UK Imaging Services Market Size, Share & Trends Analysis Report By Modality (X-ray Scans, CT Scans, MRI Scans, Ultrasound, Nuclear Medicine Scans), By End Use (Hospitals, Diagnostic Imaging Centers), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-946-9

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

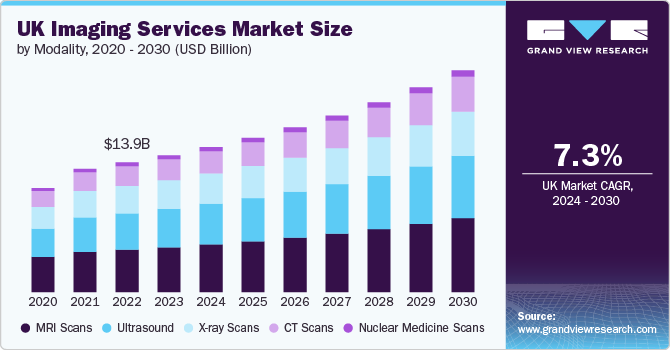

The UK imaging services market size was estimated at USD 15.60 billion in 2024 and is expected to grow at a CAGR of 7.52% from 2025 to 2030. The use of advanced medical imaging devices for diagnostics is rapidly increasing, mainly due to the rise in chronic disorders, which fuels market growth. For instance , the International Agency for Research on Cancer reported that in 2022, approximately 454,954 new cancer cases were diagnosed in the UK, resulting in 181,807 deaths. In addition, heightened medical imaging technology awareness is anticipated to drive market expansion further. For instance , according to NHS England, roughly 45.0 million imaging tests were conducted in England in the year leading up to March 2023, representing a 2.2% increase from the 44.0 million tests performed in the previous year. Furthermore, the increasing integration of artificial intelligence in medical imaging is expected to contribute significantly to market growth.

Medical imaging has significantly transformed healthcare by delivering essential information in a timely, safe, and accurate manner. Imaging services encompass non-invasive modalities such as X-rays, ultrasounds, nuclear medicine scans, MRIs, and CT scans, which are employed to diagnose various disorders. In addition, these services facilitate the early detection of diseases, thereby supporting effective treatment strategies. The market is projected to expand over the forecast period due to healthcare providers' adoption of advanced technologies aimed at enhancing medical imaging services and broadening their customer base. For instance , in May 2022, GE Healthcare and Alliance Medical Limited announced a collaboration to enhance patient access to diagnostic imaging and improve productivity in radiology departments. The partnership aims to streamline processes and optimize hospital resource management by utilizing data analytics and artificial intelligence. This initiative is designed to address current challenges in healthcare delivery, ensuring more efficient diagnostics for patients while also supporting radiology staff in managing their workloads effectively.

Artificial intelligence in medical imaging significantly drives the UK imaging services market by enhancing diagnostic accuracy and operational efficiency across various imaging modalities. Integrating AI algorithms facilitates quicker image analysis and reduces the workload for radiologists, allowing them to process more cases in less time. For instance, AI applications have been shown to decrease image interpretation times by up to 50%, enabling earlier detection of conditions such as cancer and cardiovascular diseases. In addition, the growing adoption of artificial intelligence (AI) technologies in clinical workflows is attracting investments, further expanding the imaging market. As healthcare providers increasingly rely on AI to improve patient outcomes and streamline operations, the demand for advanced imaging solutions continues to rise, propelling market growth.

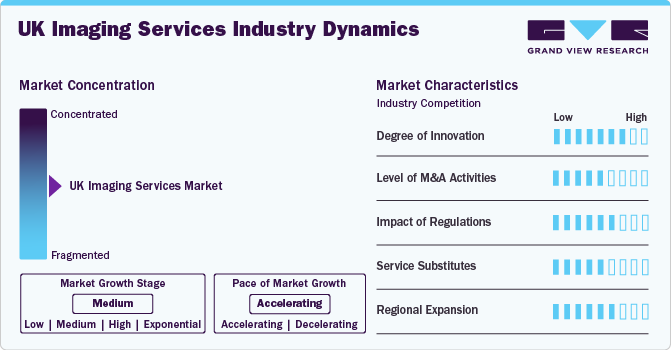

Market Concentration & Characteristics

The imaging services industry in the UK is undergoing significant growth, driven by technological advancements coupled with heightened healthcare demands and changing patient expectations. Innovations in imaging modalities, including AI-enhanced MRI, CT, and ultrasound, are markedly improving the speed, accuracy, and accessibility of diagnostic services, rendering them essential in contemporary healthcare. In addition, the increasing prevalence of chronic and age-related diseases necessitates regular monitoring and early intervention, thereby amplifying the demand for imaging services.

Prominent service providers in the imaging services industry are actively pursuing a range of strategic initiatives, such as product installations, upgrades, collaborations, and acquisitions, to sustain their competitive advantage and address the evolving demands of the market. For instance , in January 2024, Alliance Medical Limited recently installed a new cardiac MRI scanner at its Marylebone facility, enhancing its diagnostic capabilities. The installation involved craning the equipment into the building, demonstrating the advanced technology's size and complexity. This upgrade aims to improve patient care and support the growing demand for cardiac imaging services. The new scanner enables more accurate and efficient diagnoses for patients.

UK imaging services industry is witnessing continuous advancement by developing and adopting new technologies and techniques. The sector has experienced significant growth in recent years, primarily driven by the increasing demand for diagnostic imaging services and the integration of advanced imaging modalities such as MRI, CT, and PET-CT. The rapid evolution of these technologies has facilitated more precise and timely disease detection, thereby enhancing patient care and treatment outcomes. Innovations, including AI-powered imaging, higher-resolution scanners, and enhanced software capabilities, are transforming the delivery of imaging services, rendering them faster, more accurate, and more accessible.

UK imaging services industry is witnessing a notable increase in partnerships and collaborations as companies strive to expand their service offerings and engage a broader customer base. These collaborations often involve sharing advanced technologies and expertise, significantly enhancing participating organizations' service capabilities. Recent collaborations between industries and government organizations also drive the market's growth. For instance, InHealth Group partnered with the NHS in Surrey and Sussex to provide lung health checks to 72,000 individuals. This initiative aims to enhance early detection of lung conditions and improve overall respiratory health in the region. The program utilizes advanced imaging technology and clinical expertise to identify potential issues, allowing for timely intervention and treatment. This collaboration underscores the commitment to improving public health outcomes through accessible diagnostic services.

The UK imaging services market operates under stringent regulations aimed at safeguarding patient safety, protecting data privacy, and ensuring the responsible handling and disposal of medical equipment. These measures underscore our commitment to upholding the highest standards in the industry. Key regulatory authorities, such as the Care Quality Commission (CQC) and the Medicines and Healthcare Products Regulatory Agency (MHRA), play a vital role in overseeing and enforcing these standards. They establish comprehensive guidelines that imaging service providers must follow to uphold quality and safety in their operations. These regulations protect patients and foster trust in the healthcare system, as providers are held accountable for delivering safe and effective imaging services.

The imaging services industry in the UK experiences a minimal threat from direct substitutes, primarily due to the critical role that imaging plays in contemporary healthcare. Techniques such as MRI, CT, X-ray, and PET-CT provide essential, non-invasive insights necessary for the accurate diagnosis, monitoring, and management of various medical conditions. Although alternative diagnostic methods, including laboratory tests and wearable health devices, may offer complementary information, they do not replace the unique capabilities of imaging technologies.

Numerous imaging centers in the UK have been broadening their influence to new regions, aiming to accommodate a larger patient demographic. This strategic expansion has notably enhanced accessibility to imaging services, particularly in underprivileged or remote locations where such facilities were previously insufficient. By inaugurating new centers or collaborating with established healthcare providers in diverse areas, these imaging services have proficiently met the increasing demand for diagnostic testing.

For instance, in April 2024, Torbay and South Devon NHS Foundation Trust, in collaboration with InHealth Group, the UK's largest specialist provider of diagnostic solutions, is set to open a new community diagnostic center (CDC) on Market Street in Torquay. This initiative is designed to enhance healthcare accessibility for local residents, particularly those in more remote areas, by bringing vital diagnostic services closer to home. By facilitating a range of tests and procedures directly in the community, the CDC aims to expedite treatment processes and significantly reduce waiting lists that have been exacerbated by increased demand for healthcare services.

Modality Insights

MRI scans segment held the largest market share of about 32.8% in 2024. MRI's dominant position in medical imaging is primarily due to its superior soft tissue contrast. This characteristic allows for the effective diagnosis of a wide range of diseases and conditions, including neurological disorders, cancers, and musculoskeletal injuries. MRIs can achieve sensitivity rates of up to 90% in tumor detection, outpacing many other imaging methods. This high level of accuracy is vital for diagnosis and precise surgical treatment planning. Detailed MRI images help surgeons visualize complex anatomical structures, ultimately improving surgical outcomes and reducing recovery times for patients.

CT scans segment is projected to experience the fastest growth in the imaging services market during the upcoming forecast period. This imaging modality is particularly valued for its capability to generate highly detailed images of various anatomical structures, including bones, blood vessels, and soft tissues. In light of the increasing emphasis on cancer prevention and early detection, several population-level screening programs have been implemented. CT scans play a significant role in these lung health initiatives. Low-dose computed tomography (LDCT) has emerged as the standard screening tool for high-risk populations, specifically individuals aged 55 to 80 with a considerable smoking history, in accordance with the recommendations of the U.S. Preventive Services Task Force.

End Use Insights

Hospitals segment dominated the market with a share of nearly 48% in 2024, driven by the adoption of advanced imaging modalities. For instance , in October 2023, a new PET-CT scanner was installed at Norfolk and Norwich University Hospital, significantly improving access to advanced cancer diagnostics for patients throughout the East of England. In September 2021, Hexham General Hospital also introduced an advanced MRI scanner, with the strategic partnership between Northumbria Healthcare NHS Foundation Trust and InHealth Group, a leading diagnostic provider. Since its launch, this facility has been serving over 300 patients monthly with essential diagnostic scans, which include approximately 25 targeted scans for cardiac patients and 15 arthrograms—advanced imaging for musculoskeletal disorders each month. In addition, the increasing incidence of various medical conditions, such as cancer and cardiac disorders, is expected to drive continued growth in this country

The diagnostic imaging centers segment is anticipated to experience the fastest growth over the forecast period. This growth is primarily driven by an increasing number of partnerships and acquisitions between diagnostic imaging centers and various healthcare organizations. These collaborations enhance service offerings, expand access to advanced imaging technologies, and contribute to overall market growth. For instance, in March 2021, Affidea Group, a leading European provider of diagnostic imaging, outpatient, and cancer care services, acquired Fortius Clinic, the UK's largest orthopedic group distinguished for its expertise in orthopedics and musculoskeletal conditions. In addition, the availability of multiple imaging modalities within a single facility, coupled with favorable reimbursement policies for imaging procedures, is expected to positively influence market growth.

Key UK Imaging Services Company Insights

Major players in the UK imaging services industry are actively enhancing their service offerings to capture a larger market share and expand their customer base. These companies are investing in the latest technological upgrades to improve the quality and efficiency of their imaging services. Moreover, they are pursuing strategic acquisitions to broaden their service portfolios and enter new geographic regions, thereby strengthening their market position. In addition, partnerships with other healthcare providers and technology firms are being formed to leverage complementary strengths and integrate innovative solutions. Securing government clearances and regulatory approvals also remains a critical focus for these organizations.

Key UK Imaging Services Companies:

- Alliance Medical Limited

- InHealth Group

- Neuromed Diagnostic Imaging Centre

- UNILABS

- Medica Group.

- TIC Health.

- The Radiology Clinic.

- affidea

- Vista Diagnostics Limited.

- Medical Imaging Partnership

Recent Developments

-

In July 2024, the NHS Birmingham and Solihull Integrated Care Board, in partnership with University Hospitals Birmingham NHS Foundation Trust, announced the establishment of a new Community Diagnostic Centre (CDC) in Chelmsley Wood. This initiative is being developed in collaboration with InHealth, the UK’s largest specialist provider of diagnostic solutions.

-

In February 2024, InHealth Group announced the launch of a new mobile PET-CT unit, equipped with an upgraded high-spec scanner, located at Singleton Hospital in Swansea. This unit is projected to provide scans for over 2,000 patients annually, enhancing access to advanced diagnostic imaging services in the region.

-

In November 2023, the Medical Imaging Partnership received accreditation as a Continuing Professional Development (CPD) provider in the UK. This recognition allows the organization to offer professional development opportunities to healthcare professionals, supporting their ongoing education and training in medical imaging

UK Imaging Services Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 16.59 billion |

|

Revenue forecast in 2030 |

USD 23.84 billion |

|

Growth rate |

CAGR of 7.52% from 2025 to 2030 |

|

Actual period |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Modality, end use |

|

Key companies profiled |

Alliance Medical Limited; InHealth Group; Neuromed Diagnostic Imaging Centre; UNILABS; Medica Group.; TIC Health.; The Radiology Clinic.; affidea; Vista Diagnostics Limited.; Medical Imaging Partnership |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

UK Imaging Services Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the UK imaging services market report on the basis of modality and end use:

-

Modality Outlook (Revenue, USD Billion, 2018 - 2030)

-

X-rays Scans

-

CT Scans

-

MRI Scans

-

Ultrasound

-

Nuclear Medicine Scans

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Diagnostic Imaging Centers

-

Others

Frequently Asked Questions About This Report

b. MRI dominated the UK imaging services market with a share of 32.9% in 2024. This is attributable to the factors such as better soft tissue contrast than other imaging services and technological advances.

b. Some key players operating in the UK imaging services market include Alliance Medical; InHealth Group; Neuromed Diagnostic Imaging Centre; UNILAB; Medica Group; TIC Health; The radiology Clinic; Affidea Group; Vista Health; Medical Imaging Partnership

b. Key factors that are driving the UK imaging services market growth include rise in adoption of technologically advanced imaging systems and growing prevalence of chronic disorders.

b. The UK imaging services market size was estimated at USD 15.60 billion in 2024 and is expected to reach USD 16.59 billion in 2025.

b. The UK imaging services market is expected to grow at a compound annual growth rate of 7.52% from 2025 to 2030 to reach USD 23.84 billion by 2030.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."