- Home

- »

- Electronic & Electrical

- »

-

UAE Mobile Accessories Market Size, Industry Report, 2030GVR Report cover

![UAE Mobile Accessories Market Size, Share & Trends Report]()

UAE Mobile Accessories Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Headphone, Charger, Tablet, Power Bank), By Distribution Channel (Offline, Online), And Segment Forecasts

- Report ID: GVR-4-68040-448-5

- Number of Report Pages: 98

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UAE Mobile Accessories Market Trends

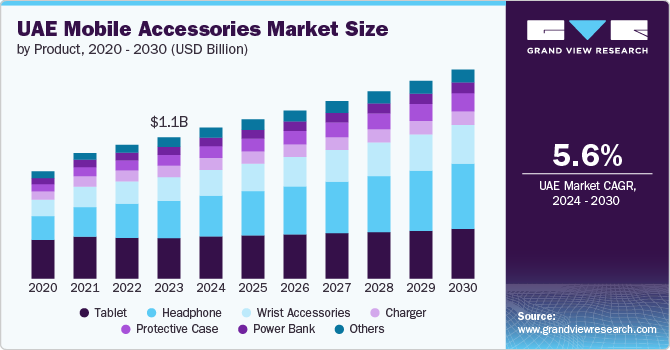

The UAE mobile accessories market size was estimated at USD 1.13 billion in 2023 and is expected to grow at a CAGR of 5.6% from 2024 to 2030. The growth can be attributed to the increasing penetration of smartphones, expansion of e-commerce, rising social media influence and new launches coupled with technological advancements.

The mobile accessories market is gaining traction in the UAE due to increasing consumer spending on smartphones. The UAE has the highest smartphone penetration rate, which is approximately 91.89% as per the data published by Global Media Insight in 2024, and consumers aged 16 to 64 spend approximately 4 hours and 34 minutes daily on their smartphones. The number of smartphone users has steadily increased in the UAE, leading to the demand for various smartphone accessories such as chargers, charging cables, and advanced power banks and headphones to enhance devices’ functionality, protection, and personalization.

The thriving e-commerce landscape within the UAE, significantly shaped by the dominance of international retail giants such as Amazon and Alibaba, alongside the robust presence of the regionally influential retailer Noon, has facilitated unprecedented access to a broad spectrum of international and local brands and products. Brands such as Speck, renowned for its protective cases, and Belkin, with its comprehensive range of charging solutions, have witnessed a notable surge in popularity within the UAE market. These brands consistently introduce new products tailored to the latest device models, ensuring that their offerings remain pertinent and appealing to consumers seeking to customize and accessorize their smartphones.

The influence of social media is a significant factor driving the UAE mobile accessories market, as platforms such as Instagram, Facebook, and TikTok serve as vital channels for marketing and consumer engagement. Brands leverage social media to showcase their products through influencer partnerships, targeted advertisements, and user-generated content, which enhances brand visibility and consumer trust. The rapid adoption of smartphones in the UAE further amplifies this effect, as consumers increasingly seek accessories that complement their devices. Additionally, social media trends can create a sense of urgency and desirability around new products, leading to increased demand.

Moreover, technological advancements, such as AI and IoT, have enabled hyper-connectivity and intelligence in electronic devices, promoting the use of wireless mobile accessories like smart wearables, smart speakers, wireless headsets, and earphones. The progress in smart wireless mobile accessories contributes to the growth of the mobile phone accessories industry. For instance, in April 2024, Nothing announced the launch of two wireless earbuds, Ear and Ear (a) integrated with ChatGPT features. This newly launched product includes effective and intelligent noise cancellation features, has a battery life of over 40 hours, and can be customized through the Nothing X app. Ear and Ear (a) are available at the respective prices of USD 149.45 and USD 103.173549 and Dh379. The product was made available for customers in the UAE from April 22.

Product Insights

Tablet accounted for a revenue share of 28.61% in 2023. The market for tablet accessories within the UAE is experiencing dynamic growth, fueled by a multitude of factors that reflect the region's innovative spirit and burgeoning demand for technological enhancements. The region’s status as a technological epicenter, coupled with its populace's inclination toward embracing cutting-edge devices, has significantly bolstered the demand for high-quality, functional accessories. Prominent brands, such as Apple and Samsung, which are recognized for their premium devices, maintain a substantial presence in the UAE market. In May 2024, Apple introduced a new iPad Pro featuring an advanced display, M4 chip, and Apple Pencil Pro. In addition to the impressive hardware upgrades, Apple also introduced an accessory, the Apple Pencil Pro alongside the new iPad Pro. This stylus offers enhanced precision, responsiveness, and functionality compared to previous models.

Headphone is expected to grow at a CAGR of 8.1% from 2024 to 2030. The proliferation of streaming services, such as Spotify, Apple Music, and Netflix, has led to consumers increasingly consuming audio and video content on their mobile devices. This shift has created a heightened demand for quality headphones that enhance the listening experience. Players in the market are focusing on promoting high-fidelity audio products and noise-canceling features to attract audiophiles and casual listeners alike.

For instance, in May 2024, American audio equipment manufacturer Sonos marked its entry into the personal listening category with the introduction of its inaugural headphones, the Sonos Ace. These high-end over-ear Bluetooth headphones are equipped with cutting-edge audio technologies, including lossless and spatial audio, aware mode, and Active Noise Cancellation (ANC). One of its standout features is the innovative TrueCinema technology, which creates an immersive home theater experience by analyzing the listener’s environment to produce a lifelike surround sound atmosphere. The Sonos Ace became available for purchase in the UAE in June 2024.

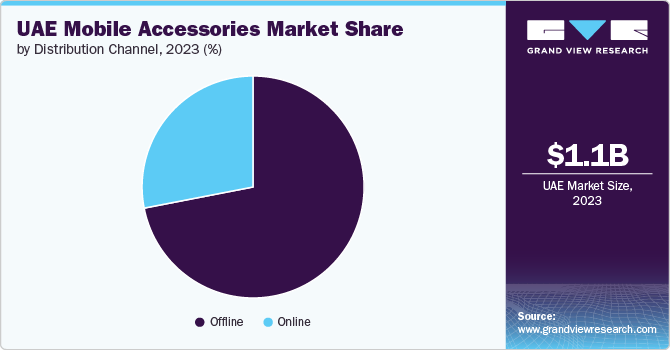

Distribution Channel Insights

Sales through offline channel accounted for a revenue share of 30.06% in 2023 in the UAE mobile accessories market. A key factor driving distribution through offline channels is the expertise and customer support provided by offline stores such as Jumbo Electronics and Sharaf DG. The knowledgeable staff offers professional advice on product compatibility and functionality, guiding consumers through the selection process and assisting with immediate installation or troubleshooting. This level of service builds trust and enhances customer satisfaction, making offline stores a preferred choice for consumers looking for technical assistance.

Sales of mobile accessories through offline channels are expected to grow with a CAGR of 8.4% from 2024 to 2030. The integration of advanced logistics and efficient delivery systems has propelled the online distribution of mobile accessories in the UAE. Companies such as Amazon, Noon, and Souq.com have set up robust delivery networks that ensure quick and reliable shipping. Many of these platforms offer same-day or next-day delivery, which is a significant incentive for customers. The option for easy returns and exchanges adds to the overall shopping experience, making online purchases of mobile accessories not only convenient but also risk-free. This has encouraged brands to focus more on their online presence, as seen with the widespread availability of products from leading accessory makers such as Anker and JBL on these platforms, further enriching the online market for mobile accessories in the UAE.

Key UAE Mobile Accessories Company Insights

The UAE mobile accessories market is highly competitive, with established brands leveraging strong distribution networks and brand loyalty to maintain market share. Emerging players often adopt innovative product designs and competitive pricing strategies to attract tech-savvy consumers. Additionally, operational strategies such as optimizing supply chains and enhancing online presence through e-commerce platforms are crucial for both established and new entrants to effectively reach their target audiences.

Key UAE Mobile Accessories Companies:

- Samsung Electronics Co., Ltd.

- Apple

- Anker

- Xiaomi Corp.

- Sony Corp.

- Fitbit

- GN Audio A/S

- Huawei Technologies

- Ugreen

- Zepp Health

Recent Developments

-

In July 2024, Zepp Health Corporation, a prominent global innovator in smart wearables and health technology, introduced Zepp OS 4, a ground-breaking advancement in wearable technology. The watch integrates OpenAI’s-GPT-4o most advanced system, producing safer and more useful responses and enhancing the functionality of Amazfit smartwatches to serve as comprehensive wellness companions.

-

In July 2024, Samsung launched the S24 series in three models, namely, Galaxy S24 Ultra, Galaxy S24+, and Galaxy S24 with new AI features. This is expected to fuel the demand for compatible chargers, earphones, power banks, and other mobile accessories.

-

In May 2024, American audio equipment manufacturer Sonos marked its entry into the personal listening category with the introduction of its inaugural headphones, the Sonos Ace. These high-end over-ear Bluetooth headphones are equipped with cutting-edge audio technologies, including lossless and spatial audio, aware mode, and Active Noise Cancellation (ANC). One of its standout features is the innovative TrueCinema technology, which creates an immersive home theater experience by analyzing the listener’s environment to produce a lifelike surround sound atmosphere. The Sonos Ace became available for purchase in the UAE in June 2024.

-

In April 2024, Caviar introduced a luxury collection of iPhone 15 Pro models called the Desperado Mafia collection. This series features three unique designs inspired by famous mafia movies: Godfather, Revenge, and Capone. Each model incorporates elements such as black titanium, gold accents, and quotes from the respective films to enhance their appeal. These limited-edition smartphones are designed for fans of gangster cinema and are available in restricted quantities.

-

In March 2024, the udoq charging station, a luxurious and flexible universal charging solution for various mobile devices, was launched in the UAE. This innovative product is designed to charge smartphones, tablets, music players, and e-readers simultaneously while maintaining an organized appearance by hiding cables. The charging stations are customizable and compatible with multiple brands, including Apple and Android devices, featuring options such as MagSafe, Lightning, and USB-C connectors.

UAE Mobile Accessories Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.21 billion

Revenue forecast in 2030

USD 1.67 billion

Growth rate

CAGR of 5.6% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Key companies profiled

Samsung Electronics Co., Ltd.; Apple; Anker; Xiaomi Corp.; Sony Corp.; Fitbit; GN Audio A/S; Huawei Technologies; Ugreen; and Zepp Health

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UAE Mobile Accessories Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UAE mobile accessories market report based on product and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Headphone

-

Charger

-

Power Bank

-

Protective Case

-

Tablet

-

Wrist Accessories

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Frequently Asked Questions About This Report

b. The UAE mobile accessories market size was estimated at USD 1.13 billion in 2023 and is expected to reach USD 1,21 billion in 2024.

b. The UAE mobile accessories market is expected to grow at a compounded growth rate of 5.6% from 2024 to 2030 to reach USD 1.67 billion by 2030.

b. Tablet accounted for a revenue share of 28.61% in 2023. The market for tablet accessories within the UAE is experiencing dynamic growth, fueled by a multitude of factors that reflect the region's innovative spirit and burgeoning demand for technological enhancements.

b. Some key players operating in the market include Samsung Electronics Co., Ltd.; Apple; Anker; Xiaomi Corp.; Sony Corp.; Fitbit; GN Audio A/S; Huawei Technologies; Ugreen; and Zepp Health

b. The growth can be attributed to the increasing penetration of smartphones, expansion of e-commerce, rising social media influence and new launches coupled with technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.