- Home

- »

- Advanced Interior Materials

- »

-

Tungsten Carbide Powder Market Size & Share Report, 2030GVR Report cover

![Tungsten Carbide Powder Market Size, Share & Trends Report]()

Tungsten Carbide Powder Market (2024 - 2030) Size, Share & Trends Analysis Report By End-use (Building & Construction, Mining), By Application (Mining Tools), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-333-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Tungsten Carbide Powder Market Trends

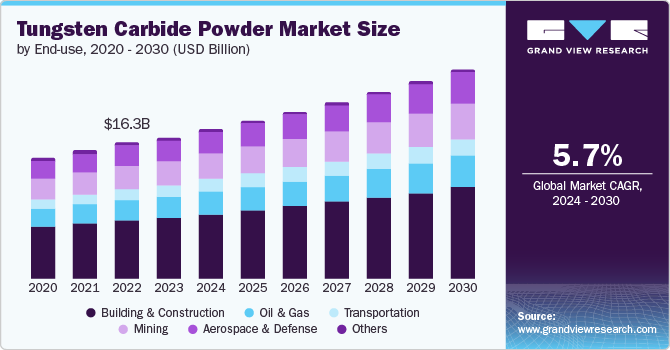

The global tungsten carbide powder market size was estimated at USD 16.88 billion in 2023 and is estimated to grow at a CAGR of 5.7% from 2024 to 2030. Increasing end user demand from industries such as construction, mining, and transportation is propelling the demand for tungsten carbide powder. The rise in defense expenditure for modernized equipment, systems, and aircraft on account of growing territorial disputes has further contributed to market growth.

Tungsten carbide powder is produced by the thermite process or by carburizing tungsten powders in the tungsten oxide reduction process at a temperature of 1400-1500oC. They are also known as cemented carbides and are characterized by high hardness, wear resistance, strength, and toughness. Owing to its inherent physical properties, tungsten carbide powder is an ideal material for cutting tools, mining, drilling parts, and abrasives.

Tungsten carbide powder also consists of common additives such as cobalt, titanium carbide, tantalum carbide, and niobium carbide. Cobalt is used as a binder metal and consists of 3-25% weight of tungsten carbide powder. Titanium carbide is a grain growth inhibitor and is 0-8% weight. Tantalum carbide is used for thermal shock resistance and is 0-8% weight. Niobium carbide is used for wear resistance and is 0-8% weight.

Drivers, Opportunities & Restraints

The increasing demand for tungsten carbide powder is primarily driven by its exceptional properties including high strength, wear resistance, and hardness. Hence, it is a vital material that is used in the production of cutting tools. The growth of the mining, industrial, and construction industries has resulted in the increased demand for tungsten carbide powder, which is used for cutting, abrasives, and grinding.

The increase in expenditure within the aerospace and defense sector, and the shifting trend towards lightweighting in the transportation industry are key drivers propelling the tungsten carbide powder market. Additionally, technological developments in powder metallurgy have been continuing to improve the physical properties of the product, enabling higher quality and lower wastage.

The market is also witness to several opportunities. This is mainly bound to be driven by ongoing R&D efforts to optimize the production process, as well as improve the physical characteristics of the powder to suit a wider range of intensive applications in end use industries such as space exploration, deep drill mining, and nuclear energy base construction. Strategic partnerships and acquisitions are anticipated to increase forward-linkage integration and offer the potential for further innovation. Hence, tungsten carbide powder can become a vital resource and raw material in the future.

The market faces inherent restraints, including the variable cost of raw materials, high production costs, and an energy-intensive production process. primarily due to energy-intensive extraction and refining processes. Supply chain disruptions owing to geopolitical conflicts between key countries such as China, the U.S., and Europe have been adversely impacting raw material availability. Further, as witnessed in 2023, disruptions to maritime trade is also a significant challenge that impacts both tungsten powder supply and demand dynamics.

Price Trends of Tungsten Carbide Powder

The market witnessed significant price volatility in recent years, driven by multiple factors. In 2022, tungsten carbide powder witnessed volatility owing to supply chain disruptions caused by the Russia-Ukraine conflict, since global trade dynamics were altered. Prices stabilized in 2023, with supply-demand disparities existing in key markets of the U.S., APAC, and Europe. The pricing outlook for tungsten carbide powder is anticipated to remain stable, with no volatile movements within the upcoming year. This is mainly owing to the pace of global economic recovery, altered trade dynamics, increasing mining activity, as well as the lightweight concept within the transportation, aerospace, and defense industries.

End-use Insights

“Building & construction accounted for the highest revenue share of over 43.0% in 2023.”

The building & construction segment is anticipated to continue its dominance over the forecast period. Demand is attributed to the improved macroeconomic outlook in countries such as the U.S. and emerging markets of Asia Pacific. The rise in non-residential construction in the U.S. and the increase in government expenditure on residential housing in countries such as China, India, South Korea, Indonesia, and Thailand are anticipated to sustain the high revenue share over the forecast period.

Tungsten carbide powder is used in the mining industry for the production of mining tools, energy drilling tools, wear and tear die parts, and bits. Producers such as Global Tungsten Powders have offtake agreements with mines throughout the Western world and also offer tolling agreements to customers to return high-quality tungsten carbide powders from recyclable sources. Such agreements ensure the continued usage of the product within the mining industry, and its demand is expected to grow over the forecast period.

Application Insights

“Cutting tools held the largest revenue share of about 38.0% in 2023.”

Cutting tools are anticipated to continue dominating the revenue share of the market over the forecast period. The high demand is attributed to its usage in the production of drill bits, masonry drills, saw tips, and earth-boring tools. These are extensively used in the construction industry.

Within the transportation industry, the product is used to manufacture fuel injection nozzle tips, and brake pad abrasives, which are considered replacement parts over the life of the vehicle. Hence, new production of transportation vehicles and equipment, along with repair & maintenance are considered to augment demand over the forecast period.

Additionally, the product is also used extensively to produce drag bits, drill bits, impregnated diamond bits, cutting tools, inserts, and end mills. These are used in the mining industry whose growth is expected to play a significant role in the demand for tungsten carbide powder.

Regional Insights

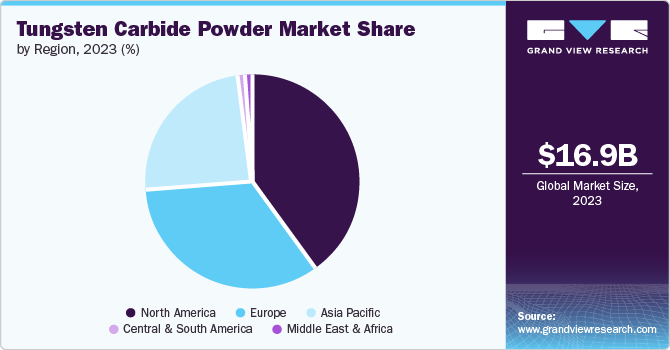

“China held over 62% revenue share of the overall Asia Pacific tungsten carbide powder market.”

North America tungsten carbide powder market is expected to witness significant growth during the forecast period. The aerospace & defense industry is a key end user of the product in North America and is significantly driven by U.S. investments. In May 2022, Airbus announced an increase of 50% in its A320 aircraft production and aims to manufacture at least 75 aircraft per month by 2025.

U.S. Tungsten Carbide Powder Market Trends

The tungsten carbide powder market of the U.S.is growing as it remained the largest spender in the world, allocating 3.1 times more to the military than the second largest spender, China. According to the SIPRI Military Expenditure Database report of April 2024, U.S. military spending was USD 916 billion in 2023, which was 2.3% more than in 2022.

Europe Tungsten Carbide Powder Market Trends

Europe tungsten carbide powder market accounted for about 34.0% of the total global revenue share of the market. It is anticipated to be driven by mining investments in the region, which require frequent replacement of drill bits.

Asia Pacific Tungsten Carbide Powder Market Trends

The tungsten carbide powder market of Asia Pacific dominated the global industry and accounted for over 24.0% revenue share of the global market in 2023 and is anticipated to continue over the forecast period owing to rapid industrialization and infrastructure development in countries like China and India. The growing demand for tungsten carbide powder in construction, mining, transportation, aerospace, and oil & gas has cemented the region as a stable growing market for tungsten carbide powder.

Key Tungsten Carbide Powder Company Insights

Some of the key players operating in the market include Kennametal Inc., and Sandvik AB.

-

U.S.-based Kennametal, Inc. specializes in the development and application of tungsten carbides, ceramics, super-hard materials, and solutions used in metal cutting and high-end wear applications. It operates through two segments: Metal Cutting and Infrastructure. The Metal Cutting segment is responsible for the production of tooling and metal-cutting products such as milling, hole-making, turning, threading, and toolmaking systems.

-

Sweden-based Sandvik AB (Sandvik Aktiebolag) is an engineering company that is active in sectors such as mining, rock excavation, metal cutting, and materials technology. It offers cutting and tooling systems that include boring, drilling, milling, reaming, and others. The company provides stainless steels, special alloys, controlled expansion, billets and blooms, metal powders, plates and sheets, and strip steels.

Key Tungsten Carbide Powder Companies:

The following are the leading companies in the tungsten carbide powder market. These companies collectively hold the largest market share and dictate industry trends.

- Ceratizit S.A.

- China Tungsten Online (Xiamen) Manu. & Sales Corp.

- Chongyi ZhangYuan Tungsten Co., Ltd

- Extramet

- Federal Carbide Company

- Guangdong Xianglu Tungsten Co., Ltd.

- H.C. Starck GmbH

- Japan New Metal Co., Ltd

- Kennametal Inc.

- Merck KGaA

- Nanchang Cemented Carbide Co., Ltd

- Reade International Corp.

- Sandvik AB

- Umicore

Recent Developments

-

In December 2023, Sweden-based Sandvik acquired U.S.-based Buffalo Tungsten, Inc. a U.S.-based manufacturer of tungsten powder and tungsten carbide powder that operates in North America. With this acquisition, Sandvik would further expand its presence in the North American market and strengthen its regional manufacturing capabilities.

-

In March 2022, Luxembourg-based CERATIZIT S.A. completely acquired Stadler Metalle on 1 March to become the sole owner of the company. The latter specializes in the trading and processing of secondary raw materials. With this acquisition, CERATIZIT S.A. strengthened its backward-link by integrating across the value chain and ensuring itself of uninterrupted raw material supply for the production of tungsten and tungsten carbide powders.

Tungsten Carbide Powder Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 17.84 billion

Revenue forecast in 2030

USD 24.92 billion

Growth rate

CAGR of 5.7% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative Units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

End-use, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; United Arab Emirates; South Africa

Key companies profiled

CERATIZIT S.A.; China Tungsten Online (Xiamen) Manu. & Sales Corp.; Chongyi ZhangYuan Tungsten Co., Ltd; Extramet; Federal Carbide Company; Guangdong Xianglu Tungsten Co., Ltd.; H.C. Starck GmbH; Japan New Metal Co., Ltd; Kennametal Inc.; Merck KGaA; Nanchang Cemented Carbide Co., Ltd; Reade International Corp.; Sandvik AB; Umicore

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tungsten Carbide Powder Market Report Segmentation

This report forecasts revenue and volume growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tungsten carbide powder market report based on end-use, application, and region:

-

End-use Outlook (Revenue, USD Billion; 2018 - 2030)

-

Building & Construction

-

Oil & Gas

-

Transportation

-

Mining

-

Aerospace & Defense

-

Others

-

-

Application Outlook (Revenue, USD Billion; 2018 - 2030)

-

Mining Tools

-

Cutting Tools

-

Dies & Punching

-

Abrasives

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global tungsten carbide powder market size was estimated at USD 16.88 billion in 2023 and is expected to reach USD 17.84 billion in 2024.

b. The global tungsten carbide powder market is expected to grow at a compound annual growth rate of 5.7% from 2024 to 2030 to reach USD 24.92 billion by 2030.

b. By end use, building & construction dominated the market with a revenue share of over 43.0% in 2023.

b. Key producers of the global tungsten carbide powder market are CERATIZIT S.A., China Tungsten Online (Xiamen) Manu. & Sales Corp., Chongyi ZhangYuan Tungsten Co., Ltd, Extramet, Federal Carbide Company, Guangdong Xianglu Tungsten Co., Ltd., H.C. Starck GmbH, Japan New Metal Co., Ltd, Kennametal Inc., Merck KGaA, Nanchang Cemented Carbide Co., Ltd, Reade International Corp., Sandvik AB, and Umicore.

b. The key factor driving the growth of the global tungsten carbide powder market is attributed to the growing application in the building & construction, and mining segments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.