- Home

- »

- Plastics, Polymers & Resins

- »

-

Turkey Automotive Plastic Compounding Market, Industry Report, 2030GVR Report cover

![Turkey Automotive Plastic Compounding Market Size, Share & Trends Report]()

Turkey Automotive Plastic Compounding Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (ABS, PP, PU, PVC), By Application (Instrument Panels, Powertrain, Door Systems, Interior Components), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-765-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

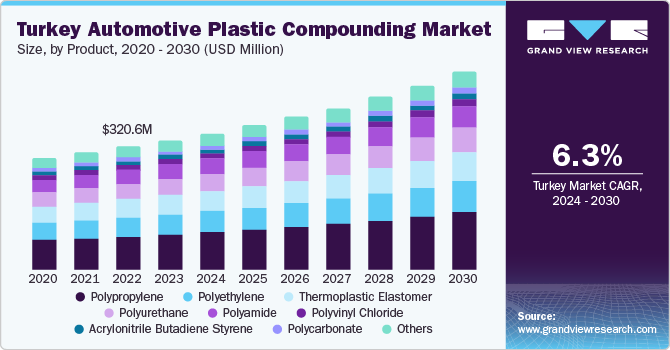

The Turkey automotive plastic compounding market size was estimated at USD 337.90 million in 2023 and is expected to expand at a CAGR of 6.3% from 2024 to 2030. The market has witnessed significant growth due to the increasing demand for automotive and the emergence and adoption of electrical vehicles (EVs) in the country.

Automobile companies are progressively resorting to various means to improve fuel efficiency and meet regulatory standards. Plastic compounds present ample opportunities in this field owing to their diverse nature, lightweight, low cost, material compatibility, and functionality, among other properties, that make them suitable for automotive applications.

The Turkish chemicals and plastics industry display significant growth potential both from domestic and international markets. Average per capita plastics consumption in the region is relatively lower than the rest of Europe, which offers significant investment opportunities for automotive plastic compounders. The Turkish automotive industry is also growing at a rapid pace with leading automobile manufacturers such as Ford, Toyota, Volkswagen, and Hyundai operating in the market.

In addition, Turkey is expected to emerge as a future hub for electric vehicles. The country also benefits from a relatively low-cost workforce with a strategically strong location serving as a corridor between Europe & Asia. For instance, in March 2022, the Turkish government launched its first homegrown electric automotive manufacturing plant in collaboration with Togg, an automobile company.

The government is providing land for the plant as part of an incentive to aid in the expansion and growth of the new business. The Turkish government offered to buy 30,000 cars from Togg over a ten-year period in addition to the land allotment. These factors are expected to drive plastic compounding demand growth in the Turkish automotive industry.

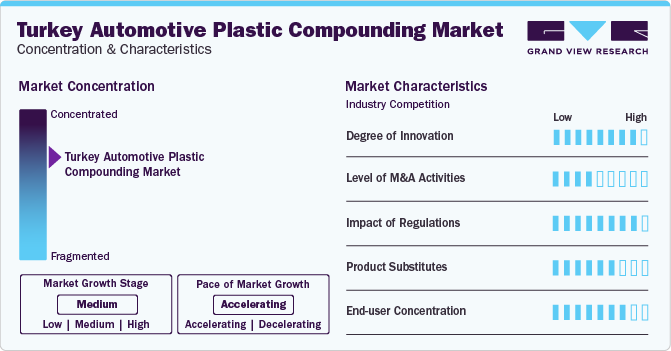

Market Concentration & Characteristics

The market is moderately consolidated, with key participants involved in R&D and technological innovations. Notable companies include Petkim Petrokimya Holding A.Ş., Alfa Polimer İnovasyon Plastik A.Ş., and Tisan Mühendislik Plastikleri San. Tic. Ltd. Şti., among others. Several players are engaged in framework development to improve their market share.

The market is characterized by a high degree of innovation. Innovation in the market is significantly focused on developing advanced material properties. Compounders are creating high-performance plastics with improved mechanical, thermal, and chemical resistance properties. For instance, reinforced polypropylene (PP) and polyamide (PA) compounds are being engineered to offer enhanced strength and durability, making them suitable for under-the-hood applications and structural components in vehicles. These advancements contribute to the production of lighter, more fuel-efficient vehicles, aligning with global trends towards reduced emissions and increased energy efficiency.

Environmental regulations, both local and international, significantly affect the Turkey automotive plastic compounding market. The European Union's stringent emissions standards, such as the Euro 6 regulations, have a direct influence on Turkish manufacturers due to Turkey's role as a key exporter of automotive components to Europe. These regulations mandate lower emissions, which drives the need for lightweight materials that improve fuel efficiency. Consequently, there is a heightened demand for advanced plastic compounds that contribute to vehicle weight reduction without compromising performance.

Product Insights

The polypropylene (PP) segment dominated the market with a share of 32.0%in 2023. Polypropylene (PP), also known as polypropene, is the second most widely produced synthetic plastic across the globe. PP is made from a combination of propylene monomers and has applications in a wide range of end-use industries, such as automotive, packaging & labeling, textiles, stationery, medical equipment, and construction.

The consumption of PP-based material in automotive applications has continued to increase, owing to its greater rigidity, impact strength, fluidity, and crystallization. PP resins have become an essential ingredient for lightweight impact-resistant automotive parts on account of the lower specific gravity of PP resins, which provides improved fuel economy and low emission.

The polyethylene (PE) segment is expected to witness a substantial growth over the forecast period. PE is a widely utilized synthetic resin, which is made from the polymerization of ethylene. Low-density, linear density, and ultrahigh molecular weight ethylene copolymers are major compounds of PE that are utilized in several applications, such as clear food wrap, shopping bags, detergent bottles, and automobile fuel tanks.

Cross-linked PE (XLPE) foams are consumed in various automotive components, owing to their lower fogging value, lightness and weight saving, flexibility, excellent thermal properties, and chemical resistance. XLPE has applications in seatbacks, liners, air condition ducts, dashboard padding, wing mirror seals, door panels, windshields, and truck liners.

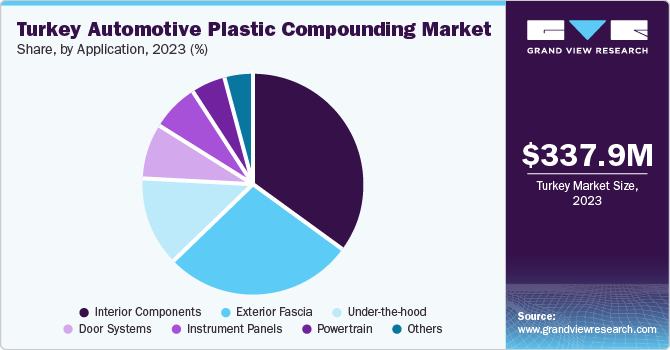

Application Insights

The interior components segment held the largest revenue share in 2023. Numerous interior components such as headliners, load floors, seat bases, and rear package shelves are being constructed from high-performance plastics, such as ABS & glass mat thermoplastic (GMT) composites, instead of conventional metal, rubber, and other parts. Plastics are used to manufacture durable, comfortable, and aesthetically appealing components while contributing to noise reduction with low harshness and vibration levels.

Furthermore, high awareness regarding improved safety in the passenger compartment includes affordable advances via innovative designs with more efficient manufacturing capabilities and specific designs for increased vehicle compatibility. These factors are expected to propel the demand for plastic compounds in interior component applications.

The exterior fascia is projected to witness a significant growth through the forecast period. Automotive engineers are constantly striving to achieve greater optimization rates and precision in extrusion and blow molding operations while cutting down on overall production costs. These factors have driven recent innovations in the assembly of cars using plastic compounds in place of conventionally heavy and expensive materials. R&D activities are increasingly focusing on the inclusion of energy management technologies that impede roof crush, resist vehicle intrusion, and lower overall car body weight without compromising on safety or performance.

Key Turkey Automotive Plastic Compounding Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as new product development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In June 2023, TR Fastenings (Trifast Group) announced the expansion of its product offerings with the addition of 1,500 new part numbers to its current Plastic & Rubber Hardware assortment. The new product range of the company includes ·screw rivets, barbed push-in rivets, kwik nuts, shockproof snap rivets, and push screws. These products are used in automotive interiors and exteriors, including wheel-arch bumpers, splash shields, bumper assemblies, internal upholstery, engine liner interior assemblies, seat trim panels, mounting brackets, trims, splash guards, and bumper assemblies.

Key Turkey Automotive Plastic Compounding Companies:

- Petkim Petrokimya Holding A.Ş.

- Alfa Polimer İnovasyon Plastik A.Ş.

- Tisan Mühendislik Plastikleri San. Tic. Ltd. Şti.

- Elastron TPE

- Pimar-Plastics Limited

- EPSAN

- MASKOM Plastik San. ve Tic. Ltd. Şti.

- ALBIS Distribution GmbH und Co. KG.

- Tosaf

- LANXESS

- PolyOne Corporation (Avient Corporation)

- LyondellBasell Industries Holdings B.V.

- EUROTEC A.S.

- Kingfa Science and Technology Co Ltd

- SABIC

- Ravago

- Polytek Development Corp.

Turkey Automotive Plastic Compounding Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 355.53 million

Revenue forecast in 2030

USD 513.63 million

Growth rate

CAGR of 6.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Volume in Kilotons, Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application

Key companies profiled

Petkim Petrokimya Holding A.Ş.; Alfa Polimer İnovasyon Plastik A.Ş.; Tisan Mühendislik Plastikleri San. Tic. Ltd. Şti.; Elastron TPE; Pimar-Plastics Limited; EPSAN; MASKOM Plastik San. ve Tic. Ltd. Şti.; ALBIS Distribution GmbH und Co. KG.; Tosaf LANXESS; PolyOne Corporation (Avient Corporation); LyondellBasell Industries Holdings B.V.; EUROTEC A.S.; Kingfa Science and Technology Co Ltd; SABIC Ravago Polytek Development Corp.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Turkey Automotive Plastic Compounding Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Turkey automotive plastic compounding market report based on product, and application:

-

Product Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Polypropylene (PP)

-

Polyurethane (PU)

-

Polyvinyl Chloride (PVC)

-

Polyethylene (PE)

-

Polycarbonate (PC)

-

Polyamide (PA)

-

Thermoplastic Elastomer (TPE)

-

Others

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Instrument Panels

-

Powertrain

-

Door Systems

-

Interior Components

-

Exterior Fascia

-

Under-the-hood

-

Others

-

Frequently Asked Questions About This Report

b. The Interior components application segment dominated the Turkey automotive plastic compounding market with a share of more than 35.10% in 2023. This is attributable to the rising demand for lightweight, durable, and environmentally friendly components with enhanced surface finish and texture.

b. Some of the key players operating in the Turkey automotive plastic compounding market include EPSAN, LANXESS, PolyOne Corporation, LyondellBasell Industries Holdings B.V., and SABIC.

b. Key factors driving the Turkey automotive plastic compounding market growth incudes rising demand for lightweight and durable automobiles to lower carbon emissions coupled with the rising rate of plastic recycling.

b. The Turkey automotive plastic compounding market size was estimated at USD 337.90 million in 2023 and is expected to reach USD 355.53 million in 2024.

b. The Turkey automotive plastic compounding market is expected to grow at a compound annual growth rate of 6.3% from 2024 to 2030 to reach USD 513.63 million by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.