- Home

- »

- Clinical Diagnostics

- »

-

UK Health Check-up Market Size And Share Report, 2030GVR Report cover

![UK Health Check-up Market Size, Share & Trends Report]()

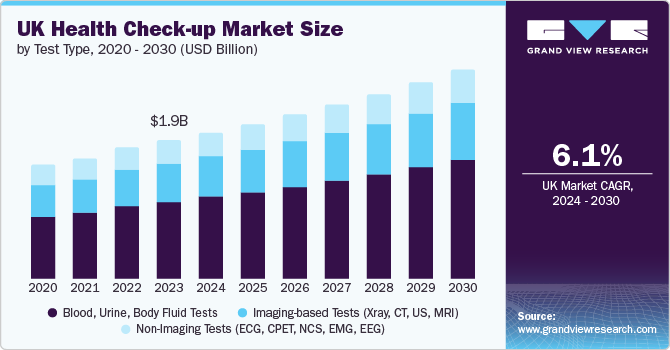

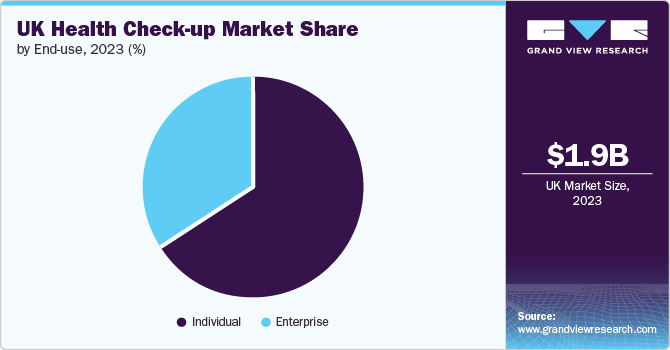

UK Health Check-up Market Size, Share & Trends Analysis Report By Test Type (Blood, Urine, Body Fluid Tests, Imaging-based Tests), By End-use (Enterprise, Individual), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-328-7

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

UK Health Check-up Market Size & Trends

The UK health check-up market size was estimated at USD 1.99 billion in 2023 and is projected to grow at a CAGR of 6.08% from 2024 to 2030. The growth of the market is attributed to the growing prevalence of chronic diseases, the rising adoption of home-based medicine and telemedicine, and rising government initiatives to enhance population screening initiatives. Moreover, the growing awareness of preventive healthcare solutions in the country is opportunistic for the market growth.

The availability of health insurance coverage that includes preventive care benefits is a key factor driving the growth of the market. According to reports, around 13% of the British population, or approximately 8 million people, have active private health insurance policies in the UK. Additionally, around 53% of people express a desire to invest in some form of insurance scheme for themselves, their employees, or their families. In recent years, there has been a shift in insurance policies to prioritize preventive care. Most insurance providers now include preventive care services, such as check-ups, vaccinations, and screenings, as part of their coverage at no additional cost. Furthermore, insurance companies often require policyholders to undergo medical risk assessments as part of the underwriting process, which typically involve comprehensive health check-ups. These assessments help insurers evaluate an individual's wellness and determine appropriate coverage and premiums.

The growing awareness of the importance of preventive care, coupled with the inclusion of health check-ups in insurance policies, is anticipated to be a significant driver for the expansion of the market in the UK. As more individuals gain access to preventive care services through their insurance plans, the demand for routine check-ups is expected to increase, fueling the growth of this market.

The market is undergoing a transformative phase driven by the integration of digital technologies within the healthcare ecosystem. In Europe, countries are actively working towards the integration of medical services to enhance healthcare facilities across multiple nations. This collaborative effort is fueling the demand for innovative digital solutions to facilitate seamless cross-border healthcare delivery. For instance, in May 2022, the European Commission announced the establishment of European Health Data Space aims to harness the medical data of nearly 450 million people. This ambitious initiative will create a robust digital infrastructure for healthcare, enabling cross-border connectivity and data sharing. By harnessing the power of data and digital technologies, the European Health Data Space will revolutionize the way healthcare services are delivered and accessed across the continent.

Furthermore, the increasing adoption of digital platforms for health monitoring is expected to drive the demand for general and preventive check-up tests over the forecast period. These digital tools empower individuals to take a more proactive approach to their health, encouraging regular check-ups and early intervention. As digital technologies become more integrated into the healthcare ecosystem, the accessibility and convenience of check-up services will improve, leading to higher adoption rates and better patients’ outcomes for the population.

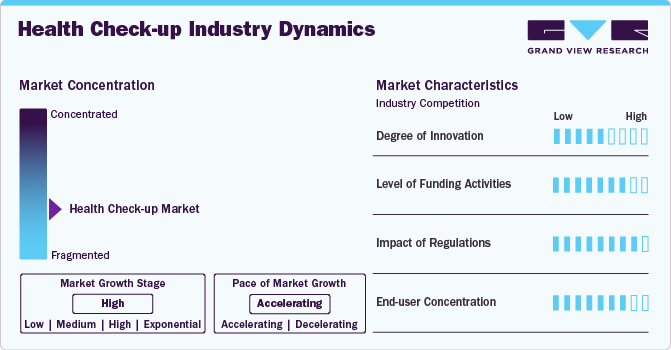

Market Characteristics & Concentration

The degree of innovation in the UK health check-up market is moderate, particularly in the development of novel solutions that help provide early detection, personalized healthcare strategies, and improved healthcare solutions. Moreover, funding has allowed companies to invest in research and development, introducing new technologies and solutions that improve the efficiency and accuracy of check-ups.

Several players are focusing on funding activities, focusing majorly on accelerated innovation, expansion of healthcare solutions, and providing improved patient outcomes. Moreover, governments are investing in population-based screening initiatives and programs to improve healthcare access and outcomes.

Regulatory support and funding are crucial factors driving the market. Regulatory changes in the healthcare sector frequently result in new standards for patient care, data management, billing practices, and other areas.

The market shows a high end-user concentration, with a significant portion of revenue generated from hospital-based laboratories. These laboratories are well equipped with cutting-edge medical equipment and infrastructure to conduct a wide range of diagnostic tests and screenings, driving demand for the segment.

Test Type Insights

Blood, urine, body fluid tests segment led the market and accounted for 55.38% of the revenue in 2023 and is anticipated to expand at the fastest growth rate over the forecast period. Blood, urine, and body fluid-based tests are comprehensive diagnostic tools for assessing overall health and detecting potential problems. Blood tests are used to measure a variety of parameters, including glucose, lipid profile, liver and kidney function, and complete blood counts (CBC). Urine tests are used to assess kidney function and detect potential problems by measuring parameters such as protein levels, glucose, and performing microscopic examinations. Furthermore, body fluid tests are used to detect cerebrospinal fluid (CSF) for conditions like meningitis and salivary cortisol tests for hormonal balance. Furthermore, the ease of sample collection and the advantage of providing early detection and preventive care through these samples is expected to drive overall growth in the segment.

Imaging-based tests held the second-largest market share in 2023. Imaging-based tests are an important part of complete checkup packages. These tests use a variety of imaging modalities to identify potential health issues early on, allowing for timely interventions and preventive measures. These tests include a variety of CT scans for detecting conditions such as colon cancer, lung cancer, and coronary heart disease, a DEXA scan for osteoporosis and bone mineral density assessments, as well as full-body composition analysis, a high sensitivity non-fasting blood test for diabetes, metabolic syndrome, heart and brain vessel, and liver health, and colposcopy for cervical cancer screening and detection.

End-use Insights

Individual end-use segment led the market with a share of 66.35% in 2023, attributed to a growing public awareness of general and preventive care benefits. Healthcare professionals also recommend regular screenings to understand disease prognosis and treatment options better. Individual end users frequently pay the fee out of pocket or through personal insurance. Individuals growing health consciousness, as well as their desire for early detection and intervention to maintain well-being, are driving the growth of the segment. Moreover, advancements in medical technology and telehealth have made checkups more convenient and accessible, contributing to the growth of this segment.

Enterprise end-use segment is projected to witness the fastest growth rate over the forecast period. Multinational corporations, educational institutions, and government bodies provide health check-ups as an employee wellness benefit to assess their employee's medical status, identify potential medical risks, and offer appropriate interventions. Furthermore, individuals frequently struggle to schedule check-ups due to time constraints; thus, enterprise-based users provide strong healthcare feasibility to employees. For example, according to an article published in April 2023 by the American Academy of Family Physicians, nearly half of all American women missed a preventive check-up in the previous year due to high out-of-pocket costs and scheduling issues.

Key UK Health Check-up Company Insights

Some of the leading players operating in the market include Quest Diagnostics Incorporated, OPKO Health, Inc., and Laboratory Corporation of America Holdings. Key players are leveraging existing customer bases in the country to prioritize maintaining high-quality standards while gaining large market access. This strategy is useful for established brands. These companies are heavily investing in advanced technology and infrastructure to process and analyze large volumes of samples efficiently. Furthermore, companies collaborate on various strategic initiatives with other companies and distributors to strengthen their market presence.

Perspectum, Enara Bio, Vinehealth Digital Limited, and simprints are some of the emerging market participants in the market. These companies focus on achieving funding support from healthcare organizations and government bodies aided with novel service launches to capitalize on untapped avenues.

Key UK Health Check-up Companies:

- Quest Diagnostics Incorporated

- Laboratory Corporation of America Holdings

- SYNLAB International GmbH

- OPKO Health, Inc.

- Eurofins Scientific

- UNILABS

- Sonic Healthcare Limited

- ARUP Laboratories

- Q2 Solutions

Recent Developments

-

In June 2023, the digital NHS Health announced the launch of a new health check in England in spring. This government initiative is launched with a motive to cover 1 million people in first four years and alleviate the pressure on GP surgeries.

-

In June 2021, NHS staff and thousands of patients are expected to benefit from thirty-eight new AI projects announced with a motive to accelerate diagnosis and revolutionize care in UK.

UK Health Check-up Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.11 billion

Revenue forecast in 2030

USD 3.00 billion

Growth Rate

CAGR of 6.08% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test type, end-use

Country scope

UK

Key companies profiled

Quest Diagnostics Incorporated; Laboratory Corporation of America Holdings; SYNLAB International GmbH; OPKO Health, Inc.; Eurofins Scientific; UNILABS; Sonic Healthcare Limited; ARUP Laboratories; Q2 Solutions

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Health Check-up Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UK health check-up market report based on test type and end-use.

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood, Urine, Body Fluid Tests

-

Imaging-based Tests (Xray, CT, US, MRI)

-

Non-Imaging Tests (ECG, CPET, NCS, EMG, EEG)

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Enterprise

-

Private (Corporate) Sector

-

Government Sector

-

Insurance

-

-

Individual

-

Out of Pocket- Direct Payment for Health Check

-

Individual Health Insurance Plan

-

-

Frequently Asked Questions About This Report

b. The UK health check-up market size was estimated at USD 1.99 billion in 2023 and is expected to reach USD 2.11 billion in 2024.

b. The UK health check-up market is expected to grow at a compound annual growth rate of 6.08% from 2024 to 2030 to reach USD 3.00 billion by 2030.

b. Blood, urine, body fluid tests dominated the UK health check-up market with a share of 55.38% in 2023. This is attributable to rising use of these test type to measure a variety of parameters, including glucose, lipid profile, liver and kidney function, and complete blood counts (CBC).

b. Some key players operating in the UK health check-up market include Quest Diagnostics Incorporated, Laboratory Corporation of America Holdings, SYNLAB International GmbH, OPKO Health, Inc., Eurofins Scientific, UNILABS, Sonic Healthcare Limited, ARUP Laboratories, Q2 Solutions.

b. Key factors that are driving the market growth include the growing prevalence of chronic diseases, the rising adoption of home-based medicine and telemedicine, and rising government initiatives to enhance population screening initiatives.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."