- Home

- »

- Advanced Interior Materials

- »

-

Turbine Control System Market Size And Share Report, 2030GVR Report cover

![Turbine Control System Market Size, Share & Trends Report]()

Turbine Control System Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Steam Turbine Control System, Gas Turbine Control System), By Function (Speed Control), By Component (Hardware), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-390-7

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Turbine Control System Market Summary

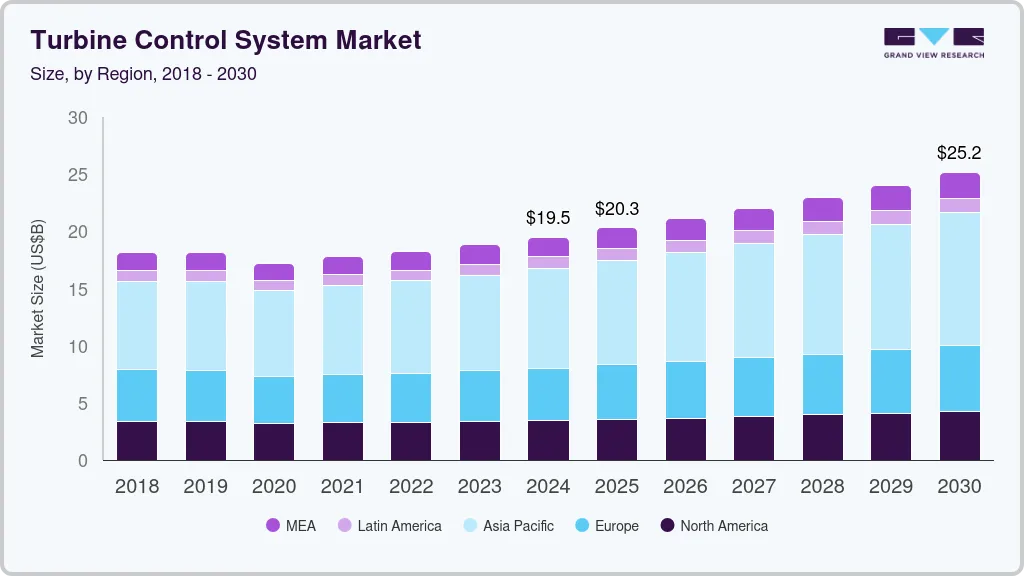

The global turbine control system market size was estimated at USD 19.50 billion in 2024 and is projected to reach USD 25.17 billion by 2030, growing at a CAGR of 4.4% from 2025 to 2030. The market is witnessing significant growth, driven by the increasing demand for energy efficiency and the push toward renewable energy sources.

Key Market Trends & Insights

- China turbine control system market is estimated to grow at a CAGR of 5.0% over the forecast period.

- North America turbine control system market is propelled by steady demand for turbine control systems.

- Based on component, the hardware segment led the market and accounted for 65.5% of the global market revenue share in 2023.

- In terms of function, the pressure control function segment accounted for 30.5% of the global market revenue share in 2023.

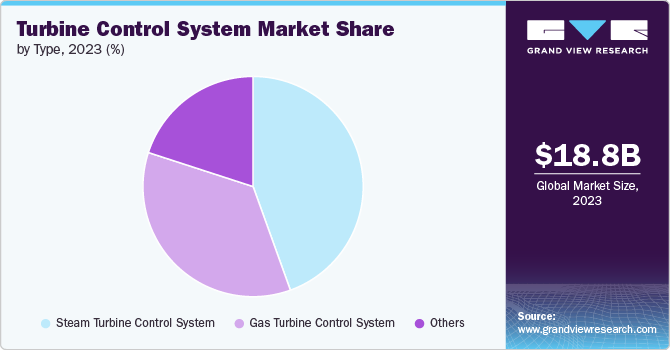

- Based on type, The steam turbine control system type segment accounted for 44.5% of the global market revenue share in 2023.

Market Size & Forecast

- 2024 Market Size: USD 19.50 Billion

- 2030 Projected Market Size: USD 25.17 Billion

- CAGR (2025-2030): 4.4%

- Asia Pacific: Largest market in 2023

This market growth is further fortified by advancements in technology that provide enhanced control and operational efficiency for various types of turbines, including gas, steam, and wind turbines. Moreover, the integration of digital technologies and IoT into turbine control systems has enabled real-time monitoring and predictive maintenance, significantly reduced downtime and enhancing the performance and lifespan of turbines. For instance, Siemens' SPPA-T3000 Control System is designed to optimize the operation of power generation facilities by improving their flexibility, reliability, and efficiency.

Another trend shaping the market is the growing focus on environmental sustainability and the reduction of carbon emissions. This has led to an increased deployment of wind and hydroelectric power plants, which require sophisticated control systems to manage the variability in power generation and ensure grid stability. Companies such as GE Renewable Energy and Vestas are at the forefront of adopting advanced control technologies in their wind turbines, which allows for more precise power output control and integration with the grid. These advancements are crucial for the scalability of renewable energy sources and highlight the critical role of control systems in the energy transition.

Additionally, the demand for turbine control systems is also being driven by the retrofitting of older power plants and turbines with modern control technologies to extend their operational life and meet current environmental regulations. This trend is particularly noticeable in emerging economies, where there is a pressing need to upgrade existing infrastructure to support growing energy demands without further contributing to environmental degradation. For instance, upgrading the control systems of gas turbines with modern solutions like Emerson's Ovation Turbine Control can significantly enhance their efficiency and flexibility, enabling utilities to meet peak demands more effectively.

Drivers, Opportunities & Restraints

Turbine control systems are crucial for the efficient operation of turbines in various industries, including power generation, oil & gas, and aviation. Moreover, the growing demand for renewable energy sources is expected to drive the demand for turbine control system. For example, the increased deployment of wind turbines worldwide demands advanced control systems to optimize their performance, reliability, and connection to the grid.

While turbine control systems offer numerous benefits, they are not without their restraints. One principal restraint is the high initial investment and maintenance costs. Implementing state-of-the-art control systems requires significant capital, which can be a barrier for smaller operations or in regions with limited funding. For instance, upgrading existing turbine infrastructure in a power plant with the latest control technologies might be cost-prohibitive, delaying or preventing such upgrades. Another restraint is the complexity of integrating advanced control systems with existing infrastructure. Many older turbines and power plants were not designed with modern digital controls in mind, posing significant challenges to integration and requiring substantial retrofitting efforts.

The market faces several challenges, notably cybersecurity threats and the need for skilled personnel. As turbine control systems become more interconnected and reliant on digital technologies, they become more vulnerable to cyberattacks. An example of this is the increasing reports of attempted hacking into energy facilities' operational networks. Such vulnerabilities require ongoing attention to cybersecurity measures, which can be resource-intensive.

Component Insights

“The demand for software component segment is expected to grow at a significant CAGR of 4.6% from 2024 to 2030 in terms of revenue”

The hardware segment led the market and accounted for 65.5% of the global market revenue share in 2023. The demand is driven by the need for reliable and robust components that can withstand the harsh operational environments of turbines. Components such as sensors, actuators, and controllers are essential for the real-time monitoring and control of turbine operation. For example, in the case of wind turbines, high-quality sensors are required to accurately measure wind speed and direction, enabling the turbine to adjust its blades for optimal efficiency.

The demand for software componentis fueled by the increasing complexity of turbine systems and the need for sophisticated control algorithms that can optimize performance in real-time. Software solutions for turbine control systems include advanced algorithms for predictive maintenance, performance optimization, and integration with the wider energy management systems. For instance, modern wind farms utilize software platforms that can analyze data from individual turbines to predict potential failures before they occur, enabling preemptive maintenance and reducing downtime.

Function Insights

“The demand for temperature control function segment is expected to grow at a significant CAGR of 5.6% from 2024 to 2030 in terms of revenue”

The pressure control function segment accounted for 30.5% of the global market revenue share in 2023. Pressure control systems are integral to managing the operational parameters of turbines, especially in power generation and processing industries. For instance, in steam turbines, maintaining the correct steam pressure is crucial for operational efficiency and safety. High or low pressure can significantly impact the turbine's performance, potentially leading to mechanical failures or reduced efficiency. Such systems ensure that turbines operate within their designed parameters, thereby maximizing efficiency and prolonging their service life.

Temperature control in turbine systems is equally critical, especially for gas turbines and aircraft engines. The temperature of the turbine blades directly affects their strength, efficiency, and lifespan. In gas turbines, for example, the ability to precisely control the temperature at which the turbine operates can significantly enhance power output while minimizing wear and tear on the components. Advanced temperature control systems utilize sophisticated sensors and cooling techniques to manage the blade and combustion chamber temperatures, thus preventing overheating and ensuring the turbine operates within safe and optimal thermal conditions.

Type Insights

“The demand for steam turbine control system type segment is expected to grow at a significant CAGR of 4.5% from 2024 to 2030 in terms of revenue”

The steam turbine control system type segment accounted for 44.5% of the global market revenue share in 2023. Steam turbines, which convert thermal energy from steam into mechanical power, are a cornerstone in electricity generation, especially in combined-cycle plants and in industrial processes requiring mechanical drive services. The control system in a steam turbine is crucial for managing its start-up, shutdown, and operational efficiency, addressing the precise control of steam flow, pressure, and temperature to optimize performance.

Gas turbine control systems are intricately designed to handle complex variables such as fuel composition, ambient temperature, and load demand. For instance, advanced control algorithms are employed to optimize fuel-to-air ratios, ensuring maximum combustion efficiency while minimizing emissions. In power generation, the flexibility of gas turbines to ramp up and down quickly in response to grid demand makes their control systems indispensable for integrating renewable energy sources. As renewables become more prevalent, the ability of gas turbines to provide stable, on-demand power hinges on sophisticated control systems capable of navigating the operational challenges posed by the intermittent nature of renewable resources.

Regional Insights

North America turbine control system market is propelled by steady demand for turbine control systems, primarily driven by the U.S. and Canada's focus on energy efficiency and reducing reliance on fossil fuels. The region has seen significant investments in both wind and hydroelectric power projects, with turbine control systems playing a crucial role in optimizing energy production and minimizing environmental impact. The push towards modernizing the existing energy infrastructure and the increasing adoption of IoT and digitalization in turbine technology are also contributing to the growth of the turbine control system market in North America.

Asia Pacific Turbine Control System Market Trends

“China to witness market growth at 5.0% CAGR”

The turbine control system market In Asia Pacific is rising as, apart from China, countries like India, Australia, and those in Southeast Asia are experiencing a growing demand for turbine control systems. This surge is attributed to the rapid industrialization and urbanization in these areas, leading to an increased need for energy. These countries are investing heavily in renewable energy projects, especially wind and hydro, to meet their growing energy needs sustainably. The emphasis on enhancing energy efficiency, coupled with governmental support and favorable policies towards renewable energy, is propelling the demand for advanced turbine control systems in the Asia Pacific region.

China turbine control system market is estimated to grow at a CAGR of 5.0% over the forecast period. With China being one of the largest producers and consumers of wind energy globally, investments in wind farms have necessitated the adoption of sophisticated turbine control systems to optimize performance and reliability. Additionally, the modernization of traditional power plants, incorporating more turbines, and the shift towards cleaner energy sources to reduce carbon emissions have further fueled the need for advanced control systems.

Europe Turbine Control System Market Trends

The turbine control system market in Europe is influenced by the region’s ambitious renewable energy targets and stringent environmental regulations. Europe has been at the forefront of adopting renewable energy technologies, with wind and hydroelectric power being significant contributors to the energy mix. The high level of technological advancement in the region has also spurred innovation in turbine control systems, making them more efficient and reliable. Countries like Germany, Denmark, and Spain, with their robust wind energy sectors, are particularly keen on deploying cutting-edge control systems to enhance turbine performance and energy output.

Key Turbine Control System Company Insights

Some of the key players operating in the market include ABB, Siemens, Eaton, General Electric, Schneider Electric among others.

-

ABB is a leading global technology company that significantly focuses on electrification, robotics, automation, and motion. Founded in 1988, ABB has since grown into a multinational corporation operating in over 100 countries and employing over 100,000 people. ABB's range of products and services includes advanced digital and connected solutions, aimed at industrial customers looking to increase their efficiency and reduce environmental impact. ABB's commitment to innovation and sustainability has made it a pioneer in addressing the energy demands of industries and communities.

-

Eaton Corporation, headquartered in Dublin, Ireland, is a diversified power management company founded in 1911. Eaton's innovative technologies help customers manage electrical, hydraulic, and mechanical power more efficiently, safely, and sustainably. Operating in more than 175 countries, Eaton's products and services cater to a variety of markets, including commercial construction, data centers, aerospace, and automotive. The company's emphasis on sustainability is evident in its commitment to reducing emissions and energy consumption for its customers, aligning with global efforts to combat climate change and support green initiatives. Eaton's broad expertise enables it to deliver solutions that address some of the world's most challenging power management problems.

WOODWARD, and Vestas are some of the emerging market participants in the turbine control system market.

-

Woodward, Inc., headquartered in Fort Collins, Colorado, is a company deeply rooted in the aerospace and energy sectors, with a history dating back to 1870. Known for its expertise in control system solutions and components for various applications, including turbines, engines, and other industrial equipment, Woodward stands as a strategic partner in the development of energy-efficient solutions. The company's commitment to innovation and sustainability is evident in its broad range of products designed to optimize performance and reduce emissions across multiple industries.

-

Vestas Wind Systems A/S, based in Aarhus, Denmark, is a global leader in the wind power industry, with a focus on the design, manufacture, installation, and service of wind turbines. Founded in 1945, Vestas started as a household appliances manufacturer and transitioned into wind energy in the 1970s, demonstrating a pioneering spirit in renewable energy. With installations in over 80 countries, Vestas has installed more wind power than any other company, underscoring its commitment to a sustainable future. The company's innovation in aerodynamics, materials science, and data analytics enables it to offer some of the most efficient and reliable wind turbines in the market.

Key Turbine Control System Companies:

The following are the leading companies in the turbine control system market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Siemens Energy

- Eaton

- General Electric

- Schneider Electric

- Honeywell International

- Voith GmbH & Co. KGaA

- Emerson Electric Co.

- Rockwell Automation

- Yokogawa Electric Corporation

- Mitsubishi Electric Corporation

- WOODWARD

- Vestas

- Danfoss

- ANDRITZ

- Hitachi

Recent Developments

-

In April 2024, Valmet supplied Energie AG’s waste recycling facility, situated in Wels, Austria, with a new steam turbine control system. The existing turbine controls were upgraded to the comprehensive Valmet DNA automation system, enabling a unified control system for the entire plant. This advancement offers enhanced process visibility, streamlines operations, and simplifies troubleshooting.

-

In December 2022, Yokogawa Electric Corporation introduced the CENTUM VP R6.10, enhancing its capabilities with steam turbine control for compressor drives and the unified management of multiple compressor units. This release featured the new CCC Inside for Yokogawa CENTUM VP solution, a collaborative effort between Compressor Controls LLC and Yokogawa. It broadens the range of control available within a single CENTUM VP system, facilitating not just process and turbomachinery control to be managed together but also making operations, engineering, procurement, and maintenance more efficient.

Turbine Control System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 20.29 billion

Revenue forecast in 2030

USD 25.17 billion

Growth Rate

CAGR of 4.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Type, component, function, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Country Scope

U.S., Canada, Mexico, Germany, France, Italy, UK, Spain, Japan, China, South Korea, India, Australia, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

ABB, Siemens Energy, Eaton, General Electric, Schneider Electric, Honeywell International, Voith GmbH & Co. KGaA, Emerson Electric Co., Rockwell Automation, Sulzer, Yokogawa Electric Corporation, Mitsubishi Electric Corporation, WOODWARD, Vestas, Danfoss, ANDRITZ, Hitachi

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Turbine Control System Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the turbine control system market report on the basis of type, component, function, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Steam Turbine Control System

-

Gas Turbine Control System

-

Others

-

-

Function Outlook (Revenue, USD Billion, 2018 - 2030)

-

Speed Control

-

Temperature Control

-

Load Control

-

Pressure Control

-

Others

-

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global turbine control system market size was estimated at USD 18.81 billion in 2023 and is expected to reach USD 19.50 billion in 2024.

b. The turbine control system market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.3% from 2024 to 2030 to reach USD 25.17 billion by 2030.

b. The pressure control function segment accounted for 30.5% of the global market revenue share in 2023. Steam turbines, which convert thermal energy from steam into mechanical power, are a cornerstone in electricity generation, especially in combined-cycle plants and in industrial processes requiring mechanical drive services.

b. Some of the key players operating in the turbine control system market include ABB, Siemens Energy, Eaton, General Electric, Schneider Electric, Honeywell International, Voith GmbH & Co. KGaA, Emerson Electric Co., Rockwell Automation, Sulzer, Yokogawa Electric Corporation, Mitsubishi Electric Corporation, WOODWARD, Vestas, Danfoss, ANDRITZ, Hitachi.

b. The turbine control systems market is witnessing significant growth, driven by the increasing demand for energy efficiency and the push towards renewable energy sources. This market growth is further fortified by advancements in technology that provide enhanced control and operational efficiency for various types of turbines, including gas, steam, and wind turbines.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.