Tungsten Market Size, Share & Trends Analysis Report By End-use (Aerospace & Defense, Construction, Automotive), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-454-1

- Number of Report Pages: 95

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

“2030 tungsten market value to reach USD 48.1 million.”

Tungsten Market Size & Trends

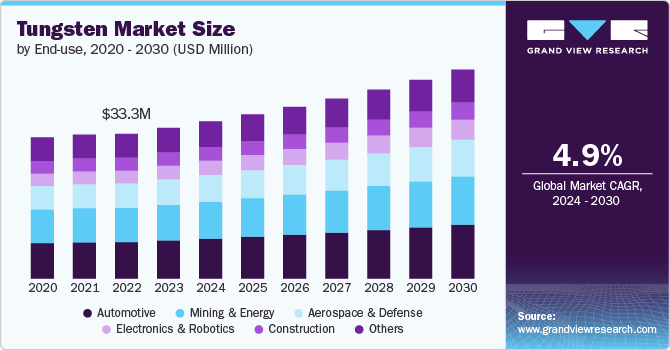

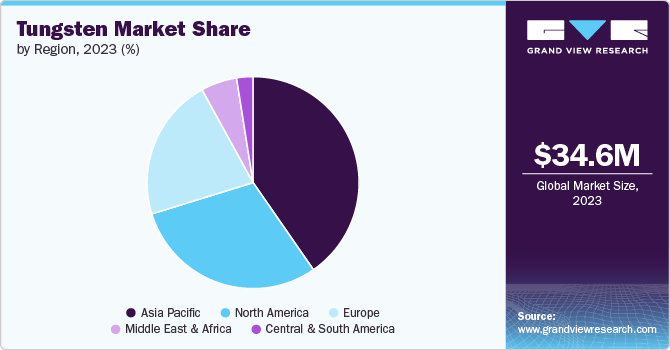

The global tungsten market size was estimated at USD 34.6 million in 2023 and is projected to grow at a CAGR of 4.9% from 2024 to 2030. Rising demand for tungsten-based products in the automotive and electronics industry is projected to remain a key growth factor for the market.

Tungsten has a high melting point, density, and tensile strength and is a key material required in manufacturing components that demand durability, heat resistance, and reliability. In the electronics industry, tungsten's conductivity and resistance to thermal expansion make it ideal for use in semiconductor manufacturing and as contacts in electronic devices, driving its demand due to the increasing global dependence on digital technology. The push towards miniaturization of electronic devices that can withstand high temperatures and maintain performance is expected to further augment growth in electronics.

Drivers, Opportunities & Restraints

In the automotive industry, the shift towards electric vehicles (EVs) and the demand for more efficient, lightweight designs are expected to contribute to the demand for tungsten. Its strength and density are utilized in manufacturing wear-resistant parts that are crucial for the longevity and performance of vehicles, such as brake pads and engine components. In addition, as automotive manufacturers seek to improve battery technology for EVs, applications such as battery electrodes and contacts are likely to observe growing demand.

Recycling of tungsten is a major opportunity for sustainable growth in the industry. Owing to stringent environmental concerns and regulations, the adoption of recycling practices will help to reduce the environmental impact as well as ensure a more stable supply chain by mitigating the risks associated with tungsten mining. Continuous research and development for new applications such as in medical imaging devices, renewable energy technologies, and as a catalyst in chemical manufacturing also represents significant opportunities for market vendors.

The concentration of tungsten supply in a few countries remains a key challenge for the market. China is the largest producer and consumer, and the concentration of demand and supply is high in a particular region. This concentration can lead to market volatility and risks of supply disruptions, affecting global prices and availability. However, with growing interest in recycling and thus rising secondary tungsten supply, challenges are expected to reduce over the coming years.

End-use Insights & Trends

“Mining & Energy held the largest revenue share of over 23% in 2023.”

Tungsten is a critical material required in mining applications due to its exceptional properties. Its strength and high melting point make it ideal for cutting and drilling tools. Tungsten carbide, a compound of tungsten and carbon known for hardness, is used in tools. It is suited for mining tools that need to withstand extreme conditions and abrasion. Furthermore, tungsten's density and rigidity enable a longer service life for tools, reducing the need for frequent replacements and thereby cutting down costs and downtime in mining operations.

In the military, tungsten is used in manufacturing kinetic energy penetrators for anti-tank weapons and small arms ammunition, where its density enables projectiles to penetrate armor efficiently. In addition, tungsten finds application in artillery shells, enhancing their shrapnel's effectiveness by maintaining velocity and penetrating power over distance. In missile technology, tungsten alloys are crucial for components that must withstand intense temperatures and pressures.

Regional Insights

The tungsten market in North America is driven by demand from the aerospace, defense, and automotive industries. The U.S. is the key regional market, with a focus on tungsten alloys and carbides for high-performance applications. The market is characterized by limited domestic production and a reliance on imports.

Asia Pacific Tungsten Market Trends

“Asia Pacific held over 40% revenue share of the overall global tungsten market.”

The tungsten market in Asia Pacific dominated the global market and is projected to grow due to rapid industrialization and the growth of manufacturing sectors in countries like India, South Korea, and Japan. The region benefits from a strong supply chain, technological advancements, and the growing use of tungsten in electronics, mining, and construction.

The tungsten market in China dominates the global market, being the largest producer and consumer. It controls a significant portion of the world’s tungsten supply, primarily through state-owned enterprises. The market growth is driven by extensive use in electronics, mining, and heavy machinery, with ongoing government regulations to control production and exports.

Europe Tungsten Market Trends

The tungsten market in Europe is supported by demand from the automotive, aerospace, and industrial manufacturing sectors. Key countries include Germany, the UK, and Austria. The region is focused on sustainable and strategic sourcing of tungsten, with increasing investments in recycling and alternative supply routes to reduce dependency on imports.

Key Tungsten Company Insights

Some key players operating in the market include A.L.M.T. Corp. Sandvik Group, Global Tungsten & Powders, and Umicore N.V.

-

A.L.M.T. Corp., a subsidiary of Sumitomo Electric Industries, is a Japanese company specializing in advanced materials, including tungsten and tungsten alloys. The company offers a wide range of tungsten products, such as powders, rods, and high-precision components, catering to the electronics, automotive, and aerospace sectors.

-

Sandvik Group, a global engineering company headquartered in Sweden, is a key player in the tungsten market, particularly through its Sandvik Machining Solutions division. The company produces tungsten carbide tools and components for metal cutting, mining, and construction applications.

Key Tungsten Companies:

The following are the leading companies in the tungsten market. These companies collectively hold the largest market share and dictate industry trends.

- A.L.M.T. Corp.

- ATI

- Buffalo Tungsten Inc. (Sandvik Group)

- China Tungsten & Hightech

- Global Tungsten & Powders

- H.C. Stark GmbH

- Plansee Group

- BETEK GmbH & Co. KG

- Umicore N.V.

- Sandvik Group

Recent Developments

-

In May 2024, Mitsubishi Materials Corporation (MMC) announced its agreement with Masan High-Tech Materials Corporation (MHT) to acquire all shares of H.C. Starck Holding GmbH, a leading manufacturer of tungsten, alloys, and tungsten carbide materials.

-

In December 2023, Sandvik Group completed the acquisition of Buffalo Tungsten, Inc. With this acquisition, the company plans to expand its footprint in the North American region. Buffalo Tungsten, Inc. is one of the leading producers of tungsten metal and carbide powder in North America.

Tungsten Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 36.2 million |

|

Revenue forecast in 2030 |

USD 48.1 million |

|

Growth rate |

CAGR of 4.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative Units |

Volume in kilotons, Revenue in USD million, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume & revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

End-use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South Africa, Middle East, Africa |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, Russia, China, India, Japan, South Korea, Brazil, |

|

Key companies profiled |

Umicore N.V., A.L.M.T. Corp., Wolfram, ATI, BETEK GmbH & Co. KG, China Tungsten & Hightech, Buffalo Tungsten Inc., Global Tungsten & Powders, H.C. Stark GmbH; Plansee Group |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Tungsten Market Report Segmentation

This report forecasts revenue and volume growth at global, country, and regional levels and analyzes the latest trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global tungsten market report based on end-use, and region.

-

End-use Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

Aerospace & Defense

-

Construction

-

Automotive

-

Mining & Energy

-

Electronics & Robotics

-

Others

-

-

Regional Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global tungsten market size was estimated at USD 34.6 million in 2023 and is expected to reach USD 36.2 million in 2024.

b. The global tungsten market is expected to grow at a compound annual growth rate of 4.9% from 2024 to 2030 to reach USD 48.1 million by 2030.

b. By end use, mining & energy dominated the market with a revenue share of over 23.0% in 2023.

b. Some of the key vendors of the global tungsten market are Umicore N.V., A.L.M.T. Corp., Wolfram, ATI, BETEK GmbH & Co. KG, China Tungsten & Hightech, Buffalo Tungsten Inc., Global Tungsten & Powders, H.C. Stark GmbH and Plansee Group

b. The key factor driving the growth of the global tungsten market is the rising demand for electronic products and growing investments in military & defense sector

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."