UK & Germany Diet And Nutrition Apps Market Size, Share & Trends Analysis Report By Type (Weight Loss/Gain Tracking Apps, Calorie Counting Apps), By Device, By Platform, By Service, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-954-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

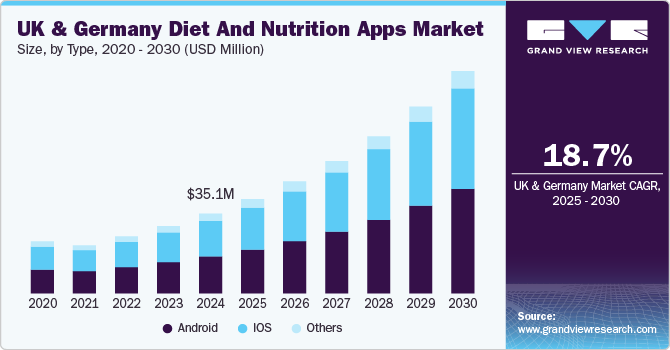

The UK & Germany diet and nutrition apps market size was estimated at USD 35.1 million in 2024 and is projected to grow at a CAGR of 18.7% from 2025 to 2030. Favorable government initiatives, growing health consciousness, and a rising number of educational programs regarding developing healthcare, diet, nutrition, and fitness-related apps fuel the market's growth.

For instance, in 2023, the UK focused significantly on improving diet and nutrition education programs, particularly within schools, with a key emphasis on promoting healthy eating habits through initiatives like the "Eatwell Guide" and by enhancing the food education curriculum within the national curriculum, aiming to equip children with the knowledge and skills to make healthy food choices; this includes initiatives to improve school meals and increase access to nutritious breakfast options for students.

With the increasing adoption of smartphones and the easy availability of technologically advanced devices, innovators have started investing to capitalize on growth opportunities by focusing on delivering quality healthcare and comfort to consumers through various mobile platforms that would help them track their fitness regimes and obtain answers to diet and fitness-related inquiries over the phone, WhatsApp, or through several mobile applications. For instance, several apps, such as MyFitnessPal, Noom, and BetterMe, have been launched in the last decade to help individuals track their diet, nutrition, and health and store their healthcare information in their fitness journey.

Smartphones have evolved from communication and entertainment devices to devices that monitor health and fitness. Smartphone mobile applications have simplified life by making it convenient to perform daily activities. According to Mobile UK, a trade association, there are 111.8 million mobile subscriptions in the UK, and 98% of the adult population have a smartphone.

Furthermore, startups with innovative business models are being established, boosting the market. For instance, in March 2023, Peter Norff, a Germany-based indie developer, revealed a new iPhone calorie-tracking app, "Caloree," designed to make healthier eating habits and weight management easy and convenient. The app features a barcode scanner, food diary, weight log, and Apple Watch support to assist users in tracking their daily calorie intake and monitoring their progress over time.

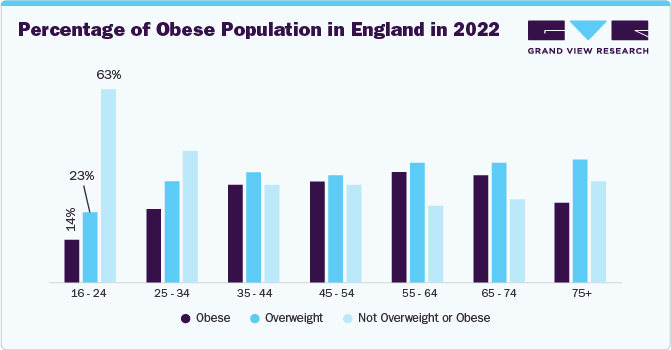

Furthermore, the growing prevalence of obesity boosts the demand for diet and nutrition apps in the UK and Germany. According to the Health Survey for England conducted in 2022, 28% of adults were obese, and 36% were overweight in England. Moreover, according to an article published by NCBI in September 2022, in Germany, 53.5% of the population is overweight, including obese, and 19% of adults are obese.

Market Concentration & Characteristics

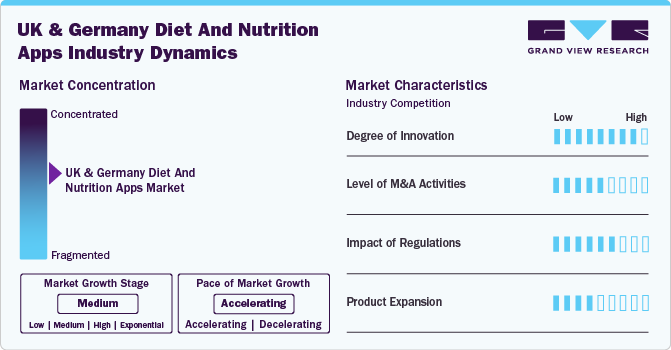

The UK and Germany diet and nutrition apps industry is characterized by a high degree of innovation owing to rapid technological advancements driven by factors such as technological advancements and the increasing number of smartphone users. For instance, in June 2024, Nightingale Health Plc., a medical laboratory, and ZOE Limited, a UK-based company, collaborated and expanded their longstanding research collaboration. This new phase reveals Nightingale Health’s technologically advanced blood collection device for self-sampled blood test and analysis technology, which significantly augments ZOE’s nutrition and overall health research. ZOE leverages the findings from this research to further enhance its personalized nutrition service, which offers at-home health tests and personalized advice based on test outcomes.

The UK and Germany diet and nutrition apps industry is characterized by medium merger and acquisition activity, owing to several factors, including the desire to expand the business to cater to the growing demand for diet and nutrition apps to maintain a competitive edge.

Diet and nutrition app companies are mandated to abide by several regulations, ensuring patient data safety. In Germany, the Federal Institute for Drugs and Medical Devices (BfArM) governs the approval and listing of digital health applications, including diet and nutrition apps.

The industry has seen a significant level of product expansion in recent years. Many apps have expanded their offerings to include new features, such as calorie tracking and providing meal recipes. For instance, in August 2023, Samsung introduced Samsung Food, a meal planning and suggestion platform in more than 104 countries, including the UK and Germany.

Platform Insights

Based on platform, the android segment led the market with the largest revenue share of 46.4% in 2024.Factors such as growing downloads of diet and nutrition apps on Android phones for tracking calorie intake and nutrients, monitoring physical activities, gathering diet recipes, and increasing smartphone users fuel the market growth. For instance, according to Business of Apps, a media company, 68.7 million individuals in Germany were active smartphone users in 2023. Android phones often offer a wider variety of options with a more extensive selection of apps, mainly for niche dietary needs. These apps are usually available at a potentially lower cost than iOS, making Android a more accessible choice for users seeking diverse dietary tracking tools

The iOS segment is anticipated to grow at the fastest CAGR over the forecast period, owing to the high adoption of iOS devices. Diet and nutrition apps designed for iOS devices offer a wide range of features such as meal tracking, calorie counting, personalized diet plans, recipe suggestions, and more. Some of the major Diet and Nutrition Apps available on iOS platforms, such as iPhone, iPad, and Apple Watch, include Lose It!, Yazio, Fooducate, FatSecret, Cronometer, and MyFitnessPal. For instance, in a financial institution in London, according to Finder UK, an estimated 8.4 million iPhones were sold in the UK in 2023.

Type Insights

Based on type, the calorie counting apps segment led the market with the largest revenue share of 49.7% in 2024. Various technology companies are actively working with academic institutes, clinicians, and policymakers to develop solutions that meet the needs of patients and clinicians. Moreover, the increasing demand for mobile healthcare apps among consumers in the UK is expected to supplement market growth. For example, NutraTech Ltd., a UK-based food diary App and website, offers Nutracheck, which tracks calories and six key nutrients: sugar, carbs, fat, protein, saturated fat, and salt.

The weight loss/gain tracking apps segment is anticipated to grow at a significant CAGR over the forecast period, owing to advancements in technology and increasing demand for personalized fitness solutions. The launch of AI-driven coaching, augmented reality fitness sessions, and wearable device integration has improved user experiences, increasing engagement and motivation. For instance, in December 2023, Hearst UK introduced new mobile applications for Men's Health UK and Women's Health UK as part of an upgraded membership initiative for both brands. This enhanced offering delivers subscribers a more personalized and comprehensive fitness and wellness experience.

Device Insights

Based on device, the smartphone segment led the market with the largest revenue share of 66.5% in 2024. This segment's growth is attributed to the increasing penetration of smartphones within the region, the high usage of smartphones, and app compatibility. For instance, according to Finder UK, a financial institution in London, 94% (51.9 million) of UK individuals aged 16 and above own a smartphone. The number of individuals with a smartphone has increased since 2023, when just 87% of people owned a smartphone.

The wearable devices segment is expected to grow at a significant CAGR during the forecast period. A wearable fitness device measures and compiles user activity data and synchronizes it with a suitable fitness application. An increasing number of lifestyle disorders, growing awareness regarding healthy lifestyles, and technological advancements are the key factors propelling segment growth. For instance, in January 2025, Zepp INC. introduced the Amazfit Active 2, a lifestyle smartwatch for health-oriented customers to monitor their fitness without compromising aesthetics.

Service Insights

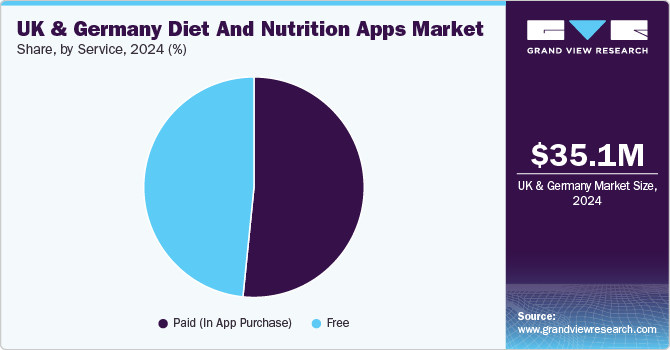

Based on service, the paid (In App Purchase) segment led the market with the largest revenue share of 51.6% in 2024. This segment includes services such as personalized meal plans, advanced nutrition analysis, recipe collections, one-on-one coaching, and access to exclusive health content. Users often engage with these apps on a freemium model, where basic features are free, but premium tools and resources are unlocked through in-app purchases. This model allows developers to attract a larger user base while monetizing through a subset of committed users seeking tailored dietary support. Thus, such factors fuel the market growth.

The free segment is expected to grow at a significant CAGR during the forecast period. The free segment in diet and nutrition apps has gained significant traction as more users seek accessible ways to improve their health and wellness without the commitment of paid subscriptions. These apps typically offer basic features such as meal tracking, basic nutritional information, calorie counting, and food logging, making them an appealing option for individuals just starting their health journey or those on a tight budget. By providing free services, these segments cater to a broader audience and make it easier for users to track their diet and nutritional intake, promoting better awareness of their eating habits.

Key UK & Germany Diet & Nutrition Apps Company Insight

Key participants in the UK and Germany diet and nutrition apps industry are focusing on devising innovative business growth strategies, such as expanding their product portfolios, partnerships and collaborations, mergers and acquisitions, and expanding their business footprints.

Key UK & Germany Diet And Nutrition Apps Companies:

- MyNetDiary Inc.

- fatsecret

- Adidas

- FitNow, Inc.

- Eat This Much Inc.

- Under Armour, Inc.

- Azumio, Inc.

- Lifesum AB

- Fitbit, Inc. (Google)

- MyFitnessPal, Inc.

- Noom, Inc.

Recent Developments

-

In June 2024, Lifesum AB acquired LYKON, a Germany-based personalized nutrition company. The company integrated its nutrition expertise with LYKON's capabilities in customized health solutions and at-home biomarker testing to offer a personalized and comprehensive solution and solidify its position in the European market.

-

In October 2023, MyFitnessPal launched new updates and features to simplify tracking and logging on Google’s Wear OS. Users can monitor their dietary intake directly through their smartwatch powered by Wear OS by Google.

-

In October 2023, Lifesum AB introduced a healthy fasting program for employees to help increase well-being and optimize productivity. It offers a safe, sustainable fasting experience tailored to individual needs.

UK & Germany Diet And Nutrition Apps Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 41.6 million |

|

Revenue forecast in 2030 |

USD 97.9 million |

|

Growth rate |

CAGR of 18.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast data |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, platform, device, service |

|

Country scope |

UK; Germany |

|

Key companies profiled |

MyNetDiary Inc.; fatsecret; Adidas; FitNow, Inc.; Eat This Much Inc.; Under Armour, Inc.; Azumio, Inc.; Lifesum AB; Fitbit, Inc. (Google); MyFitnessPal, Inc.; Noom, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

UK & Germany Diet And Nutrition Apps Market Report Segmentation

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the UK and Germany diet and nutrition apps market report based on type, platform, device, and service:

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Android

-

IOS

-

Others

-

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Smartphone

-

Tablet

-

Wearable Devices

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Weight Loss/Gain Tracking Apps

-

Calorie Counting Apps

-

Meal Planning Apps

-

Others

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Paid (In App Purchase)

-

Free

-

Frequently Asked Questions About This Report

b. The UK & Germany diet and nutrition apps market size was estimated at USD 35.1 million in 2024 and is expected to reach USD 41.6 million in 2025.

b. The UK & Germany diet and nutrition apps market is expected to grow at a compound annual growth rate of 18.7% from 2025 to 2030 to reach USD 97.9 million by 2030.

b. Calorie counting apps segment held the largest revenue share of 49.7% in 2024. Factors such as growing downloads of diet and nutrition apps on Android phones for tracking calorie intake and nutrients, monitoring physical activities, gathering diet recipes, and increasing smartphone users fuel the market growth.

b. Some of the major players operating in theUK & Germany diet and nutrition apps market are MyNetDiary Inc., fatsecret, Adidas, FitNow, Inc., Eat This Much Inc., Under Armour, Inc., Azumio, Inc., Lifesum AB, and Fitbit, Inc. (Google).

b. Favorable government initiatives, growing health consciousness, and a rising number of educational programs regarding developing healthcare, diet, nutrition, and fitness-related apps fuel the market's growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."