Tris Nonylphenyl Phosphite Market Size, Share & Trends Analysis Report By Application (Antioxidants, Stabilizer), By End Use (Plastics, Rubber, Oil & Gas), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-368-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Tris Nonylphenyl Phosphite Market Trends

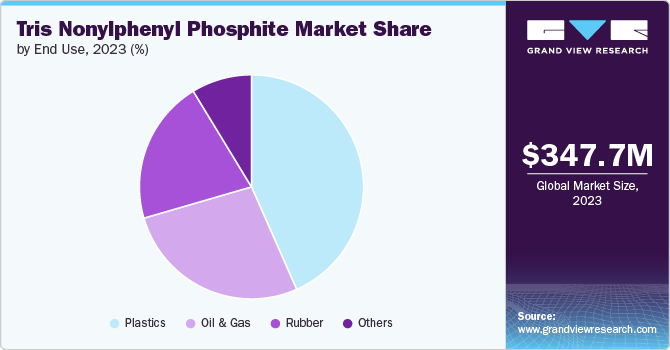

The global tris nonylphenyl phosphite market size was estimated at USD 347.68 million in 2023 and is projected to grow at a CAGR of 5.9% in terms of revenue from 2024 to 2030. The market is driven by the increasing demand for antioxidants in the polymer and plastic industry. The tris nonylphenyl phosphite (TNPP) is widely used as a heat stabilizer and antioxidant in various polymer applications to improve the thermal stability and durability of the final products. The growth of the automotive and construction industries, particularly in emerging economies, is further boosting the demand for TNPP. The growing awareness of the benefits of using antioxidants to extend the lifespan of polymers is expected to stimulate market growth.

TNPP is primarily used as a stabilizer and antioxidant in processing various plastic materials (LLDPE, PVC, rubber, and HDPE) in concentrations between 0.05 and 3%. TNPP is an important process stabilizer for thermoplastic polymers such as polyethylene, polyester, and polypropylene. TNPP's industrial uses include manufacturing packaging materials and plastic products for plastics and manufacturing unlaminated film and sheets as stabilizers. TNPP is also suitable for elastomers such as NBR, SIS, and SBR. It is highly effective in light-colored solutions and emulsion-polymerized elastomers. TNPP prevents buildup, increases viscosity, and retains tack adhesive.

Drivers, Opportunities & Restraints

The oil & gas industry is the second-largest consumer of antioxidant phosphite. TNPP has been in high demand due to its high processing stability. TNPP offers better stability and prevents discoloration during polymer processing, making it a preferred material in the petrochemical industry. TNPP also experiences minimal price fluctuations, which has further contributed to its consumption in the industry.

The increasing worries about the environmental and health effects of TNPP play a significant role in the market. TNPP can remain in the environment for a long time and may harm aquatic life. Regulatory authorities are paying more attention to the concerns about TNPP's toxicity, which could result in stricter regulations on its usage. As a result, industries are looking for safer alternatives to TNPP that are more eco-friendly and have fewer health risks. This shift to greener options could slow down the market growth.

Industries increasingly seek environmentally friendly and non-toxic stabilizers for polymers, creating a demand for new products. The growing concerns over the environmental and health impacts of TNPP have led to a shift towards greener alternatives. Manufacturers are focusing on developing stabilizers that offer similar performance benefits to TNPP but have reduced health risks and environmental. Regulatory pressures and consumer preferences for sustainable products are driving this trend. As the demand for safer alternatives continues to grow, there is a significant opportunity for manufacturers to innovate and introduce new products that meet these evolving market needs.

Application Insights

“Stabilizer emerged as the fastest growing application with a CAGR of 6.2%”

Stabilizer dominated the market and accounted for a revenue share of 62.09% in 2023. Stabilizers such as heat stabilizers are widely used in the TNPP market, with TNPP being one of the most favored phosphite stabilizers due to its intrinsic properties. This stabilizer helps maintain color and melt flow during polymer processing, protecting against heat degradation. This is especially important for plastics, particularly thermoplastics. In addition, phosphite stabilizers offer better hydrolytic stability during shipping and transportation, preventing chemical decomposition. These attributes make TNPP widely preferred in food packaging, petrochemicals, and hygiene products.

TNPP is widely recognized for its superior antioxidative properties, making it an invaluable asset in the oil and gas industry. Its primary function is to prevent thermal degradation and oxidation, thus ensuring the durability and reliability of plastic components. These components play critical roles in various applications, from insulating materials to pipelines, where maintaining material integrity is crucial for operational efficiency and safety. TNPP's ability to protect these materials under extreme conditions significantly prolongs their lifespan and performance.

End Use Insights

“Plastics emerged as the fastest growing end use with a CAGR of 6.5%”

Plastics dominated the market and accounted for a revenue share of 43.39% in 2023. TNPP is widely utilized as a stabilizer in the plastics industry, offering significant protection against thermal degradation and oxidation. Its effectiveness extends the lifespan and improves the performance of various plastic materials, particularly in challenging environmental conditions. Moreover, TNPP helps maintain clarity and prevent discoloration in plastic products, ensuring they remain aesthetically appealing over time.

TNPP is used in the oil and gas industry for its exceptional antioxidative properties, crucial for enhancing the longevity and reliability of materials exposed to extreme conditions. By preventing thermal degradation and oxidation, TNPP plays an essential role in maintaining the integrity of plastic components used in various applications, ranging from pipelines to insulating materials. Its ability to preserve material performance under harsh conditions directly contributes to operational efficiency and safety in the sector.

Regional Insights

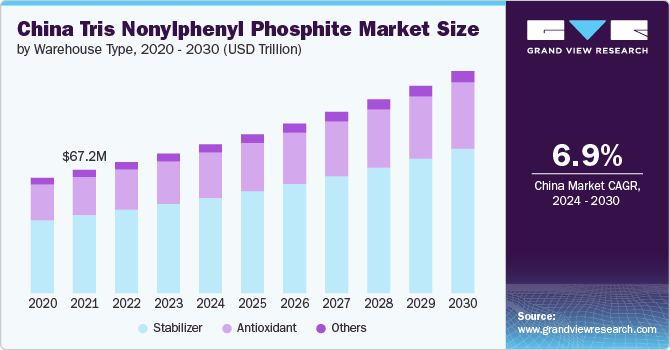

“China emerged as the fastest growing region in Asia Pacific with a CAGR of 6.9% in 2030”

Asia Pacific dominated the market and accounted for a 44.89% share in 2023. The growing need for TNPP antioxidants in various industries is a crucial factor driving the market's expansion. TNPP is favored for its cost-effectiveness and is widely used as a stabilizer in polymer production. The increasing consumption of stabilizers in the Asia-Pacific region is projected to boost the TNPP market in this area. Emerging economies such as China, India, Japan, and South Korea are expected to contribute to the rise in demand for the product market in the region.

China Tris Nonylphenyl Phosphite Market Trends

The tris nonylphenyl phosphite market in China dominated the market and accounted for a market share of 48.78% in 2023. This growth is attributed to increasing demand for plastic, petrochemicals, automobiles, and construction products in the country. China is one of the largest manufacturers of plastic products, leading to a rise in demand for the product market in the region.

North America Tris Nonylphenyl Phosphite Market Trends

The tris nonylphenyl phosphite market in North American is expected to grow due to the growing oil and gas segment in the region. This growth will lead to a rise in demand for heat stabilizers.

Europe Tris Nonylphenyl Phosphite Market Trends

The tris nonylphenyl phosphite market in Europe plays a significant role, with countries such as Germany, the UK, France, Italy, Spain, Russia, Netherlands, and Belgium being key contributors to the market. The region's market dynamics are influenced by factors such as the rise in demand for plastics in the region leading to increased demand for the market.

Key Tris Nonylphenyl Phosphite Company Insights

Some of the key players operating in the global tris nonylphenyl phosphite market include

-

Zhengzhou Alfa Chemical Co., Ltd manufactures pharmaceutical intermediates, organic intermediates, photoelectric materials, and various catalysts. The company is also a global supplier of chemicals for research, development, and manufacturing. It has established one advanced base, which includes a production facility, test laboratories, and research centers.

-

Galata Chemicals produces and supplies CPVC, PVC, Polyolefin Additives, and Engineering Thermoplastics. The company has manufacturing facilities on three continents and serves many industries worldwide, including building and packaging, construction, automotive, and medical.

Adishank Chemicals Pvt. Ltd. and Dover Chemical Corporation are some of the emerging market participants in the global tris nonylphenyl phosphite market.

-

Adishank Chemicals Pvt. Ltd. is a significant player in the specialty chemicals industry, focused on developing and manufacturing a wide range of specialty chemicals and additives for the Polymer, Surface Coating, and Pharmaceutical Industries. The company is committed to delivering high-quality specialty chemicals to meet industry-specific needs and has a strong presence in India.

-

Dover Chemical Corporation specializes in providing chemical additives for household and industrial applications. The company's products are designed to enhance various materials used in applications such as metalworking, fuels, and polymers. They are a leading producer of chlorinated alkanes, alkylphenols, flame retardants, liquid antioxidants, polymer additives, solid antioxidants, additives for oil-based and water-based drilling fluids, and metalworking fluid additives. The company is a subsidiary of ICC Industries Inc. and has a global presence.

Key Tris Nonylphenyl Phosphite Companies:

The following are the leading companies in the tris nonylphenyl phosphite market. These companies collectively hold the largest market share and dictate industry trends.

- Addivant USA LLC

- Adishank Chemicals Pvt. Ltd.

- Zhengzhou Alfa Chemical Co., Ltd

- Dover Chemical Corporation

- Galata Chemical

- Cristol (Krishna Antioxidants Pvt. Ltd).

- SANDHYA GROUP

- Valtris Specialty Chemicals

- Sterling Auxiliaries Pvt. Ltd.

- Songwon Industrial Co. Ltd.

- Gulf Stabilizers Industries

- Akcros Chemicals

Recent Developments

-

In October 2022, Songwon Industrial Co. Ltd. announced significant investments to bolster the global plastic industry. The company aims to ramp up its long-term strategic initiatives to meet growing demand. In addition, it has introduced new product lines of antioxidant chemicals: SONGNOX 9228 and SONGSORB 1164 UV absorbers.

-

In April 2022, Dover Chemical Corporation announced a price increase of USD 0.25 per pound for all grades of Doverphos tris nonylphenol phosphite (TNPP). This adjustment is necessary due to ongoing increases in global raw materials and freight costs, higher energy-related operational expenses, and limited availability of trucking and raw materials.

Tris Nonylphenyl Phosphite Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 367.28 million |

|

Revenue forecast in 2030 |

USD 518.25 million |

|

Growth rate |

CAGR of 5.9% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume forecast and revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa. |

|

Key companies profiled |

Addivant USA LLC; Adishank Chemicals Pvt. Ltd.; Zhengzhou Alfa Chemistry; Dover Chemical Corporation; Galata Chemical; Krishna Antioxidants Pvt. Ltd.; SANDHYA GROUP; Valtris Specialty Chemicals, Sterling Auxiliaries Pvt. Ltd.; Songwon Industrial Co. Ltd.; Gulf Stabilizers Industries; Akcros Chemicals. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Tris Nonylphenyl Phosphite Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tris nonylphenyl phosphite market report based on application, end use, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Antioxidant

-

Stabilizer

-

Other Applications

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plastics

-

Rubber

-

Oil & Gas

-

Other End Uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global tris nonylphenyl phosphite market size was estimated at USD 347.68 million in 2023 and is expected to reach USD 367.28 million in 2024.

b. The global tris nonylphenyl phosphite market is expected to grow at a compound annual growth rate of 5.9% from 2024 to 2030 to reach USD 518.25 million by 2030.

b. Asia Pacific dominated the tris nonylphenyl phosphite market with a share of 44.89%. The growing need for tris nonyl phenyl phosphite (TNPP) antioxidants in various industries is a crucial factor driving the market's expansion. TNPP is favored for its cost-effectiveness and is widely used as a stabilizer in polymer production. The increasing consumption of stabilizers in the Asia-Pacific region is projected to boost the TNPP market in this area

b. Some key players operating in the tris nonylphenyl phosphite market include Addivant USA LLC; Adishank Chemicals Pvt. Ltd.; Zhengzhou Alfa Chemistry; Dover Chemical Corporation; Galata Chemical; Krishna Antioxidants Pvt. Ltd.; SANDHYA GROUP; Valtris Specialty Chemicals, Sterling Auxiliaries Pvt. Ltd.; Songwon Industrial Co. Ltd.; Gulf Stabilizers Industries; and Akcros Chemicals.

b. Key factors that are driving the market growth include increasing demand for antioxidants in the polymer and plastic industry. TNPP is widely used as a heat stabilizer and antioxidant in various polymer applications to improve the thermal stability and durability of the final products. The growth of the automotive and construction industries, particularly in emerging economies, is further boosting the demand for TNPP

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."