- Home

- »

- Advanced Interior Materials

- »

-

UAE Property And Community Management Market Report, 2030GVR Report cover

![UAE Property And Community Management Market Size, Share & Trends Report]()

UAE Property And Community Management Market (2024 - 2030) Size, Share & Trends Analysis Report By Service (Property Management, Community Management), By Application (Residential, Office/Workplaces), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-384-6

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

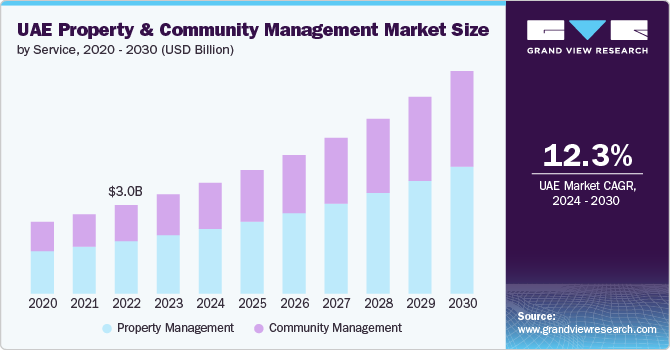

The UAE property and community management market size was estimated at USD 3.42 billion in 2023 and is projected to grow at a CAGR of 12.3% from 2024 to 2030. The growth is driven by the rising investments in construction companies in residential and commercial buildings in the country. Moreover, an increase in rental contracts for residential and office properties is expected to drive the growth of the market by surging the requirement for tenant management and rent collection services in the UAE in the coming years. The booming real estate market in the UAE is set to significantly drive the growth of the property & community management market. This surge is largely attributed to several key factors, including the country's robust economic recovery, increasing foreign investments, and a spate of new development projects. As the real estate sector flourishes, the demand for professional property management services is expected to rise correspondingly.

The integration of smart technologies presents a lucrative opportunity for the UAE property & community management market by transforming traditional management practices into efficient, cost-effective, and user-friendly processes. One of the primary benefits of smart technology is the enhancement of operational efficiency. Smart building management systems, powered by the Internet of Things (IoT), enable real-time monitoring and control of various building functions such as lighting, HVAC systems, security, and energy management.

Drivers, Opportunities & Restraints

Lease management serves as a critical driver for property & community management in the UAE by providing a structured and reliable framework for handling rental agreements. In a market characterized by a high expatriate population and dynamic economic activities, clear and comprehensive lease agreements are becoming essential to establish stability and satisfaction among tenants.

One of the main factors fueling this expansion is the growing number of foreign investors and professionals entering the UAE market. Attracted by the country's strategic location, favorable business environment, and high quality of life, these individuals and entities are investing heavily in real estate. This surge is creating a burgeoning demand for property management services that can handle various activities, from tenant relations and maintenance to legal compliance and financial reporting.

Moreover, the UAE government's ambitious urban development plans, such as the Dubai 2040 Urban Master Plan and Abu Dhabi's Vision 2030, are fueling the construction of new residential, commercial, and mixed-use projects. These large-scale developments necessitate professional community management to ensure their sustainability and appeal. Community management encompasses a broad range of services, including security, landscaping management, and community engagement initiatives.

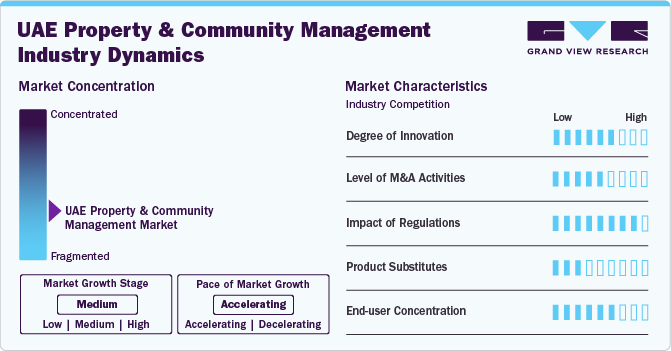

Market Concentration & Characteristics

The industry growth stage is medium, and the pace is accelerating. The market is characterized by a high degree of innovation, which is attributable to the rapid technological advancements. Moreover, market players are adopting organic and inorganic growth strategies, such as product launches, geographical expansions, mergers & acquisitions, and collaborations, to strengthen their position in the global market.

Regulations play a significant role in shaping the UAE property & community management market dynamics. The United Arab Emirates (UAE) boasts a dynamic and rapidly evolving real estate market, underpinned by a robust regulatory framework designed to ensure transparency, protect investors, and maintain high standards of living and working conditions. This regulatory framework, especially applies to residential and office properties, encompasses a range of laws, regulations, and regulatory bodies at both the federal and emirate levels, with particular emphasis on Dubai and Abu Dhabi.

The growth of UAE property & community management among end users is driven by the growing the residential and commercial construction. The growth of this end user segment can be attributed to a steady demand for high-quality living spaces that cater to the diverse lifestyle preferences of customers and demographic profiles in the country. The vibrant real estate market of the UAE offers a wide range of residential options, including luxury villas, high-rise apartments, and townhouses.

Threat of substitutes in the UAE property and community management market ranges from low to moderate. While direct substitutes for property and community management services are limited, alternative investment avenues exist. However, these alternatives do not entirely supplant the necessity for property management services. Yet, the emergence of innovative technologies and disruptive business models holds the potential to alter traditional practices, influencing market dynamics in the long term.

Service Insights

“The demand for community management service segment is expected to grow at a significant CAGR of 13.0% from 2023 to 2030 in terms of revenue”

The property management service segment held the largest market share in 2023. Property management is a dynamic sector in the UAE that plays a crucial role in maintaining and enhancing the value of real estate assets. The market is characterized by a comprehensive range of services designed to meet the diverse needs of property owners, investors, and tenants. With a robust regulatory framework and a strong emphasis on quality and professionalism, property management in the UAE ensures the efficient operation and sustainability of real estate properties.

The demand for community management service segment is expected to grow at a significant CAGR from 2023 to 2030 in terms of revenue. Community management plays a crucial role in ensuring the smooth functioning and well-being of residential and commercial communities in the UAE. This segment encompasses a range of services aimed at governance, financial management, legal compliance, and fostering a sense of community among residents.

Property Type Insights

“The demand for community management by property type segment is expected to grow at a significant CAGR of 13.0% from 2023 to 2030 in terms of revenue”

The property management property type segment held the largest share in 2023. Property management for freehold residential properties in the UAE encompasses a wide range of services tailored to meet the needs of homeowners and tenants. Property managers focus on ensuring the seamless operation and maintenance of residential properties from luxury villas and high-rise apartments to townhouses and gated communities.

The demand for community management property type segment is expected to grow at a significant CAGR from 2023 to 2030 in terms of revenue. Community management for freehold residential properties focuses on creating vibrant and inclusive neighborhoods where residents can thrive. Property managers oversee homeowner associations (HOAs), enforce community rules and regulations, and organize events and activities to foster a sense of community among residents.

Application Insights

“The demand for offices/workplaces application segment is expected to grow at a significant CAGR of 13.5% from 2023 to 2030 in terms of revenue”

The residential application segment held the largest share of 63.9% in 2023. The residential segment has steadily demanded high-quality living spaces that cater to diverse lifestyle preferences and demographic profiles. The country's vibrant real estate market offers a wide range of residential options, including luxury villas, high-rise apartments, townhouses, and gated communities.

The demand for office/workplaces segment is expected to grow at a significant CAGR from 2023 to 2030 in terms of revenue. The market for managing properties and communities within the UAE's office and workspace sectors has seen remarkable growth. This upward trend is largely fueled by the nation's vibrant business climate and consistent economic growth. Cities such as Dubai and Abu Dhabi have become key global business centers, leading to increased demand for efficiently managed office spaces.

Regional Insights

“In UAE, Dubai dominated the market in 2023 and it accounted for 49.5% market share in 2023”

Dubai is home to a number of upcoming mega projects related to offices and residential areas, proving that it is one of the most innovative and fast-developing cities in the world. One significant driver for the Dubai property & community management market is the increasing influx of expatriates and international investors, drawn by Dubai's status as a global business hub and its favorable tax policies. This has led to a surge in the demand for residential & office properties, necessitating efficient property and community management services to maintain high living standards and operational efficiency.

Abu Dhabi’s residential sector has experienced one of its best years on record, driven by several positive government initiatives and announcements, a thriving economy, and the launch of new projects. As per a report by Savills, in 2023, the demand for residences surged, resulting in the sale of 4,800 villa and townhouse units, which accounted for 43% of the total sales. In addition, Abu Dhabi has also witnessed a rise in the demand for office spaces due to the growing private sector, increasing business confidence, and rising foreign direct investments, which continue to attract investors and foreign professionals to the UAE’s capital city.

Key UAE Property And Community Management Company Insights

Some of the key players operating in the market include Binayah Properties, Land Sterling Property Consultants L.L.C., CCA For Vacation Home Rentals LLC, and Manage My Property.

-

Binayah Properties offers different types of services, including asset management, real estate brokerage services, property management, assistance in selling or renting properties, and working as an investment and development consultancy. The company has diversified its business lines by expanding into the development of apartment buildings and other development projects.

-

Land Sterling Property Consultants L.L.C provides professional property expertise across various regions, including the Middle East, North Africa, and Europe. It helps clients with research-based & analytical advice to make informed property decisions and reduce risks.

Dacha Real Estate, ADCP, Bricklane Properties Management LLC, BSO Real Estate Management, Asteco Property Management LLCare some of the emerging participants in the UAE property & community management market.

-

Dacha Real Estate Dacha is a property agency that provides real estate for sale & lease in Dubai and comprehensive property management services. The company has a total of 25 years of experience, spanning the UK, the UAE, and Russia. The company continued its expansion with a team of 70 real estate professionals in 2024.

-

ADCP serves a wide client base, ranging from government bodies to private individuals, property owners, and renters. It manages 1,900 buildings comprising approximately 51,000 commercial and residential units.

Key UAE Property And Community Management Companies:

- DEYAAR

- Binayah Properties

- Land Sterling Property Consultants L.L.C.

- CCA For Vacation Home Rentals LLC

- Manage My Property

- Betterhomes LLC

- Kaizen Property Services

- Dacha Real Estate

- ADCP

- Bricklane Properties Management LLC

- BSO Real Estate Management

- Asteco Property Management LLC

- Imdaad LLC

Recent Developments

-

In January 2024, Land Sterling Property Consultants L.L.C. partnered to offer handover and project delivery expertise with the District One MBR City initiative, located four kilometers away from the heart of Dubai. Through this partnership, the organization's QA/QC inspectors will conduct thorough snag and de-snag checks by maintaining the highest quality standards while ensuring smooth collaboration with all involved parties.

-

In September 2023, Betterhomes LLC launched a new branch in Sharjah, expanding its turn-key real estate solutions within the emirate. This move marks the company's fifth office in the UAE, set up to offer comprehensive property and community management solutions, meeting clients' demands for both residential and commercial properties.

UAE Property And Community Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.82 billion

Revenue forecast in 2030

USD 7.68 billion

Growth rate

CAGR of 12.3% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, property type, application, region

Region scope

Dubai; Abu Dhabi

Key companies profiled

DEYAAR; Binayah Properties; Land Sterling Property Consultants L.L.C.; CCA For Vacation Home Rentals LLC; Manage My Property; Betterhomes LLC; Kaizen Property Services; Dacha Real Estate; ADCP; Bricklane Properties Management LLC; BSO Real Estate Management; Asteco Property Management LLC; Imdaad LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UAE Property & Community Management Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UAE property & community management market report based on service, property type, application, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Property Management

-

Lease Accounting & Real Estate Management

-

Asset Management

-

Project Management

-

Security & Surveillance Management

-

Support & Maintenance

-

Rent Collection

-

Tenant Management Services

-

Others

-

-

Community Management

-

Governance & Compliance Management

-

Service Charge Invoice and Collection

-

Vendor and Contract Management

-

Financial Management

-

Legal Compliance

-

Others

-

-

-

Property Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Property Management

-

Freehold

-

Residential

-

Office/Workplaces

-

-

Non-Freehold

-

Residential

-

Office/Workplaces

-

-

-

Community Management

-

Freehold

-

Residential

-

Office/Workplaces

-

-

Non-Freehold

-

Residential

-

Office/Workplaces

-

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Office/Workplaces

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Dubai

-

Abu Dhabi

-

Frequently Asked Questions About This Report

b. The UAE property and community management market size was estimated at USD 3.42 billion in 2023 and is expected to reach USD 3.82 billion in 2024.

b. The UAE property and community management market, in terms of revenue, is expected to grow at a compound annual growth rate of 12.3% from 2024 to 2030 to reach USD 7.68 billion by 2030

b. Dubai dominated the UAE property and community management market and accounted for a 495%% share in revenue in 2023. One significant driver for the Dubai property & community management market is the increasing influx of expatriates and international investors, drawn by Dubai's status as a global business hub and its favorable tax policies. This has led to a surge in the demand for residential & office properties, necessitating efficient property and community management services to maintain high living standards and operational efficiency.

b. Some of the key players operating in the UAE property & community management market include DEYAAR, Binayah Properties, Land Sterling Property Consultants L.L.C., CCA For Vacation Home Rentals LLC, Manage My Property, Betterhomes LLC, Kaizen Property Services, Dacha Real Estate, ADCP, Bricklane Properties Management LLC, BSO Real Estate Management, Asteco Property Management LLC, Imdaad LLCamong others.

b. The growth of the market is driven by rising investments construction companies in residential and commercial buildings in the country.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.