- Home

- »

- Medical Devices

- »

-

UK Hypodermic Syringes And Needles Market, Report, 2030GVR Report cover

![UK Hypodermic Syringes And Needles Market Size, Share & Trends Report]()

UK Hypodermic Syringes And Needles Market (2024 - 2030 ) Size, Share & Trends Analysis Report By Product (Hypodermic Syringes, Hypodermic Needles), By End-use (Hospitals, Clinics, Ambulatory Surgical Centers), And Segment Forecasts

- Report ID: GVR-4-68040-452-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

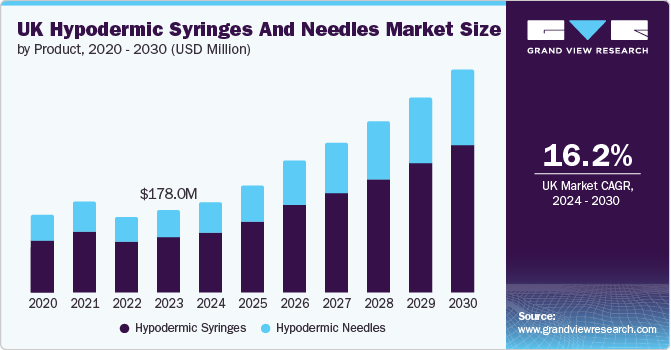

The UK hypodermic syringes and needles market size was valued at USD 178.0 million in 2023 and is projected to grow at a CAGR of 16.2% from 2024 to 2030. Its growth can be attributed to factors such as the growing geriatric population, increasing prevalence of chronic disorders, and rising number of surgeries. Increasing demand for syringes for mass vaccination is the primary factor driving the demand for hypodermic syringes and needles. According to Diabetes UK, as of 2022-23, there were over 5.6 million people in the UK living with diabetes. Moreover, an increasing number of needle stick injuries is expected to drive the market growth. According to a National Library of Medicine study published in April 2024, approximately 100,000 needlestick injuries occur annually in the UK.

The increasing technological advancements in syringes and needle designs are enhancing the effectiveness and safety of anesthesia administration. Advancements such as ultra-thin needles, safety-engineered syringes, and smart syringes equipped with integrated technology are propelling the market forward. These innovations contribute to reducing patient discomfort, enhancing precision, and decreasing complications, thereby facilitating the adoption of newer products.

In addition, the Dumfries and Galloway Council, a governmental body in the UK, is actively addressing the issue of proper disposal of hypodermic products. They promote the reporting of discarded needles and syringes found on public land or council properties. The staff within the council is specifically trained to safely collect and dispose of these hypodermic items. Government initiatives aimed at the distribution and responsible disposal of hypodermic products are anticipated to foster market growth over the next decade.

Furthermore, the UK’s well-established healthcare system, characterized by advanced hospitals and clinics, fuels the demand for hypodermic needles and syringes. Investments aimed at upgrading and expanding medical facilities lead to an increased utilization of these products. The funding provided by the National Health Service (NHS) for healthcare services facilitates the acquisition of modern medical equipment, which includes anesthesia needles and syringes. According to the UK Parliament, total health expenditure in the UK reached USD 273.84 billion for the financial year 2022/2023.

The National Patient Safety Team of NHS England, in collaboration with the Association of Anaesthetists, the Royal College of Anaesthetists, and the Safe Anaesthesia Liaison Group, has released a National Patient Safety Alert. These alerts mandate that all NHS-funded providers must switch to NRFit Connectors for all intrathecal and epidural procedures, as well as for the administration of regional blocks. The deadline for completing this transition is set for January 31, 2025.

Actions to be completed by January 31, 2025:

Explanation of Identified Safety Issue

Actions Required

The NHS has long used a range of medical devices with the universal Luer connector to administer medicines via different routes of administration, including the intravenous, intrathecal, and epidural routes.

1. Prioritize the establishment of a Short-Life Working Group (SLWG) to scope out and coordinate the transition to NRFit across all relevant clinical specialties: a. Identify a clinical lead to chair the group. b. Ensure local procurement leads are included to identify all devices that need to transition to NRFit. Plan and risk assess the most appropriate & safe process for transition and monitor implementation.

This commonality of connectors carries a significant risk of accidental wrong route administration of medication. The potential for a fatal outcome from this, especially if medication for intravenous administration is given via the intrathecal or epidural route, is well known and previous patient safety alerts have been issued.

2. To ensure the comprehensive transition from Luer to NRFit devices is managed and supply chain continuity maintained, local procurement leads must:

a. Engage with NHS Supply Chain to agree to a timeline for transition to NRFit.

b. Identity all device locations and order codes and revise stock management systems.Although access to a full portfolio of NRFit devices and supply chain fragility has delayed its full implementation in the NHS, industry across the UK has now adopted NRFit

3. After completion of Action 2, the SLWG will:

a. Clearly communicate the agreed timeline and implementation plan to all relevant clinical staff.

b. Ensure all relevant policies, procedures, and educational & training resources for intrathecal; epidural, & regional block procedures are updated with reference to the use of NRFit devices as well as fully accessibleSome organizations have already transitioned to these devices, supported by a joint statement from the Association of Anesthetists, Royal College of Anaesthetists, and the Safe Anaesthesia Liaison Group, but many have yet to do so completely.

The pharmaceutical industry is growing, and drug approvals have increased, which is anticipated to create lucrative opportunities for the hypodermics market. According to data published by Imperial College London in March 2023, around 35 new drugs were authorized by the Medicine and Healthcare Products Regulatory Agency (MHRA), a UK regulatory authority, in 2021. In addition, during 2022/23, over 100,000 notifications were authorized to allow patients access to essential drugs not otherwise available in the UK. As a result, the increasing number of drug approvals is expected to boost the demand for hypodermic needles and syringes in the coming decade. These rising drug approvals and the growing demand for hypodermic syringes & needles are expected to create significant opportunities for key players to increase their manufacturing capabilities and strengthen their distribution networks over the forecast period.

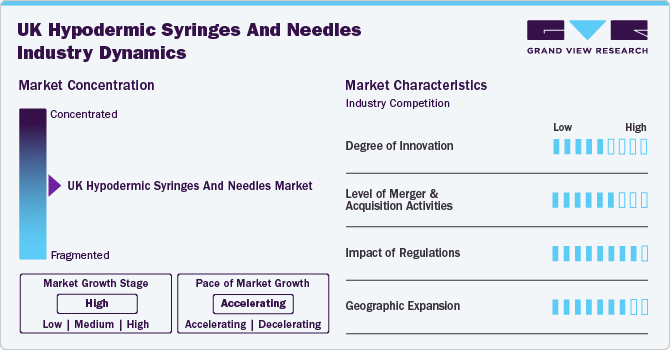

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration that is high. The y-axis represents various industry characteristics, including industry competition, degree of innovation, impact of regulations, level of partnership & collaboration activities, and geographic expansion. The industry is fragmented, with smaller and larger players offering a variety of specialized services and customized solutions. The degree of innovation is moderate, and the impact of regulations on industry is high. The level of partnership & acquisition activities is moderate, and the geographic expansion of the industry is high.

The degree of innovation in the market is moderate. Advancements in the designs and features of syringes & needles are anticipated to propel market growth. Modern hypodermic needles incorporate safety-engineered protection mechanisms, such as sheathing systems and blunting technologies. For instance, Cardinal Health offers a Monoject Safety Hypodermic Needle with an integrated safety sheath to reduce the risk of needle stick injuries. Furthermore, it has one-handed activation and Hinged Arm Technology to enhance safety. Such product design and feature advancements are anticipated to drive market growth over the forecast period.

The impact of regulations on the market is expected to remain high. The Medicines and Healthcare Products Regulatory Agency (MHRA) serves as the principal regulatory authority responsible for overseeing medical devices, which include hypodermic needles and syringes. Prior to being marketed in the UK, all hypodermic products are required to be registered with the MHRA. This registration process entails a thorough evaluation of the product’s safety and performance. Post-Brexit, the UK introduced the UKCA mark, which replaces the EU’s CE mark for products sold in Great Britain (England, Scotland, and Wales). Hypodermic products must have a UKCA mark to demonstrate conformity with UK regulations.

Merger & acquisition activities in the market are moderate, driven by the need for improved patient outcomes, cost efficiency, and enhanced service delivery. Hospitals are forming strategic alliances with various stakeholders, including other healthcare providers, technology companies, and community organizations. For instance, in July 2024, GBUK Group Ltd., a portfolio company of A&M Capital Europe, acquired Care & Independence (“C&I”), a rapidly expanding UK provider of patient handling and mobility devices.

Geographic expansion in the market is high due to factors including increasing healthcare needs, advancements in medical technology, and a growing emphasis on safety and hygiene. The market encompasses a wide range of products, including disposable syringes, safety-engineered devices, and specialized needles for different medical applications. The expansion is particularly evident in urban areas where healthcare facilities are more concentrated, leading to higher demand for these essential medical supplies. Additionally, the rise of chronic diseases such as diabetes and the need for vaccinations have further propelled the market growth across different regions.

Product Insights

The hypodermic syringes segment dominated the market with a revenue share of 67.4% in 2023. Hypodermic syringes are used in medical research and clinical trials for sample collection and drug delivery. They are also crucial for managing diabetes with insulin injections. Additionally, they make home healthcare easier by enabling patients to take their own meds. The market for hypodermic syringes is expanding because of quick technical developments that increase patient comfort, safety, and effectiveness during medical procedures. For instance, Safety-engineered syringes with retractable needles or shielded tips assist in lowering the danger of needlestick injuries and infections, addressing major problems in healthcare contexts.

The hypodermic needles segment is expected to grow at the fastest CAGR over the forecast period. The increasing incidence of chronic illnesses such as diabetes, cancer, and cardiovascular diseases requires regular injections for both treatment and monitoring purposes, leading to a heightened demand for hypodermic needles. For example, a report from Diabetes UK indicates that during the period of 2022–2023, over 5.6 million people in the UK were diagnosed with diabetes, including approximately 1.2 million individuals who may have type 2 diabetes. With the rising number of diabetes cases, especially type 1 and type 2, there is an increasing need for hypodermic needles for insulin injections, which drives the market growth over the forecast period. In addition, developments in needle technology, such as improved safety features, including retractable needles and enhanced precision, are contributing to market growth.

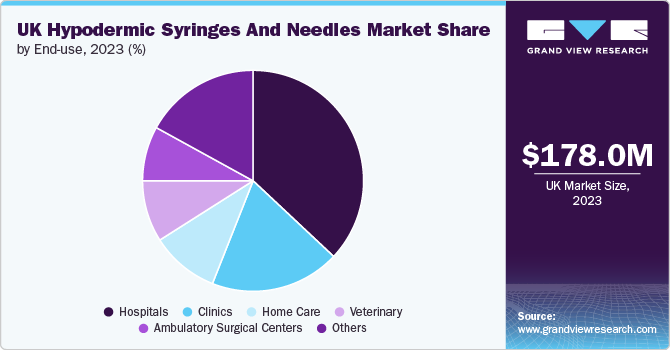

End-use Insights

The hospitals segment dominated the market with the largest revenue share in 2023 and is projected to grow at the fastest CAGR over the forecast period. Hospitals play a crucial role in shaping the hypodermics market by maintaining a consistent and high demand for hypodermic needles and syringes, primarily due to the extensive number of medical procedures carried out. According to a report from the National Institute for Health and Care Research (NIHR) published in January 2022, the NHS performs over 5 million surgical procedures each year. Various medical interventions that require injections-such as administering medications, drawing blood for diagnostic tests, and delivering anesthesia-are frequently conducted in hospitals.

The diverse range of patient requirements, which spans from routine healthcare to intricate emergency treatments, necessitates an array of hypodermic products, thereby fueling market demand. Additionally, the high turnover rate of patients in hospitals further amplifies the utilization of these medical devices, contributing significantly to the growth of the market.

The home care segment is anticipated to grow at a lucrative rate over the forecast period. The rising incidence of chronic illnesses and the expanding trend of managing medical disorders at home are the main reasons behind the expansion of the home care industry. Patients with increasingly prevalent illnesses, including diabetes, rheumatoid arthritis, and multiple sclerosis need frequent injections to administer medications, which drives up demand for hypodermic syringes and needles.

Additionally, the home care market is growing because of developments in hypodermic technology, such as safety features and ergonomic designs. The improvement of patient compliance and safety during self-injections is achieved by the invention of syringes with safety-engineered features and minimum pain or discomfort.

Key UK Hypodermic Syringes And Needles Company Insights

The market is fragmented due to diverse product offerings and regulations. Companies such as BD; Cardinal Health; B. Braun SE; ICU Medical; Nipro Medical Europe dominate the market due to their extensive networks of facilities and comprehensive service offerings. The company has a significant share of the market due to its focus on quality products and operational efficiency. As companies continue to adapt to evolving healthcare needs and consumer preferences, their market shares may fluctuate based on strategic mergers and acquisitions or expansions into new regions of the country.

Key UK Hypodermic Syringes And Needles Companies:

- BD (Becton, Dickinson & Corporation)

- Cardinal Health

- B. Braun SE

- ICU Medical

- Terumo Corporation

- Nipro Europe Group Companies (Nipro Corporation)

- SolM

- GBUK Group Ltd.

UK Hypodermic Syringes And Needles Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 194.9 million

Revenue forecast in 2030

USD 479.3 million

Growth rate

CAGR of 16.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use

Country scope

UK

Key companies profiled

BD; Cardinal Health; B. Braun SE; ICU Medical; Nipro Medical Europe; Terumo; SolM; GBUK Group Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Hypodermic Syringes and Needles Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UK hypodermic syringes and needles market report based on product, and end-use.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypodermic Syringes

-

Conventional Syringes

-

Safety Syringes

-

Retractable Safety Syringes

-

Non-retractable Safety Syringes

-

-

-

Hypodermic Needles

-

Conventional Needles

-

Safety Needles

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Ambulatory Surgical Centers

-

Veterinary

-

Home Care

-

Others

-

Frequently Asked Questions About This Report

b. The UK hypodermic market size was estimated at USD 178.0 million in 2023 and is expected to reach USD 194.86 million in 2024.

b. The UK hypodermic market is expected to grow at a compound annual growth rate of 16.18% from 2024 to 2030 to reach USD 479.28 million by 2030.

b. Hypodermic syringes dominated the UK hypodermic market in 2023. This is attributed to the quick technical developments that increase patient comfort, safety, and effectiveness during medical procedures.

b. Some of the key players in UK hypodermic Becton, Dickinson and Company (BD), Medline Industries, Inc., Smiths Medical (ICU Medical), Thermo Fisher Scientific Inc., Gland Pharma Limited, Direct Healthcare Group, and Dame Products.

b. Key factors that are driving the market growth include rising prevalence of chronic diseases, increasing geriatric population, and growth in vaccination programs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.