- Home

- »

- Clinical Diagnostics

- »

-

Tuberculosis Diagnostics Market Size, Industry Report, 2030GVR Report cover

![Tuberculosis Diagnostics Market Size, Share & Trends Report]()

Tuberculosis Diagnostics Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Detection Of Latent Infection, Phage Assay, Nucleic Acid Testing), By End-use (Diagnostic Laboratories, Hospitals & Clinic), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-098-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tuberculosis Diagnostics Market Summary

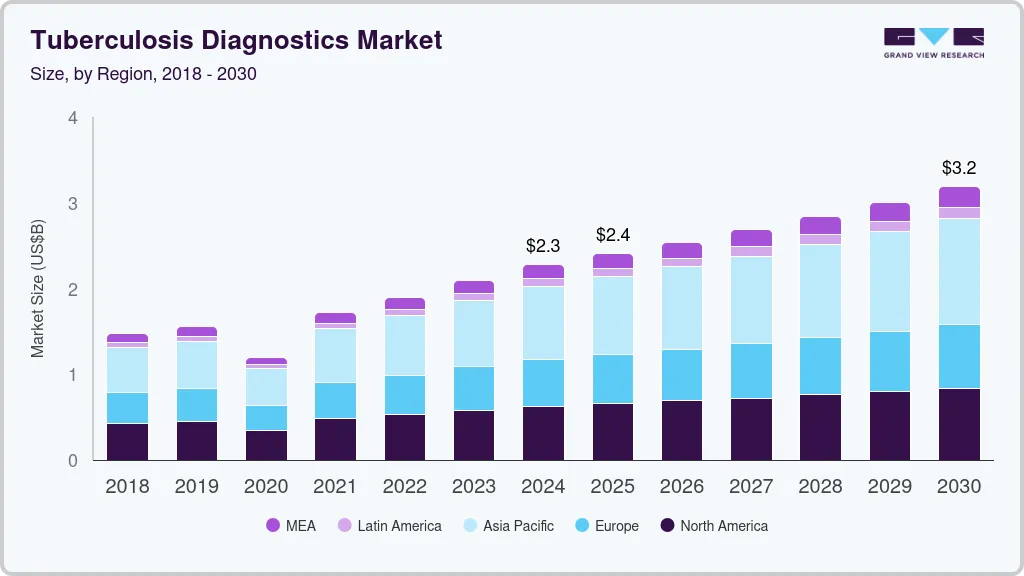

The global tuberculosis diagnostics market size was estimated at USD 2,279.1 million in 2024 and is projected to reach USD 3,184.9 million by 2030, growing at a CAGR of 5.8% from 2025 to 2030. The market is driven by the increasing incidence of tuberculosis, breakthroughs in diagnostic technologies, and expanded government funding initiatives for TB diagnosis, all supported by rising public awareness and screening efforts.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- Country-wise, the UAE is expected to register the highest CAGR from 2024 to 2030.

- In terms of type, detection of latent infection (skin test & IGRAs) accounted for a revenue share of over 40% in 2023.

- Detection of Drug Resistance (DST) is the most lucrative test type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 2,279.1 Million

- 2030 Projected Market Size: USD 3,184.9 Million

- CAGR (2025-2030): 5.8%

- Asia Pacific: Largest market in 2023

Tuberculosis remains one of the top ten causes of death globally; the WHO estimates that approximately 10 million new cases occur each year, resulting in around 1.5 million fatalities annually. The rising prevalence of tuberculosis (TB) is significantly boosting the TB diagnostics market. According to the Global Tuberculosis Report 2024, approximately 10.8 million new TB cases were recorded in 2023, translating to 134 cases per 100,000 populations. This increase, which has been evident since 2021 due to COVID-19 disruptions, underscores the urgent need for rapid and accurate diagnostic tools. The WHO South-East Asia Region accounts for 45% of cases, followed by Africa (24%) and the Western Pacific (17%), with eight countries-India, Indonesia, China, the Philippines, Pakistan, Nigeria, Bangladesh, and the Democratic Republic of the Congo-contributing over two-thirds of global cases.

High TB incidence, especially in low- and middle-income countries, is driving demand for advanced diagnostics. WHO data reveal significant regional disparities, with sub-Saharan Africa reporting incidence rates over 500 per 100,000, while 60 countries in the Americas and Europe report less than 10 cases per 100,000. TB primarily affects adult men (55%), followed by women (33%) and children (12%), and is particularly prevalent among people living with HIV in Africa.

Between 2015 and 2023, global TB incidence declined by only 8.3%, far from the WHO End TB Strategy target of a 50% reduction by 2025. In some regions, declines reached 24% and 27%, while the Americas saw a 20% increase. This situation, coupled with insufficient funding-only USD 5.8 billion allocated against a planned annual investment of USD 22 billion plus an extra USD 5 billion for research by 2027-hampers progress.

To address these gaps, the U.S. government has ramped up its support, increasing TB-related funding from USD 233 million in 2013 to USD 406 million in 2023. With a return on investment of up to USD 39 per dollar spent, enhanced funding for TB screening and preventive treatment is critical. Furthermore, the Global Fund, contributing 76% of international TB financing, allocated USD 9.2 billion for TB programs and an additional USD 1.5 billion for TB/HIV initiatives by mid-2023, helping reduce TB fatalities by 36% from 2002 to 2022.

Moreover, the U.S. has long been a leader in global TB control. Initiatives such as USAID’s Global Tuberculosis Strategy 2023-2030, with targets of a 35% reduction in TB incidence and a 52% reduction in mortality by 2030, demonstrate the commitment to combating TB. These efforts enhance TB control and drive innovation in the TB diagnostics market, improving access to timely, accurate testing and ultimately strengthening global public health outcomes protein (120 mg/dL) with normal cell count.

Case Study: Implementation of a Simplified TAM-TB Assay for TB Diagnosis

Introduction

This case study explores using a CD4 T cell phenotyping-based blood assay designed to meet the WHO target product profiles (TPP) for non-sputum biomarker-based TB diagnostics. The study aimed to evaluate a simplified T cell activation marker (TAM)-TB assay that uses only one millilitre of blood with a 24-hour turnaround time.

Methodology

-

Population: Recruited 479 GeneXpert-positive TB cases and 108 symptomatic but GeneXpert-negative controls from adult TB patients in the Temeke District, Dar-es-Salaam, Tanzania.

-

Procedure: One millilitre of fresh blood was processed to measure the expression of activation markers CD38 and CD27 on CD4 T cells producing IFN-γ and/or TNF-α in response to a synthetic peptide pool covering Mtb antigens (ESAT-6, CFP-10, TB10.4).

-

Instrumentation: Analysis was conducted using a 4-color FACSCalibur apparatus.

-

Reference Standard: The assay’s accuracy was compared to a composite reference standard of GeneXpert and solid culture.

Results

The CD38-based TAM-TB assay outperformed the CD27-based approach, achieving a specificity of 93.4% and a sensitivity of 82.2%, with an area under the ROC curve of 0.87 (95% CI: 0.84-0.91). Importantly, the assay’s performance was not significantly affected by HIV status.

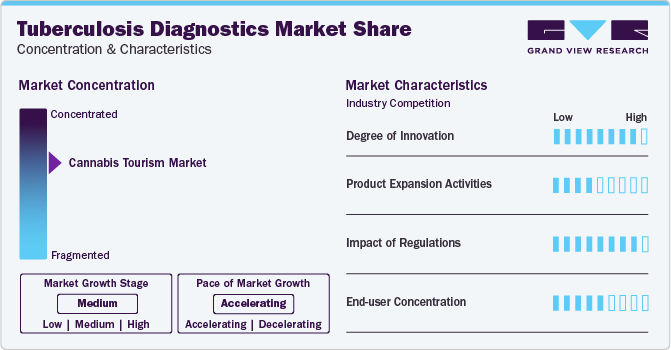

Market Concentration & Characteristics

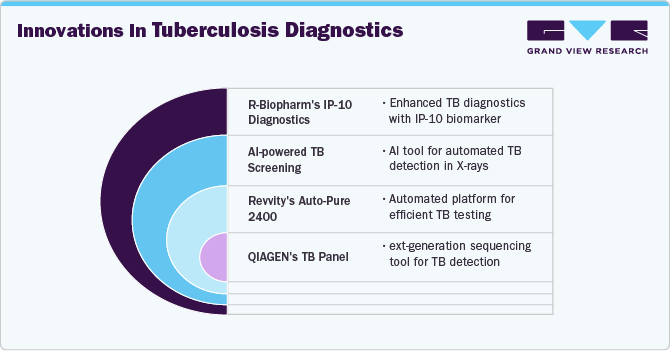

The market is highly innovative, driven by advancements in molecular diagnostics, particularly with nucleic acid amplification tests (NAATs) like the GeneXpert MTB/RIF assay. These technologies rapidly detect TB bacteria and assess rifampicin resistance, delivering results within hours instead of the weeks required by conventional methods.

Mergers and acquisitions in the Tuberculosis diagnostics industry are increasing as major healthcare and biotechnology firms seek to expand their diagnostic portfolios. Companies are acquiring innovative startups to enhance technological capabilities, streamline research efforts, and strengthen market presence. Strategic collaborations are fostering innovation, accelerating product development, and improving accessibility.

Regulations in the TB diagnostics market play a pivotal role by establishing rigorous standards for quality, safety, and performance. Regulatory bodies such as the U.S. FDA, the European Medicines Agency, and national health authorities require comprehensive clinical validation and adherence to strict manufacturing protocols. This ensures that diagnostic tools are reliable and accurate, thereby protecting patients’ safety. However, the lengthy and resource-intensive approval processes can delay market entry and increase development costs. In response, some agencies have introduced accelerated pathways and emergency use authorizations to expedite access during public health crises. Clear, harmonized regulations foster innovation by providing well-defined requirements and enhancing market trust and uptake, ultimately improving TB control and patient outcomes globally.

Product expansion is moderate, with companies and research institutions actively developing novel TB diagnostic tests. These innovations include NAATs, serological tests, rapid molecular assays, and next-generation sequencing methods that offer enhanced sensitivity and specificity compared to traditional techniques. Continuous investment in R&D helps address emerging challenges such as drug resistance, TB-HIV co-infections, and diverse TB strains while stringent regulatory standards guide product development, market entry, and commercialization.

The tuberculosis diagnostics industry is expanding geographically, with companies focusing on emerging economies and improving healthcare infrastructure. Increased awareness, growing patient populations, and government initiatives in Asia-Pacific, Latin America, and Africa drive market penetration. Collaborations with regional healthcare providers are enhancing accessibility to advanced diagnostic solutions.

Type Insights

The latent infection detection segment (Skin Test & IGRA) led the market in 2024 with a 40.59% share, driven by the increasing prevalence of tuberculosis. The Tuberculin Skin Test (TST) and Interferon-Gamma Release Assay (IGRA) are crucial diagnostic tools for TB. Rising latent TB infections, particularly among high-risk groups, are driving demand for these tests. According to a May 2024 report from the U.S. Centers for Disease Control and Prevention, 13 million Americans have latent TB infection, placing them at high risk for developing active TB disease. As latent TB remains a major public health issue, there is a growing need for efficient and rapid diagnostic solutions, which in turn boosts the overall TB diagnostics market. The TST is a widely used, reliable method for screening latent TB infection. It involves injecting a purified protein derivative of tuberculin into the inner surface of the skin. In individuals without TB risk factors, an induration of 15 mm or more is considered positive. Standardized administration, reading procedures, and proper training are essential, as the test must be evaluated 48 to 72 hours after administration. High market penetration, increased TB awareness, and the cost-effectiveness of TST are expected to drive this segment's growth over the forecast period.

Drug Resistance (DST) is projected to achieve the fastest CAGR during the forecast period. DST evaluates the susceptibility of Mycobacterium tuberculosis to various antibiotics, identifying which drugs are effective for treatment. It detects resistance to first-line medications (isoniazid, rifampicin, ethambutol, pyrazinamide) as well as second-line drugs used against multidrug-resistant and extensively drug-resistant TB. By informing tailored treatment decisions, DST ensures patients receive effective therapy, thereby enhancing outcomes, curbing the development of further drug resistance, and reducing the spread of resistant TB strains.

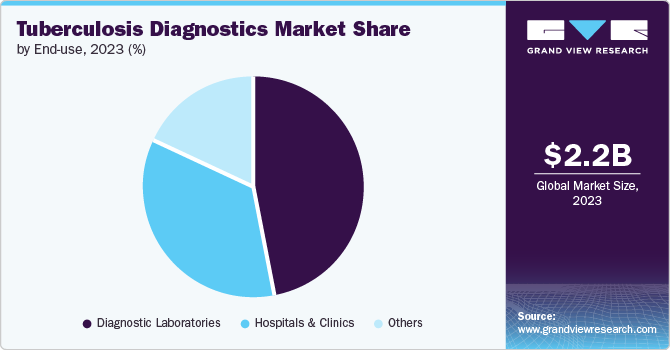

End-use Insights

In 2024, the diagnostic laboratories segment dominated the TB diagnostics market with the largest revenue share, driven by initiatives to enhance patient outcomes through accessible, retail-level diagnostic services. These laboratories are increasingly offering advanced blood tests for screening, with independent facilities like Dynacare and Life Labs providing competitively priced tests-such as QuantiFERON-TB and T-SPOT.TB-to detect latent TB infection (LTBI). Convenient online appointment booking further supports this trend, fueling segment growth.

In addition, according to ETHealthworld.com, under its National TB Elimination Programme (NTEP), the Indian government significantly boosted funding for TB diagnostic laboratories. The TB budget increased from Rs 6,400 million (USD 73.84 million) in 2015 to Rs 34,000 million (USD 392.29 million) in 2022-2023. This expansion supported the scale-up of modern molecular diagnostic technologies, improved treatment regimens, and free screening, diagnosis, and treatment. India's extensive TB lab network, the largest globally with 7,767 rapid molecular testing facilities and 87 culture & drug susceptibility labs, is further enhanced by acquiring over 800 AI-enabled portable chest x-ray devices.

The hospitals and clinics segment is poised for significant growth, driven by increasing TB testing rates in healthcare settings. Patients with conditions like HIV/AIDS, chronic renal failure, and other immunocompromising diseases are more susceptible to TB, which in turn boosts demand for diagnostic services. In August 2023, Santa Clara Valley Healthcare (SCVH) launched its Valley Health Center (VHC) Lundy primary care clinic, incorporating a dedicated Tuberculosis Clinic and Refugee Health Assessment Program. This development is especially critical for Santa Clara County, known for having the third-highest TB case rate among California jurisdictions and the highest influx of refugees. The combination of high patient footfall, advanced diagnostic technology integration, and expanding healthcare infrastructure fuel growth in the hospitals and clinics segment, ensuring that increased TB screening and improved patient outcomes remain at the forefront of healthcare priorities.

Regional Insights

North America tuberculosis diagnostics market holds a significant market share in the tuberculosis diagnostics market in 2024, representing the most advanced region for TB diagnostics. Key drivers include an aging population, increasing TB prevalence, and widespread adoption of state-of-the-art diagnostic techniques. The WHO Global TB Report shows that in 2023, PAHO recorded 325,000 TB cases and 35,000 deaths in the Americas. In 2022, Mexico reported 31,000 cases-including 1,900 in children-while Canada identified 1,971 cases. Rising patient awareness, a shift towards innovative diagnostic methods, and supportive reimbursement policies further propel the regional market.

In Canada, the growing pharmaceutical and biotechnology sectors are enhancing R&D efforts, which are expected to boost the North American TB diagnostics market over the forecast period. However, the high cost of advanced diagnostic products poses a significant challenge for small and medium-sized companies in the country.

U.S. Tuberculosis Diagnostics Market Trends

The tuberculosis diagnostics market in the U.S. leads the North American market, with rising TB prevalence set to further fuel its growth. As of December 14, 2024, the U.S. CDC reported 8,040 TB cases, nearly half of which occurred in California, Texas, New York, and Florida. Latent TB remains a significant issue, affecting up to 13 million people. In 2023, TB cases increased by 16%, with 76% occurring among non-U.S.-born individuals, highlighting persistent public health challenges. Many U.S. cases are attributed to the progression of latent TB to active disease rather than new transmission events.

Europe Tuberculosis Diagnostics Market Trends

The tuberculosis diagnostics market in Europe held the second-largest market share, driven by the presence of major research institutes and key market players in the region. Furthermore, government initiatives and nonprofit organizations supporting R&D funding and awareness campaigns on the benefits of early disease detection are expected to propel market growth. Collaborations between European universities and TB diagnostic test providers further contribute to this expansion. Several public and private initiatives focused on funding research for novel diagnostics and promoting awareness are anticipated to drive the market forward. For instance, the World Health Organization's (WHO) Tuberculosis Action Plan for the European Region 2023-2030 aims to eliminate TB as a public health concern by 2030. The plan prioritizes universal access to prevention, diagnosis, and treatment, setting ambitious targets: a 75% reduction in TB deaths and a 50% decrease in TB incidence by 2025, progressing to 90% and 80% reductions, respectively, by 2030 compared to 2015 levels. The Action Plan underscores the demand for innovative diagnostic tools by emphasizing early and accurate TB detection.

The UK tuberculosis diagnostics market is projected to experience significant growth during the forecast period, driven by the rising prevalence of TB, increasing awareness of diagnosis, and advancements in healthcare infrastructure. According to a report by the UK Health Security Agency (UKHSA) published in January 2025, TB cases in England increased by 13%, rising from 4,850 in 2023 to 5,480 in 2024, with notification rates reaching 9.5 per 100,000. The majority of cases (81.5%) were reported among individuals born outside the UK, with London and the West Midlands witnessing the highest surges.

The tuberculosis diagnostics market in Germany held the largest revenue market share in 2024, driven by its well-established biopharmaceutical industry, increasing R&D efforts by biopharmaceutical companies, and the high prevalence of TB. Growing research initiatives further contribute to market expansion. For example, in January 2025, researchers from the Research Center Borstel and the Marius Nasta Institute evaluated the Molecular Bacterial Load Assay (MBLA), an innovative test that rapidly measures bacterial load in TB patients, providing treatment success indicators within hours. Unlike conventional methods, MBLA accurately detects viable bacteria, reducing dependence on slow culture-based tests. This advancement has the potential to streamline drug-resistant TB monitoring and enhance early-phase clinical trials, significantly improving TB treatment monitoring through faster and more precise evaluations of drug-resistant cases.

France tuberculosis diagnostics market is expected to experience significant growth over the forecast period, driven by the rising prevalence of infectious diseases, rapid technological advancements, and increasing awareness of disease diagnosis. In January 2025, AlterDiag partnered with the Institut Pasteur to develop next-generation rapid diagnostic tests utilizing single-domain antibodies (VHH) and lateral flow immunochromatography. This collaboration aims to produce affordable, high-performance point-of-care tests for infectious diseases, with AlterDiag overseeing industrialization, regulatory approvals, and commercialization. By introducing advanced VHH-based diagnostics, the partnership has the potential to enhance rapid TB detection, improving both accuracy and accessibility in healthcare settings.

Asia Pacific Tuberculosis Diagnostics Market Trends

The tuberculosis diagnostics market in Asia Pacific dominated the market with revenue share of 37.18% in 2024 and is expected to witness the fastest growth over the forecast period. This expansion is driven by significant untapped opportunities, including unmet medical needs, increasing prospects for scientific research, and strong economic growth. However, the evolving healthcare regulatory landscape in high-growth countries is likely to attract international players to invest and capitalize on existing opportunities. Factors such as rising awareness, government-supported healthcare benefits, and a growing demand for advanced medical diagnostics are also anticipated to contribute to market growth.

Japan tuberculosis diagnostics market is driven by the strategic initiatives among key players. For example, in December 2024, SD Biosensor, the Research Institute of Tuberculosis, the Japan Anti-Tuberculosis Association (RIT/JATA), and Korea’s ITRC signed an MOU to develop new molecular diagnostic products for extensively drug-resistant tuberculosis (XDR-TB) using SD Biosensor’s STANDARD M10 platform. This collaboration aims to enhance rapid and precise TB detection, improving treatment outcomes in high-risk Asian regions. By integrating advanced molecular detection, the partnership accelerates Japan’s TB diagnostics sector, reducing diagnostic time for XDR-TB and increasing treatment success rates. Strengthened collaboration further positions Japan as a key player in global TB research, driving innovation and reinforcing its leadership in precision TB diagnostics.

The tuberculosis diagnostics market in China is expected to grow significantly over the forecast period. The high prevalence of infectious diseases, such as tuberculosis, underscores the need for advanced molecular diagnostics. According to the WHO, China remains a high-burden country for TB, HIV-associated TB, and multidrug-resistant TB (MDR/RR-TB), ranking third globally in TB incidence with 741,000 new cases in 2023. Although TB incidence has declined since 2010, a notable increase was recorded in 2023. Between 2015 and 2023, TB incidence decreased by 20% and deaths by 35%, yet significant gaps remain in case detection and treatment. The rising TB prevalence is fueling market growth in China. In 2023, China reported an incidence rate of 52 per 100,000 population and accounted for 6.5% of the global TB diagnosis gap, highlighting the urgent need for improved diagnostic solutions.

Latin America Tuberculosis Diagnostics Market Trends

The tuberculosis diagnostics market in Latin America is expected to significant growth. Pulmonary tuberculosis (TB), caused by Mycobacterium tuberculosis, continues to pose a significant global health challenge. According to the WHO Global TB 2021 report, TB accounted for 1.6 million deaths and 10 million new cases, with Latin America reporting 169,000 cases and 18,000 deaths in 2019. Although incidence and mortality have declined by less than 4%, TB remains a major public health concern. The WHO aims to reduce TB incidence by 90% and mortality by 95% by 2030, highlighting R&D and technological advancements as essential strategies. These eradication goals, along with growing R&D efforts, are expected to drive demand for advanced diagnostics, encouraging investment in rapid molecular tests, point-of-care diagnostics, and innovative detection technologies. Strengthening TB surveillance and early detection initiatives will further expand the diagnostics market across Latin America, enhancing accessibility and efficiency in TB screening programs.

Brazil tuberculosis diagnostics market is emerging as lucrative in the region, driven by the rising prevalence of TB, a developing economy, and ongoing healthcare system reforms. A study published in Nature Medicine in January 2025 revealed that Brazil’s Bolsa Família Program (BFP) significantly reduced TB cases and deaths among extremely poor and Indigenous populations, with declines exceeding 50% and 60%, respectively. These findings underscore the impact of social protection programs in improving health outcomes and combating TB, particularly in vulnerable communities. As TB cases decline due to BFP, demand for diagnostics may shift towards more targeted testing in high-risk groups rather than widespread screening. However, the potential resurgence of TB in the post-pandemic period could sustain demand, driving further investment in advanced and early detection technologies.

Middle East and Africa Tuberculosis Diagnostics Market Trends

The tuberculosis diagnostics market in the Middle East & Africa region, including South Africa, Saudi Arabia, and the UAE, is experiencing growth due to the steady expansion of healthcare facilities in emerging economies and rising healthcare expenditure. The region’s increasing role as a key investor has attracted more diagnostic manufacturers, particularly in South Africa, the UAE, and Saudi Arabia. The regulatory framework, which supports infrastructure development and government-regulated reimbursement policies, has contributed to the stability of medical facilities and diagnostic services. However, challenges such as ethical concerns, inadequate infrastructure, and limited affordability may hinder market growth in this region.

Saudi Arabia tuberculosis diagnostics market is growing rapidly due to healthcare reforms under the Vision 2030 initiative. Early detection programs and the adoption of advanced diagnostic tools, such as biomarker analysis and nerve conduction studies, are driving market expansion. Increased investments in healthcare infrastructure are expected to further enhance diagnostic accessibility across the country.

Key Tuberculosis Diagnostics Company Insights

Some major players catering to the market are Abbott, QIAGEN, Thermo Fisher Scientific Inc., BD, F. Hoffmann-La Roche AG; Hologic, Inc., Cepheid, DiaSorin S.p.A., Hain Lifescience GmbH, Oxford Immunotec.; among others. These companies focus on capturing the market by increasing their presence using various business initiatives, such as collaborations and partnerships with the government. Their well-established product portfolios help them capture major market share.

SD Biosensor, Inc., Wantai BioPharm., and Lionex GmbH are among the emerging market participants. These companies' prevalent operating strategies include developing and launching improved and new diagnostic tools that offer higher accuracy, faster results, and easier usability.

Key Tuberculosis Diagnostics Companies:

The following are the leading companies in the tuberculosis diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- QIAGEN

- Thermo Fisher Scientific Inc.

- BD

- F. Hoffmann-La Roche AG

- Hologic, Inc.

- Cepheid

- DiaSorin S.p.A.

- Hain Lifescience GmbH

- Oxford Immunotec

Recent Developments

-

In April 2024, the Auto-Pure 2400 liquid handler from Allsheng was introduced by Revvity, Inc. for use with the T-SPOT.TB test. The Auto-Pure 2400 platform is user-friendly and developed to facilitate productive lab procedures. Labs, physicians, and eventually patients gain from the potent combination of the Auto-Pure 2400 system's effectiveness and the T-SPOT.TB test's accuracy.

-

In November 2024, QIAGEN partnered with McGill University's Centre for Microbiome Research to promote microbiome studies and outputs. It is anticipated that the partnership will increase QIAGEN's footprint in the USD 1.8 billion North American microbiome research market.

-

In May 2024, BD launched a "TB Guardianship Program" to enhance awareness and knowledge among healthcare professionals regarding effective TB diagnostic practices. The program is a tri-partite educational series that aims to improve drug susceptibility testing and TB diagnosis in partnership with a number of prestigious partners, including the Indian Chest Society (ICS), the Central TB Division (CTD), the International Union Against Tuberculosis and Lung Disease (The Union), Corporate TB Pledge, and USAID

Tuberculosis Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.41 billion

Revenue forecast in 2030

USD 3.18 billion

Growth rate

CAGR of 5.8% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott; QIAGEN; Thermo Fisher Scientific Inc.; BD, F. Hoffmann-La Roche AG; Hologic, Inc.; Cepheid; DiaSorin S.p.A.; Hain Lifescience GmbH; Oxford Immunotec

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tuberculosis Diagnostics Market Report Segmentation

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global tuberculosis diagnostics market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Detection of Latent Infection (Skin Test & IGRA)

-

Phage Assay

-

Detection of Drug Resistance (DST)

-

Nucleic Acid Testing

-

Radiographic Method

-

Cytokine Detection Assay

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic Laboratories

-

Hospitals & Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global tuberculosis diagnostics market size was estimated at USD 2.28 billion in 2024 and is expected to reach USD 2.41 billion in 2025.

b. The global tuberculosis diagnostics market is expected to grow at a compound annual growth rate of 5.8% from 2025 to 2030, reaching USD 3.18 billion by 2030.

b. Asia Pacific dominated the tuberculosis diagnostics market with a share of 37.18% in 2024. This is attributable to the increasing opportunities for scientific research, the presence of high untapped opportunities in the form of unmet medical needs, and positive economic growth, which are some primary growth drivers of this market.

b. Some key players operating in the tuberculosis diagnostics market include Abbott, QIAGEN, Thermo Fisher Scientific Inc., BD, F. Hoffmann-La Roche AG, Hologic, Inc., Cepheid, DiaSorin S.p.A., Hain Lifescience GmbH, Oxford Immunotec.

b. Key factors that are driving the tuberculosis diagnostics market growth include the increasing prevalence of tuberculosis, advancements in diagnostics technologies, and rising government funding programs for TB diagnosis, aided by growing awareness and screening programs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.