- Home

- »

- Medical Devices

- »

-

Trauma And Extremities Devices Market Size Report, 2030GVR Report cover

![Trauma And Extremities Devices Market Size, Share & Trends Report]()

Trauma And Extremities Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Internal Fixation, External Fixation), By End-use (Hospitals, Outpatient Facilities), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-136-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

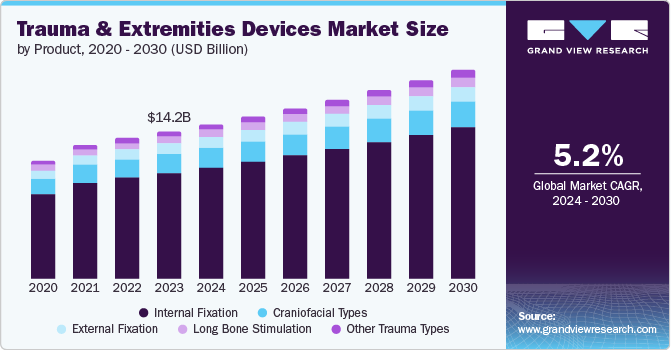

The global trauma and extremities devices market size was valued at USD 14.17 billion in 2023 and is projected to grow at a CAGR of 5.2% from 2024 to 2030. The increased incidence of road accidents in several countries has triggered the need for trauma and extremities devices. Technological advancements and the development of more efficient and less invasive surgical techniques are also driving market expansion. Furthermore, rising healthcare expenditures and improved access to healthcare in developing markets are anticipated to drive the market growth for these devices.

The increasing incidence of pathological fractures due to various bone disorders, such as osteoporosis, is anticipated to drive the global trauma and extremities devices market. Since the global population is aging, diseases such as osteoporosis tend to increase, and this results in increased rates of fractures and bone injuries. This demographic shift has also influenced the growth in the usage of trauma and extremities devices as older adults are at a higher risk of acquiring bone fractures that require surgical stabilization. Furthermore, various awareness programs and drives taken by healthcare sectors to spread knowledge about the signs and symptoms of bone disorders and their timely diagnosis and treatment are anticipated to further propel the market growth. According to the International Osteoporosis Foundation, Osteoporosis affects 1 in 3 women and 1 in 5 men over 50 globally, with 75 million diagnosed cases in Europe, the U.S., and Japan alone.

In addition, a significant driver is the growing adoption of value-based healthcare models emphasizing patient outcomes and cost-effectiveness. Hospitals and healthcare providers are focusing on improving surgical outcomes and reducing recovery times, which has led to a higher demand for advanced trauma and extremities devices. These devices enhance the effectiveness of surgeries and reduce hospital stays and rehabilitation times, leading to better patient outcomes and lower healthcare costs. Furthermore, increased investment in healthcare infrastructure is expanding access to advanced medical technologies, fuelling the growth of the trauma and extremities devices market. For instance, in March 2024, researchers used fat tissue to 3D print living skin with hair follicle precursors in rats, potentially leading to more natural-looking reconstructive surgery outcomes.

Product Insights

Internal fixation dominated the market and accounted for a share of 71.8% in 2023 due to its effectiveness in stabilizing severe fractures, promoting faster and more reliable healing compared to other methods. Improved internal fixation devices such as bio-absorbable implants and better surgical techniques make treatments safer and more effective. At the same time, a rise in complex fractures due to accidents and aging population fuels demand for these advancements. According to the Insurance Institute for Highway Safety, over 42,000 people in the US died in car crashes in 2022, with a national fatality rate of 12.8 per 100,000 people. However, this varied significantly by state (4.8 in the District of Columbia to 23.9 in Mississippi).

Long bone stimulation is expected to register a CAGR of 4.9% during the forecast period. This is attributed to the high prevalence of long bone fractures, mainly due to road accidents and sports-related injuries, which require appropriate surgical treatment. Advancements such as stronger nails and locking plates for bone fixation are boosting the market, while the growing elderly population susceptible to fractures fuels demand for specialized devices for their long bones.

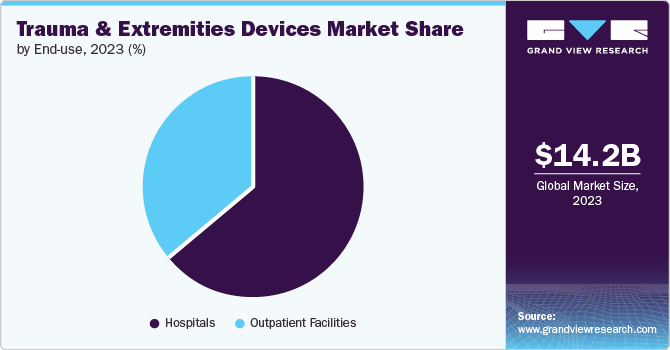

End Use Insights

The hospitals segment dominated the market and accounted for a share of 64.5% in 2023 due to increased infrastructure development and exclusive surgical professional to manage the extremities and trauma procedures. Improved surgical tools and technology at hospitals are leading to more successful trauma surgeries, further driving the need for specialized devices as trauma cases and healthcare spending rise. For instance, in November 2021, DePuy Synthes (Medical Device Business Services, Inc.) launched the UNIUM power tool system for trauma and other surgeries, focusing on ergonomics, reliability, and efficiency for various procedures.

The outpatient facilities segment is projected to grow at a CAGR of 4.9% over the forecast period due to the increasing preference for minimally invasive surgeries that allow for quicker recovery and shorter hospital stays. New surgical techniques and anaesthesia allow complex procedures on limbs and trauma to be done in outpatient centres, saving money and offering more convenience. This trend is expected to grow due to a focus on cost-effective care and an increase in outpatient facilities, especially in developing areas.

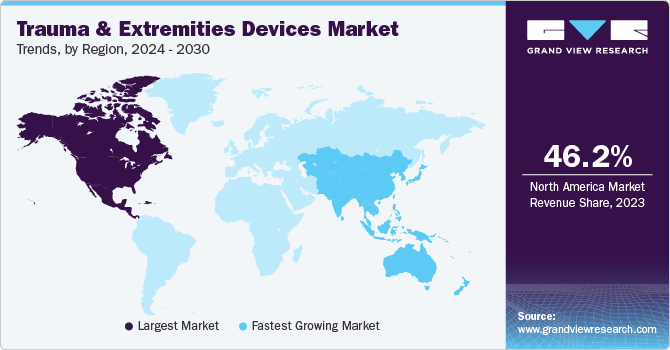

Regional Insights

North America trauma and extremities devices dominated the market and accounted for a revenue share of 46.2% in 2023. This is attributable to better healthcare facilities and higher investment in new technologies made by the region in the medical field. In addition, it undergoes a high rate of traumas and fractures, especially caused by traffic accidents and sports events, leading to a growing need for surgical procedures. Furthermore, a significant aging population and increased healthcare spending are anticipated to drive market growth in the region.

U.S. Trauma And Extremities Devices Market Trends

The U.S. trauma and extremities devices market is dominated in North America, with a share of 89.3% in 2023 due to a well-established medical device market and leading manufacturers operating in the U.S. For instance, Medtronic is a medical technology company offering a comprehensive portfolio of devices for trauma and extremities. Their products include advanced implants, surgical instruments, and biologics to treat fractures, deformities, and soft tissue injuries. Medtronic focuses on innovative solutions to enhance patient outcomes and improve surgical efficiency in orthopaedic trauma care.

Europe Trauma And Extremities Devices Market Trends

Europe trauma and extremities devices market grew high in 2023 due to increased incidence of trauma-related injuries and a higher prevalence of bone disorders, necessitating advanced treatment solutions. The region's strong healthcare infrastructure and substantial investment in medical technology have facilitated the adoption of innovative and minimally invasive devices. In addition, favorable healthcare policies and rising government and private sector funding for medical research and development have further driven European market expansion. For instance, in 2021, over 2.88 million work accidents in the European Union caused at least four days of absence, with wounds, sprains, and bone fractures being the most frequent.

Asia Pacific Trauma And Extremities Devices Market Trends

The Asia Pacific trauma and extremities devices market is anticipated to witness significant growth. The rapidly aging population in this region is more susceptible to bone fractures, driving up demand for these devices. In addition, the developing healthcare infrastructure in many Asian Pacific countries is improving access to advanced surgical techniques and trauma care, which often rely on these specialized devices. According to the World Health Organization (WHO), China's rapidly aging population, expected to hit 28% over 60 by 2040, demands a new healthcare system offering equal access across the country to meet their needs.

Key Trauma And Extremities Devices Company Insights

Some key companies in the global trauma and extremities devices market include DePuy Synthes (Medical Device Business Services, Inc.), Stryker, Zimmer Biomet, Smith+Nephew, Medtronic, Integra LifeSciences Corporation, Wright Medical Group N.V., Orthofix Medical Inc., CONMED Corporation, and Arthrex, Inc, among others. Organizations in the market are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Stryker is a global medical technology company that focuses on providing innovative medical equipment and devices for various specialties. This includes implants for joint replacements and surgeries, surgical tools with navigation systems, and emergency medical equipment.

-

Zimmer Biomet is a global medical device company that designs and develops innovative implants and digital technologies that surgeons use to improve patients’ mobility and quality of life. The company’s product range includes joint replacements, fracture repair systems, and surgical instruments.

Key Trauma And Extremities Devices Companies:

The following are the leading companies in the trauma and extremities devices market. These companies collectively hold the largest market share and dictate industry trends.

- DePuy Synthes (Medical Device Business Services, Inc.)

- Stryker

- Zimmer Biomet

- Smith+Nephew

- Medtronic

- Integra LifeSciences Corporation

- Wright Medical Group N.V.

- Orthofix Medical Inc.

- CONMED Corporation

- Arthrex, Inc.

Recent Developments

-

In July 2024, Orthofix Medical Inc. received FDA clearance for their Fitbone Transport and Lengthening System, a new implant for leg bone defects. This implant is unique because it lengthens or repairs bone in just one surgery, unlike traditional methods that require multiple procedures.

-

In May 2024, Stryker announced the successful completion of its first surgeries with the Adaptis surgical and Everlast suction systems. The Adaptis platform is equipped with modern technologies to increase the accuracy and speed of operations, and the everlast suction system was expected to provide better fluid control during surgeries.

Trauma And Extremities Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 14.87 billion

Revenue forecast in 2030

USD 20.09 billion

Growth Rate

CAGR of 5.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

DePuy Synthes (Medical Device Business Services, Inc.); Stryker; Zimmer Biomet; Smith+Nephew; Medtronic; Integra LifeSciences Corporation; Wright Medical Group N.V.; Orthofix Medical Inc.; CONMED Corporation; Arthrex, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

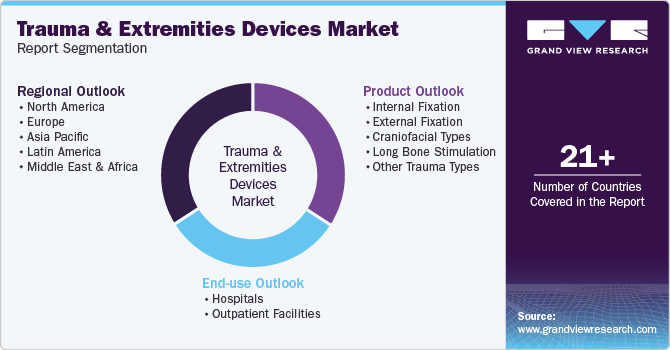

Global Trauma And Extremities Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global trauma and extremities devicesmarket report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Internal Fixation

-

Plates and screws

-

Rods and Pins

-

-

External Fixation

-

Craniofacial Types

-

Internal Craniofacial Devices

-

External Craniofacial Devices

-

-

Long Bone Stimulation

-

Other Trauma Types

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.