- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Trivalent Chromium Finishing Market Size Report, 2030GVR Report cover

![Trivalent Chromium Finishing Market Size, Share & Trends Report]()

Trivalent Chromium Finishing Market (2023 - 2030) Size, Share & Trends Analysis Report By System (Plating, Conversion Coatings, Passivation), By Application (Decorative, Functional), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-676-9

- Number of Report Pages: 112

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Trivalent Chromium Finishing Market Trends

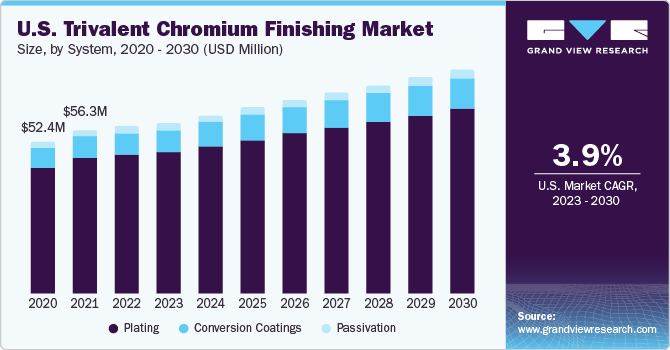

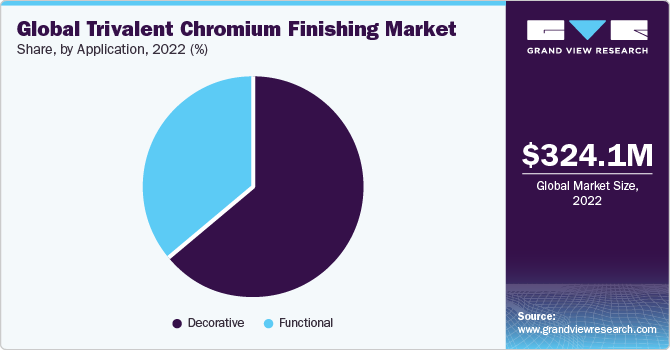

The global trivalent chromium finishing market size was valued at USD 324.1 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030.The regulatory mandates to enforce the use of the product as a replacement for hexavalent is expected to be a key factor driving the global market growth over the forecast period.

Trivalent chromate is preferred in industries such as automotive, hydraulic, and heavy equipment manufacturing as it eliminates the hazards associated with hexavalent plating. The system also allows a layer of uniform thickness over the surface of the component with better throwing power, thus enhancing the productivity of metal and non-metal finishing operations. The rising environmental concerns with regards to hexavalent chrome are expected to boost the demand for trivalent chrome in the U.S.

There has been a considerable rise in automobile sales in the U.S. on account of the availability of cheaper fuel. The automobile manufacturers are providing various incentive schemes to boost vehicle sales. The increasing demand for automotive is in turn expected to encourage the trivalent chromium finishing growth as automotive component manufacturers have to comply with end-of-life vehicles (ELV) directive, which mandates the use of trivalent chrome.

The increasing focus on predictive maintenance in the hydraulics industry, where chrome offers superior abrasive resistance is expected to have a positive impact on the overall growth. The emerging economies of Asia Pacific such as China, India, Japan, and others have registered an increase in construction activities, which is further expected to boost the chrome-finished architectural components growth in the region over the forecast period.

However, the higher initial investments to set up a trivalent chrome facility is a challenge, as it affects the adoption rate of the system. The procurement, commissioning, and installation of these tanks incurs additional costs to the metal and non-metal finishing companies.

System Insights

The trivalent chrome plating process meets stringent regulatory requirements laid down by REACH under the substance of very high concern (SVHC) regulations. The compliance of these regulatory requirements is expected to be one of the primary drivers for the growth of plating systems over the forecast period.

Theplating segment accounted for the largest revenue share of 83.1% in 2022. Plating has gained higher share as compared to coating and passivation systems on account of wide acceptance in industries such as automotive, appliance, and architecture.

It is being increasingly used in developed countries as they are more focused on complying with the environmental regulatory norms in the metal and non-metal finishing industries. Europe is widely recognized as the automotive manufacturing hub, which is a key factor driving the growth of plating systems in the European region.

Theconversion coatings segment is expected to grow at the fastest CAGR of 5.1% during the forecast period. The growth of the conversion coatings segment is being propelled by several factors, including an increasing demand for corrosion-resistant coatings, the rising popularity of environmentally conscious coatings, the booming automotive and aerospace sectors, advancements in coating technology, and the expanding infrastructure development.

End-use Insights

The automotive segment accounted for the largest revenue share of 43.3% in 2022. The automotive industry can be further split into two-wheeler, passenger vehicles, and commercial vehicles, where two-wheelers are being widely used as they are economical, involve less maintenance cost, require lesser parking space, and are a viable option. The increasing demand for two-wheelers has, in turn, resulted in the increased demand for trivalent chrome plated components as they help in improving the aesthetics of the vehicle.

The development of emerging economies on account of rapid industrialization and improving infrastructure is projected to boost the sales of commercial vehicles. Different types of decorative and functional chrome plating are widely used for components in commercial vehicles. These factors together are expected to result in increased demand over the forecast period.

Theaerospace segment is expected to grow at the fastest CAGR of 4.4% during the forecast period. Factors driving trivalent chromium finishing in aerospace include the demand for lightweight materials, superior performance in high-temperature environments, excellent adhesion properties, and improved aesthetics. Furthermore, trivalent chromium plating provides aerospace components with improved wear resistance, greater corrosion resistance, and increased durability as compared to hexavalent chromium finishes.

Application Insights

The decorative segment accounted for the largest revenue share of 64.5% in 2022 and is expected to grow at the fastest CAGR of 4.3% during the forecast period. Increasing popularity of decorative application has resulted in the declining market share of functional plating in various end-uses such as automotive, appliances, and architecture. The decorative application offers different types of shades, which impacts product differentiation and hence, is leading the growth of decorative applications. The use of chromium in decorative application enhances the look of components by making the surface glossy and resistant to corrosion.

The functional application uses a thick layer of chrome over the surface of the component to provide better resistance and protect it from dust and other particulate impurities. The functional chrome finds application in the refurbishment of worn-out components to increase the lifespan of the component.

In Europe, Germany as a major manufacturing hub is expanding its production facilities, which is expected to increase the demand for decorative chromium. The presence of chrome finishing companies in large numbers within the European region which implies easy and cost-effective availability of chromium finishing is a key factor driving the growth of the decorative chromium market in the region.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 36.9% in 2022. The rapid growth of the automotive industry coupled with the rising demand for hydraulic & heavy machinery in Asia Pacific, which is one of the major end-user industries using trivalent chromium finished components, is projected to be an important driver.

Middle East and Africa is expected to grow at the fastest CAGR of 5.5% during the forecast period. The recent swift industrialization and economic expansion in the Middle East and Africa region has raised the need for high-quality finished products in a variety of sectors, including the electronics, automotive, consumer goods, and aerospace industries. Trivalent chromium finishing is an ideal choice for producers trying to satisfy the market's need for high-quality finishes. This is because it offers enhanced corrosion resistance, better wear resistance, and aesthetic appeal. Trivalent chromium finishing's rising popularity is mostly due to its capacity to produce high-quality outcomes.

Europe is expected to grow at a significant CAGR of 3.8% during the forecast period. The increased demand can be attributed to the presence of regulatory mandates set by the European Union, which are anticipated to impact the chromate component finishing industry. The growing trend toward compliance of regulatory norms is expected to fuel the demand over the next eight years.

Key Companies & Market Share Insights

The trivalent chromium finishing market is fragmented in nature with the presence of several global and regional players. Market players are engaged in the research & development activities to develop new processes, which comply with the regulatory policies. Most of the key industry players are fully integrated across the value chain posing entry barriers for new players.

Key Trivalent Chromium Finishing Companies:

- MacDermid, Inc.

- Atotech

- Sarrel Group

- Chem Processing, Inc.

- Kakihara Industries Co., Ltd.

- Ronatec C2C, Inc.

Recent Developments

-

In March 2022, MacDermid, Inc. successfully completed the acquisition of Alent PLC, a division of Platform Specialty Products. A new division named Performance Solutions was established, bringing together the original operations of MacDermid, Inc. with the businesses acquired from Alent. The integrated entity aimed to offer clients enhanced innovation and service frameworks across all stages of the supply chain, catering to customers worldwide.

-

In May 2022, Atotech announced a business partnership with Schweitzer Engineering Laboratories, Inc. As part of this collaboration, Schweitzer Engineering Laboratories will employ Atotech’s Uniplate equipment in its new PCB manufacturing unit located in Idaho, U.S.

Trivalent Chromium Finishing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 331.3 million

Revenue forecast in 2030

USD 444.0 million

Growth rate

CAGR of 4.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

System, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; India; Japan; South Korea; Brazil

Key companies profiled

MacDermid, Inc.; Atotech; Sarrel Group; Chem Processing, Inc.; Kakihara Industries Co., Ltd.; Ronatec C2C, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Trivalent Chromium Finishing Market Report Segmentation

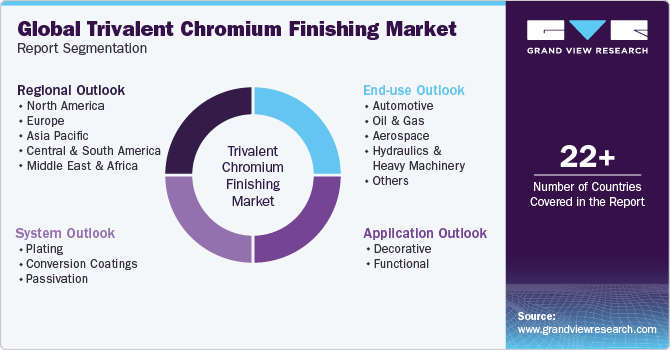

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global trivalent chromium finishing market based on system, application, end-use, and region:

-

System Outlook (Revenue in USD Million, 2018 - 2030)

-

Plating

-

Decorative Plating

-

Functional Plating

-

-

Conversion Coatings

-

Decorative Conversion Coatings

-

Functional Conversion Coatings

-

-

Passivation

-

-

Application Outlook (Revenue in USD Million, 2018 - 2030)

-

Decorative

-

Functional

-

-

End-use Outlook (Revenue in USD Million, 2018 - 2030)

-

Automotive

-

Oil & Gas

-

Aerospace

-

Hydraulics & Heavy Machinery

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

U.K.

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global trivalent chromium finishing market was estimated at USD 324.1 million in 2022 and is expected to reach USD 331.3 million in 2023.

b. The trivalent chromium finishing market is expected to grow at a compound annual growth rate of 4.3% from 2023 to 2030 to reach USD 444.0 million by 2030.

b. Plating was the key application segment of the global market with a revenue share of more than 83.0% in 2022.

b. Some of the key players operating in the trivalent chromium finishing market are MacDermid Incorporated, Atotech Deutschland GmbH, Sarrel Group, Chem Processing, Inc., Kakihara Industries Co., Ltd., and Ronatec C2C, Inc among others.

b. The growing usage of plating in heavy-duty applications to improve the durability of finished products is anticipated to drive the growth of the trivalent chromium finishing market over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.