- Home

- »

- Processed & Frozen Foods

- »

-

Truffle Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Truffle Market Size, Share & Trends Report]()

Truffle Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Black Truffle, White Truffle), By Nature (Organic, Conventional), By Form, By Distribution Channel, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-153-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Truffle Market Summary

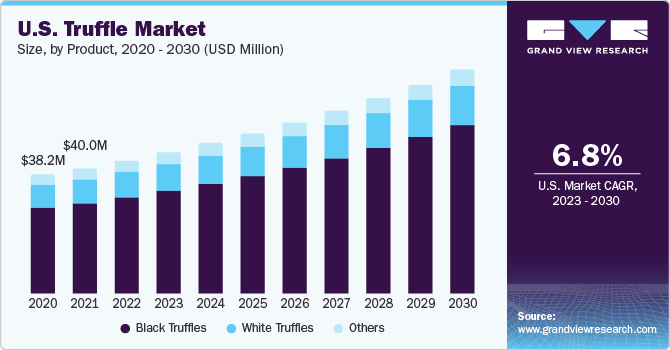

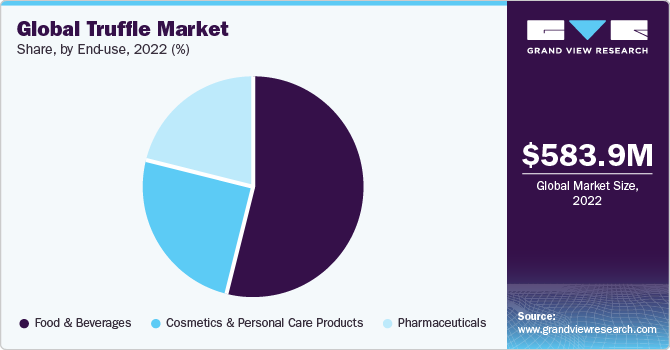

The global truffle market size was estimated at USD 583.9 million in 2022 and is projected to reach USD 1,024.3 million by 2030, growing at a CAGR of 7.3% from 2023 to 2030. The market is experiencing substantial expansion, propelled by a convergence of factors that cater to a wide range of consumer preferences and industry demands.

Key Market Trends & Insights

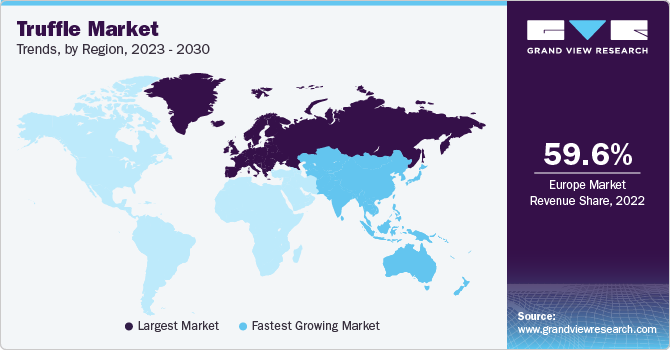

- Europe dominated the market with a revenue share of 59.6% in 2022.

- Asia Pacific is expected to grow at a CAGR of 7.2% from 2023 to 2030.

- Based on product, the black truffles held the largest market share of 66.9% in 2022.

- Based on nature, the conventional segment held the largest market share of 78.0% in 2022.

- Based on form, the fresh truffle segment held the largest market share of 55.4% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 583.9 Million

- 2030 Projected Market Size: USD 1,024.3 Million

- CAGR (2023-2030): 7.3%

- Europe: Largest market in 2022

As gourmet cuisine and fine dining lifestyles gain increasing popularity, truffles play a pivotal role in elevating the flavor and aroma of these dishes, making them even more alluring to consumers. Fine dining establishments worldwide have recognized the appeal of truffles. They frequently feature truffle-based dishes on their menus, ranging from truffle-infused pasta and risottos to truffle garnishes on meats and seafood. The aroma and taste of truffles offer a sensory indulgence that appeals to discerning palates, making them a natural fit for upscale dining.

Many restaurants in the world are adding truffles to their products to elevate the customer experience. For instance, in February 2023, Shake Shack, a burger joint in the U.S., introduced truffle-infused fine dining in Austin. The meal encompasses Shake Shack's full range of white truffle offerings, featuring the White Truffle Shroom Burger, Parmesan Fries drizzled with White Truffle Sauce, and the White Truffle Burger.

The truffles themselves possess certain nutritional qualities that appeal to health-conscious individuals. They are a source of antioxidants, are cholesterol-free, and can impart a rich umami flavor to dishes without the need for excessive amounts of added fats or salt. As consumers seek natural and unprocessed ingredients to enhance the flavor of their meals, truffles are increasingly seen as a valuable and nutritious addition.

The high cost and rarity of truffles are significant factors restraining the growth of the market. Truffles are known for their distinctive and rich taste, but their scarcity and the difficulty of sourcing them contribute to their exorbitant price tag. For instance, an Italian white truffle was sold for USD 118,000 for 1 KG at the international Alba White Truffle Auction in Italy in 2021.

Product Insights

Based on product, the black truffles held the largest market share of 66.9% in 2022.It is the most valued truffle variety as it is employed in the manufacturing of various black truffle-based products such as truffle oil, truffle sauce, truffle butter, truffle cheese, truffle vinegar, truffle salt, and truffle juice. It is harvested from May to September, during which they are at their peak availability and freshness.The culinary industry is constantly evolving, and chefs are continuously seeking new and unique ingredients to create innovative dishes. For instance, in 2023, Bel Brands USA launched a sea salt-flavored cheese, which consists of a rich flavor of black truffle. It can be applied to flatbread and pasta dishes. This evolution of the culinary industry is anticipated to drive the demand for black truffles over the forecast period.

The white truffles are expected to grow at a significant CAGR of 5.8% from 2023 to 2030.White truffles are highly prized fungi that grow underground in symbiosis with certain tree species, particularly oak, hazel, poplar, and beech trees. They are known for their rare availability, distinct aroma, exquisite flavor, and unique appearance. According to Sabatino Truffles, in November 2022, white truffles are renowned as the scarcest truffle species globally. Valued at prices reaching up to USD 6,000 per pound, they stand as one of the most exclusive culinary items worldwide.

Nature Insights

Based on nature, the conventional segment held the largest market share of 78.0% in 2022.Conventional cultivation of truffles refers to the traditional approach of growing truffles using synthetic chemicals, fertilizers, and fossil fuels. The first step in conventional truffle cultivation is selecting the appropriate truffle species based on the desired market demand, soil conditions, and climate. Common truffle species cultivated conventionally include black truffle (Tuber melanosporum), summer truffle (Tuber aestivum), and bianchetto truffle (Tuber borchii).

The organic segment is expected to grow at the fastest CAGR of 8.0% from 2023 to 2030. Organic cultivation of truffles refers to the process of growing truffles using organic farming methods without the use of genetically modified organisms (GMOs), synthetic chemicals, or pesticides. It involves implementing environmentally friendly practices that promote soil health, biodiversity, and sustainable farming techniques. Consumers are becoming more conscious about their food preferences and seeking organic options due to health concerns, environmental sustainability, and the disadvantages of synthetic chemicals. These factors are prompting growers to adopt organic cultivation methods, consequently, paving the way for an increase in demand for organically cultivated truffles.

Form Insights

Based on form, the fresh truffle segment held the largest market share of 55.4% in 2022. Fresh truffles are highly prized culinary items known for their unique aroma and flavor. These are natural, unprocessed truffles that are harvested directly from the ground. Fresh truffles come in various species, including black truffles, white truffles, summer truffles, and others. They are highly valued by chefs and food enthusiasts for their ability to elevate the flavor profile of a dish.

The processed truffle segment is expected to grow at the fastest CAGR of 7.9% from 2023 to 2030. Processed truffles refer to truffles that have undergone various methods of preservation or transformation to extend their shelf life and enhance their usability. The processing techniques can vary, but they generally involve techniques such as freezing, canning, drying, or transforming truffles into different forms, such as truffle-infused oils, truffle pastes, or truffle powders.

Distribution Channel Insights

Based on distribution channel, the B2C distribution channel segment held a market share of 55.2% in 2022. In the B2C distribution channel of the market, truffles are sold directly to individual consumers. One of the B2C distribution channels is farmers' markets, which offer fresh truffles directly to consumers. In farmers’ markets, truffle farmers or local truffle hunters participate and create a unique shopping experience where consumers interact with the truffle hunters, learn about truffles, and subsequently make their purchases. The availability of truffles through online platforms, specialty food stores, and gourmet markets has increased consumer access to truffles. This increased accessibility, along with enhanced awareness through food media, cooking shows, and social media, is estimated to stimulate the growth of the market with the help of the B2C distribution channel.

The B2B segment is expected to grow at a significant CAGR of 7.1% from 2023 to 2030. Increasing demand among consumers for truffle-infused products such as oils, salts, sauces, and snacks is driving the market growth in this segment. Additionally, the increasing demand for highly prized gourmet cuisines and healthy food options is another factor fueling the demand for truffles among B2B companies.

End-use Insights

Based on end-use, the food & beverages segment held the market share of 54.4% in 2022. The food & beverage sector is constantly evolving, with a focus on culinary innovation and new taste experiences. For instance, in 2022, TRUFF, U.S. based food and beverage company, launched TRUFF white truffle oil, which is a blend of olive oil and white winter truffles. It is produced to drizzle on pizza, seafood, mashed potatoes, spring greens, and scrambled eggs. Truffles offer a unique ingredient that can elevate the flavors of various dishes, making them a popular choice for chefs and food manufacturers looking to create innovative and high-end culinary creations. Hence, culinary innovation and trends are expected to play a vital role in driving the growth of the market over the forecast period.

The pharmaceutical sector is expected to grow at the fastest CAGR of 8.8% from 2023 to 2030.Truffles are known to contain bioactive compounds with potential medicinal properties. They contain a high number of macronutrients such as protein, carbohydrates, and fiber. Besides, it contains both saturated and unsaturated fatty acids, as well as micronutrients, such as phosphorus, magnesium, vitamin C, calcium, iron, manganese, and sodium. In addition, they are rich in antioxidants and polysaccharides that consist of various health benefits. The exploration of truffles for their medicinal properties, such as anti-inflammatory, antimicrobial, and anticancer activities, drives research and development in the pharmaceutical industry. Therefore, the medicinal property of truffles is anticipated to escalate the demand for truffles in the pharmaceutical industry.

Regional Insights

Europe dominated the market with a revenue share of 59.6% in 2022. The truffle is infused with a variety of products, including chocolates. The truffle-based chocolates are expensive and are ideal for gifting on special occasions. The demand for such high-quality ingredients of chocolates is high in the region, making them an attractive and exclusive gift choice. For instance, in June 2023, Toblerone, a Swiss chocolate brand, launched Toblerone Truffles, a premium product aimed at gifting. It consists of Toblerone chocolate, crafted into individually wrapped diamond-shaped truffles, covering a velvety center infused with finely chopped almond and honey nougat. The product targets Gen Z adults and millennials, who have an appetite for indulgence within the premium chocolate segment.

Asia Pacific is expected to grow at a CAGR of 7.2% from 2023 to 2030. Many companies are introducing their products in the region due to the presence of untapped market potential. For instance, in June 2022, Aroma Truffle, a Singapore-based firm, expanded its presence in Asia and the Middle East. The company's product portfolio has truffle-based oil, butter, dipping sauce, and mooncakes. Moreover, the company also created the first-ever truffle gelato with hand-shaved truffles from central Italy.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Brand share analysis indicates that key market players are focusing on strategies such as new launches, partnerships, mergers & acquisitions, global expansion, and others. For instance, in August 2022, TRUFF & Hidden Valley Ranch collaborated and launched a special limited-edition product: spicy truffle ranch. This unique condiment consists of a mixture of creamy Hidden Valley Ranch and TRUFF's Original Black Truffle Hot Sauce. It was a strategic collaboration between both brands as they ventured into their debut partnership for launching an innovative truffle-based product.

Key Truffle Companies:

- Arotz, SA

- Gazzarrini Tartufi

- TruffleHunter, Inc.

- Urbani Truffles

- SABATINO NA LLC

- LES FRÈRES JAUMARD

- The Welsh Truffle Co.

- PLANTIN Truffles

- Truffle Hill

- Tartufi Morra

- Angellozzi Tartuficoltura

- Great Southern Truffles

- BLACK BOAR TRUFFLE

- Trufo

- OLD WORLD TRUFFLES

Truffle Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 624.2 million

Revenue forecast in 2030

USD 1,024.3 million

Growth rate

CAGR of 7.3% from 2023 to 2030

Market volume in 2023

602.7 tons

Volume forecast in 2030

947.1 tons

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in tons, revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, nature, form, distribution channel, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central and South America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; The Netherlands; Czech Republic; China; India; Japan; Australia, South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Arotz, SA; Gazzarrini Tartufi; TruffleHunter, Inc.; Urbani Truffles; SABATINO NA LLC; LES FRÈRES JAUMARD; The Welsh Truffle Co.; PLANTIN Truffles; Truffle Hill; Tartufi Morra; Angellozzi Tartuficoltura; Great Southern Truffles; BLACK BOAR TRUFFLE; Trufo; OLD WORLD TRUFFLES

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Truffle Market Report Segmentation

This report forecasts revenue and volume growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global truffle market report based on product, nature, form, distribution channel, end-use and region:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2030)

-

Black Truffles

-

White Truffles

-

Others

-

-

Nature Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2030)

-

Organic

-

Conventional

-

-

Form Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2030)

-

Fresh

-

Processed

-

-

Distribution Channel Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2030)

-

B2B

-

B2C

-

-

End-use Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2030)

-

Food & Beverages

-

Cosmetics & Personal Care Products

-

Pharmaceuticals

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Czech Republic

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Thailand

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global truffle market size was estimated at USD 583.9 million in 2022 and is expected to reach USD 624.2 million in 2023

b. The global truffle market is expected to grow at a compound annual growth rate of 7.3% from 2023 to 2030 to reach USD 1,024.3 million by 2030

b. Europe dominated the truffle market with a market share of 59.6% in 2022. This is attributed to the increasing demand for high-quality ingredients comprised chocolates and evolving culinary trends

b. Some key players operating in the truffle market include Arotz, SA, Gazzarrini Tartufi, TruffleHunter, Inc., Urbani Truffles, SABATINO NA LLC, LES FRÈRES JAUMARD, The Welsh Truffle Co., PLANTIN Truffles, Truffle Hill, Tartufi Morra, Angellozzi Tartuficoltura, Great Southern Truffles, BLACK BOAR TRUFFLE, Trufo, OLD WORLD TRUFFLES

b. Key factors driving the market growth include substantial expansion, propelled by a convergence of factors that cater to a wide range of consumer preferences and industry demands. Also, as gourmet cuisine and fine dining lifestyles gain increasing popularity, truffles play a pivotal role in elevating the flavor and aroma of these dishes, making them even more alluring to consumers

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.