- Home

- »

- Healthcare IT

- »

-

Trauma Care Centers Market Size, Industry Report, 2030GVR Report cover

![Trauma Care Centers Market Size, Share & Trends Report]()

Trauma Care Centers Market (2025 - 2030) Size, Share & Trends Analysis Report By Facility Type (In-house, Standalone), By Trauma Type (Falls, Traffic-related Injuries, By Service Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-564-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Trauma Care Centers Market Summary

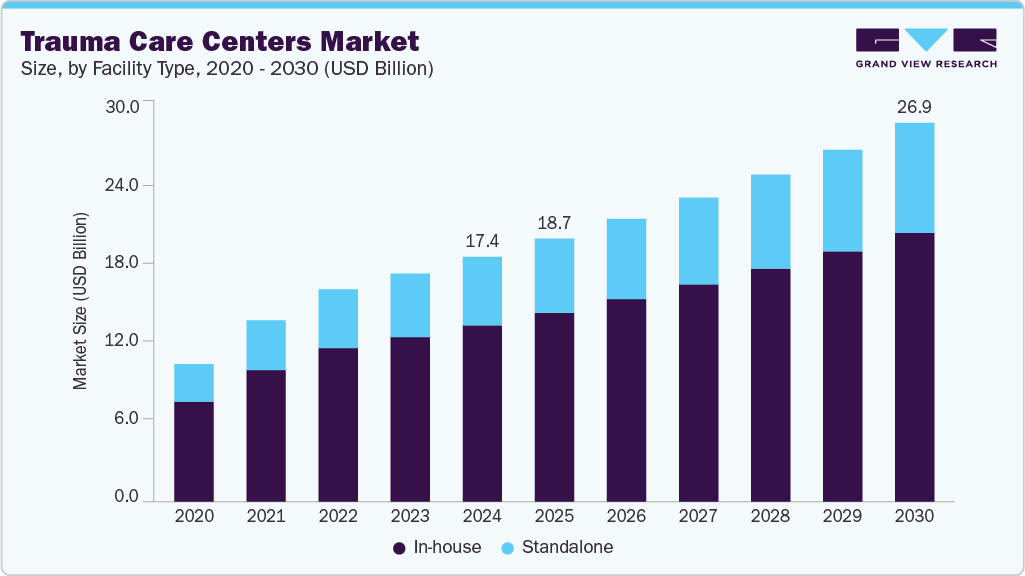

The global trauma care centers market size was valued at USD 17.37 billion in 2024 and is projected to reach USD 26.87 billion by 2030, growing at a CAGR of 7.6% from 2025 to 2030. Factors such as the increasing number of traumatic injury-related Emergency Department (ED) visits and hospitalizations of patients with injuries primarily caused by traumatic car crash injuries, falls, and wounds caused by gunshot or stabbing are expected to propel the market growth during the forecast period.

Key Market Trends & Insights

- North America trauma care centers market held the largest share of 55.0% of the global market in 2024.

- The trauma care centers industry in the U.S. is expected to grow significantly over the forecast period.

- By facility type, the in-house segment held the highest market share of 58.9% in 2024.

- Based on trauma type, the falls segment held the highest market share in 2024.

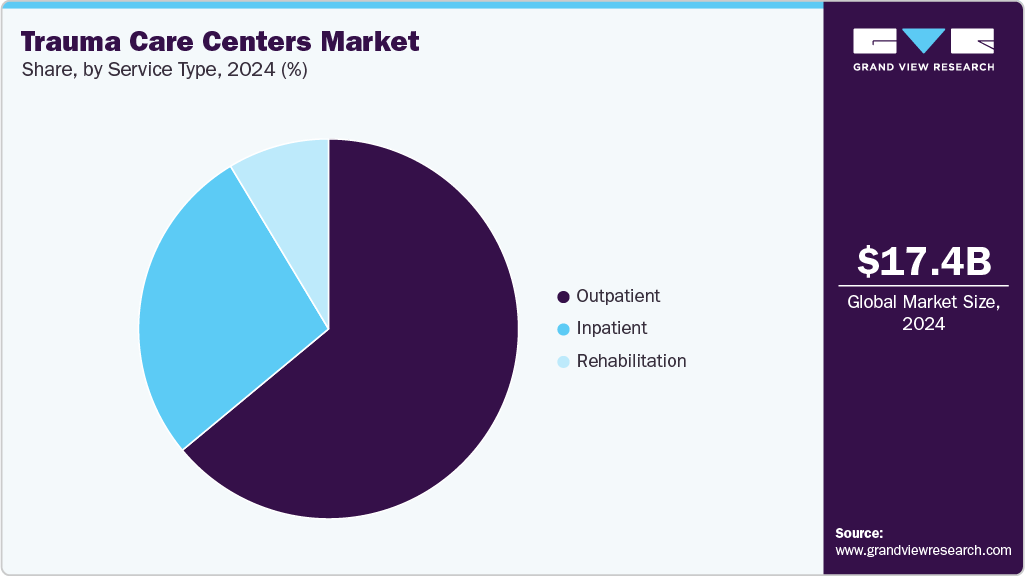

- By service type, the outpatient segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 17.37 Billion

- 2030 Projected Market Size: USD 26.87 Billion

- CAGR (2025-2030): 7.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The demand for trauma care services is increasing among the elderly population owing to physical, sensory, and cognitive changes related to aging, which increase the chances of moderate to severe injuries such as bruises, head trauma, and hip fractures. According to the CDC, falls are a major cause of injuries for people aged 65 and older. In the U.S., about one in four older adults falls each year. While not every fall causes an injury, over one-third (37%) of these falls require medical care or cause people to limit their activities for at least a day. Moreover, evolving developmental stages, innate curiosity, and risk-taking factors are further increasing the demand for trauma care services among the pediatric population.

According to a study published in the Journal of the American Medical Association, about 69% and 84% of U.S. residents had access to Level I and II trauma centers within 45 to 60 minutes, respectively. Each year, approximately 1.19 million deaths occur due to road traffic crashes. In addition, between 20 and 50 million individuals sustain non-fatal injuries in these events, with many subsequently living with a disability. The government is making constant efforts to minimize the damage caused by road traffic accidents. Hence, they are focusing on establishing trauma care centers in accident-prone areas.

Facility Type Insights

The in-house segment dominated the market in 2024 with a revenue share of over 71.7%. The in-house trauma centers are integrated with general hospitals, leveraging existing infrastructure. The rising presence of acute care hospitals with specialized in-house trauma setups globally is expected to drive the market. The scarcity of standalone centers in Asia Pacific and the Middle East is resulting in the majority of critical patients receiving trauma care from in-house specialized trauma centers.

Governments in developing economies are undertaking initiatives to promote in-house facilities. The Government of India promoted the opening of in-house trauma care facilities under the National Program for Prevention of Trauma & Brain Injuries. The funding and availability of high-quality care at multispecialty hospitals with in-house trauma care are resulting in a growing preference among patients for such facilities.

The standalone facility type segment is expected to witness the fastest CAGR over the forecast period. This can be attributed to more patients preferring value-based and personalized care over general healthcare services. Standalone trauma centers are specially equipped and well-staffed to provide high-quality care to patients suffering from major traumatic injuries.

Trauma Type Insights

The falls segment dominated the market in 2024. The increasing geriatric population and prevalence of moderate to severe injuries, such as bruises, head trauma, and hip fractures, caused by falls, are driving this segment. As per the CDC, a 25% reduction in severe injury-related deaths has been registered among patients receiving care at trauma centers. Fall-related injuries are the most common cause of trauma, accounting for approximately 45% of the overall trauma-related Emergency Department (ED) visits. Based on the trauma type, the market is segmented into falls, Traffic-related injuries, stab/wound/cut, burn injury, brain injury, and other injuries.

Due to an increase in critical ED visits for burn injuries, the burn injury segment of the market is anticipated to register a significant growth rate over the forecast period. According to the American Burn Association, 156,073 people have sustained burn injuries in the U.S. over the past five years.

Traffic-related injuries are expected to witness lucrative growth during the forecast period. Road crashes are the primary cause of mortality for children and young adults between 5 and 29 years old. However, a significant majority, approximately two-thirds, of all road traffic deaths, involve individuals aged 18 to 59.

Service Type Insights

The market is segmented by service type into inpatient, outpatient, and rehabilitation. The outpatient segment accounted for the largest revenue share in 2024. Growing demand for these services among the elderly population, reduced costs, better reimbursement, and greater access to care are factors expected to drive this segment.

The inpatient segment is expected to be the fastest-growing segment over the forecast period, owing to the increasing number of in-house admissions for trauma victims globally. The growing complexity of trauma cases, often involving multiple organ injuries necessitating ICU admission, coupled with advancements in life-saving surgical techniques, contributes to a higher inpatient burden. For instance, according to a Chinese Medical Association study, car, motorcycle, and pedestrian accidents can result in hospitalizations lasting 56, 31, and 14 days, respectively.

The revenue gap between outpatient and inpatient services is gradually narrowing, with hospital outpatient income growing at a faster rate. According to the American Heart Association (AHA), outpatient surgeries in hospital outpatient departments and Ambulatory Surgery Centers (ASCs) are expected to increase by 19% and 25%, respectively.

Regional Insights

North America trauma care centers market dominated the global market with a revenue share of 55.0% in 2024. This can be attributed to standalone, well-established trauma care centers and hospitals with efficient reimbursement frameworks. Elevated rates of injury and substantial healthcare expenditure are significant factors propelling market growth. As per the study, Estimating the Global Incidence of Traumatic Brain Injury, published in NIH, North America had the highest incidence of Traumatic Brain Injury (TBI) globally, with approximately 1,299 cases per 100,000 individuals. This high prevalence is largely attributed to road traffic accidents and interpersonal violence.

U.S. Trauma Care Centers Market Trends

The U.S. trauma market is uniquely shaped by gun violence, necessitating mass casualty readiness, substantial trauma research funding, and increasing elderly fall-related hospitalizations. According to the Centers for Disease Control and Prevention (CDC), in 2023, 46,728 people died from gun violence. TraumaCare.AI is creating AI-powered software that delivers immediate, data-analyzed information to trauma and critical care teams.

Europe Trauma Care Centers Market Trends

Europe is expected to hold a significant share in the market over the forecast period, owing to the growing prevalence of such injuries and diseases in the geriatric population. According to Eurostat, in January 2024, the European Union's population reached approximately 449.3 million, with over 21.6% being individuals aged 65 and older, which is contributing to the demand for proper and convenient trauma care centers.

Asia Pacific Trauma Care Centers Market Trends

Asia Pacific is anticipated to witness the fastest growth during the forecast period. India and China, the two emerging Asian Pacific economies, have observed rapid economic expansion and increased healthcare spending. The need for sophisticated trauma treatment is anticipated to grow in these countries in the coming years as a result of the rising disposable income.

Key Trauma Care Centers Company Insights

The major players operating in the market are contributing to its growth by adopting various strategies such as service launches, mergers and acquisitions, partnerships, and collaborations. These facilities are committed to enhancing their inpatient and outpatient services for trauma patients. The rapid expansion of level I trauma care centers offering diverse treatment options to trauma patients is also contributing to market expansion.

-

The University of Alabama at Birmingham (UAB) Hospital is Alabama's sole American College of Surgeons (ACS)-verified Level I Trauma Center. As a leading academic medical center, UAB integrates advanced trauma care with research and education, reinforcing its commitment to excellence in patient outcomes and medical innovation.

-

Albany Medical Center, located in New York's Capital Region, is a Level I Adult and Level I Pediatric Trauma Care, verified by the ACS. It oversees a regional trauma system encompassing over 400 emergency medical service providers and 25 non-trauma hospitals.

Key Trauma Care Centers Companies:

The following are the leading companies in the trauma care centers market. These companies collectively hold the largest market share and dictate industry trends.

- UAB Health System

- Banner Health

- St. Joseph’s Hospital and Medical Center

- Albany Med Health System

- Ascension

- NYC Health + Hospitals/Bellevue

- China Medical University Hospital

- Klinikum Stuttgart

- Kaiser Foundation Health Plan, Inc.

- University Hospital Southampton NHS Foundation Trust

Trauma Care Centers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.66 billion

Revenue forecast in 2030

USD 26.87 billion

Growth rate

CAGR of 7.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Facility type, trauma type, service type, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

UAB Health System; Banner Health; St. Joseph’s Hospital and Medical Center; Albany Med Health System; Ascension; NYC Health + Hospitals/Bellevue; China Medical University Hospital; Klinikum Stuttgart; Kaiser Foundation Health Plan, Inc.; University Hospital Southampton NHS Foundation Trust.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Trauma Care Centers Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global trauma care centers market report on the basis of facility type, trauma type, service type, and region:

-

Facility Type Outlook (Revenue, USD Million, 2018 - 2030)

-

In-house

-

Standalone

-

-

Trauma Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Falls

-

Traffic-related Injuries

-

Stab/Wound/Cut

-

Burn Injury

-

Brain Injury

-

Other Injuries

-

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Inpatient

-

Outpatient

-

Rehabilitation

-

-

Regional Outlook (Revenue, USD million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.