation are some instances of the essential services contributing to the growth of NEVs in the UK. With the government's support and a focus on environmental sustainability, the market is positioned to play a key role in the transformation of the country's transportation sector, reducing emissions and paving the way for a more sustainable future.

The growth of UK's market is significantly influenced by multiple driving factors, with one of the key factors being the advancements in battery technology. Advances in battery technology, including higher energy density and improved energy efficiency, are expanding the driving range of EVs. As EVs travel longer distances on a single charge, they become more attractive to customers. TIC services are essential to assuring the safety and performance of these advanced batteries, ensuring they meet stringent standards and regulations.

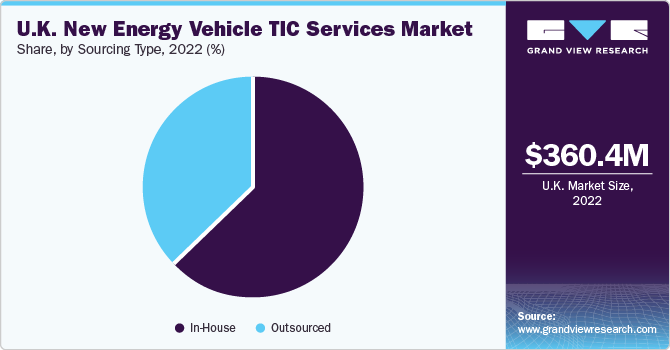

Sourcing Type Insights

The in-house segment led the market in 2022 with a revenue share over 62%. In-house TIC of EVs in the UK is becoming increasingly common, particularly among large automakers. When automakers perform TIC in-house, they have complete control over the process, from the development of test procedures to the execution of tests. This helps to ensure that EVs are tested and certified to the highest standards. Major players in the UK are significantly fueling market growth with new strategic initiatives. For instance, in April 2023, Jaguar Land Rover (JLR), which has in-house TIC in the UK, revealed stimulating strategies to accelerate its conversion to become the world's top manufacturer of modern luxury cars, revealing its next-generation electrified modular architecture (EMA) for medium-sized SUVs and its Halewood plant in the UK, which will become an all-electric production facility.

The outsourced segment is estimated to grow significantly over the forecast period. Outsourced TIC providers have the expertise and services necessary to test and certify EVs to the highest standards. This process can be particularly beneficial for smaller automakers and companies that need more resources to invest in in-house TIC. Key players are initiating strategic developments, which are significantly propelling market growth. For instance, in June 2022, a new facility for EV battery testing was established by Applus+ Laboratories. The new lab has already opened at Applus+ 3C Test, at their UK test center. It is specifically used for battery testing for UN DOT 38.3 compliance and ECE R100 homologation.

Service Type Insights

The testing segment led the market in 2022 with a revenue share over 60%. The rapid growth of the testing segment in the new energy vehicle industry is fueled by the increasing adoption of electric and hybrid vehicles. The segment is evolving with the widespread adoption of AI and ML for more precise and efficient testing methods, utilizing data analysis to spot patterns and irregularities. The development of new test equipment for next-generation batteries, such as solid-state batteries, is meeting the changing needs of industry. On-site testing is gaining traction to minimize downtime and enhance efficiency, driving the creation of portable, compact test equipment.

The certification segment is estimated to grow significantly over the forecast period. There is a growing emphasis on safety and cybersecurity certification due to the increasing complexity of NEVs and their interconnected nature. Certification bodies are developing new standards to assess these aspects. There is a rising demand for over-the-air (OTA) software updates to enhance NEV performance, safety, and security, with corresponding certification standards evolving. Furthermore, certification services in the UK are gaining importance as NEV manufacturers are expanding their foothold into new markets, leading certification bodies to collaborate on harmonized standards and procedures for facilitating NEV certification.

Application Insights

The safety and security segment held the largest revenue share of over 47% in 2022. Safety and security are very critical, and TIC services in NEV as for many people buying a new car, safety is the top concern. Prospective purchasers are interested in learning the operation of EVs in terms of safety as EVs become more and more common in the UK. Consequently, EVs are equipped with a multitude of safety features and undergo extensive testing and safety checks prior to being allowed on public roads. The UK government has introduced several regulations that require EVs to meet certain safety and security standards. For instance, all new EVs sold in the UK are certified to the UNECE WP.29 standards for electric vehicles.

The connectors segment is predicted to foresee significant growth in the forecast period. A significant development in connectors is fueling the market growth of the UK NEV TIC market. For instance, on 13 July 2023, the robustness of the cable to connection determines the high voltage connector that ABB invented, which is necessary for the increasing number of heavy-duty EVs and EVs. Heavy-duty EV wires are especially exposed to strain, high engine temperatures, vibration, abrasion, corrosion, and infiltration. With its Harnessflex EVOTM Connector Interfaces, ABB Installation Products created the first entire line of hinged high voltage connector backshells for heavy-duty EVs to safeguard and stabilize these connections.

Vehicle Type Insights

The battery electric vehicles (BEVs) segment held the largest revenue share of over 47% in 2022. The UK has been experiencing significant growth in the testing and development of BEVs. Several factors, including government initiatives such as in May 2022, the UK government introduced new legislation where the government will work with EV industries to make data more accessible so that drivers can simply pay for their charging, compare costs, and rely on the public ChargePoint network with increased dependability, regardless of the ChargePoint supplier, and access real-time information about ChargePoint across the network. Environmental concerns, consumer demand, and advancements in electric vehicle technology are also significantly contributing to market growth.

The Fuel Cell Electric Vehicles (FCEVs) segment is predicted to foresee significant growth in the forecast period. The UK is making strides in expanding its hydrogen refueling infrastructure. Hydrogen refueling is a crucial trend as FCEVs rely on hydrogen fuel cells, and the availability of refueling stations is vital for their growth. Testing and certification of these hydrogen refueling stations were a part of this expansion trend. FCEVs are seen as promising technology for achieving emission reduction goals, especially in heavy-duty transportation such as buses and trucks.

Industry Insights

The automotive segment dominated the market in 2022 with a revenue share of over 49% owing to an increase in sales of BEVs and plug-in hybrid electric vehicles (PHEVs). Premium EV brands such as Tesla, BMW AG, and Mercedes-Benz AG are increasing their market share by providing high-quality and high-performance EV models. For instance, in September 2023, Cambustion Ltd. launched a testing laboratory in Cambridge, UK, which provides diverse testing services for the electric vehicle (EV) industry. These services encompass electric powertrain development, all-wheel drive hub dyno and chassis dynamometer test cells, and facilities for testing electric motors, batteries, and fuel cells.

The aerospace segment is anticipated to register the fastest CAGR over the forecast period. In the UK, several research and development projects focused on electric and hybrid-electric aircraft, supported by government funding and partnerships between aerospace firms and academic institutions, are undertaken to advance electrified aviation technologies. These initiatives aim to reduce the aviation industry's carbon footprint and address sustainability goals. Also, companies are actively developing electric propulsion systems while regulatory and certification challenges unique to electrified aircraft are being addressed.

Key Companies & Market Share Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in October 2023, TÜV SÜD partnered with Segula Technologies Group, an engineering services provider, to offer a wide range of services for automotive manufacturers. Plans envisaged are the two companies combining their expertise to offer a one-stop-shop solution and a comprehensive suite of services for vehicle development, market entry, and global market access, significantly reducing costs and time for automotive manufacturers.

Key U.K. New Energy Vehicle TIC Services Companies:

- Bureau Veritas

- DEKRA SE

- Element Materials Technology

- Intertek Group plc

- iASYS Technology Solutions

- SGS Société Générale de Surveillance SA

- TÜV SÜD

- TÜV Rheinland

- The British Standards Institution

- UL LLC

U.K. New Energy Vehicle TIC Services Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 572.1 million

Growth rate

CAGR of 6.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, sourcing type, application, vehicle type, industry

Country scope

UK

Key companies profiled

Bureau Veritas; DEKRA SE; Element Materials Technology; Intertek Group plc; iASYS Technology Solutions; SGS Société Générale de Surveillance SA; TÜV SÜD; TÜV Rheinland; The British Standards Institution; and UL LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.K. New Energy Vehicle TIC Services Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.K. new energy vehicle TIC services market report based on service type, sourcing type, application, vehicle type, and industry.

-

Service Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Testing

-

Battery Testing

-

Electric E-Motor Testing

-

Electromagnetic Compatibility (EMC) Testing

-

Component Testing

-

-

Inspection

-

Certification

-

-

Sourcing Type Outlook (Revenue, USD Million, 2017 - 2030)

-

In-House

-

Outsourced

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Safety and Security

-

Connectors

-

Communication

-

EV Charging

-

-

Vehicle Type Outlook (Revenue, USD Million, 2017 - 2030)

-

BEV

-

PHEV

-

FCEV

-

Others

-

-

Industry Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Aerospace

-

Defense

-

Others

-

Frequently Asked Questions About This Report

b. The U.K. New Energy Vehicle TIC Services Market size was estimated at USD 360.4 million in 2022 and is expected to reach USD 372.1 million in 2023.

b. The U.K. New Energy Vehicle TIC Services Market is expected to grow at a compound annual growth rate of 6.3% from 2023 to 2030 to reach USD 572.1 million by 2030.

b. The testing segment led the market in 2022, accounting for over 60% share of the total revenue. The rapid growth of the testing segment in the new energy vehicle industry is fueled by the increasing adoption of electric and hybrid vehicles

b. Some key players operating in the U.K. New Energy Vehicle TIC Services Market include Bureau Veritas; DEKRA SE; Element Materials Technology; Intertek Group plc; iASYS Technology Solutions; SGS Société Générale de Surveillance SA; TÜV SÜD; TÜV Rheinland; The British Standards Institution; and UL LLC.

b. Key factors driving the U.K. New Energy Vehicle TIC Services Market growth include the ongoing advancements in battery technologies and government policies and initiatives.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."