- Home

- »

- IT Services & Applications

- »

-

UAE And KSA System Integrators Market Size, Report, 2030GVR Report cover

![UAE And KSA System Integrators Market Size, Share & Trends Report]()

UAE And KSA System Integrators Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Solutions (ELV, ICT), By Services, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-484-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

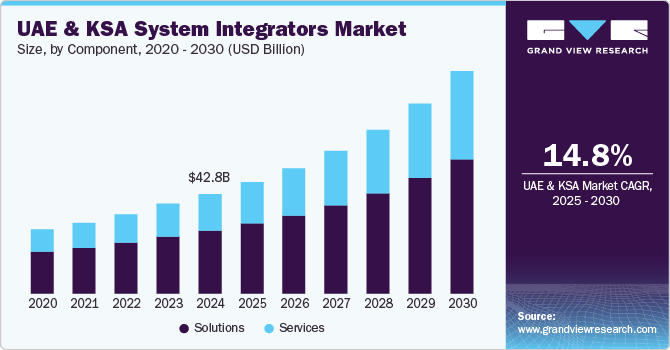

The UAE and KSA system integrators market size was estimated at USD 42.82 billion in 2024 and is anticipated to grow at a CAGR of 14.8% from 2025 to 2030. The rapid pace of digital transformation across sectors such as healthcare, BFSI, oil and gas, transportation, retail, and real estate drives the growth of the system integrators market in the UAE and KSA. Businesses in these sectors require advanced integration solutions to manage complex IT systems, enhance cybersecurity, and ensure regulatory compliance. In addition, the strategic focus of both countries on economic diversification and smart infrastructure investments has amplified the need for integrated technologies.

The governments of the UAE and KSA are putting a strong emphasis on digital transformation as part of the efforts to modernize public services and streamline governance. Digitalization of governance calls for implementing complex, interconnected systems seamlessly integrating legacy infrastructure with cutting-edge technologies. System integrators play a pivotal role in implementing these systems by providing the expertise required to navigate the intricacies of multi-platform environments, cloud migrations, and integrating emerging technologies, such as Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), and advanced analytics.

The governments of the UAE and KSA are aggressively pursuing digitalization initiatives. The UAE Digital Government Strategy 2025 and Saudi Arabia’s Vision 2030 are ambitious initiatives to deliver seamless and efficient digital services to citizens. Both initiatives emphasize digital transformation to enhance governance and improve the quality of life for the citizens. The two countries are particularly concentrating on developing and expanding e-government services to streamline access to government functions online, reduce bureaucratic hurdles, and enhance the overall efficiency of service delivery. Seamless integration of new systems with the existing infrastructure becomes increasingly critical as the governments of the two countries prioritize the modernization of public services through the adoption of advanced digital technologies.

The adoption of Industrial Internet of Things (IIoT) technology in industrial settings also drives the need for deploying system integrators to take up the crucial role of seamlessly integrating advanced technologies into existing industrial infrastructure. Key trends toward this end include the growing emphasis on integration solutions tailored to specific industrial needs, a focus on interoperability and cybersecurity, and the integration of edge computing and AI-driven analytics. As industrial establishments embrace IIoT, system integrators are being called upon to develop scalable, secure, and efficient solutions that enable real-time data processing and support the shift toward smart factories and Industry 4.0, ensuring long-term adaptability and operational excellence. For instance, Saudi Arabia's Aramco, one of the leading integrated energy and chemical companies, and TWTG, a pioneer in IIoT solutions, signed a Memorandum of Understanding (MoU) at the Global Industrial Internet of Things Summit (GIITS) convened in the Saudi Arabian city of Dammam in November 2023. The two companies were looking forward to the MoU as the beginning of a transformative collaboration and a major step forward in advancing the digital transformation of Aramco's industrial infrastructure.

Component Insights

The solutions segment accounted for the largest market share of over 63% in 2024, primarily driven by the increasing demand for digital transformation across industries. Government initiatives aimed at fostering smart cities, enhancing public services, and advancing infrastructure development are encouraging enterprises to embrace cutting-edge technologies. Moreover, sectors such as oil and gas, healthcare, and finance are adopting integrated solutions to streamline operations, reduce costs, and improve efficiency. The growing focus on cybersecurity and data protection further contributes to the rising need for sophisticated system integration solutions.

The services segment is expected to grow significantly during the forecast period, propelled by the rising complexity of IT ecosystems and the need for seamless connectivity between various business operations. Organizations increasingly rely on service providers to implement, manage, and maintain advanced technologies such as cloud computing, AI, and IoT. In addition, the region’s strong emphasis on national digital agendas and smart governance initiatives creates a demand for customized services that align with specific industry and governmental needs. The evolving regulatory landscape and the need for compliance also contribute to the growing adoption of professional services in system integration.

Solutions Insights

The IoT segment accounted for the largest market share of over 17% in 2024. The evolving landscape of IoT and legacy system integration in countries such as Saudi Arabia, the UAE, and Qatar is characterized by several key trends. These nations increasingly prioritize integrating IoT technologies seamlessly with legacy systems to enhance operational efficiency and drive innovation across diverse industries. A notable trend is the adoption of advanced middleware solutions that bridge the gap between modern IoT applications and outdated legacy systems, facilitating smoother data flow and system interoperability. In addition, businesses are leveraging cloud-based platforms and edge computing to support real-time data processing and analysis, thereby improving decision-making and responsiveness. The integration of AI and machine learning technologies is also becoming more prevalent, enabling predictive maintenance and automation within legacy infrastructures.

The AI segment is expected to grow at a significant rate during the forecast period. Trends in AI system integration solutions reflect the growing need for seamless integration of artificial intelligence into existing business processes and IT infrastructures. Businesses are increasingly using AI-driven automation in system integration, which enhances efficiency by automating repetitive tasks and streamlining workflows across disparate systems. Organizations are also adopting hybrid integration models that combine on-premises infrastructure with cloud-based AI solutions, enabling greater flexibility, scalability, and real-time data processing capabilities. Furthermore, data analytics platforms are increasingly utilizing AI technology to enable predictive insights and more informed decision-making, driving business innovation.

Services Insights

The professional services segment accounted for the largest market share of over 44% in 2024. The growing demand for tailored solutions to meet specific business needs is driving the need for professional services in system design and solutions. Organizations are emphasizing upgrading their existing systems and capabilities to utilize the latest innovations and drive business goals, which subsequently provides opportunities for system integrators to provide advanced upgrade and migration services. Moreover, the rising complexity of modern IT environments requires expert guidance for effective system integration and optimization. As businesses adopt new technologies and integrate complex systems, the need for professional services capable of managing these complexities is expected to rise, offering significant opportunities for system integrators in the UAE and KSA.

The licensing services segment is expected to grow significantly during the forecast period. Licensing services provided by system integrators aid organizations in managing and optimizing their software licenses, ensuring legal compliance while maximizing the value of their investments in technology. These services encompass a range of activities, such as conducting licensing audits to identify discrepancies, managing compliance to avoid legal penalties, and optimizing licenses to ensure cost efficiency. System integrators play a vital role in interpreting the jargon of software agreements, helping organizations determine the correct number of licenses needed, and ensuring that software usage aligns with the vendor's policies. Moreover, these service providers support organizations in managing renewals, extending license terms as needed, and adapting to evolving business requirements, thereby preventing unnecessary costs and ensuring resourcefulness.

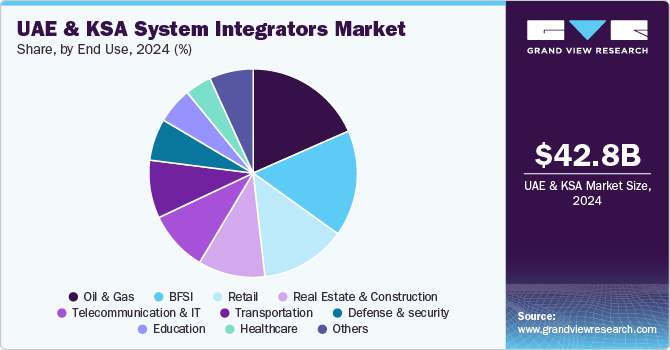

End-use Insights

The oil & gas end use segment accounted for the largest market share in 2024. The growth of the oil & gas segment can be attributed to the increasing complexity associated with the operations of oil & gas companies. The demand for integrated solutions designed to enhance operational efficiency, safety, and environmental compliance is increasing in the UAE and KSA. Adopting advanced technologies like IoT, AI, and big data analytics requires sophisticated integration to streamline processes, optimize resource management, and reduce operational risks. The push toward digital transformation materializing in the oil & gas industry to remain competitive necessitates integrating legacy systems with cutting-edge digital platforms. At the same time, regulatory requirements to reduce carbon emissions and ensure sustainable practices also demand comprehensive integration solutions to monitor and control environmental impact. Toward this end, system integrators can help oil & gas companies achieve their strategic objectives by providing end-to-end solutions seamlessly integrating diverse technologies and processes.

The telecommunication & IT segment is expected to grow significantly during the forecast period. The growth of the telecommunication & IT segment can be attributed to the rapid expansion of digital infrastructure and the increasing demand for advanced connectivity solutions across the UAE and Saudi Arabia. The continued rollout of 5G networks and the proliferation of IoT devices necessitate sophisticated integration services to ensure scalability and seamless network performance. The growing preference for data-driven applications and cloud services also drives the need for robust IT integration to support the evolving demands of businesses and consumers. Government initiatives fostering digital economies and encouraging the establishment of smart cities are particularly driving the need for system integrators as both government agencies and enterprises seek to enhance their technological capabilities through comprehensive system integration solutions.

Key UAE & KSA System Integrators Company Insights

Key players operating in the network emulator market include Al Moammar Information Systems Co., Al-Falak Electronic Equipment & Supplies Co., Alpha Data, BTS, Creative Solutions Co. Ltd., Gulf Business Machines, MDS SI, Telematics, Nasma, Networks & System Integration S. A. Co. Ltd (NESIC Saudi Arabia), Fujicloud, Integrix Systems Solutions, Synoptic, solutions by stc, e& enterprise, Emitac, and Visionaire Group. The companies focus on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key UAE & KSA System Integrators Companies:

- Al Moammar Information Systems Co.

- Al-Falak Electronic Equipment & Supplies Co.

- Alpha Data

- BTS

- Creative Solutions Co. Ltd.

- Gulf Business Machines

- MDS SI

- Telematics

- Nasma

- Comp10

- Networks & System Integration S. A. Co. Ltd (NESIC Saudi Arabia)

- Fujicloud

- Integrix Systems Solutions

- Synoptic

- solutions by stc

- e& enterprise

- Emitac

- Visionaire Group

Recent Development

-

In June 2024, e& enterprise launched a customer service and call center in Saudi Arabia, aiming to enhance customer support and engagement in the region. It will provide businesses with advanced customer service solutions, including AI-driven analytics and personalized support, helping them improve customer satisfaction and streamline service operations.

-

In May 2024, solutions by stc and Jeddah Development & Urban Regeneration Company announced a new joint venture to introduce smart city initiatives and drive digital transformation in Jeddah. This collaboration will focus on developing innovative solutions to enhance urban infrastructure, improve city management, and boost residents' quality of life. The partnership aligns with Saudi Arabia's Vision 2030, aiming to modernize urban environments and promote sustainable development in the region.

-

In February 2024, solutions by stc completed the acquisition of a 40% stake in Devoteam Middle East, a leading IT consulting firm. This strategic move aims to strengthen the company’s position in the digital transformation market by leveraging Devoteam's expertise in IT consulting and digital services. It is also expected to enhance the company's capabilities in delivering advanced technology solutions, aligning with its growth strategy, and expanding its regional offerings.

UAE & KSA System Integrators Report Scope

Report Attribute

Details

Market size value in 2025

USD 47.91 billion

Revenue forecast in 2030

USD 95.55 billion

Growth Rate

CAGR of 14.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, solutions, services, end-use, country

Country scope

UAE; Saudi Arabia

Key companies profiled

Al Moammar Information Systems Co.; Al-Falak Electronic Equipment & Supplies Co.; Alpha Data; BTS; Creative Solutions Co. Ltd.; Gulf Business Machines; MDS SI; Telematics; Nasma; Networks & System Integration S. A. Co. Ltd (NESIC Saudi Arabia); Fujicloud; Integrix Systems Solutions; Synoptic, solutions by stc; e& enterprise; Emitac; Visionaire Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UAE and KSA System Integrators Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UAE and KSA system integrators market report based on component, solutions, services, and end-use:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solutions

-

Services

-

-

Solutions Outlook (Revenue, USD Billion, 2018 - 2030)

-

ELV

-

Security and Surveillance

-

ICT

-

BCAV

-

Software and Applications

-

Cyber

-

IoT

-

AI

-

Analytics

-

BMS

-

Data Center

-

Networking

-

Others

-

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consulting Services

-

Licensing Services

-

Hardware Procurement Services

-

Professional Services

-

Support Services

-

Annual maintenance contract

-

Managed Services

-

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Government & Public Sector

-

Healthcare

-

Defense & Security

-

Telecommunication & IT

-

Oil & Gas

-

Transportation

-

Retail

-

Real Estate & Construction

-

Education

-

Others

-

Frequently Asked Questions About This Report

b. The UAE and KSA system integrators market size was estimated at USD 42.82 billion in 2024 and is expected to reach USD 47.91 billion in 2025

b. The UAE and KSA system integrators market is expected to grow at a compound annual growth rate of 14.8% from 2025 to 2030 to reach USD 95.55 billion by 2030

b. The oil & gas end use segment accounted for the largest market share in 2024. The growth of the oil & gas segment can be attributed to the increasing complexity associated with the operations of oil & gas companies. The demand for integrated solutions designed to enhance operational efficiency, safety, and environmental compliance is increasing in UAE and KSA.

b. Some key players operating in the UAE and KSA system integrators market include Al Moammar Information Systems Co., Al-Falak Electronic Equipment & Supplies Co., Alpha Data, BTS, Creative Solutions Co. Ltd., Gulf Business Machines, MDS SI, Telematics, Nasma, Networks & System Integration S. A. Co. Ltd (NESIC Saudi Arabia), Fujicloud, Integrix Systems Solutions, Synoptic, solutions by stc, e& enterprise, Emitac, and Visionaire Group.

b. The rapid pace of digital transformation across sectors such as healthcare, BFSI, oil and gas, transportation, retail, and real estate drives the growth of the system integrators market in the UAE and KSA. Businesses in these sectors require advanced integration solutions to manage complex IT systems, enhance cybersecurity, and ensure regulatory compliance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.