- Home

- »

- Medical Devices

- »

-

UK Hysteroscopy Procedures Market, Industry Report, 2030GVR Report cover

![UK Hysteroscopy Procedures Market Size, Share & Trends Report]()

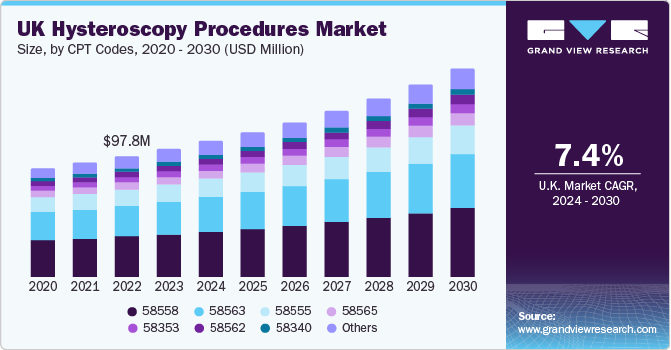

UK Hysteroscopy Procedures Market Size, Share & Trends Analysis Report By CPT Codes (CPT Code 58555, CPT Code 58558, CPT Code 58562, CPT Code 58340, CPT Code 58563), By End-use (Hospitals, Clinics), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-274-9

- Number of Report Pages: 172

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

UK Hysteroscopy Procedures Market Trends

The UK hysteroscopy procedures market size was estimated at USD 103.55 million in 2023 and is anticipated to grow at a CAGR of 7.41% from 2024 to 2030. The rising prevalence of gynecological conditions and growing preference for minimally invasive surgeries across the UK are anticipated to propel market growth over the forecast period. According to the All Party Parliamentary Group (APPG) on Endometriosis Report 2020, endometriosis impacts around 10% of females from puberty to menopause, which is more than 1.5 million in the UK.

The rising prevalence of gynecological diseases, such as uterine fibroids, abnormal vaginal bleeding, ovarian cysts, endometriosis, cervical cancer, and other related diseases, is driving the market growth. According to the study published by the National Library Of Medicine in December 2021, endometrial cancer is the most common gynecological disorder in the UK, with more than 9,700 new cases diagnosed each year.

Statistics for some gynecological cancer in the UK are as follows:

Type of Cancer

New Cases 2022 in UK

5-year prevalence in UK

Corpus Uteri

10 440

42 999

Ovary

6 390

19 325

Cervix uteri

3 235

12 964

In addition, a growing preference for minimally invasive surgical procedures due to lower associated risks is expected to drive the market growth. Moreover, hysteroscopy is associated with reduced hospitalizations, less blood loss, minimal abdominal wounds, and faster recovery. These benefits are anticipated to drive the demand among patients for noninvasive or minimally invasive treatments such as hysteroscopy.

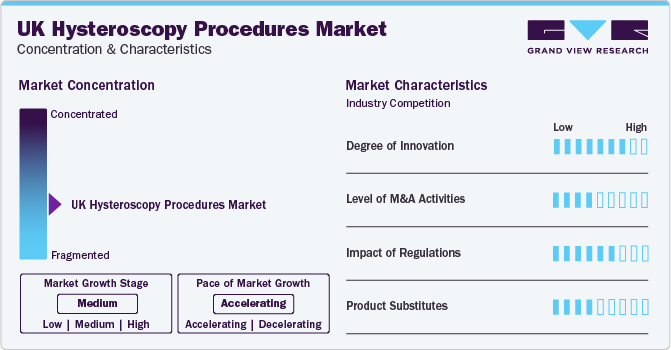

Market Concentration & Characteristics

The industry's growth stage is medium, and the pace of its growth is accelerating owing to the growing demand for hysteroscopy procedures and the growing adoption of technologically advanced devices that can be used during these procedures.

The degree of innovation is high due to the rising launches and development of innovative products and devices that can be used in hysteroscopy procedures. Emerging and established players focus on R&D to offer novel products. For instance, in January 2022, Inovus Medical introduced the HystAR, a high-fidelity hysteroscopy simulator. This product incorporates augmented reality (AR) technology and a cloud-based learning platform with its simulated tissue models to provide scalable, realistic, tracked hysteroscopy skills training. Such developments are expected to drive innovation in the industry

Several industry participants are undergoing M&As to bolster their presence in the industry. Some companies that implement this strategy include Olympus Corporation, CooperSurgical, Inc., and Medtronic. This strategy helps companies provide novel offerings across the country

The primary regulatory authority, the Medicines & Healthcare Products Regulatory Agency (MHRA), governs regulations for medical devices, including those used in hysteroscopy procedures. The authority provides a regulatory framework to assure the effectiveness, safety, and quality of the products used in hysteroscopy procedures. In addition, hysteroscopy devices undergo comprehensive evaluations and need regulatory authorization from the MHRA before commercial distribution

Product substitutes in the market include transvaginal ultrasound, pelvic ultrasound, and endometrial biopsy

Fragmented market: Several emerging and established players are present in the UK market. Major participants, such as Medtronic, Stryker Corporation, and Hologic Inc., have wider product portfolios. In addition, emerging players like Delmont Imaging and Inovus Medical focus on offering novel and advanced products

CPT Codes Insights

The 58558 CPT codes segment accounted for the largest share of 33.39% of the overall revenue in 2023 due to the increased demand for hysteroscopy and biopsy procedures as a result of the high prevalence of gynecological disorders. The code 58558 is for medical procedures that involve laparoscopic and hysteroscopic procedures carried out on the Corpus Uteri.

The code is utilized to diagnose or report the cause of abnormal uterine bleeding, such as fibroids, polyps, or cancer. The 58562 CPT codes segment is expected to grow at the highest CAGR from 2024 to 2030. This code is associated with removing the impacted foreign body and is useful for reporting an impacted intrauterine device (IUD).

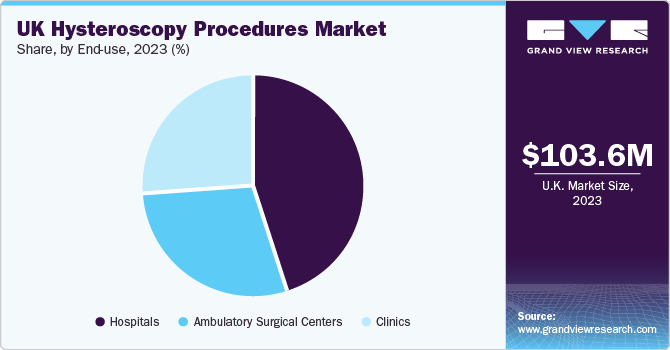

End-use Insights

The hospitals end-use segment accounted for the largest share of 45.38% in 2023. Operative hysteroscopy is conducted in hospitals to rectify any abnormal conditions detected during diagnostic hysteroscopy. The increasing number of gynecology surgical procedures and the availability of a large number of hospitals in the UK are major factors contributing to segment growth. In addition, the increasing funding from the government for developing hospitals is anticipated to support the segment growth. For instance, according to an article published by the Department of Health and Social Care in October 2020, the government of the UK invested around USD 4.03 billion in building 40 hospitals across the UK.

Such investments are expected to drive the segment’s growth. The ambulatory surgery centers segment is anticipated to grow at the fastest CAGR from 2024 to 2030. The surgeries and procedures conducted in ASCs help increase patient comfort and reduce the required time for diagnostic hysteroscopy. Moreover, it is economical and efficient for both patients and surgeons. Thus, several factors, such as increased patient comfort, lowered time for medical procedures, and reduced costs associated with these centers are anticipated to boost the segment growth.

Key UK Hysteroscopy Procedures Company Insights

The competition in the market is anticipated to be driven by the rising developments of advanced and novel products. In addition, the major and emerging participants operating in the market are adopting various strategies, such as partnerships and mergers & acquisitions. Furthermore, the easy availability of products from major companies is expected to propel market competition in the coming years.

Key UK Hysteroscopy Procedures Companies:

- Medtronic

- Olympus Corp.

- Stryker Corporation

- B. Braun Melsungen AG

- Johnson & Johnson (Ethicon, Inc)

- Hologic, Inc.

- Delmont Imaging

- KARL STORZ SE & CO. KG

- Richard Wolf GmbH

- CooperCompanies

Recent Developments

-

In November 2023, Medtronic Plc extended its partnership with Cosmo Intelligent Medical Devices, a subsidiary of Cosmo Pharmaceuticals. This partnership is anticipated to revolutionize endoscopy by utilizing the power of AI to enhance patient outcomes

-

In June 2023, Olympus Corp. announced the establishment of Digital Excellence Centers (DECs) after the acquisition of London-based Odin Vision. Odin Vision provides a wide portfolio of computer-aided diagnostic/detection solutions and cloud-AI endoscopy. Such acquisitions by market participants are expected to boost market growth

-

In May 2023, B. Braun launched its latest laparoscopic AESCULAP EinsteinVision 3.0 FI. This solution is useful for gynecology oncological procedures

UK Hysteroscopy Procedures Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 109.99 million

Revenue forecast in 2030

USD 168.94 million

Growth rate

CAGR of 7.41% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

CPT codes, end-use

Country scope

UK

Key companies profiled

Medtronic; Olympus Corp.; Stryker Corp.; B. Braun Melsungen AG; Johnson & Johnson (Ethicon, Inc.); Hologic, Inc.; Delmont Imaging; KARL STORZ SE & CO. KG; Richard Wolf GmbH; CooperCompanies

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Hysteroscopy Procedures Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UK hysteroscopy procedures market report on the basis of CPT codes and end-use:

-

CPT Codes Outlook (Revenue, USD Million, 2018 - 2030)

-

CPT code 58555

-

CPT code 58558

-

CPT code 58562

-

CPT code 58340

-

CPT code 58563

-

CPT code 58565

-

CPT code 58353

-

CPT code 58561,74740 And More (Others)

-

-

End- use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Ambulatory Surgery Centers

-

Frequently Asked Questions About This Report

b. The UK hysteroscopy procedures market size was estimated at USD 103.55 million in 2023 and is expected to reach USD 109.99 million in 2024.

b. The UK hysteroscopy procedures market is expected to grow at a compound annual growth rate of 7.41% from 2024 to 2030 to reach USD 168.94 million by 2030.

b. Based on CPT codes, the 58558 segment dominated the UK hysteroscopy procedures market with a share of 33.4% in 2023.

b. Some of the key players operating in the UK hysteroscopy procedures market include Medtronic, Stryker Corporation, Hologic, Inc., KARL STORZ SE & Co. KG, Medical Devices Business Services, Inc. (Ethicon, Inc.), Olympus Corporation, Delmont Imaging, B. Braun Melsungen AG, Richard Wolf GmbH, CooperCompanies, Maxer Endoscopy GmbH, Boston Scientific Corporation, MedGyn Products, Inc., Lina Medical APS, Luminelle, and Meditrina, Inc. (Aveta).

b. Key factors that are driving the UK hysteroscopy procedures market growth include the increasing prevalence of gynecological disorders such as uterine abnormalities, abnormal uterine bleeding, uterine fibroids, fertility disorders, amongst other gynecological disorders.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."