Transradial Access Devices Market Size, Share & Trends Analysis Report By Product (Catheters, Guidewires), By End-use (Hospitals, Clinics & Ambulatory Care Centers), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-363-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Transradial Access Devices Market Trends

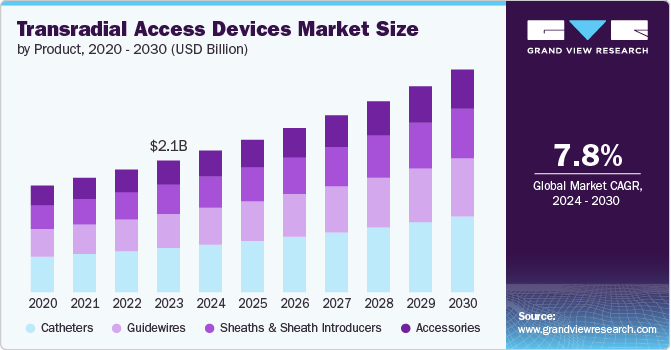

The global transradial access devices market size was estimated at USD 2.1 billion in 2023 and is projected to grow at a CAGR of 7.8% from 2024 to 2030. The market is driven by several key factors such as the increasing prevalence of cardiovascular diseases, technological advancements in interventional cardiology procedures, and growing demand for minimally invasive surgeries. Furthermore, the increasing adoption of transradial access techniques by healthcare providers is expected to contribute significantly to the growth of the market.

The rising incidence of cardiovascular diseases globally is a significant driver for the market. According to the World Health Organization (WHO), cardiovascular diseases are the leading cause of mortality worldwide, with an estimated 17.9 million deaths annually. In 2021, around 695,000 people died from heart disease in the U.S. that equates to one in every 5 deaths according to U.S. Centers for Disease Control and Prevention (CDC). This high prevalence of cardiovascular conditions necessitates the use of advanced medical devices such as transradial access devices for effective diagnosis and treatment.

Advancements in interventional cardiology procedures lead to the development of innovative transradial access devices that offer improved safety, efficacy, and patient outcomes. For instance, the introduction of hydrophilic coatings on sheaths reduces friction during radial artery cannulation, enhancing procedural success rates. Technological advancements result in a lower rate of access site complications and improved patient comfort during transradial interventions.

The shift towards minimally invasive procedures across various medical specialties is fueling the demand. Patients prefer minimally invasive surgeries due to shorter hospital stays, faster recovery times, and reduced risk of complications compared to traditional open surgeries. This trend positively impacts the adoption of transradial access techniques and devices in clinical practice. For instance, in September 2023, MicroVention, a neurovascular company and a subsidiary of Terumo Corporation, announced that its Sofia EX 5-F, 115-cm intracranial support catheter has received FDA 510(k) clearance for use with both transradial and transfemoral access methods. This expanded clearance enables healthcare providers to utilize the Sofia EX 5-F catheter in a wider range of procedures, providing them with greater flexibility and versatility when treating patients.

Product Insights

The catheters segment held the largest market share of 33.6% in 2023. The rising prevalence of cardiovascular diseases and demand for minimally invasive procedures are driving growth in the transradial access devices market. This is supported by advancements in catheter design and materials, the adoption of transradial access for procedures such as angiography and angioplasty, and benefits such as reduced complications, faster recovery, and improved patient comfort. For instance, in July 2023, ALVIMEDICA received CE Mark approval and launched its Alvision Kaplan curves radial portfolio for diagnostic procedures, emphasizing a safer transradial approach with its advanced catheter design for better stability and patient outcomes.

The Guidewires segment is expected to grow at a significant rate over the forecast period. Guidewires are designed to navigate vessels to reach a lesion or vessel segment and act as a guide for larger catheters to allow rapid follow-up and easier delivery of medication to the treatment site. For instance,Terumo offers a wide range of guidewire products, including the GLIDEWIRE Hydrophilic Coated Guidewire line and the Radifocus Guide Wire M, designed for transradial access procedures. Their guidewire products feature innovative design elements including hydrophilic coatings, nitinol cores, and radiopaque jackets to provide superior lubricity, flexibility, and visibility.

End-use Insights

The hospitals segment held the largest market share of 40.4% in 2023. The rise of cardiovascular diseases and demand for minimally invasive procedures significantly drive hospitals towards transradial access devices. Benefits such as fewer complications, reduced hospital stays, and faster recovery times through these procedures encourage adoption. It is attributed to the availability of advanced medical facilities, and favorable reimbursement policies for surgeries performed in hospital settings. For instance, in October 2022, the health insurance company EmblemHealth introduced a new reimbursement policy for billing in hospital treatment rooms, further incentivizing the use of transradial access devices in the hospital setting and contributing to the rapid expansion of this market segment.

The clinics & ambulatory care centers segment is expected to witness the fastest CAGR over the forecast period. According to Cath Lab Digest, Programs, such as the Society for Cardiovascular Angiography and Interventions (SCAI), and Transradial Intervention Program (TRIP) program, provide not only physician education but also staff education focused on appropriate ambulatory setup and peri-procedural care. For transradial procedures in clinic and ambulatory care, there is a dire need for superlative staff training and education. In May 2024, a research study published in SCAI, radial artery access for percutaneous coronary interventions is superior to femoral access, with lower rates of complications. The adoption of radial access has seen a remarkable surge, increasing from 20.3% in 2013 to an impressive 57.5% by 2022 - a 2.8-fold rise over the past decade.

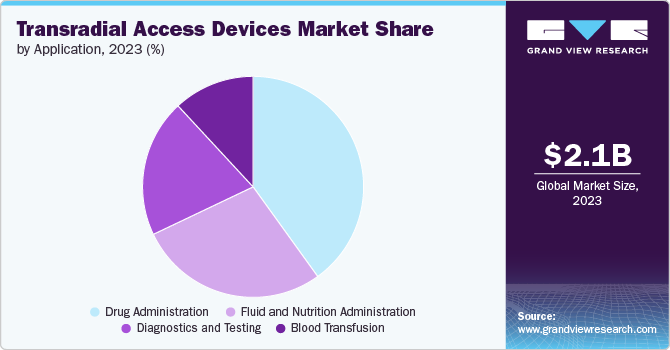

Application Insights

The drug administration segment held the largest market share of 40.1% in 2023. The drug administration segment is driven by the rising prevalence of chronic diseases such as cardiovascular disorders, increasing demand for minimally invasive procedures, and technological advancements that enhance the precision and efficiency of drug delivery. The expanding elderly population in need of regular medical interventions, and the broader use of these devices beyond conventional angiography for multiple therapeutic applications also contribute to its growth.

The diagnostics and testing segment is expected to grow at the fastest CAGR over the forecast period. The diagnostics and testing segment is driven by the increasing prevalence of cardiovascular diseases, which necessitates frequent diagnostic procedures such as angiography and angioplasty. The rising adoption of minimally invasive procedures due to their associated benefits, such as reduced recovery time and lower risk of complications, is fueling the demand for transradial access devices specifically designed for diagnostic purposes. Technological advancements, such as the development of hydrophilic coatings to enhance lubricity and reduce friction during catheter insertion, are further propelling market growth. For instance, in April 2024, Medtronic Japan announced that the company began selling of Rist Radial Access Guide Catheter, the first device in Japan designed for radial artery puncture in cerebrovascular treatment. This new catheter provides an alternative to the traditional femoral artery puncture approach.

Regional Insights

North America transradial access devices market is anticipated to witness the fastest CAGR of 8.3% over the forecast period. Increasing prevalence of cardiovascular diseases, advancements in healthcare infrastructure, and a growing preference for minimally invasive procedures drive the North American market. U.S. dominates the North American market due to the high adoption rate of advanced medical technologies and a well-established healthcare system.

The demand for transradial access devices in North America is also fueled by the rising geriatric population and the increasing awareness about the benefits of radial access procedures in reducing complications and improving patient outcomes. The market in North America is witnessing accelerated growth, driven by growing product approvals. For instance, in September 2021, Medtronic, a global pioneer in medical technology, received CE mark approval for its radial artery access portfolio, which features the Rist 079 Radial Access Guide Catheter and Rist Radial Access Selective Catheter.

U.S. Transradial Access Devices Market Trends

The transradial access devices market in the U.S. is expected to grow from 2024 to 2030. The U.S. is a key player in the market, with a strong focus on technological innovation and research and development activities. This market is driven by the rising prevalence of chronic diseases, increasing healthcare expenditure, and a shift towards outpatient care. The country’s well-developed healthcare infrastructure and favorable reimbursement policies further contribute to the expansion of the market.

Europe Transradial Access Devices Market Trends

Europe transradial access devices market was identified as a lucrative region in this industry. In Europe, the transradial access devices market is witnessing notable growth attributed to the increasing adoption of minimally invasive procedures, advancements in interventional cardiology techniques, and a growing emphasis on patient safety and comfort. Countries such as Germany, France, and the UK are leading contributors to the European market for transradial access devices.

The region’s supportive regulatory environment, along with initiatives promoting early diagnosis and treatment of cardiovascular conditions, are driving market growth in Europe. For instance, in May 2024, Demax Group, headquartered in Beijing, China and a developer of cardiovascular interventional devices, received CE certification for its eleven lines of interventional products, including catheters and radial artery compression tourniquets, complying with the EU's Medical Devices Regulation (MDR). This marks a significant advancement in coronary, neuro, and peripheral intervention technologies.

Asia Pacific Transradial Access Devices Market Trends

Asia Pacific transradial access devices market dominated the market with 25.4% of revenue share in 2023. This region is emerging as a lucrative market due to factors such as a large patient pool with cardiovascular diseases, improving healthcare infrastructure, and increasing awareness of radial artery access among healthcare professionals. Rapid market expansion in countries such as China, India, and Japan, driven by increased awareness about minimally invasive procedures among both patients and healthcare providers. The Asia Pacific market for transradial access devices is also benefiting from collaborations between medical device manufacturers and local healthcare facilities to enhance product accessibility and affordability in this region.

Key Transradial Access Devices Company Insights

Key players operating in the market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling the market growth.

Key Transradial Access Devices Companies:

The following are the leading companies in the transradial access devices market. These companies collectively hold the largest market share and dictate industry trends.

- TERUMO CORPORATION

- Medtronic

- Boston Scientific Corporation

- BD

- Cordis

- AngioDynamics

- Merit Medical Systems

- Edwards Lifesciences Corporation

- NIPRO MEDICAL CORPORATION

- Abbott

- Teleflex Incorporated

- Surmodics, Inc.

Recent Developments

-

In January 2024, AngioDynamics announced U.S. FDA 510(k) clearance for its Auryon XL catheter for peripheral artery disease treatment. The catheter, designed for radial access and spanning 225 cm, began its limited market release in the U.S. in January 2024, with plans for a full market release in February 2024.

-

In November 2023, Cordis, one of the global leaders in cardiovascular technologies announced the completion of patient enrollment in the RADIANCY pre-market study, aiming for CE Mark approval in Europe for its SMART Radianz stent system. The study evaluates the system's safety and efficacy in treating artery lesions via radial artery access, involving 151 patients across twelve sites in Europe, with a 30-day follow-up.

Transradial Access Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.30 billion |

|

Revenue forecast in 2030 |

USD 3.62 billion |

|

Growth rate |

CAGR of 7.8% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end-use, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

TERUMO CORPORATION; Medtronic; Boston Scientific Corporation; BD; Cordis; AngioDynamics; Merit Medical Systems; Edwards Lifesciences Corporation; NIPRO MEDICAL CORPORATION; Abbott; Teleflex Incorporated; Surmodics, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Transradial Access Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global transradial access devices market report based on product, end-use, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Catheters

-

Guidewires

-

Sheath & Sheat Introducers

-

Accessories

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics & Ambulatory Care Centers

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Administration

-

Fluid and Nutrition Administration

-

Blood Transfusion

-

Diagnostics and Testing

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global transradial access devices market size was estimated at USD 2.1 billion in 2023 and is expected to reach USD 2.30 billion in 2024.

b. The global transradial access devices market is expected to grow at a compound annual growth rate of 7.8% from 2024 to 2030 to reach USD 3.62 billion by 2030.

b. Asia Pacific dominated the transradial access devices market with a share of 25.38% in 2023. This is attributable to the high adoption of the radial approach among healthcare professionals and an increasing number of cardiovascular disorders in the region

b. Some key players operating in the transradial access devices market include B. Braun; Boston Scientific; Teleflex Incorporated; Terumo Corporation; Medtronic; and AngioDynamics

b. Key factors that are driving the market growth include increasing cardiovascular disease burden, growing preference for interventional procedures using radial artery access, and cost benefits associated with these procedures.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."