- Home

- »

- Pharmaceuticals

- »

-

UAE Complementary And Alternative Medicine Market, 2030GVR Report cover

![UAE Complementary And Alternative Medicine Market Size, Share & Trends Report]()

UAE Complementary And Alternative Medicine Market (2025 - 2030) Size, Share & Trends Analysis Report By Intervention (Traditional Alternative Medicine & Botanicals, Mind Healing), By Application, By Age, By Income, By Gender, Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-301-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

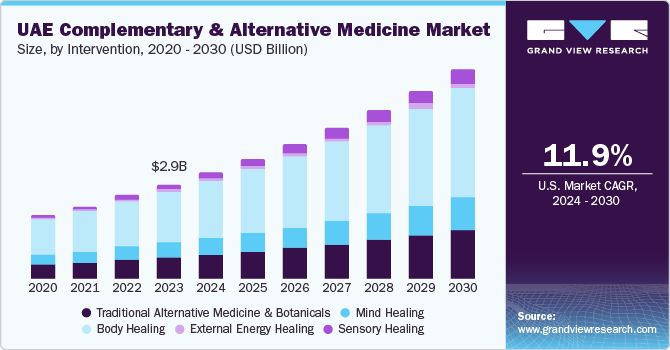

The UAE complementary and alternative medicine market size was estimated at USD 2.78 billion in 2024 and is projected to grow at a CAGR of 25.39% from 2025 and 2030. This upward trajectory is fueled by increasing consumer demand for holistic and alternative therapies. A key driver of this growth is the UAE’s rich cultural heritage, where traditional practices such as Hijama (cupping), herbal treatments, and Ayurveda have long played a central role in community health. Public trust in complementary and alternative medicine (CAM) continues to strengthen as the government actively works to integrate these time-honored methods with modern medical systems.

The industry is also witnessing a surge in investments and policy support. A prominent example is the USD 28.59 million mental health initiative introduced in July 2024 by Sheikh Hamdan bin Mohammed, Crown Prince of Dubai, under the Dubai Social Agenda 33. This program underscores the nation’s holistic health vision and positions the UAE as a rising hub for global wellness investment.

The nation’s multicultural population-comprising Arabs, South Asians, and Western expatriates-has significantly influenced the widespread acceptance of diverse CAM practices. Ayurveda and Traditional Chinese Medicine (TCM), for instance, are highly favored among Indian and Chinese communities, while Emiratis often gravitate toward holistic therapies such as Hijama and herbal medicine. This cultural alignment creates fertile ground for CAM businesses to thrive, especially as the public increasingly values natural remedies for chronic illnesses, stress, and preventive care.

Recognizing CAM's growing relevance, the UAE government has taken strategic steps to regulate and promote the sector. The Ministry of Health and Prevention (MOHAP) has implemented rigorous licensing frameworks for CAM professionals, ensuring high standards of safety and care. Dubai Healthcare City (DHCC) and other specialized zones support CAM practices through structured operational guidelines. Legal recognition of disciplines like homeopathy, acupuncture, naturopathy, and Ayurveda has further institutionalized CAM in the country’s healthcare ecosystem. Moreover, the government's commitment to wellness tourism, as seen in Dubai’s global health strategy, has spotlighted CAM on the international stage. Initiatives such as the certification of herbal products and the enforcement of quality checks also foster consumer trust and drive investor interest.

A major catalyst for the growth of the UAE’s CAM industry is the rising prevalence of chronic health issues, particularly mental health disorders, obesity, diabetes, and hypertension. According to a March 2025 report by BMC, the UAE recorded an average of approximately 24,000 reported mental health cases, with depressive and anxiety disorders being the most prevalent. As "pharmaceutical fatigue" becomes more common, where individuals grow weary of long-term medication regimens, many UAE residents are turning toward holistic and preventive healthcare approaches. CAM therapies that emphasize lifestyle modification, including yoga, herbal nutrition, meditation, and mindfulness practices, are gaining significant traction. This is particularly evident among millennials and Gen Z, who are more open to non-invasive, wellness-centered solutions. What was once considered a trend has now evolved into a wellness movement, fueled by social media, public awareness campaigns, and influencers advocating for natural healing. CAM’s core appeal lies in its ability to treat root causes rather than just symptoms, aligning with the public’s growing preference for sustainable and proactive well-being.

The UAE’s status as a medical tourism hotspot, particularly in Dubai and Abu Dhabi, further accelerates the CAM industry’s expansion. International patients are drawn to the country’s luxurious, well-regulated healthcare environment, where CAM services are increasingly integrated into mainstream treatment and recovery programs. High-end wellness resorts, Ayurvedic detox centers, and certified TCM clinics offer personalized, holistic care that aligns with global health trends. With the UAE’s reputation for high-quality infrastructure and trusted regulation, CAM is now a sought-after feature of the medical tourism experience, boosting the market's global reach and financial viability.

Investment from the private sector is another key growth driver. Healthcare groups, hotel chains, and wellness startups are pouring capital into CAM offerings, often merging traditional healing with cutting-edge technology. The rise of integrative medicine clinics-blending conventional and alternative approaches-underscores this shift. Startups are exploring AI-powered diagnostics, digital CAM consultations, and personalized herbal treatments, enhancing accessibility and engagement. The UAE’s investor-friendly environment, free zones, and tech-forward mindset continue to attract global players, further cementing CAM’s role in the nation’s future healthcare landscape.

Adding to this momentum, institutions are taking concrete steps to expand CAM infrastructure. In December 2022, LLH Hospital in Abu Dhabi launched the ‘Vaidyashala Ayurveda Center’, offering comprehensive Ayurvedic treatments under the guidance of experienced practitioners. This initiative reflects a growing trend of integrating evidence-based CAM into clinical settings, bridging traditional wisdom with modern science. As such projects multiply, they reinforce CAM’s legitimacy and broaden access for residents seeking natural, effective, and culturally familiar care options.

Market Concentration & Characteristics

The UAE CAM industry is experiencing a wave of innovation, particularly through the integration of digital health technologies. Advancements in telemedicine and mobile applications now allow patients to access remote consultations and book CAM services online, eliminating geographical barriers and enhancing accessibility. Additionally, wearable health devices and mobile apps that monitor vital signs, sleep quality, and activity levels are increasingly being linked to CAM treatments. These tools support personalized care plans based on real-time health data. Furthermore, cutting-edge technologies such as virtual reality (VR) and augmented reality (AR) are being explored for immersive therapies, including VR-guided meditation and AR-assisted acupuncture, providing both enhanced patient engagement and new possibilities for clinical research and validation in the CAM field.

The industry also reflects a moderate level of merger and acquisition (M&A) activity, as larger healthcare providers look to consolidate their presence by acquiring smaller players. This strategic approach allows companies to broaden their service offerings, enhance operational capabilities, and expand their product portfolios. Notable players engaging in such growth strategies include Mediclinic Middle East and TCMSH Middle East Ltd. Terms Ltd., aiming to strengthen its foothold in the evolving CAM ecosystem.

Government backing remains a critical driver of CAM industry expansion in the UAE. The Dubai Health Authority (DHA) has implemented comprehensive regulations to govern CAM practitioners and products, ensuring high standards of quality and patient safety. Additionally, the DHA actively promotes the integration of CAM into conventional healthcare systems through strategic efforts such as the Dubai Complementary & Alternative Medicine Project. Complementing these initiatives is the booming wellness tourism industry. The UAE has become a leading destination in the Middle East for wellness-focused travelers, thanks to its luxury resorts and hotels that offer a wide range of CAM services, including yoga, meditation, and therapeutic spa treatments. This influx of wellness tourists continues to fuel growth and global interest in the UAE’s CAM industry.

The industry is witnessing rapid service expansion, with increasing availability of therapies such as acupuncture, Ayurveda, homeopathy, and naturopathy across hospitals, wellness centers, and luxury resorts. Integrative medicine clinics and telehealth platforms are also broadening access, offering personalized treatment plans that blend traditional healing with modern healthcare technologies to meet growing consumer demand.

In the UAE CAM market, service substitutes include conventional allopathic treatments and pharmaceutical interventions, which often serve as alternatives to holistic therapies. Additionally, wellness apps, fitness programs, and over-the-counter supplements may replace certain CAM services for consumers seeking convenience. However, growing preference for natural, preventive care sustains strong demand for CAM despite the availability of these substitutes.

Intervention Insights

Based on intervention, the traditional alternative medicine/botanicals segment dominated the market with the largest share of 33.99% in 2024. This dominance is attributed to the cost-effectiveness and perceived health benefits of traditional remedies, especially among the aging population. The UAE government has been proactive in supporting this growth. For instance, in January 2023, the Ministry of Health inaugurated a new Ayurvedic medical center in Dubai's Al Qusais area, offering traditional treatments, meditation, yoga, and nutritional therapies. Such initiatives underscore the integration of traditional medicine into the mainstream healthcare system. Furthermore, the inclusion of alternative therapies in basic health insurance plans, like Dubai's Essential Benefits Plan, has enhanced accessibility, encouraging more residents to explore CAM options. As the UAE continues to prioritize preventive healthcare and wellness, the Traditional Alternative Medicine/Botanicals segment is poised for sustained growth in the coming years.

The mind healing segment is expected to grow at the fastest rate over the forecast period, driven by increasing awareness of mental health and a shift towards holistic wellness practices. The integration of CAM therapies into mainstream healthcare, supported by government initiatives and insurance coverage, further propels this growth. Platforms like Takalam, offering online counseling services, exemplify the digital transformation in mental health support.

Application Insights

Based on application, the psychological condition segment dominated the market with the largest share of 14.81% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. This growth is primarily driven by the rising prevalence of mental health disorders and the increasing demand for CAM therapies in the UAE. Psychological conditions include a wide array of mental health issues such as anxiety, depression, bipolar disorder, schizophrenia, and post-traumatic stress disorder (PTSD), which significantly impact individuals' quality of life and contribute to societal healthcare costs. Complementary and Alternative Medicine is emerging as a dynamic component of healthcare, offering nontraditional yet effective treatment options for these conditions. CAM practices such as herbal medicine, acupuncture, massage therapy, Mindfulness-Based Stress Reduction (MBSR), and Cognitive Behavioral Therapy (CBT) are gaining popularity for their holistic benefits.

Meanwhile, the women’s health segment is expected to record the second-highest CAGR over the same period. This segment spans various health concerns, including reproductive health, cardiovascular conditions, osteoporosis, and mental health, reflecting the distinct biological, behavioral, and social factors that influence women's health differently than men’s. In the UAE, interest in CAM solutions for women’s health, particularly for conditions like Polycystic Ovary Syndrome (PCOS), endometriosis, and general reproductive wellness, is steadily growing. This trend is fueled by cultural receptiveness to alternative care, a growing base of specialized CAM practitioners, and the increasing awareness of integrative approaches that support long-term well-being.

Age Insights

Based on age, the 15 to 64-year-old segment dominated the market with the largest share of 62.47% in 2024. This prominence is largely due to the substantial population within this age bracket, encompassing working professionals, middle-income families, and health-conscious individuals who are increasingly turning to CAM therapies for preventive care and overall wellness. The appeal of CAM among this segment is multifaceted. Urban lifestyles, characterized by high stress levels and sedentary habits, have led many to seek holistic approaches such as yoga, acupuncture, and mindfulness practices to manage mental health and enhance physical well-being. Furthermore, the integration of CAM services into mainstream healthcare facilities and the availability of these therapies through both direct sales and online platforms have made them more accessible to this age group.As awareness of alternative health solutions continues to grow, and with the UAE government's supportive stance on integrative medicine, the 15-64 age segment is poised to maintain its leading position in the CAM market, driving sustained growth and innovation in the sector.

The 65 and above age group is projected to experience the fastest CAGR over the forecast period. This surge is primarily attributed to the increasing geriatric population and the prevalence of chronic conditions such as arthritis, chronic pain, and stress-related ailments among seniors. Elderly individuals are increasingly turning to CAM therapies, like acupuncture, yoga, herbal remedies, and massage, to manage chronic conditions, enhance mobility, and improve overall quality of life. The growing health consciousness among seniors, coupled with the availability of specialized CAM practitioners, is further propelling this trend. Moreover, the integration of CAM services into mainstream healthcare facilities and the expansion of wellness tourism in the UAE are making these therapies more accessible to the elderly population. As a result, the 65 and above segment is poised to be a significant driver of growth in the UAE's CAM market in the coming years.

Income Insights

Based on income, the middle-income segment dominated the market with the largest share in 2024 due to the large population base, the high affordability of CAM therapies by the population of this segment, and an increase in the number of CAM therapies priced for this segment. This segment includes individuals with a monthly income between AED 5,000 and 50,000 or an annual income between USD 16,000 and USD 160,000. This segment includes middle-class families, professionals, and small business owners who have moderate disposable income. This segment has greater access to a variety of CAM services compared to the lower-income group and can afford regular treatments. Popular CAM applications in this segment include chiropractic care for musculoskeletal health, acupuncture for pain management & overall wellness, and yoga & meditation for stress relief & mental well-being. In addition, mid-range herbal products are commonly used for health maintenance and preventive care.

The higher-income segment is projected to experience the fastest CAGR over the forecast period. Affluent consumers are increasingly drawn to CAM therapies such as acupuncture, yoga, and herbal medicine, integrating these into their wellness routines. This trend is evident in luxury establishments like the One&Only's Longevity Hub in Dubai, offering services like IV drips and cryotherapy. The demand is further fueled by a growing interest in preventive healthcare and longevity, with high-income individuals prioritizing wellness investments. Government initiatives, including the inclusion of CAM services in basic health insurance plans like Dubai's Essential Benefits Plan, have enhanced the accessibility and legitimacy of alternative therapies. Additionally, the rise of wellness tourism and the integration of CAM into luxury experiences underscore the market's expansion.

Gender Insights

Based on gender, the male segment dominated the market with the largest share in 2024, driven by a growing awareness of holistic health practices and a proactive approach to managing physical and mental well-being.Men are turning to CAM therapies such as acupuncture, chiropractic care, and physiotherapy to address musculoskeletal issues, chronic pain, and stress-related conditions. The rising prevalence of lifestyle-related ailments has further propelled this trend, with many seeking preventive measures and alternative treatments to enhance their quality of life.Additionally, the integration of CAM services into mainstream healthcare facilities and the availability of specialized male-focused wellness centers have made these therapies more accessible. The government's support for CAM practices, including regulatory frameworks and inclusion in health insurance plans, has also played a pivotal role in legitimizing and promoting these alternatives.

The female segment in the UAE CAM market is projected to experience the fastest CAGR over the forecast period. This surge is driven by a holistic approach to health, encompassing physical, mental, and reproductive well-being. Women are increasingly turning to CAM therapies to address conditions such as Polycystic Ovary Syndrome (PCOS), endometriosis, and menopause-related symptoms. The growing popularity of practices like yoga, acupuncture, and herbal medicine reflects a cultural openness to alternative treatments and a desire for personalized care. Homeopathy, in particular, has gained traction among women seeking natural remedies during pregnancy and for managing stress and anxiety.

Distribution Channel Insights

Based on distribution channel, the direct sales (direct channels/offline) segment dominated the market with a share of 56.16% in 2024. Several factors driving this segment include the entry of new health & wellness centers and growing disposable income. Direct sales through offline channels involve physical locations and face-to-face interactions for the delivery of Complementary & Alternative Medicine (CAM) products and services. This traditional approach includes various facilities where practitioners and sellers meet customers directly. In the UAE complementary & alternative medicine market, direct sales channels include retail pharmacies & health stores, specialized CAM clinics, wellness centers & spas, hospitals & medical centers, and practitioner home visits & mobile services.

The distance correspondence (e-channels/online) segment is anticipated to grow at the fastest CAGR over the forecast period. Distance correspondence via online channels involves the use of the Internet for the distribution of CAM products & services. This approach includes e-commerce platforms, telemedicine, and other digital means to reach & serve customers remotely. UAE is seeing a major shift in how telehealth platforms are integrated with the current healthcare systems, improving the effectiveness of healthcare delivery and streamlining communication. An increasing number of people are using specialized online consultation platforms that offer more individualized and focused healthcare services. These platforms cater to particular medical issues and demographics. This growth is supported by underlying macroeconomic factors, such as the growing usage of digital technology and the internet, which have expanded the pool of potential customers for telehealth services related to CAM therapies. For instance, Okadoc Technologies FZ-LLC, DoctorUna, HealthHub by Al-Futtaim, Bioessence Holistic Clinic, Naturopathy UAE, and Local Wellness Centers & Practitioner Websites provide access to CAM services, making holistic health options more convenient and reachable for people.

Key UAE Complementary And Alternative Medicine Company Insights

Key players operating in the UAE complementary and alternative medicine market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key UAE Complementary And Alternative Medicine Companies:

- Home of Wellness

- Emirates European Medical Centre

- TCMSH Middle East Ltd. Terms Ltd.

- Oasis Care Ayurveda

- HeliumDoc

- Okadoc Technologies FZ-LLC

- Hakkini

- ZennMore

- Nabta Health

- Mediclinic Middle East

Recent Developments

-

In November 2024, luxury fashion and lifestyle brand Alo Yoga unveiled its newest sanctuary at the Galleria Al Maryah Island in Abu Dhabi, in collaboration with Alshaya Group, one of the world’s premier international retail franchise operators. This new location showcases Alo’s latest luxury activewear collections for both men and women, offering a comprehensive experience that blends style, comfort, and holistic wellness.

-

In March 2024, WHO and the UAE's Ministry of Health and Prevention (MOHAP) conducted a rigorous 5-day audit, post which Mediclinic City Hospital became the first private hospital in the country to receive the Patient Safety Friendly Hospital Initiative (PSFHI) certification.

-

In March 2024, Forest Essentials, in partnership with Apparel Group, celebrated the grand opening of its luxury Ayurveda experience at Dubai Hills Mall. The event unfolded in a setting of elegant décor, where guests were welcomed into the enchanting world of Luxurious Ayurveda. Vibrant blooms and striking product displays-featuring the brand’s signature ingredients like saffron, rose, jasmine, and hibiscus-beautifully illustrated the integral role of nature in the Forest Essentials story.

UAE Complementary And Alternative Medicine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.45 billion

Revenue forecast in 2030

USD 10.70 billion

Growth rate

CAGR of 25.39% from 2025 to 2030

Actual Years

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Intervention, application, age, income, gender, distribution channel

Key companies profiled

Home of Wellness; Emirates European Medical Centre; TCMSH Middle East Ltd. Terms Ltd.; Oasis Care Ayurveda; HeliumDoc; Okadoc Technologies FZ-LLC; Hakkini; ZennMore; Nabta Health; Mediclinic Middle East

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UAE Complementary And Alternative Medicine Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UAE complementary and alternative medicine market report based on intervention, application, age, gender, income, distribution channel, and region:

-

Intervention Outlook (Revenue, USD Million, 2018 - 2030)

-

Traditional Alternative Medicine & Botanicals

-

Ayurveda

-

Apitherapy

-

Bach Flower Therapy

-

Naturopathic Medicine

-

Traditional Chinese Medicine

-

Traditional Korean Medicine

-

Traditional South African Medicine

-

Traditional Mongolian Medicine

-

Traditional Tibetan Medicine

-

Zang Fu Theory

-

-

Mind Healing

-

Autosuggestion

-

Hypnotherapy

-

Neuro-linguistic Programming

-

Self-hypnosis

-

Spiritual Mind Treatment

-

Transcendental Meditation

-

-

Body Healing

-

Acupressure

-

Acupuncture

-

Alexander Technique

-

Auriculotherapy

-

Autogenic Training

-

Chiropractic

-

Cupping Therapy

-

Kinesiology

-

Osteomyology

-

Osteopathy

-

Pilates

-

Qigong

-

Reflexology

-

Yoga

-

-

External Energy Healing

-

Magnetic Therapy

-

Radionics

-

Reiki

-

Therapeutic Touch

-

Chakra Healing

-

-

Sensory Healing

-

Aromatherapy

-

Music therapy

-

Sonopuncture

-

Sound Therapy

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Psychological Condition

-

Stress, Anxiety, and Depression

-

Addiction Recovery

-

-

Pain

-

Body Pain

-

Headache

-

Others

-

-

Women’s Health

-

Menstrual Health

-

Pregnancy

-

Menopause

-

Others

-

-

Men's Health

-

Weight Management & Obesity

-

Immune and Autoimmune Issues

-

Musculoskeletal Issues

-

Diabetes

-

Cardiovascular Diseases (Heart and Circulatory Issues)

-

Infertility

-

Others

-

-

Age Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 14-year-old

-

15- to 64-year-old

-

65 and above

-

-

Income Outlook (Revenue, USD Million, 2018 - 2030)

-

Lower Income

-

Middle Income

-

Higher Income

-

-

Gender Outlook (Revenue, USD Million, 2018 - 2030)

-

Male

-

Female

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct Sales (direct channels/offline)

-

Distance Correspondence (e-channels/online)

-

Frequently Asked Questions About This Report

b. The UAE complementary and alternative medicine market size was estimated at USD 3.45 billion in 2025 and is expected to reach USD 2.78 billion in 2024.

b. The UAE complementary and alternative medicine market is expected to grow at a compound annual growth rate (CAGR) of 25.39% from 2025 to 2030 to reach USD 10.70 billion by 2030.

b. The psychological condition segment dominated the UAE complementary and alternative medicine with a share of 14.81% in 2024. This growth can be attributed to the rising prevalence of mental health disorders and the increasing demand for CAM therapies in the UAE.

b. Some key players operating in UAE complementary and alternative medicine market include Home of Wellness; Emirates European Medical Centre; TCMSH Middle East Ltd. Terms Ltd.; Oasis Care Ayurveda; HeliumDoc; Okadoc Technologies FZ-LLC; Hakkini; ZennMore; Nabta Health; Mediclinic Middle East

b. Key factors that are driving the market growth include the increasing demand for Complementary and Alternative Medicine (CAM) therapy due to the rising incidence of chronic diseases across the UAE.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.