- Home

- »

- Clinical Diagnostics

- »

-

UAE Health Check-up Market Size, Industry Report, 2030GVR Report cover

![UAE Health Check-up Market Size, Share & Trends Report]()

UAE Health Check-up Market Size, Share & Trends Analysis Report By Type, By Test, By Test Technique (Blood Tests), By Application (Cardiovascular, Cancer), By Service Provider, By End-use (Enterprise, Individual), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-329-2

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

UAE Health Check-up Market Size & Trends

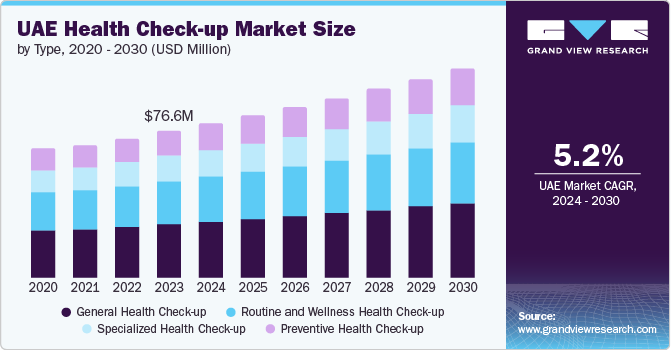

The UAE health check-up market size was estimated at USD 76.56 million in 2023 and is projected to grow at a CAGR of 5.2% from 2024 to 2030. The growth of the market is attributed to the growing prevalence of chronic diseases, the rising adoption of home-based medicine and telemedicine, and rising government initiatives to enhance population screening initiatives. Moreover, the growth of the market is attributed to the growing awareness of preventive healthcare solutions in the country.

The availability of health insurance coverage that includes preventive care benefits is a key factor driving the growth. The health insurance landscape in the UAE plays a pivotal role in shaping the health check-ups industry. As of recent data, approximately 4.6 million people in the UAE are covered by private health insurance policies, indicating a substantial portion of the population accessing private healthcare services. This high penetration of private health insurance underscores the significant demand for check-ups and preventive healthcare services, as insured individuals are incentivized to utilize healthcare facilities for regular screenings and diagnostic tests covered under their policies. In March 2024, the UAE Health Cabinet announced that mandatory insurance for private sector employees and domestic workers like to be enforced starting on January 1, 2025. The new policy covers all private sector employees and domestic workers who do not have existing health insurance coverage.

In recent years, there has been a shift in insurance policies to prioritize preventive care. For instance, the Thiqa program, a health insurance scheme exclusively managed by Daman on behalf of the Government of Abu Dhabi, caters specifically to the insurance needs of UAE nationals and individuals with similar status residing in Abu Dhabi. In addition, the presence of insurance program like ‘Saada’ for citizens of Dubai who are not covered by any government program. It is expected to ultimately reach 130,000 people. The third-party administrator for this program is NEXtCARE.

Digital technologies have revolutionized the healthcare ecosystem in the UAE, particularly impacting the health check-ups sector. The adoption of electronic health records (EHRs), telemedicine platforms, and wearable devices has enhanced accessibility and convenience for patients seeking routine assessments. These technologies enable remote monitoring, personalized health tracking, and seamless integration of medical data, thereby facilitating proactive health management and early intervention.

The growing awareness of the importance of preventive care, coupled with the inclusion of health check-ups in insurance policies, is anticipated to be a significant driver for the expansion of the health check-up market in the UAE. As more individuals gain access to preventive care services through their insurance plans, the demand for routine check-ups is expected to increase, fueling the growth of this market. The UAE health check-up market is undergoing a transformative phase driven by the integration of digital technologies within the healthcare ecosystem. In MEA, countries are actively working towards the integration of medical services to enhance healthcare facilities across multiple nations. Government initiatives are further promoting healthy lifestyles and preventive care which is encouraging individuals to prioritize regular assessments. For instance, in November 2023, the UAE Ministry of Health and Prevention (MoHAP) launched a 6-month nationwide campaign to provide free diabetes screening for Emirati residents across the UAE. The goal was to detect diabetes and associated risk factors early, with the aim of reversing the disease through lifestyle modifications. The expanding healthcare infrastructure, with state-of-the-art clinics and diagnostic centers equipped with advanced medical technology, supports the delivery of comprehensive health check-up services. Looking ahead, the market is poised for further growth with anticipated advancements in digital health solutions, continued insurance coverage expansions, and evolving consumer preferences toward proactive healthcare management.

Furthermore, the increasing adoption of digital platforms for health monitoring is expected to drive the demand for general and preventive check-up tests over the forecast period. For instance, in April 2020, ADQ announced the launch of "Union71", a new laboratory testing platform that aims to provide faster, more accessible, and more sophisticated laboratory testing services in the UAE. The platform offers a range of tests, including genetic testing, microbiology, and molecular diagnostics, and is available 24/7. These digital tools empower individuals to take a more proactive approach to their health, encouraging regular check-ups and early intervention. As digital technologies become more integrated into the healthcare ecosystem, the accessibility and convenience of health check-up services improve, leading to higher adoption rates and better patient outcomes for the population.

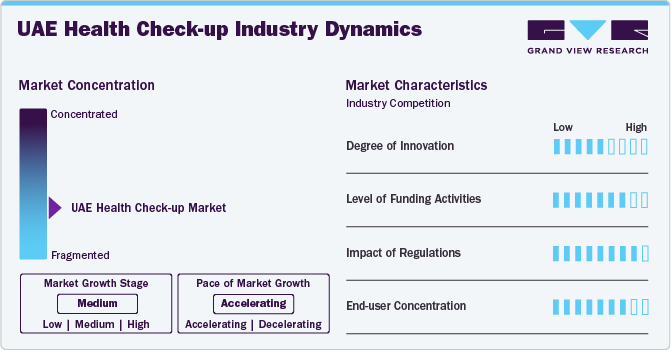

Market Concentration & Characteristics

The degree of innovation in the market is moderate, particularly in the development of novel solutions that help provide early detection, personalized healthcare strategies, and improved healthcare solutions. Moreover, funding has allowed companies to invest in research and development, introducing new technologies and solutions that improve the efficiency and accuracy of check-ups.

Several players are focusing on funding activities, focusing majorly on accelerated innovation, expansion of healthcare solutions, and providing improved patient outcomes. Moreover, governments are investing in population-based screening initiatives and programs to improve healthcare access and outcomes.

Regulatory support and funding are crucial factors driving the market. Regulatory changes in the healthcare sector frequently result in new standards for patient care, data management, billing practices, and other areas.

The market shows a high end-user concentration, with a significant portion of revenue generated from hospital-based laboratories. These laboratories are well equipped with cutting-edge medical equipment and infrastructure to conduct a wide range of diagnostic tests and screenings, driving demand for the segment.

Type Insights

The general health check-up type segment led the UAE health check-up market and accounted for 36.6% of the revenue in 2023. The general check-up market segment in the UAE is characterized by a growing emphasis on preventive healthcare and routine medical assessments among the population. This segment encompasses a range of services aimed at providing comprehensive health evaluations to individuals of all ages and health statuses. Recent developments indicate an increasing preference among UAE residents for annual screenings that cover basic parameters such as blood pressure, cholesterol levels, diabetes screening, and overall wellness assessments. Major healthcare providers in the UAE, such as Dubai Health Authority (DHA) and Abu Dhabi Health Services Company (SEHA), offer comprehensive packages tailored to different demographic groups. These packages often include consultations with general practitioners, basic lab tests, and screenings for common health conditions. Furthermore, there has been a notable integration of digital platforms in general health check-ups, enabling patients to book appointments online, access their health records digitally, and receive reminders for upcoming screenings.

The specialized health check-up type segment is projected to witness a fastest growth rate of 5.8% over the forecast period. This segment caters to individuals seeking more targeted assessments and screenings related to specific health concerns or demographic groups. This segment includes specialized diagnostic tests, screenings for chronic diseases, and comprehensive assessments that go beyond the scope of general health check-ups. Specialized clinics in the UAE offer advanced cardiac health check-ups, including electrocardiograms (ECGs), stress tests, and lipid profile evaluations. Recently, in May 2024, Burjeel Holdings commissioned a cutting-edge, advanced molecular diagnostics and immune profile testing laboratory in the UAE with the Canada-based OncoHelix called OncoHelix-CoLab. This is a first-of-its-kind facility in the UAE that offers comprehensive capabilities in molecular, cellular immunology, and transplant diagnostics. These assessments are crucial for early detection and management of cardiovascular diseases, which are prevalent in the region.

Test Insights

The blood glucose test segment led the UAE health check-up market and accounted for 21.7% of the revenue in 2023. The high share is attributable to continued growth as the prevalence of diabetes increases and healthcare services expand in the region. According to the International Diabetes Federation (IDF), the prevalence of diabetes in the UAE is significantly higher than the global average, at 16.3% compared to 9.3% worldwide. More recent studies in the UAE have revealed that the prevalence of diabetes mellitus (DM) among nationals in the Northern Emirates is as high as 25.1%, while among expatriates, it stands at 19.1%. In addition, the increasing adoption of Continuous glucose monitoring devices, and POCT home-based testing is also expected to drive market growth, as these methods provide greater convenience and flexibility for patients, and the growing demand for home-based testing. There are several providers of blood glucose testing services in the UAE, including Proficiency Healthcare Diagnostics (PHD) and Unilabs. These providers offer a range of advanced blood glucose testing capabilities, including point-of-care testing and home-based testing. Home-based testing also provides greater convenience and flexibility for patients, allowing them to test their glucose levels at any time and from any location.

Tumor Marker segment is projected to witness fastest growth rate over the forecast period. The increasing incidence of cancer is a major concern in the region. According to the World Health Organization, the UAE has one of the highest cancer rates in the world, with approximately 12,000 new cases diagnosed annually. Companies are investing in research and development to improve the accuracy and convenience of tumor markers testing. Molecular diagnostics allow for the detection of genetic mutations associated with cancer, which is critical for early detection and treatment. Liquid biopsy testing also provides a non-invasive method for monitoring cancer biomarkers, which is particularly important for patients with cancer who require frequent monitoring.

Test Technique Insights

The blood, urine, body fluid tests segment led the UAE health check-up market and accounted for 55.4% of the revenue in 2023 and is anticipated to grow at the fastest growth over the forecast period. Blood, urine, and body fluid-based tests are comprehensive diagnostic tools for assessing overall health and detecting potential problems. Blood tests are used to measure a variety of parameters, including glucose, lipid profile, liver and kidney function, and complete blood counts (CBC). Urine tests are used to assess kidney function and detect potential problems by measuring parameters such as protein levels, glucose, and performing microscopic examinations. Recently, in October 2022, Unilabs announced the launch of the UAE's first-of-its-kind drive-through blood test service in Dubai, in collaboration with the Dubai Health Authority (DHA) and United Medical Center (UMC), this drive-through blood test service allows customers with an approved laboratory test application to get their blood drawn without leaving their vehicle. Furthermore, body fluid-based tests are used to detect cerebrospinal fluid (CSF) for conditions like meningitis and salivary cortisol tests for hormonal balance. Furthermore, the ease of sample collection and the advantage of providing early detection and preventive care through these samples is expected to drive overall growth in the segment.

Imaging-based tests held the second-largest market share in 2023. Imaging-based tests are an important part of complete checkup packages. These tests use a variety of imaging modalities to identify potential health issues early on, allowing for timely interventions and preventive measures. These tests include a variety of CT scans for detecting conditions such as colon cancer, lung cancer, and coronary heart disease, a DEXA scan for osteoporosis and bone mineral density assessments, as well as full-body composition analysis, a high sensitivity non-fasting blood test for diabetes, metabolic syndrome, heart and brain vessel health, and liver health, and colposcopy for cervical cancer screening and detection.

Application Insights

Cardiovascular diseases led the UAE health check-up market and accounted for 28.4% of the revenue in 2023. The high prevalence of CVDs in the UAE is driven by factors like sedentary lifestyles, high cholesterol levels, obesity, high blood pressure, and diabetes. Cardiovascular disease is the leading cause of death in the UAE, accounting for 16% of deaths from acute myocardial infarction, 22% from cerebrovascular disease, 6% from ischemic heart disease, and 5% from hypertension. Research data by the Cleveland Clinic shows that more than half of UAE residents are affected by heart disease. An audit of patients admitted for major heart attacks found that nearly half were under the age of 50, and one in 10 were under 40 years old. The UAE has also implemented a mandatory national insurance program that covers treatments for cardiovascular diseases, further driving demand for check-ups and screenings.

The cancer segment is projected to witness the fastest growth rate over the forecast period. This segment includes screenings, diagnostic tests, and comprehensive assessments aimed at identifying various types of cancer at early stages when they are most treatable. Recent developments in cancer health check-ups in the UAE reflect advancements in technology, increased awareness, and specialized healthcare services. Specialized clinics and hospitals in the UAE offer comprehensive cancer screening programs. These programs emphasize early detection and timely intervention. Furthermore, there is a growing integration of genetic testing and biomarker analysis in cancer health check-ups, allowing for personalized treatment strategies based on individual genetic profiles and tumor characteristics. This approach improves treatment efficacy and patient outcomes, which is poised to drive market growth in the forecast period.

Service Provider Insights

The hospital-based laboratories segment led the UAE health check-up market and accounted for 57.8% of the revenue in 2023. Hospital-based laboratories provide a wide range of diagnostic services, including routine check-ups, specialized tests, and emergency diagnostics. These laboratories are integral to patient care pathways, offering timely and accurate test results that inform clinical decision-making and treatment plans. The global clinics, manufacturers, and hospitals in the UAE are collaborating to improve patient access to advanced diagnostic services, particularly in the areas of cancer, genetics, and infectious diseases. For instance, in January 2021, Mayo Clinic Laboratories and American Hospital Dubai announced a strategic partnership to enhance healthcare services in the UAE. The partnership aims to provide high-quality diagnostic services and improve patient outcomes. Hospital-based laboratories in the UAE are increasingly adopting automation and digital solutions to streamline workflows, enhance efficiency, and ensure rapid turnaround times for test results. This includes the implementation of laboratory information management systems (LIMS) and automated testing platforms.

The standalone laboratories segment is projected to witness the fastest growth rate over the forecast period. As standalone laboratories are often strategically located in urban centers and residential areas, making them easily accessible to a large population. This convenience factor encourages individuals to undergo regular check-ups without having to visit a hospital or clinic. Many standalone laboratories offer specialized check-up packages tailored to specific demographics or health concerns. These packages may include comprehensive screenings for conditions such as diabetes, cardiovascular health, and cancer markers, which attract individuals looking for targeted health assessments. For instance, M42’s National Reference Laboratory (NRL) is a single standalone laboratory network of 12 state-of-the-art facilities across the UAE, which focuses on providing excellent customer service and personalized care. This includes offering flexible appointment scheduling, clear communication about procedures, and comprehensive post-test consultations, enhancing the overall patient experience.

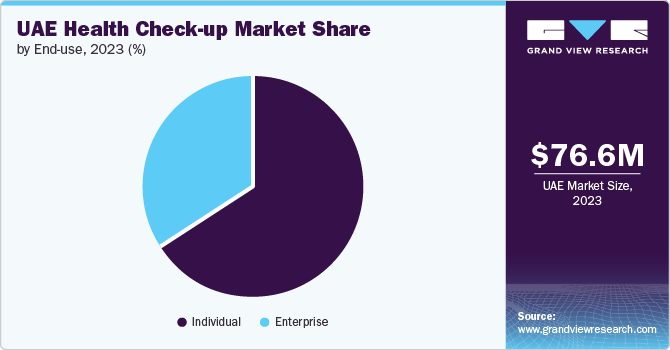

End Use Insights

Individual end use segment led the UAE health check-up market with a share of 66.1% in 2023, attributed to a growing public awareness of general and preventive care benefits. Healthcare professionals also recommend regular screenings to understand disease prognosis and treatment options better. Individual end users frequently pay the fee out of pocket or through personal insurance. Individuals growing consciousness, as well as their desire for early detection and intervention to maintain well-being, are driving the growth of the segment. Moreover, advancements in medical technology and telehealth have made checkups more convenient and accessible, contributing to the growth of this segment.

Enterprise end-use segment is projected to witness the fastest growth rate over the forecast period.Multinational corporations, educational institutions, and government bodies provide health check-ups as an employee wellness benefit to assess their employee's medical status, identify potential medical risks, and offer appropriate interventions. In June 2024, over 200 workers from various companies in Dubai received free check-ups at a mobile clinic set up by the Dubai Health Authority (DHA) and the private sector. The health check-ups included blood pressure, blood sugar, and body mass index (BMI) tests, as well as consultations with doctors and health educators. Furthermore, individuals frequently struggle to schedule check-ups due to time constraints; thus, enterprise-based users provide strong healthcare feasibility to employees.

Key UAE Health Check-up Company Insights

Some of the leading players operating in the market include Quest Diagnostics Incorporated, OPKO Health, Inc., and Laboratory Corporation of America Holdings. Key players are leveraging existing customer bases in the region to prioritize maintaining high-quality standards while gaining large market access. This strategy is useful for established brands. These companies are heavily investing in advanced technology and infrastructure to process and analyze large volumes of samples efficiently. Furthermore, companies collaborate on various strategic initiatives with other companies and distributors to strengthen their market presence.

Perspectum, Enara Bio, Vinehealth Digital Limited, and simprints are some of the emerging participants in the UAE health check-up market. These companies focus on achieving funding support from healthcare organizations and government bodies aided with novel service launches to capitalize on untapped avenues.

Key UAE Health Check-up Companies:

- Quest Diagnostics Incorporated

- Laboratory Corporation of America Holdings

- SYNLAB International GmbH

- OPKO Health, Inc.

- Eurofins Scientific

- UNILABS

- Sonic Healthcare Limited

- ARUP Laboratories

- Q2 Solutions

Recent Developments

-

In May 2024, Burjeel Holdings commissioned a cutting-edge, advanced molecular diagnostics and immune profile testing laboratory in the UAE with the Canada-based OncoHelix called OncoHelix-CoLab. This is a first-of-its-kind facility in the UAE that offers comprehensive capabilities in molecular, cellular immunology and transplant diagnostics.

-

In January 2023, Dubai National Insurance (DNI) launched a partnership with Takalam, an award-winning mental health and well-being platform. This partnership aimed to provide private and easy access to mental health professionals, tools, and solutions for DNI customers. The agreement allowed customers to add Takalam's package to their policy, giving them access to a network of qualified counselors and next-generation tools and platforms.

-

In September 2021, HealthPlus Diabetes & Endocrinology Center, Abu Dhabi, installed and started offering artificial pancreas devices (MiniMed 780G), a new smart insulin pump for patients suffering from type 1 diabetes.

UAE Health Check-up Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 80.56 million

Revenue forecast in 2030

USD 108.98 million

Growth Rate

CAGR of 5.2% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, test, test technique, application, service provider, end use

Key companies profiled

Quest Diagnostics Incorporated; Laboratory Corporation of America Holdings; SYNLAB International GmbH;OPKO Health Inc.; Eurofins Scientific; UNILABS; Sonic Healthcare Limited; ARUP Laboratories; Q2 Solutions

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UAE Health Check-up Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UAE health check-up market report based on type, test, test techniques, application, service provider, and end use:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

General Health Check-up

-

Preventive Health Check-up

-

Specialized Health Check-up

-

Routine & Wellness Health Check-up

-

-

Test Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood Glucose Test

-

Kidney Function Test

-

Bone Profile Test

-

Electrolytes Test

-

Liver Function Test

-

Lipid Profile Test

-

Special Biochemistry

-

Cardiac Biomarkers

-

Hormones & Vitamins

-

Tumor Markers

-

Others

-

-

Test Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood, urine, body fluid tests

-

Imaging based tests (Xray, CT, US, MRI)

-

Non-Imaging Tests (eg: ECG, CPET, NCS, EMG, EEG)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular Diseases

-

Metabolic Disorders

-

Cancer

-

Inflammatory Conditions

-

Musculoskeletal Disorders

-

Neurological Conditions

-

Others

-

-

Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital-Based Laboratories

-

Central Laboratories

-

Standalone Laboratories

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Enterprise

-

Private (Corporate) Sector

-

Government Sector

-

Insurance

-

-

Individual

-

Out of Pocket- Direct Payment for Health Check

-

Individual Health Insurance Plan

-

-

Frequently Asked Questions About This Report

b. The UAE health check-up market size was estimated at USD 76.56 million in 2023 and is expected to reach USD 80.56 million in 2024.

b. The UAE health check-up market is expected to grow at a compound annual growth rate of 5.17% from 2024 to 2030 to reach USD 108.98 million by 2030.

b. Cardiovascular diseases dominated the UAE health check-up market with a share of 28.37% in 2023. This is attributable to the high prevalence of CVDs in the UAE is driven by factors like sedentary lifestyles, high cholesterol levels, obesity, high blood pressure, and diabetes.

b. Some key players operating in the UAE health check-up market include Quest Diagnostics Incorporated, Laboratory Corporation of America Holdings, SYNLAB International GmbH, OPKO Health, Inc., Eurofins Scientific, UNILABS, Sonic Healthcare Limited, ARUP Laboratories, Q2 Solutions.

b. Key factors that are driving the market growth include growing prevalence of chronic diseases, the rising adoption of home-based medicine and telemedicine, and rising government initiatives to enhance population screening initiatives.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."