- Home

- »

- Advanced Interior Materials

- »

-

Turf Protection Market Size, Share & Growth Report, 2030GVR Report cover

![Turf Protection Market Size, Share & Trends Report]()

Turf Protection Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Pest, Stress, Scarification), By Application (Sports, Recreational), By Mode Of Application, By Solution, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-350-6

- Number of Report Pages: 201

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Turf Protection Market Summary

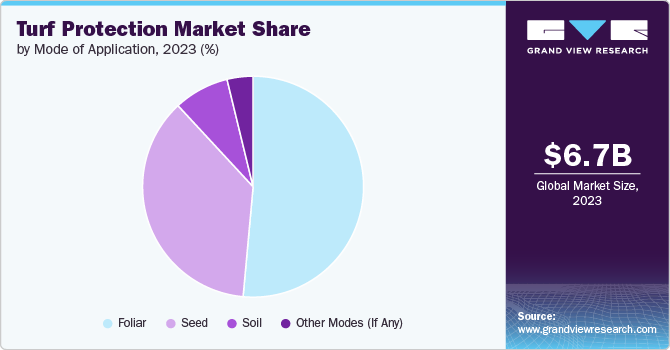

The global turf protection market size was estimated at USD 6.72 billion in 2023 and is projected to reach USD 9.34 billion by 2030, growing at a CAGR of 4.9% from 2024 to 2030. The growth is attributed to the increasing construction projects for commercial and residential properties, expansion projects, and the growing focus on sports, increasing the demand for turf protection.

Key Market Trends & Insights

- North America dominated the market in 2023 with the highest revenue share.

- The turf protection market in the U.S. is expected to dominate North America, with a market share of 27.0% in 2030.

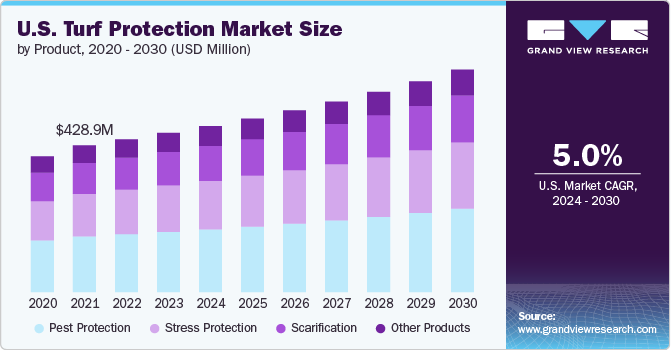

- By product, the pest protection segment dominated the market and accounted for a revenue share of 37.91% in 2023.

- By solution, the chemical segment dominated the market with a market and accounted for a revenue share of 37.7% in 2023.

- By application, the sports segment dominated the market with a market and accounted for a revenue share of 57.60% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 6.72 Billion

- 2030 Projected Market Size: USD 9.34 Billion

- CAGR (2024-2030): 4.9%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Turf protection is essential to caring for a lawn, which can be challenging; using the product can prevent damage from pests and weeds. The market for turf protection is expected to grow due to the high demand for sports like football, cricket, and golf. Companies that prioritize innovation can adapt quickly to changes and achieve high profits. Major players in the market are experiencing export and domestic sales growth. However, the market also faces challenges such as competition among local players, increasing buyer bargaining power, and competition for high-quality supplies at a low cost.

Drivers, Opportunities & Restraints

The turf industry is witnessing a notable surge in demand, particularly from sports fields and residential areas. This increase is driven by the desire for better quality and aesthetically pleasing green spaces for sports, leisure, and home landscaping. In response to this growing demand, there's a significant advancement in integrated pest management (IPM) practices within the industry. These improvements are crucial for maintaining the health and appearance of turf in both public and private spaces, ultimately leading to enhanced satisfaction among consumers and stakeholders in the turf industry.

The turf industry needs to improve its regulations regarding using synthetic chemicals across different regions. This disparity arises from varying environmental policies, health standards, and local governance structures. Such inconsistencies complicate the adoption of uniform, sustainable pest management practices, potentially hindering the effectiveness of Integrated Pest Management (IPM) efforts. Furthermore, these regulatory inconsistencies challenge the industry's ability to meet rising consumer expectations for quality and environmentally friendly green spaces, thus impacting the health of turf areas and consumer satisfaction.

There has been a noticeable surge in demand for bio-based turf protection solutions within the turf industry. This trend is primarily driven by growing environmental awareness and increasing consumer preferences for sustainable and eco-friendly practices. As people become more conscious of the harmful effects that synthetic chemicals can have on the environment and human health, there's a natural pivot towards greener alternatives. Bio-based turf protectants, derived from natural materials, offer a promising solution by minimizing the reliance on synthetic chemicals. These eco-friendly alternatives cater to rising consumer expectations and align with the industry's objectives for promoting sustainable and effective turf management practices.

Product Insights

Pest protection dominated the market and accounted for a revenue share of 37.91% in 2023. Pest protection involves adopting strategies to control and prevent damage caused by various pests, including insects, rodents, and weeds, that can negatively impact the health and appearance of turfgrass. This is achieved by combining cultural, biological, and chemical methods to maintain healthy turf, ensuring it remains functional and aesthetically pleasing. Pest management practices are crucial for the sustainability of golf courses, sports fields, and residential lawns, aiming to balance pest control and environmental stewardship.

Stress protection emerged as the fastest-growing product segment, with a CAGR of 5.3% during the forecast period. Stress protection encompasses strategies and products designed to enhance turf resilience to various stressors, such as drought, extreme temperatures, and foot traffic. Improving turf health and vigor helps maintain its aesthetic and functional qualities. Innovations, including bio-based solutions, are increasingly favored for their environmental benefits, contributing to a more sustainable approach to turf management. This shift aligns with broader industry goals of reducing reliance on synthetic chemicals while effectively managing turf stress.

Solution Insights

Chemical dominated the market with a market and accounted for a revenue share of 37.7% in 2023. Chemical solutions have traditionally played a crucial role in maintaining lawns' and landscapes' health and aesthetic appeal. These chemicals combat various issues, including pests, diseases, and weeds, that can detrimentally affect turf quality. Although effective, there is growing concern regarding their environmental impact and the safety of chemical residues, pushing the industry towards exploring more sustainable and eco-friendly alternatives. This shift aims to balance effective turf management with environmental responsibility, highlighting the need for continuous innovation in turf care practices.

Biological solutions emerged as the fastest-growing, with a CAGR of 5.4%.The shift towards biological solutions is a shift towards biological sustainability and eco-friendliness. These natural alternatives, including microorganisms and botanical extracts, target pests and diseases without harming the environment or non-target organisms. Their integration into turf management practices supports the maintenance of healthy lawns and landscapes while reducing dependency on traditional chemical solutions. This approach aligns with environmental responsibility and paves the way for innovative, safe, and effective turf care methodologies.

Application Insights

Sports dominated the market with a market and accounted for a revenue share of 57.60% in 2023. This increasing emphasis is on integrating biological solutions for maintaining healthy and resilient playing surfaces in sports turf protection. Microorganisms and botanical extracts play a significant role in managing pests and diseases, ensuring the safety and playability of sports turf without relying heavily on synthetic chemicals. This sustainable approach not only preserves the quality of the turf but also aligns with environmental stewardship by minimizing ecological impact. It represents a forward-thinking methodology in sports turf management, combining the best of nature and innovation for adequate care.

Recreational emerged as the fastest-growing application with a CAGR of 5.5%.The product market is crucial in sustaining the health and vitality of grass surfaces used for recreational purposes, such as sports fields, golf courses, and public parks. This sector focuses on developing and implementing solutions to prevent damage caused by physical wear, pests, and diseases, ensuring these green spaces remain functional and aesthetically pleasing. The industry supports the longevity and sustainability of recreational turf areas through innovative products, best practices in turf management, and environmentally friendly approaches.

Mode Of Application Insights

Foliar segment dominated the market with a market share of 51.50% in 2023. The demand for foliar sprays in the agricultural market is growing rapidly due to their ability to significantly increase crop yields, improve nutrient efficiency, and promptly address nutrient deficiencies. Foliar sprays offer an efficient way to deliver crucial nutrients directly to plant leaves. This focused approach ensures that plants receive nutrients exactly where needed, promoting healthy growth and optimizing nutrient utilization.

Seed mode of application emerged as the fastest growing, with a CAGR of 5.3% in 2023. The seed mode of application involves strategically deploying seeds treated with protective coatings or embedded with growth-promoting substances. This method enhances seed germination, fosters healthy root development, and increases the emerging turf's resistance to pests and diseases. By integrating these protected seeds, turf managers can establish a more robust and resilient turf surface, effectively reducing the need for chemical treatments and fostering a healthier, more sustainable turf environment.

Regional Insights

North America dominated the market in 2023 with the highest revenue share. Major players and an increasing number of sports fields drive the growth of turf protection in the region. Significant factors defining the extent of the market in the region include huge residential areas with plenty of play areas, public parks, and numerous golf courses. The U.S. holds most of the market share for turf and ornamental chemical inputs within the region, followed by Canada. While still developing due to its harsh climatic conditions, Mexico is expected to grow considerably, particularly in the warmer southern regions.

U.S. Turf Protection Market Trends

The turf protection market in the U.S. is expected to dominate North America, with a market share of 27.0% in 2030. The market is expected to grow in the region due to increasing recreational projects, leading to a rise in demand for turf products. Rising consumer preference and the increase in MLS and NFA have led to rising demand for higher-quality turf in the country. As a result, the demand for turf protection is increasing.

Asia Pacific Turf Protection Market Trends

The turf protection market in Asia Pacific is expected to grow at the fastest CAGR during the forecast period. The construction industry in Asia Pacific is expected to witness significant growth over the coming years owing to the high demand for non-residential construction projects such as hospitals, commercial buildings, and colleges. The rise in recreational projects is also expected to boost the demand for turf protection in the region over the forecast period.

Europe Turf Protection Market Trends

The turf protection market in Europe is expected to grow significantly over the forecast period. Europe plays a significant role in the turf protection market, with countries such as Germany, the UK, France, Italy, Spain, Russia, Netherlands, and Belgium being key contributors to the market. The region's market dynamics are influenced by factors such as the rising high level of turf to meet the international standards for sports, which has driven the for-turf protection market in the region.

Key Turf Protection Company Insights

Some of the key players operating in the global turf protection market include

-

Bayer AG manufactures, develops, and commercializes products for human health and agriculture. The company provides medicines for women's health, cardiovascular diseases, hematology, cancer, ophthalmology, and other conditions. It also focuses on creating new molecules and technologies for medicine and modern agriculture. Bayer's product portfolio includes diagnostic imaging equipment, prescription and specialty pharmaceuticals, over-the-counter products, crop protection, seeds, and non-agricultural pest control solutions. The company has a global presence.

-

BASF SE is a global chemical company that manufactures and sells plastics, chemicals, crop protection, and performance products. Its product line includes turf protection, adhesives, fuel additives, solvents, surfactants, pigments, electronic chemicals, food additives, paints, herbicides, and fungicides. The company serves various industries, including furniture, construction, electronics, agriculture, electrical, paints and coatings, home care, automotive, and nutrition. BASF operates through a network of manufacturing facilities worldwide. The company offers a wide array of broad-spectrum disease management solutions to help turf professionals protect the health of their turf, keeping it strong and resistant to disease throughout the year.

Nufarm Ltd and Syngenta AG are some of the emerging market participants in the global turf protection market.

-

Nufarm Ltd specializes in agricultural chemicals, seed technologies, and crop protection solutions. Its products include insecticides, herbicides, and fungicides. The company's seed treatment products protect against damage caused by fungi, insects, and diseases. Its offerings aid farmers in safeguarding crops from the harm caused by pests, weeds, and diseases. Additionally, the company markets seed treatments for various products, including sorghum, canola, and sunflower crops, and it has a global presence.

-

Syngenta AG is a subsidiary of Syngenta Group Investment Co Ltd (HK) subsidiary, an agribusiness specializing in crop and seed protection. The company manufactures and markets crop protection chemicals, including herbicides, insecticides, seed treatments, and fungicides. These products are used to control insects, weeds, and diseases that affect crops. Additionally, Syngenta offers a variety of seeds for field crops, such as cereals, corn, sugar beet, oilseeds, flowers, and vegetables, as well as high-quality pot and bedding plants. The company's products are also used in professional sectors like public turf, health, and ornamental markets. The company has a global presence.

Key Turf Protection Companies:

The following are the leading companies in the turf protection market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Atticus, LLC

- SIGMA ORGANICS, INC.

- BioSafe Systems, LLC.

- UPL

- Koppert

- Syngenta Crop Protection AG

- Corteva

- Nufarm

- Bayer AG

- SDS Biotech

Recent Developments

-

In May 2021, BASF launched Alucion 35 WG, a dual-active insecticide designed for golf courses. This non-restricted product offers superintendents an effective solution against surface-feeding insects like ants, chinch bugs, cutworms, and bluegrass weevils.

-

In May 2021, AMVAC Chemical Corporation acquired the rights to sell Envoke herbicide in the U.S. from Syngenta, enabling them to offer the product to American farmers. The acquisition includes end-use product trademarks and registration for Envoke herbicide in the U.S.

Turf Protection Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.01 billion

Revenue forecast in 2030

USD 9.34 billion

Growth rate

CAGR of 4.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, mode of application, solution, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

BASF SE; Atticus, LLC; SIGMA ORGANICS, INC.; BioSafe Systems, LLC; UPL; Koppert; Syngenta Crop Protection AG; Corteva; Nufarm; Bayer AG; SDS Biotech

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Turf Protection Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global turf protection market report based on product, mode of application, solution, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Pest Protection

-

Stress Protection

-

Scarification

-

Other Products

-

-

Mode Of Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Foliar

-

Seed

-

Soil

-

Other Modes (If Any)

-

-

Solution Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Biological

-

Chemical

-

Mechanicals

-

Other Solutions

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Sports

-

Recreational

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global turf protection market size was estimated at USD 6.72 billion in 2023 and is expected to reach USD 7.01 billion in 2024.

b. The global turf protection market is expected to grow at a compound annual growth rate of 4.9% from 2024 to 2030 to reach USD 9.34 billion by 2030.

b. North America dominated the turf protection market with a share of 37.60%. This growth is attributable to Major players, and an increasing number of sports fields drive the growth of turf protection in the region. Significant factors defining the extent of the market in the region include huge residential areas with plenty of play areas, public parks, and numerous golf courses.

b. Some key players operating in the turf protection market include BASF SE; Atticus, LLC; SIGMA ORGANICS, INC.; BioSafe Systems, LLC; UPL; Koppert; Syngenta Crop Protection AG; Corteva; Nufarm; Bayer AG; and SDS Biotech

b. Key factors that are driving the market growth include the increasing construction projects for commercial and residential properties, expansion projects, and the growing focus on sports, increasing the demand for turf protection.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.