Transthyretin Amyloidosis Treatment Market Size, Share & Trends Analysis Report By Therapy (Targeted Therapy, Supportive Therapy, Pipeline Therapy), By Type (ATTR-PN, ATTR-CM), By Disease, By Distribution Channel, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-977-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

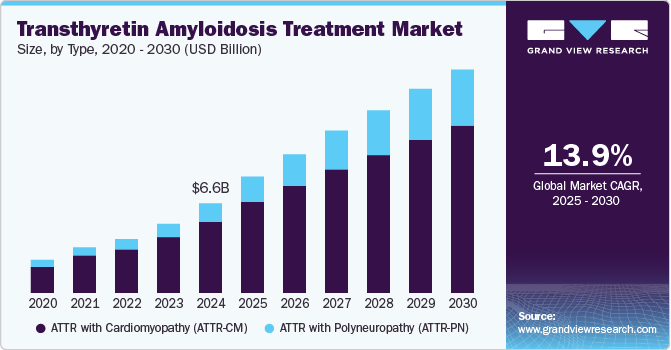

The global transthyretin amyloidosis treatment market size was estimated at USD 6.64 billion in 2024 and is projected to grow at a CAGR of 13.9% from 2025 to 2030. As demographic trends indicate a rising geriatric populace, the prevalence of this rare and complex disease escalates. This demographic shift emphasizes the urgent need for effective treatment options to manage its debilitating symptoms and halt disease progression. The growing case numbers have made it imperative for healthcare systems to focus on novel interventions tailored to this condition.

Advancements in drug development are another critical factor propelling market growth. Pharmaceutical companies are engaged in intensive research and innovation to introduce new therapies, particularly for transthyretin amyloidosis, which historically lacked robust treatment options. Recent approvals such as AstraZeneca's Eplontersen and Alnylam Pharmaceuticals' AMVUTTRA underscore the industry’s commitment to addressing the unmet medical needs associated with this disease. The ongoing clinical trials and evolving drug formulations signify a renewed optimism for patients and healthcare providers alike, expanding the landscape for effective treatment modalities.

Moreover, improved awareness and diagnostic capabilities are fostering demand for transthyretin amyloidosis treatments. Enhanced education among healthcare professionals and patients regarding this rare condition has facilitated earlier detection and diagnosis. As a result, timely interventions are more achievable, subsequently increasing patient enrollment in treatment regimens. The focus on elevating awareness around the disease ensures that those affected receive the necessary care, thereby driving market growth.

Favorable reimbursement policies significantly contribute to the market's expansion by facilitating access to advanced therapies. In regions such as North America, supportive reimbursement frameworks encourage patients and healthcare providers to consider newly approved treatment options. This financial backing alleviates the economic burden often associated with innovative therapies, making treatment more accessible to a broader range of patients. Moreover, the collaboration between research institutions and pharmaceutical companies further enhances the development of effective, targeted therapies.

Therapy Insights

Targeted therapy dominated the market and accounted for a share of 86.9% in 2024, owing to the effectiveness of therapies such as tafamidis and patisiran, which directly address the disease's causes, enhance patient outcomes, and impede disease progression, fueling demand among healthcare providers.

Pipeline therapy is expected to grow lucratively over the forecast period, driven by advancements in drug development and clinical research. Investments by pharmaceutical companies in innovative treatments for both hereditary and wild-type forms are poised to yield new options. Current clinical trials focus on enhancing efficacy and minimizing side effects, further meeting the needs of underserved patient populations.

Type Insights

ATTR with Polyneuropathy (ATTR-PN) led the market with a revenue share of 79.3% in 2024, driven by its high prevalence and the significant neurological symptoms that necessitate effective management. Heightened awareness of this condition, coupled with advancements in treatment options, has led healthcare providers to prioritize therapies focused on polyneuropathy. Moreover, improved diagnostic capabilities enable earlier detection, facilitating timely interventions that yield better patient outcomes.

ATTR with Cardiomyopathy (ATTR-CM) is expected to grow at the fastest CAGR of 5.6% over the forecast period due to increasing awareness and improved diagnostic methods allowing for earlier identification of cardiomyopathy associated with transthyretin amyloidosis. As healthcare professionals enhance their understanding of the symptoms and implications of ATTR-CM, the demand for targeted therapies is anticipated to rise significantly.

Disease Insights

Wild type amyloidosis held the largest market share of 55.1% in 2024, supported by greater recognition and diagnosis, particularly among older adults at higher risk. This demographic trend has resulted in an increased incidence, driving demand for effective treatment options. Furthermore, advancements in understanding the disease pathology and the emergence of targeted therapies have bolstered healthcare providers' confidence in managing wild type amyloidosis effectively.

Hereditary transthyretin amyloidosis is expected to register the fastest CAGR of 13.9% over the forecast period, propelled by the rise in genetic testing and awareness initiatives aimed at early identification of familial cases. An increasing number of diagnoses is generating demand for specialized treatments, while ongoing research into gene-silencing therapies further expands the treatment landscape and enhances market growth prospects.

Distribution Channel Insights

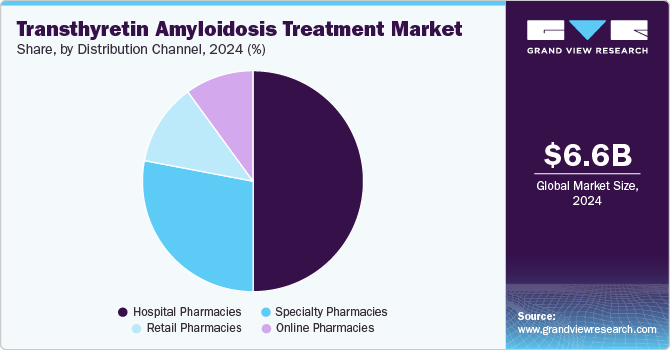

Hospital pharmacies dominated the market and accounted for a share of 50.0% in 2024, attributed to their critical role in providing specialized medications and comprehensive care for patients with rare diseases, such as transthyretin amyloidosis. Their expertise in managing complex therapies ensures tailored treatment for patients. Moreover, hospital pharmacies often collaborate closely with healthcare providers to monitor patient outcomes and adjust treatment plans effectively.

Online pharmacies are projected to grow at the fastest CAGR of 14.7% over the forecast period. There has been a shift in consumer preferences toward convenience and accessibility for obtaining medications, particularly for chronic conditions such as transthyretin amyloidosis. The proliferation of telehealth services and digital health platforms enhances access to prescriptions, making online pharmacies increasingly attractive to patients seeking efficient healthcare solutions, including competitive pricing and home delivery options.

Regional Insights

North America transthyretin amyloidosis treatment market dominated the global market with a revenue share of 47.8% in 2024. Increased awareness, favorable reimbursement policies, and innovative therapies encourage patient treatment-seeking behavior. Collaborations between pharmaceutical companies and research institutions are driving innovation, enhancing patient outcomes, and reinforcing North America's competitive advantage in the global market.

U.S. Transthyretin Amyloidosis Treatment Market Trends

The transthyretin amyloidosis treatment market in the U.S. dominated North America with the largest revenue share in 2024. Leading pharmaceutical companies facilitate rapid drug approvals and innovative treatment options. In addition, patient assistance programs improve therapy accessibility, while heightened awareness among healthcare professionals results in more timely diagnoses and interventions.

Europe Transthyretin Amyloidosis Treatment Market Trends

Europe transthyretin amyloidosis treatment market held substantial market share in 2024. Countries such as Germany and France are investing in healthcare infrastructure to improve access to specialized treatments. Ongoing clinical trials and research initiatives foster innovation, while collaboration between healthcare providers and pharmaceutical companies ensures timely and effective patient treatments.

The transthyretin amyloidosis treatment market in Germany is expected to grow in the forecast period. The country's advanced healthcare system enables access to cutting-edge therapies and clinical trials. Moreover, several key pharmaceutical companies contribute to developing transthyretin amyloidosis treatments, fostering innovation and availability. Increased healthcare professional awareness of disease symptoms promotes earlier diagnosis and treatment initiation, further propelling market growth.

Asia Pacific Transthyretin Amyloidosis Treatment Market Trends

Asia Pacific transthyretin amyloidosis treatment market is expected to register the fastest CAGR of 6.1% in the forecast period. Countries including Japan and Australia are advancing diagnostic capabilities and treatment options for transthyretin amyloidosis. The region's growing geriatric population contributes to higher disease incidence, driving demand for effective therapies. Collaborations between local healthcare providers and international pharmaceutical companies foster innovation and expand access to novel treatments.

The transthyretin amyloidosis treatment market in China dominated the Asia Pacific transthyretin amyloidosis treatment market in 2024. The Chinese government prioritizes health improvements, enhancing diagnostic and treatment access for transthyretin amyloidosis. Rising healthcare professional awareness facilitates earlier diagnoses and interventions, significantly increasing demand for effective therapies and positioning China as a key player in the region's market.

Key Transthyretin Amyloidosis Treatment Company Insights

Some key companies operating in the market include Pfizer Inc.; Alnylam Pharmaceuticals, Inc.; Ionis Pharmaceuticals; and AstraZeneca; among others. Organizations are pursuing strategic mergers, acquisitions, and partnerships, while increasing R&D investment to enhance product portfolios, improve patient access, and meet rising treatment demand.

-

Alnylam Pharmaceuticals, Inc. specializes in RNA interference therapeutics for transthyretin amyloidosis (ATTR), with its flagship product, vutrisiran, targeting both mutant and wild-type transthyretin to reduce protein accumulation. Nucresiran, a promising next-generation therapy, is advancing through clinical trials to transform ATTR treatment paradigms and improve patient outcomes.

-

AstraZeneca concentrates on therapeutics that target the root causes of ATTR. The company's dedication to innovation, clinical research, and strategic partnerships enhances drug development and ensures improved treatment accessibility for patients.

Key Transthyretin Amyloidosis Treatment Companies:

The following are the leading companies in the transthyretin amyloidosis treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Pfizer Inc.

- Alnylam Pharmaceuticals, Inc.

- Ionis Pharmaceuticals

- AstraZeneca

- Akcea Therapeutics

- BridgeBio Inc.

- Intellia Therapeutics, Inc.

- SOM BIOTECH

- Oncopeptides AB

- Takeda Pharmaceutical Company Limited

Recent Developments

-

In November 2024, Alnylam Pharmaceuticals announced FDA acceptance of their supplemental New Drug Application for vutrisiran to treat ATTR amyloidosis with cardiomyopathy, with a PDUFA date set for March 23, 2025.

-

In October 2024, Wainzua (eplontersen) received a positive EU CHMP approval recommendation for treating hereditary transthyretin-mediated amyloidosis, demonstrating sustained benefits in neuropathy and quality of life versus placebo in Phase III trials.

Transthyretin Amyloidosis Treatment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 8.64 billion |

|

Revenue forecast in 2030 |

USD 16.53 billion |

|

Growth rate |

CAGR of 13.9% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Therapy, type, disease, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

Pfizer Inc.; Alnylam Pharmaceuticals, Inc.; Ionis Pharmaceuticals; AstraZeneca; Akcea Therapeutics; BridgeBio Inc.; Intellia Therapeutics, Inc.; SOM BIOTECH; Oncopeptides AB; Takeda Pharmaceutical Company Limited |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Transthyretin Amyloidosis Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global transthyretin amyloidosis treatment market report based on therapy, type, disease, distribution channel, and region:

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Targeted Therapy

-

Vyndaqel/ Vyndamax

-

Onpattro

-

Amvuttra

-

Tegsedi

-

Wainua

-

-

Supportive Therapy

-

Pipeline Therapy

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

ATTR with Polyneuropathy (ATTR-PN)

-

ATTR with Cardiomyopathy (ATTR-CM)

-

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Hereditary Transthyretin Amyloidosis

-

Polyneuropathy

-

Cardiomyopathy

-

Mixed Type

-

-

Wild Type Amyloidosis

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Specialty Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."