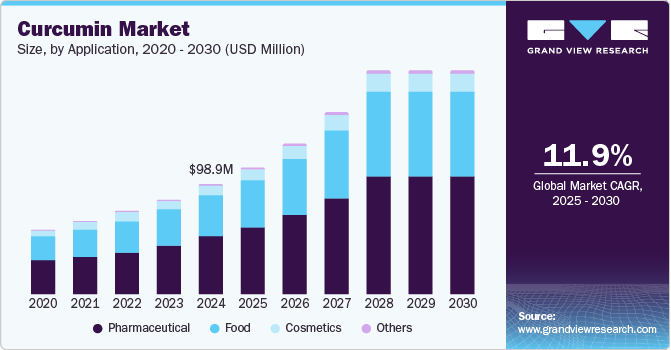

Curcumin Market Size, Share & Trends Analysis Report By Application (Pharmaceutical, Food, Cosmetics), By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-431-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

Curcumin Market Size & Trends

The global curcumin market size was valued at USD 98.9 million in 2024 and is projected to grow at a CAGR of 11.9% from 2025 to 2030. The market growth is attributed to the inherent properties of the product, such as anti-cancer, antioxidant, and anti-inflammatory properties. Curcumin is also widely used across skin-care applications, including the prevention of ringworms, eye infection, leech bites, sore skin, bruising, and swelling, among others, which, in turn, is expected to drive the growth of this market over the forecast period. Curcumin is an active ingredient commonly extracted from turmeric and ginger. Turmeric is widely consumed in Southeast Asian countries in both food and medical products due to its therapeutic properties.

Increasing awareness among consumers about curcumin's health benefits and medicinal values is driving product demand worldwide. Shifts observed in consumer trends and rising awareness about the benefits of using organic and natural ingredients in medical, cosmetics, and food applications will also augment the curcumin industry during the forecast period.

Curcumin is hydrophobic and lipophilic, and its application in the pharmaceutical industry is driven largely by its traditional therapeutic use. Various research is also underway to use different nanoparticles, such as dendrimers, polymeric nanoparticles, and nano gels, as carriers to deliver curcumin in the treatment of cancer and therapy of various neurological diseases. It is proven to have significant health benefits along with the potential to prevent various diseases, including Alzheimer’s, coronary heart disease, and cancer. Such R&D activities and use across pharmaceutical and nutraceutical applications are encouraging the growth of the curcumin industry.

The U.S. has witnessed a rise in product demand over the past few years owing to the growing awareness among consumers about its medicinal properties and health benefits. The product also has significant usage in tissue engineering, and companies are increasingly focused on investing in its research to extrapolate its application in the pharmaceutical industry, mainly due to its non-toxicity. Consumers in developed economies are well aware of these research findings and hence high demands can be anticipated from the countries including the U.S., Denmark, and Germany.

Application Insights

The pharmaceutical application segment led the market in 2024 with the largest revenue share of 52.2%. The segment is estimated to expand further at the fastest CAGR of 12.5% from 2025 to 2030. For centuries, curcumin has been widely used in traditional Asian herbal medicines to treat infections and inflammation. Besides, modern allopathic medicines and nutraceutical companies are also incorporating curcumin on a considerable scale in their products. All such factors are boosting the demand for curcumin for pharmaceutical applications.

The cosmetics application segment is estimated to grow significantly over the forecast period. The product’s applicability in cosmetic applications can be largely attributed to its antioxidant, anti-inflammatory, and antiaging properties. Exposure to UV radiation causes the formation of free radical species, which react with protein, DNA, and fatty acids, further irritating the epidermis. These free radicals also damage the skin, causing visible photo-aging effects, such as hyperpigmentation, wrinkles, and loss of skin firmness. Curcumin-infused products can reduce these effects. Thus, brand owners in the personal care and cosmetic verticals are increasingly incorporating it as an additive. Rising consumer awareness regarding the product benefits, along with consumer inclination for organically produced products, will bolster the curcumin industry growth during the forecast period.

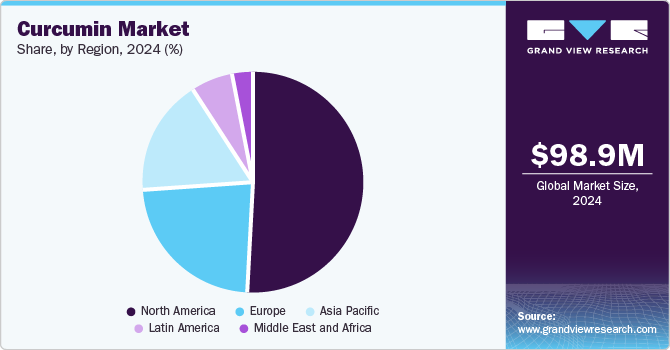

Regional Insights

North America accounted for the largest revenue share of 50.5% in 2024. The high revenue share is attributed to the high product demand in food and nutritional supplements. North America is also the home of numerous premium cosmetic and nutraceutical brands, and these companies are increasingly inclined towards incorporating organic ingredients such as curcumin in their products, which, in turn, provides growth opportunities to the regional curcumin industry.

U.S. Curcumin Market Trends

The U.S. dominated the North America curcumin market in 2024 due to its significant and growing population that is increasingly focused on health and wellness. This drives demand for natural products and dietary supplements with perceived health benefits, such as curcumin. The food and beverage industry in the U.S. is increasingly utilizing curcumin as a natural coloring and flavoring agent and incorporating it into functional foods and beverages to cater to health-conscious consumers.

Europe Curcumin Market Trends

Europe is expected to register the fastest CAGR of 12.5% during the forecast period. A major factor driving the regional market is the well-established personal care & cosmetics industry in Western European countries, including Italy, Germany, and Spain. Besides, growing awareness of the health benefits of curcumin among consumers and subsequently, growing use of curcumin across food and dietary supplements are expected to promote the demand for the curcumin market in Europe.

The German curcumin market held the largest regional market share in 2024, demonstrating its leading position in the European curcumin market; Germany also accounted for the highest volume consumption in 2024. The large market share in the country is attributed to the fact that consumers are becoming increasingly knowledgeable about curcumin's potential health benefits, particularly its anti-inflammatory and antioxidant properties. The country has a considerable aging population, which is susceptible to age-related health issues, including arthritis and cardiovascular diseases. Curcumin's potential role in managing these conditions is expected to drive demand and propel the curcumin market in the country.

Asia Pacific Curcumin Market Trends

The Asia Pacific curcumin market is anticipated to grow at a considerable CAGR during the forecast period. This growth is attributed to significantly increasing investments in curcumin R&D across the region. Turmeric is a fundamental spice in many South and Southeast Asian cuisines. This widespread culinary use provides a natural familiarity and acceptance of curcumin as a food ingredient.

In 2024, India led the APAC curcumin market with the largest share, accounting for 21.5% of the regional market. This dominant position highlights the country's strong production capabilities and growing demand for curcumin-based products. As a result, India remains the key driver of the curcumin industry in the Asia-Pacific region.

Key Curcumin Company Insights

The global market is highly competitive & fragmented, and is primarily driven by its applicability in the nutraceuticals and cosmetics industry. This product is extracted from turmeric and ginger. Hence, production plants need to be in the vicinity of the raw material source, which lowers the cost of the final product and removes the strains observed in logistics.

-

WackerChemie AG operates across key industries, such as pharmaceuticals, cosmetics, food, agriculture, and many more. WackerChemie AG has developed innovative solutions to improve the bioavailability and stability of curcumin (the active compound in turmeric) using its CAVAMAX cyclodextrin technology.

-

Arjuna Natural Extracts Ltd offers a range of patented ingredients, including BCM-95 (Curcugreen), Shoden, Oxystorm, and Rhuleave-K, each backed by clinical research to support various health benefits such as immunity, joint health, and cognitive function.

Key Curcumin Companies:

The following are the leading companies in the curcumin market. These companies collectively hold the largest market share and dictate industry trends.

- WackerChemie AG

- BioMaxLifesciences Ltd.

- Synthite Industries Ltd.

- Hindustan Mint & Agro Products Pvt. Ltd.

- Arjuna Natural Extracts Ltd.

- SV Agrofood

- Star Hi Herbs Pvt. Ltd.

- Herboveda India Pvt. Ltd.

- Helmigs Prima Sehejtera P.T.

- Javaplant

- Konark Herbals & Healthcare Pvt. Ltd.

- Rosun Natural Products Pvt. Ltd.

- Sabinsa Corporation

Recent Developments

-

In September 2023, NutriOriginal, in collaboration with Star-Hi Herbs Pvt. Ltd, introduced TurmiMax Bio, a turmeric-based supplement featuring enhanced absorption and water solubility using the patented OptiBio Assurance process.

-

In February 2022, Sabinsa Corporation introduced CurCousina turmeric-derived ingredient featuring Calebin A, shown to support healthy weight, cholesterol, and blood sugar levels.

Curcumin Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 113.8 million |

|

Revenue forecast in 2030 |

USD 199.7 million |

|

Growth rate |

CAGR of 11.9% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Germany, Italy, Spain, Poland, Russia, Denmark, China, Japan, India, South Korea, Malaysia, Australia, Indonesia, Thailand, Vietnam, Brazil, Argentina, Saudi Arabia, UAE, and South Africa |

|

Key companies profiled |

WackerChemie AG; BioMaxLifesciences Ltd.; Synthite Industries Ltd.; Hindustan Mint & Agro Products Pvt. Ltd.; Arjuna Natural Extracts Ltd.; SV Agrofood; Star Hi Herbs Pvt. Ltd.; Herboveda India Pvt. Ltd.; Helmigs Prima Sehejtera P.T.; Javaplant; Konark Herbals & Healthcare; Rosun Natural Products Pvt. Ltd.; Sabinsa Corporation. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Curcumin Market Report Segmentation

This report forecasts revenue growth at global levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global curcumin market report based on application, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical

-

Food

-

Cosmetics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Poland

-

Russia

-

Denmark

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Malaysia

-

Indonesia

-

Thailand

-

South Korea

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

UAE

-

South Africa

-

South Arabia

-

-

Frequently Asked Questions About This Report

b. The global curcumin market size was estimated at USD 58,199.4 thousand in 2020 and is expected to reach USD 65.36 million in 2021.

b. The curcumin market is expected to grow at a compound annual growth rate of 16.1% from 2020 to 2028 to reach USD 191.89 million by 2028.

b. Pharmaceutical application accounted for the highest share of 51.82% in the curcumin market in 2020.

b. Some of the key players in the curcumin market are Wacker Chemie AG, BioMax Lifesciences Ltd., Synthite Industries Ltd., Hindustan Mint & Agro Products Pvt. Ltd., Arjuna Natural Extracts Ltd., SV Agrofood, Star Hi Herbs Pvt. Ltd., Herboveda India Pvt. Ltd., Helmigs Prima Sehejtera P.T., Tri Rahardja PT/Javaplant, Konark Herbals & Healthcare, Rosun Natural Products Pvt. Ltd., and Sabinsa Corporation.

b. The demand is due to the increasing demand for curcumin in the pharmaceuticals, especially in the Asiatic countries.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."