- Home

- »

- Medical Devices

- »

-

UK Continuous Renal Replacement Therapy Market, Report 2030GVR Report cover

![UK Continuous Renal Replacement Therapy Market Size, Share & Trends Report]()

UK Continuous Renal Replacement Therapy Market (2024 - 2030) Size, Share & Trends Analysis Report by Product (System, Consumables), By Modality (Slow Continuous Ultra Filtration, Continuous Venovenous Hemofiltration), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-434-4

- Number of Report Pages: 300

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

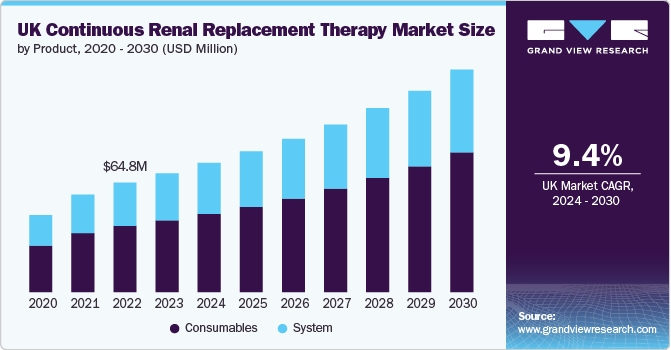

The UK continuous renal replacement therapy market size was estimated at USD 70.33 million in 2023 and is projected to grow at a CAGR of 9.4% from 2024 to 2030. Growing prevalence of acute kidney injury (AKI) and chronic kidney disease (CKD), increasing research funding for kidney disease, rapid increase in the volume of hospitals and urgent care centers, growing hospital admissions rate, and constant product launches by prominent market players are a few factors driving the demand for CRRT devices, thereby propelling the market growth in the UK.

For instance, in the UK, approximately 3.25 million people are living with chronic kidney disease (CKD) at stages 3-5, which are characterized by significant loss of kidney function. Additionally, around 3.9 million people are believed to have earlier stages of CKD, specifically stages 1-2, which often involve minimal to no impairment of kidney function. These numbers underscore the substantial prevalence of kidney disease in the UK population. Further, approximately 615,000 cases of acute kidney injury occur annually in the UK. This widespread issue predominantly affects individuals who are already hospitalized or experiencing other health issues.

Economic Burden of Kidney Disease in the UK

According to Kidney Research UK report published in June 2023, the number of individuals with CKD stages 3-5 is expected to reach 3.9 million by 2033. This significant growth is primarily driven by the increasing prevalence of an ageing population, as well as the rise of risk factors such as diabetes, hypertension, and cardiovascular disease . Dialysis is a significant contributor to the economic burden of kidney disease, with an estimated annual cost of USD 36,796.0 per patient in 2023 for the National Health Service (NHS). This staggering figure is more than three times the annual value of a state pension, highlighting the substantial financial implications of kidney disease on the healthcare system and society as a whole.

Furthermore, the total annual cost of kidney disease to the National Health Service (NHS) is estimated to be USD 6.7 billion, accounting for approximately 3.2% of the NHS budget. This enormous figure is a significant contributor to the total economic burden of kidney disease, which totals USD 7.4 billion annually.

NHS Funding and Research Cost for Kidney Disease

Year

UKRI/MRC funding for kidney disease (KD) (USD Million)

NIHR funding for KD (USD Million)

Total KD research funding (USD Million)

UKRI Medical research budget (USD)

NIHR spent research programmes Budget 2022 (excluding COVID-19) (USD Million)

Total estimated relevant research budget (USD Million)

KD % of budget

2019/20

8.79

15.99

24.79

913.76

486.58

1,400.34

2.06

2020/21

9.23

9.47

18.69

946.54

504.03

1,450.58

1.54

2021/22

7.06

11.59

18.65

843.03

448.91

1,291.94

1.48

Market Concentration & Characteristics

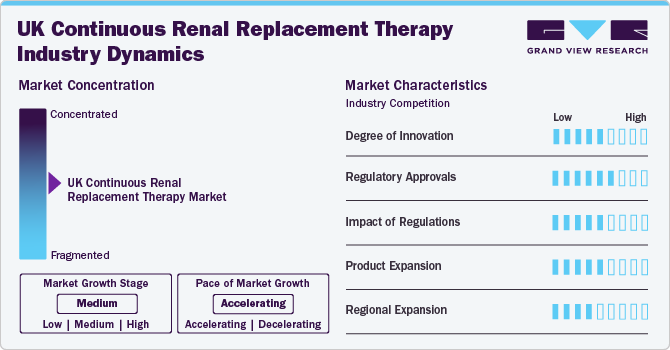

The market growth stage is medium, and pace of the market growth is accelerating driven by the growing prevalence of AKI among hospitalized patients. With the rising number of patients requiring continuous renal replacement therapy (CRRT), the market is becoming increasingly competitive, with multiple players vying for dominance.

The current landscape in the UK continuous renal replacement therapy (CRRT) market is characterized by a mix of established players and new entrants, each with their own strengths and weaknesses. Baxter, Fresenius Medical Care UK Ltd, and B. Braun Medical Ltd are among the leading players in the market, boasting a strong presence in the UK and globally. These companies have built their reputation through decades of innovation, quality, and customer satisfaction.However, the market is also seeing an influx of new entrants, including smaller companies and startups, which are leveraging innovative technologies and business models to disrupt the traditional CRRT landscape. These newcomers are often driven by a focus on patient-centricity, ease of use, and cost-effectiveness, which are becoming increasingly important considerations for healthcare providers and payers.

Key strategies implemented by players and government entities in the UK Continuous Renal Replacement Therapy market are product launch, expanding distribution channels, partnerships, collaboration, marketing & awareness campaigns, and other strategies.

The UK CRRT market is characterized by a moderate degree of innovation, driven by the growing need for high-quality, patient-centric solutions. While the market has seen significant advancements in recent years, the pace of innovation is expected to accelerate as companies focus on developing more automated, portable, and data-driven CRRT systems. One of the key areas of innovation in the UK continuous renal replacement therapy (CRRT) market is the development of patient-centric solutions. Companies are recognizing the importance of providing personalized care to patients with AKI and are designing CRRT systems that cater to their specific needs. This includes the development of smaller, more portable systems that can be used in a various settings, from ICUs to emergency departments.

The UK CRRT market is subject to a complex regulatory framework, designed to confirm the quality and safety of critical care products. Regulatory approvals play a crucial role in ensuring that CRRT systems meet the required standards for patient safety, efficacy, and performance. The Medicines and Healthcare Products Regulatory Agency (MHRA) grants approval for medical devices, including CRRT systems, after thoroughly reviewing of the device's safety, efficacy, and performance. CRRT manufacturers must also obtain CE marking to demonstrate compliance with EU regulations. CE marking is a mandatory requirement for medical devices sold in the EU.

Regulations often set standards for safety and efficacy, driving manufacturers to invest in R&D to meet these requirements. Companies prioritize the development of innovative features and advancements in existing technologies to not only meet regulatory requirements but also to ultimately enhance patient outcomes and improve healthcare quality. Compliance with these regulations is mandatory, which can increase the cost and time required for product development and market entry.

Market players are focusing on expanding their product portfolios to cater to a broader range of patient needs. Growing demand for customized solutions is expected to increase in the development of new products. For instance, Baxter’s PRISMAX System is a revolutionary CRRT system that is designed to provide individualized and effective therapies for critically ill patients in the ICU. With its flexible design and compatibility with a wide range of membranes, the PRISMAX System is an ideal solution for healthcare providers seeking optimal patient. This trend is driven by the growing demand for personalized healthcare and the need for tailored products that meet specific patient needs. In addition, new entrants are expected to enter the market, particularly in the areas of innovative materials and digital health integration. Established players will need to adapt to these changes to maintain market share and remain competitive.

Within the UK CRRT market, many companies focus on addressing several patient demographics or meeting specific therapeutic requirements. The market includes large, established companies such as B. Braun Medical Ltd, Baxter, Medtronic, Braun & Co. Limited, and Fresenius Medical Care UK Ltd which offer a broad range of products and having significant market shares. Due to an emphasis of companies on developing customized solutions for certain specializations in the market, this specialization contributes to market fragmentation.

Forming strategic partnerships or collaborations with local distributors, healthcare providers, and key opinion leaders can facilitate market entry and accelerate adoption. Collaborating with established entities can provide valuable insights into regional market nuances, regulatory requirements, and customer preferences.

Product Insights

Consumables segment dominated the market in 2023. The increase in the utilization of charcoal filters, hemofilter, fluid, and other consumable products in CRRT has been a contributing factor to the segment growth. Hemofilters, often known as artificial kidneys, are made out of a hollowfiber membrane that decides how much solute and fluid is removed. For patients with significant renal illnesses, businesses such as Baxter and Fresenius offer a variety of consumables across modalities. Although these products are inexpensive, they are frequently purchased as compared to other segments.

System segment is expected to witness a moderate CAGR of 8.4% during the forecast period. The continuous renal replacement therapy machines are mainly intended to deliver renal therapy. It consists of blood and fluid pumps, a user-friendly interface, scales, and integrated safeguards. Significant technological advancements, such as high-volume permeability of CRRT, and integration of Electronic Medical Record (EMR) connectivity, are likely to drive segment growth. Manufacturers are currently developing sophisticated devices that are safe and provide consistent performance throughout CRRT procedures.

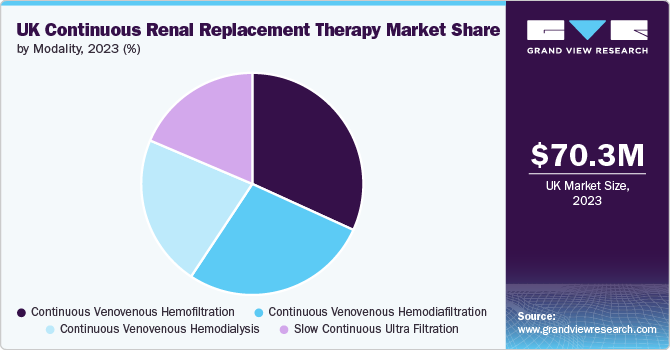

Modality Insights

The Continuous venovenous hemofiltration (CVVH) segment dominated the market in 2023 due to the rising prevalence of fluid overload cases, which are commonly observed in acute kidney injury patients in critical care units. This is expected to fuel the growth of the CVVH segment as it is a popular choice among clinicians due to its ease of use, flexibility, and effectiveness in managing critically ill patients with AKI or CKD.

The CVVH segment is expected to witness the fastest CAGR of 10.2% during the forecast period.The industry is expected to continue its growth trajectory, driven by advancements in technology, increasing awareness among healthcare professionals, and growing demand for CRRT modalities. However, there are also challenges that must be addressed, including the high costs of systems and consumables, the complexity of the process, and regulatory requirements.

Regional Insights

England Continuous Renal Replacement Therapy Market Trends

England dominates the UK CRRT market in 2023, driven by the growing demand for CVVH in English hospitals. The market is expected to continue its growth trajectory, driven by the growing incidence rate of AKI, technological advancements, increasing awareness among healthcare professionals, and growing demand for CRRT modalities. For instance, according to the latest report published by The Renal Association in 2022, the rate of AKI episodes in England has increased significantly over the recent years. In 2022, the rate of AKI episodes per million population was 12,651, compared to 11,660 in 2018. However, there are also challenges that are expected to impede the market growth include high costs of systems and consumables, complexity of the process, and regulatory requirements.

Key UK Continuous Renal Replacement Therapy Company Insights

Key players are adopting numerous strategic initiatives to increase their market share in the market such as new product approval, partnership, and merger & acquisition strategies, among others. For instance, in March 2024, Fresenius Medical Care announced the launch of an Augmented Reality (AR) application for training nursing staff on kidney replacement therapy in intensive care units. This innovative approach aims to enhance the quality of patient care. Further, in April 2022, Baxter announced U.S. FDA clearance of ST Set which is used in Continuous Renal Replacement Therapy (CRRT) to treat Acute Kidney Injury (AKI) patients in hospitals. The ST Set is a pre-connected, disposable extracorporeal circuit that utilizes a semipermeable membrane to provide blood purification through a blood purification system. This device is designed to be used with the PrisMax or Prismaflex control units (monitors).

Key UK Continuous Renal Replacement Therapy Companies:

- Baxter

- B. Braun Medical Ltd

- Medtronic

- Fresenius Medical Care UK Ltd

- Braun & Co. Limited

- Medica Advanced Technologies Ltd

- NIKKISO UK Co. Ltd.

Recent Developments

-

In April 2022, Baxter announced that it has received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its ST Set, a preconnected, disposable, extracorporeal circuit used in continuous renal replacement therapy (CRRT). The ST Set is designed to provide blood purification through a semipermeable membrane, which can be used in conjunction with the PrisMax control units. The ST Set is currently in use across multiple countries in North and South America, Europe, and Asia Pacific.

UK Continuous Renal Replacement Therapy Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 76.44 million

Revenue forecast in 2030

USD 131.69 million

Growth rate

CAGR of 9.4% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Product, modality, region

Regional scope

UK

Region Scope

England; Scotland; Wales; Northern Ireland

Key companies profiled

Baxter; B. Braun Medical Ltd; Medtronic; Fresenius Medical Care UK Ltd; Braun & Co. Limited; Medica Advanced Technologies Ltd; NIKKISO UK Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Continuous Renal Replacement Therapy Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UK Continuous Renal Replacement Therapy market report based on product, modality, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables

-

System

-

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Continuous venovenous hemofiltration (CVVH)

-

Continuous venovenous hemodiafiltration (CVVHDF)

-

Continuous venovenous hemodialysis (CVVHD)

-

Slow continuous ultra filtration (SCUF)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

UK

-

England

-

Scotland

-

Wales

-

Northern Ireland

-

-

Frequently Asked Questions About This Report

b. The UK continuous renal replacement therapy market size was estimated at USD 70.33 million in 2023 and is expected to reach USD 76.44 million in 2024.

b. The UK continuous renal replacement therapy market is expected to grow at a compound annual growth rate of 9.4% from 2024 to 2030 to reach USD 131.69 million by 2030 market.

b. Continuous Venovenous Hemofiltration (CVVH) segment dominated the market in 2023 and is also expected to register the fastest growth with a CAGR of 10.2% over the forecast period due to the rising prevalence of fluid overload cases, which are commonly observed in acute kidney injury patients in critical care units. CVVH is a popular choice among clinicians due to its ease of use, flexibility, and effectiveness in managing critically ill patients with Acute Kidney Injury (AKI) or Chronic Kidney Disease (CKD).

b. Some key players operating in the UK continuous renal replacement therapy market include Baxter, B. Braun Medical Ltd, Medtronic, Fresenius Medical Care UK Ltd, Braun & Co. Limited, NIKKISO UK Co. Ltd., among others market.

b. Key factors driving the market growth include the increasing prevalence of Acute Kidney Injury (AKI) and growing adoption of continuous renal replacement therapy in Intensive Care Units (ICUs). Furthermore, rising awareness of the importance of early treatment in the country is expected to boost the demand for continuous renal replacement therapy in UK.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.