- Home

- »

- Clothing, Footwear & Accessories

- »

-

UK Lingerie Market Size, Share And Growth, Report, 2030GVR Report cover

![UK Lingerie Market Size, Share & Trends Report]()

UK Lingerie Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Briefs, Bras, Shapewear, Others), By Distribution Channel (Online, Offline), And Segment Forecasts

- Report ID: GVR-4-68040-207-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UK Lingerie Market Size & Trends

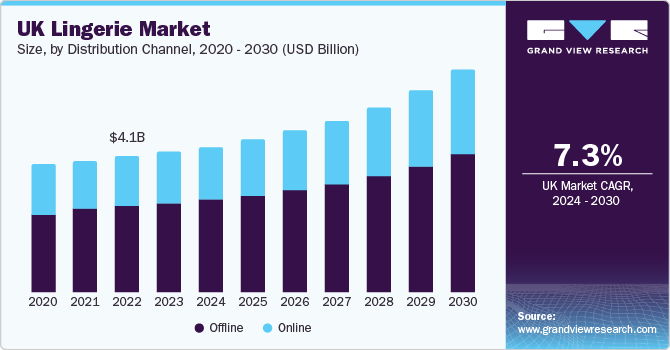

The UK lingerie market size was estimated at USD 4.28 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.3% from 2024 to 2030. In terms of regional market for lingerie, the Europe is believed to have a strong fashion sense and particular emphasis on trends and styles. However, owing to the shift in cultural norms and attitude towards lingerie in societies across the region, including UK, there is greater acceptance and openness about body positivity, and acknowledging diverse nature of the beauty. The projected growth in UK lingerie market can be attributed to fashion conscious customers, high quality products offered by domestic as well as international companies that are also equipped by appealing aesthetics, change in attitude towards use of lingerie in users, rise in disposable income levels across communities and population, and influence of aspects such as social media, web and reality shows.

The UK lingerie market accounted for 4.70% of the global lingerie market revenue in 2023. Often, customers buying a lingerie, consider factors such as breathability, style, fabric used in the making of the product and brand that has brought the product to market. The quality of the lingerie as generally measured on the basis of quality of fabric and other materials used in production, the elasticity offered by the elements such as lycra or popularly known as spandex, elegance and luxurious feel it offers, softness of material, aesthetic charm of the product. Common fabrics used in the development of intimate wear, especially lingerie are silk, cotton, lycra, lyocell, lace, organza, polyamide and more. The manufacturers and customers often prefer these fabrics as they provide characteristics such as resilience, capacity to hold shape, ability to draw off moisture, seamless blend between elegance and delicacy, and decorative details.

As the customers in UK value aspects such as innovative design, attention to details, aesthetic allure, the companies that are manufacturing lingerie are concentrating on the development of products that will be characterised by such liking and preferences of the customers. In addition, the increased availability of the data that provides improved insights regarding the factors such as customer behaviour, buying preferences is assisting designers and manufacturers to develop products aligned with the specific needs and inclinations of the customers.

Innovation in the industry has been at higher level where companies are constantly exploring novel opportunities in terms of product distinction and linked factors, which in turn supports them in creating larger demand. Specialty store, shopping centres, company outlets provide yet another aspect, which tend to lure the greater number of customers, assisted shopping experience. Moreover, availability of lingerie through online distribution channels has been attracting large pool of customers.

Entirely private and convenient buying experience provided the online stores and e-commerce websites, which is further assisted by efficient delivery channels, unwavering customer support, and policies such as return and replace have also been attracting younger customers who are part of technology driven world for more than a few decades now. Customers who tend to use online platforms for shopping, transactions, travel and more, mainly drive the segment of the UK lingerie market.

Market Concentration & Characteristics

The market is growing at an accelerating pace and the growth stage is identified as medium. The UK lingerie market is fragmented and is principally characterized by the existence of both domestic organisations and companies operating in global lingerie market as well. The increasing presence of residents from diverse backgrounds and cultures has been encouraging the manufacturers to deliver extensive collections of the merchandises that would be in alignment of customer expectations on various fronts such as styles, sizes, and body types.

The degree of innovation in the market is identified as high. Modern societies across the Europe, including UK, are intensively influenced by trends on social media, kinds of content broadcasted and consumer through advanced OTT platforms, fashion blogs, reality shows, talk shows, interviews, podcasts regarding trends of the industry, fashion magazines, apparel and intimate wear featured in popular films and TV advertisements, endorsements by influencers, etc. which develops and nurtures anticipations in terms of improvement and invention of new designs.

The series of partnerships have been playing vital role in the growth of the industry, yet the level of mergers and acquisition is moderate. However, some of the industry leaders such as Victoria’s secret have been acquiring medium scale and other companies to further their strategic initiatives. The partnerships in the UK lingerie market are mainly accomplished with determined approach of increasing penetration in unexplored areas of the market, cut the costs and share the related risks, enhance the efficiency of innovation, and gain assistance in terms of expertise in functions such as product development, expansion strategy implementations and customer engagement.

The counterfeit goods are the only threat identified in the market as substitute. These lesser quality substitutes are being sold in local markets, which might hamper the had-earned brand value of the products. However, in the age of information availability and growing awareness about brands and their offerings, very less amount of customers tend to buy these goods from vendors. Therefore, threat of substitutes can be considered as low.

Impact of regulations is at moderate level, which is present only in terms of safety and quality evaluations of the fabric used in the making. The lingerie market is mainly regularised in terms of standard performance specifications, which deals with quality and sustainably sourced fabric. In addition, organisations follow their own set of rules as well as follow recommendations of independent expert groups that are experienced in the particular area of product safety and durability.

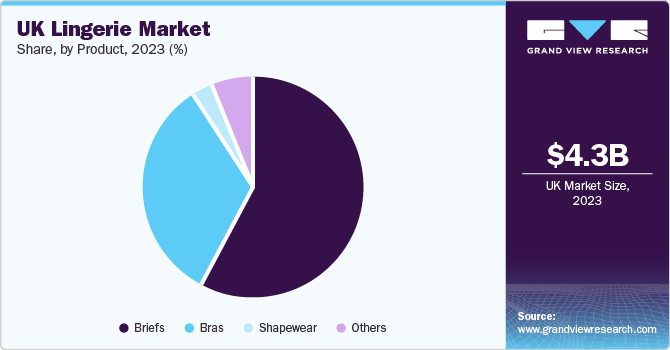

Product Insights

The briefs market in the UK held the revenue share of 57.7% in the year 2023 and is most expected maintain its top place in terms of revenue generation from 2024 to 2030. The growth can be attributed to increasing acceptance of briefs in European population, the high quality products sold by manufacturers in the prime urban markets such as London, Birmingham and Manchester among others. In addition, the key market participants of the UK lingerie market have been offering diligently made products that are in line with customers’ needs and available in different types such as low-cut, high-cut, boy shorts and hipster. Furthermore, charming appearances of the products and delicate designs accompanied by attractive discounts at point of purchase are expected to generate more demand for the market in upcoming years.

Often elastic and stiff materials such as spandex, nylon, or latex are used in the manufacturing of shapewear with precise purpose of offering soft and yet sophisticated outline through constricting and shaping specific portions of the user’s build. The shapewear market in UK is expected to grow at CAGR of 7.3% from 2024 to 2030. The decisive benefits offered in terms of shaping and well-being of body are the common reason behind purchase of shapewears. Few other factors such as moisture-absorbing abilities, flexibility, softness and comfort offered by the shapewear also influence the purchase decision. Adoption of cutting-edge technology in creating constricting shapewear has been assisting this product type to attain unprecedented response from variety of customers.

Distribution Channel Insights

The sales of lingerie through offline channels accounted for the revenue share of 63.65% in 2023. The offline sales are at higher level than online sale mainly due to various extra benefits it provide for customers such as amusing individual experience of shopping in stores, instantaneous possession of the bought products, and facility to examine and select material and value of the product. Yet another dynamic that backs to the improved sales through offline distribution channel is the assistance offered by the store executives and experts from developers in buying process, in which they deliver the extra information about features such as size, quality of cloth and distinguishing characteristics of the merchandise.

On the other hand, the sales of lingerie through online channels is expected to grow at a CAGR of 7.8% from 2024 to 2030. Primarily, this can traced back to elements such as hassle-free and privacy oriented shopping experience. The online shopping process is largely done through use of smartphones these days, which offers absolute confidentiality to buyers while purchasing intimate wear of their choice and preference. Often, lucrative discounts offered by dedicated online lingerie stores and e-commerce website, the rewarding offers that provide complementary products or accompanying accessories also bring newer customers to online lingerie shopping at constant rate.

Key UK lingerie Company Insights

The UK lingerie market is fragmented and mainly shared by a lot companies who are in the business since a few decades. In addition, some of the companies cater to specific requirements of the customers and act as specialists in particular types and styles of intimate wear. For instance, Royce Lingerie has 30 years of experience in making wirefree bras and now they provide the same product for every customer including women in pregnancy and women who have undergone breast surgeries. The presence of market leaders such Victoria’s Secret & Co. adds spice to competitive dashboard of this industry in the country. Some of the emerging players of the industry are all undone, and Emma Harris Lingerie.

-

Pour Moi, British multinational fashion brand, mainly operating in lingerie and womenswear, in its latest strategic initiative, formed a partnership with Wunderkind, a company that provides marketing performance solutions. This initiative is primarily regarding improved first-party data acquisition and performance enhancement objectives regarding company’s direct-to-customers’ business.

-

In 2022, Victoria's Secret launched Love Cloud collection with 18 women from different backgrounds including Sofía Jirau, 25 years old popular face of new collection, who made history to become first model with Down syndrome that appeared in Victoria’s Secret Campaign.

Key UK lingerie Companies:

- Aura Lingerie

- Inspire

- All Undone

- Sulis

- Emma Harris Lingerie

- Rigby & Peller

- Pour Moi

- Royce Lingerie

- Victoria’s Secret

- Wacoal Company

Recent Developments

-

Parade, intimate wear brand known for its assurance of diversity and inclusivity, expanded its business the UK market after securing USD 20 million in Series B funding led by Stripes in 2021.

-

In November 2023, Victoria’s Secret launched adaptive bras and panties, to extend support for Women with Disabilities. Prior to this, the company was not catering to this large demographic.

UK Lingerie Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.46 billion

Revenue forecast in 2030

USD 6.80 billion

Growth rate

CAGR of 7.3% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Key companies profiled

Aura Lingerie; Inspire; All Undone; Sulis; Emma Harris Lingerie; Rigby & Peller; Pour Moi; Royce Lingerie.; Victoria’s Secret; Wacoal Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Lingerie Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UK lingerie market report based on product, and distribution channel:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Briefs

-

Bras

-

Shapewear

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Online

-

Frequently Asked Questions About This Report

b. Briefs dominated the UK lingerie market with a share of more than 57.7% in 2023. The growth can be attributed to the increasing acceptance of briefs in the European population, and the high-quality products sold by manufacturers in prime urban markets such as London, Birmingham, and Manchester among others.

b. Some key players operating in the UK lingerie market include Jockey Aura Lingerie; Inspire; All Undone; Sulis; Emma Harris Lingerie; Rigby & Peller; Pour Moi; Royce Lingerie.; Victoria’s Secret; Wacoal Company

b. Key factors that are driving the UK lingerie market growth include the increasing disposable income of women in the country, growing awareness about the best fit of the products, rising population of millennials are some of the growth driving factors for this market

b. The UK lingerie market size was estimated at USD 4.28 billion in 2023 and is expected to reach USD 4.45 billion in 2024.

b. The UK lingerie market is expected to grow at a compound annual growth rate of 7.3% from 2024 to 2030 to reach USD 6.80 million by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.