- Home

- »

- Nutraceuticals & Functional Foods

- »

-

UK Gummy Market Size And Share, Industry Report, 2030GVR Report cover

![UK Gummy Market Size, Share & Trends Report]()

UK Gummy Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Vitamins, Dietary Fibres, Melatonin), By Ingredient (Gelatine, Plant-based Gelatine Substitute), By End Use, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-221-2

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UK Gummy Market Size & Trends

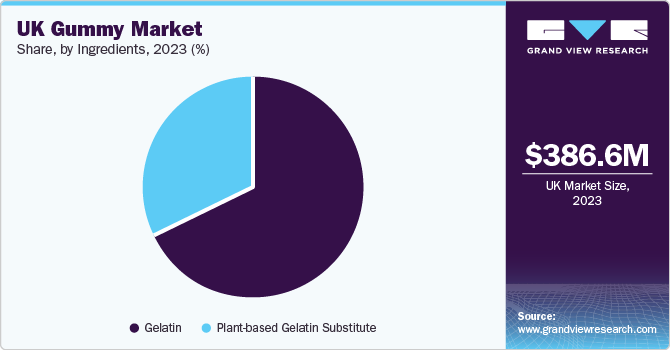

The UK gummy market size was estimated at USD 386.64 million in 2023 and is expected to grow at a CAGR of 12.9% from 2024 to 2030. Projected growth for this market can be attributed to extensive admiration of gummy supplements in the UK, rising awareness about elements utilised in the processed foods, mindful consumer behaviour concerning food and beverages, shifting tendencies causing preference towards nutraceuticals over pharmaceuticals, and growing prevalence of health intricacies such as cardiovascular diseases and diabetes among others.

The UK gummy market accounted for 3.98% of the global gummy market in 2023.

Features that mainly influence the growth of gummy market in the UK are growing inclinations towards improved lifestyle in terms of health, increased embracing of easy-to-consume foods and supplements, growing accessibility of diverse variants such as vegan and plant-based alternatives, increasing mindfulness about environmental accountabilities as customers, and novelty accompanied by massive product portfolio.

The ever-changing lifestyle of young population, draining and extended work hours followed by long travels, unceasing urbanisations has directed this population to situation where customers are more concerned about their health and food that they consume. This has led them to consumption of food, which is considered healthy, thoughtful addition of vitamins and minerals and melatonin as well in daily diets, increased consciousness about animal welfare and deliberate moves by producers to highlight their approach towards adoption of sustainable products that are made through cruelty free processes.

Market Concentration & Characterisation

The UK gummy market is growing at accelerating pace and the growth stage is identified as high. The market is characterised by existence of numerous popular brands as well as various additional makers and suppliers, which function at moderately smaller or medium range scale in the business. This advances the entire market into highly competitive state, which is fragmented in nature now.

Degree of innovation is moderate in UK gummy market. Demand for inclusion of new flavors, growing needs of personalised product, constantly changing needs of customers are some of key aspects, which drive the innovation for this market. Producers have been discovering mixes of flavors and blends accompanied with enhanced formulations. This has been generating greater demands and growing number of buyers who prefer the use of gummies over substitute products.

The impact of regulation in this market is at high-level compliance, regulation requirements and quality control measures are of paramount importance in UK gummy market. The companies that are manufacturing these gummies lean towards investing huge amounts in this, as safety and efficacy of the offerings is entirely dependent on these regulations and manufacturing practices. Threat of alternatives is fairly low in the industry, due to overwhelming response that consumers have been providing while preferring the gummies over other forms of supplements and vitamins.

Product Insights

Vitamin-based gummy market accounted for 24.91% in the year 2023. Growing vitamin deficiencies is one of the main reasons behind the increasing use of vitamin-based gummies in the UK. Vitamins like D and B12, are becoming a problem area for many due to the changing lifestyles, the long working hours and other health related problems. The vitamin gummies are considered as one of the most convenient ways of vitamin intake and they are also provided by manufacturers in different kinds of shapes and colour to variety to it.

CBD/CBN-based gummy market is expected to grow at CAGR of 18.6% from 2024 to 2030. CBD/CBN, (Cannabidiol/Cannabinol) two of more than many other kinds of chemical constituents, which are found in the cannabis, plant naturally. The projected growth for this market is also been positively impacted by the increasing adoption of CBD/CBN-based gummies in treatments of chronic health conditions such as dementia.

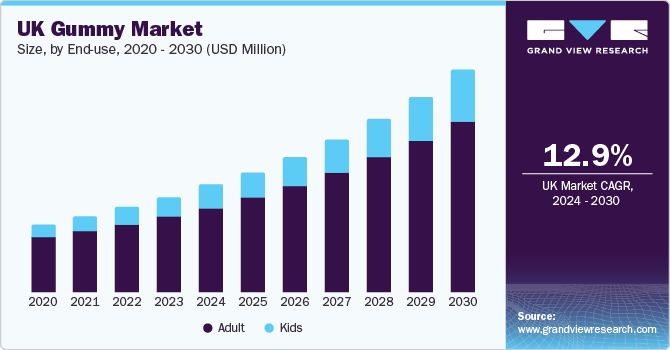

End-use Insights

Adult gummy market accounted for 79.63% in 2023. This can be attributed to presence of growing geriatric population in the country. In addition, prescription-based use of gummies have now become a thing in the market, which is assisting the increase in demands.

Kids gummy market in UK is expected to grow at CAGR of 14.9% from 2024 to 2030. This market has continuously been acquiring the greater market share each year is projected to reach unmatched growth patterns in approaching years.

Ingredients Insights

The gelatin-based gummy market in the UK accounted for 67.86% in the year 2023. These are one of the most common gummies that are distributed widely by the manufacturing companies. The texture offering and cost-effective feature of these gummies generate greater demand through all sorts of market and distribution channels. Gummies like these, with gelatine as their prime ingredient, offer hard and chewy texture for users. This is one of the key reasons behind consumer’s inclination towards gelatine-based gummies.

The plant-based gelatin-substitute market in the country is expected to grow at CAGR of 14.4% from 2024-2030. In recent past, several cases about excessive consumption of the gelatine-based gummies have created the awareness about consequences associated with it. This has helped the plant-based substitute market to grow with greater pace.

Distribution Channel Insights

The sales generated through offline distribution channel in UK gummy market accounted for 79.00% of the market size in 2023. This is mainly due to unparalleled distribution and availability of gummies through offline channels such as practitioners, hypermarkets, speciality store, supermarkets and most importantly local pharmacies. This approach offers increased brand visibility as well as enhanced market penetration for companies. This is easiest for makers to reach their consumers directly.

Sales of gummies through online channel is expected to grow at CAGR of 15.6% from 2024 to 2030. This can be attributed to slowly yet steadily growing popularity of online shopping experience. The online way of buying gummies is also considered as absolutely private and limited to knowledge of the buyer only.

Key UK Gummy Company Insights

-

Amway Corp, one of the leading companies in business of nutrition, personal care, beauty and home appliances, and sells juicy fruit flavoured gummies infused with Vitamin C and zinc in the UK Gummy market. The products are distributed through online sale as well.

-

Bayer AG, one among the top companies in healthcare and agriculture industry, is into distribution of multivitamin gummies. The company has been in the business of supplements for more than a few decades.

Key UK Gummy Companies:

- Amway Corp.

- Bayer AG

- Chruch & Dwight Co. Inc.

- Ernest Jackson & Co. Ltd.

- Ion Labs Inc.

- Pfizer Inc.

- Reckitt Benckiser Group Plc

- UK Gummy Company

- Nature’s Bounty Inc.

- Perrigo Co.

Recent Developments

-

In August 2023, in order to gain certainty regarding industry worth millions, hundreds of companies and thousands of products sold in market, the CBD industry in UK called for much needed legal clarity.

UK Gummy Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 433.89 million

Revenue Forecast in 2030

USD 899.67 million

Growth Rate

CAGR of 12.9% from 2024 to 2030

Actuals

2018 - 2023

Forecasts

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast; company ranking; competitive landscape; growth factors; and trends

Segments Covered

Product, end-use, ingredient, distribution channel

Key companies profiled

Amway Corp; Bayer AG; Chruch & Dwight Co. Inc.; Ernest Jackson & Co. Ltd.; Ion Labs Inc.; Pfizer Inc.; Reckitt Benckiser Group Plc; UK Gummy Company; Nature’s Bounty Inc.; Perrigo Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Gummy Market Report Segmentation

This report forecasts revenue growth at the UK level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the UK gummy market report on the basis of product, ingredient, end-use, and distribution channel.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamins

-

Minerals

-

Carbohydrates

-

Omega Fatty Acids

-

Proteins & Amino Acids

-

Probiotics & Prebiotics

-

Dietary Fibers

-

CBD/CBN

-

Psylocybin/Psychedelic Mushroom

-

Melotonin

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult

-

Men

-

Women

-

Pregnant Women

-

Geriatric

-

-

Kids

-

-

Ingredients Outlook (Revenue, USD Million, 2018 - 2030)

-

Gelatin

-

Plant-based Gelatin Substitute

-

-

Distribution Channel Outlook (Reveune, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others

-

-

Online

-

Frequently Asked Questions About This Report

b. The UK gummy market size was estimated at USD 386.64 billion in 2023 and is expected to reach USD 433.89 billion in 2024.

b. The UK gummy market is expected to grow at a compounded growth rate of 12.9% from 2024 to 2030 to reach USD 899.67 billion by 2030.

b. Vitamin-based gummy market accounted for 24.91% in the year 2023. Growing vitamin deficiencies is one of the main reasons behind the increasing use of vitamin-based gummies in the UK. Vitamins like D and B12, are becoming a problem area for many due to the changing lifestyles, the long working hours and other health related problems.

b. Some key players operating in the market include Amway Corp; Bayer AG; Chruch & Dwight Co. Inc.; Ernest Jackson & Co. Ltd.; Ion Labs Inc.; Pfizer Inc.; Reckitt Benckiser Group Plc; UK Gummy Company; Nature’s Bounty Inc.; Perrigo Co.

b. Key factors that are driving the market growth include extensive admiration of gummy supplements in the UK, rising awareness about elements utilised in the processed foods, mindful consumer behaviour concerning food and beverages, shifting tendencies causing preference towards nutraceuticals over pharmaceuticals, and growing prevalence of health intricacies such as cardiovascular diseases and diabetes among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.