- Home

- »

- Advanced Interior Materials

- »

-

Transparent Ceramics Market Size And Share Report, 2030GVR Report cover

![Transparent Ceramics Market Size, Share & Trend Report]()

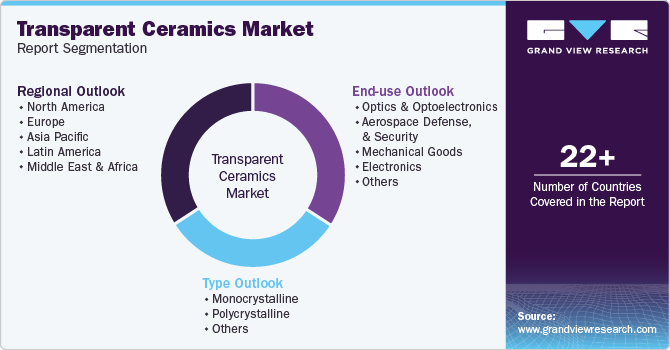

Transparent Ceramics Market (2024 - 2030) Size, Share & Trend Analysis Report, By Type (Monocrystalline, Polycrystalline), By End-use (Optics & Optoelectronics, Aerospace Defense, & Security), By Region, And Segment Forecasts

- Report ID: 978-1-68038-869-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Transparent Ceramics Market Size & Trends

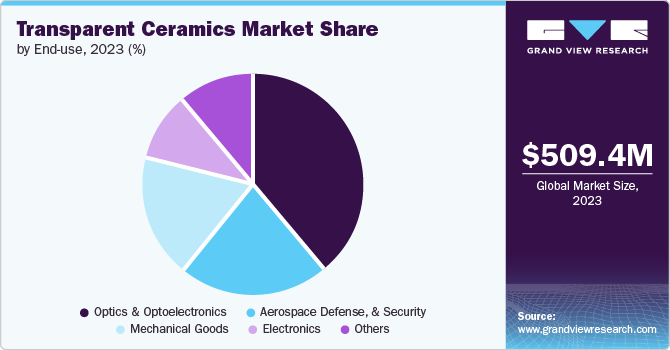

The global transparent ceramics market size was valued at USD 509.4 million in 2023 and is projected to grow at a CAGR of 14.5% from 2024 to 2030. The global market is anticipated to grow due to increasing demands across various sectors, focusing on R&D to innovate and broaden product applications. Specifically, advancements in transparent ceramics drive significant growth, fueled by their expanding use in aerospace, defense, healthcare, and infrastructure development. Novel applications in photography and imaging devices underpin this growth.

Transparent ceramics are becoming preferred over conventional glass in many industries due to their lightweight, high durability, and improved visibility. Due to their exceptional characteristics, they are widely used in the military for transparent armor and other high-tech applications. Advances in fabrication techniques have significantly enhanced their thermal, mechanical, and optical properties.

The rising utilization of transparent ceramics in solar panels is expected to contribute to the market's growth. When sunlight enters through solar panels, it heats the double-wall glass absorber pipe to around 400°C. Regular tempered glass has a melting point of 315°C and cannot withstand such high temperatures. In contrast, clear ceramic glass has a melting point of approximately 800°C. Recent advancements made it possible to shape ceramics into various forms, such as tubes and rods. They are used in industrial and chemical sectors, including abrasives, furnaces, semiconductor equipment, and lighting.

The application scope has expanded due to ongoing research and development efforts from different institutes and companies. For instance, ALON windows and domes are under assessment in various airborne laser systems such as Airborne laser data links, Counter Manpads, Laser rangefinders, Laser target designators, Laser radars, etc. Transparencies are utilized to shield the laser system from external influences. In this case, transparency is described as a window or a dome. This implies that the laser beam must pass through the transparency effectively, with minimal absorption, scatter, and minimal distortion.

Type Insights

The monocrystalline segment dominated the market and accounted for a share of 53.9% in 2023 as the substance is primarily utilized in solar panels due to its elevated melting point and minimal susceptibility to corrosion. It is utilized as insulation in Solar Photovoltaic (PV) panels due to the increasing popularity of renewable energy. This is predicted to enhance market expansion during the forecast period.

The polycrystalline segment is expected to grow at the fastest CAGR of 14.6% over the forecast period. Polycrystalline is set to rapidly expand because of its reliable performance and eco-friendliness, driven by its unique features, such as easy manufacturing and superior mechanical properties. For instance, tetragonal zirconia polycrystal (TZP) ceramics are promising materials due to their superior thermal and mechanical characteristics. Yttria-stabilized tetragonal zirconia (Y-TZP) ceramics comprise tetragonal zirconia (t-ZrO2) grains with around 2-3 mol% of Y2O3 in a solid solution. These ceramics are valued for their use in adiabatic engine components within ceramic-metal composite systems for thermal insulation.

End-use Insights

Optics and optoelectronics segment accounted for the largest market revenue share of 39.4% in 2023. The growth of this application segment is being propelled by new product innovations along with cost-effective and cutting-edge technologies. According to the Journal of the American Ceramic Society, cerium-doped yttria ceramics, enhanced with 10% La2O3 and 1% ZrO2, exhibit an optical absorption edge shift from 290 nm to 380 nm with up to 3% Ce doping due to 4f-5d transitions in Ce3+ ions. These ceramics demonstrate near-total UV radiation blocking (1.7% transmittance in the 220-400 nm range) with high visibility and infrared transmittance, exceeding 70% at 450 nm and about 80% at 1100 nm for 2 mm thick samples.

Others segment is expected to grow at the fastest CAGR of 15.7% over the forecast period. Transparent ceramics are utilized in diverse industries beyond optics and defense, including medical imaging devices, laser surgery, LED lighting, automotive components such as windshields and headlight covers, consumer goods such as watch crystals and synthetic gemstones, environmental monitoring sensors, and food inspection equipment. Their unique properties, including optical clarity, hardness, and thermal and chemical damage resistance, make them ideal for these applications. These materials provide durability and performance advantages across these various fields.

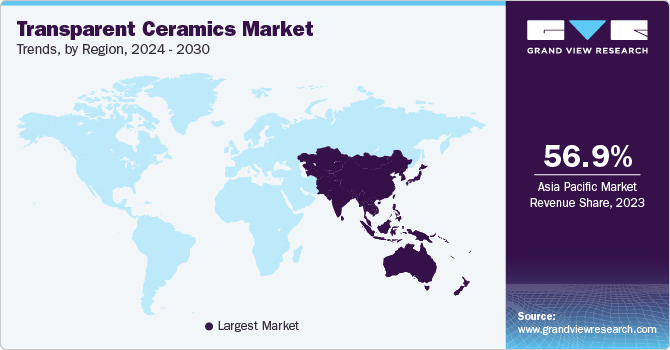

Regional Insights

North America transparent ceramics is anticipated to witness significant growth in the market. Increasing utilization of transparent ceramics over conventional ceramics in the region is driving the market. Rising investment for developing advanced transparent ceramic products is expected to boost the market in the region.

U.S. Transparent Ceramics Market Trends

The transparent ceramics market in the U.S. held a significant share in 2023 due to the country's high utilization of transparent ceramics. High usage of transparent ceramics in aircraft manufacturing, vehicle armor, and bulletproof windows is expected to fuel the U.S. transparent ceramic market. For instance, in July 2023, CoorsTek Inc. expanded into body armor by buying a ceramic plate plant from Avon Protection in Lexington, Kentucky, and investing in its Benton, Arkansas, facility. It became a top supplier of military ceramic plates to improve battlefield protection for servicemembers.

Europe Transparent Ceramics Market Trends

Europe transparent ceramics market was identified as a lucrative region in this industry. Strategies to expand the business in different regions, moreover transparent ceramics are increasingly being utilized in optics and laser systems, which is also driving the growth of the European transparent ceramics market. For instance, in April 2024, KYOCERA Corporation, known for its fine ceramic components, established a new company, KYOCERA Fineceramics Medical GmbH (KFMG), to enter the medical ceramic ballhead market. This move represents a strategic expansion and growth initiative, showcasing Kyocera's commitment to innovation and progress. By investing in new facilities and locations, the company aims to enhance its offerings and simplify life for its customers.

The UK transparent ceramics market is expected to grow rapidly in the coming years due to the increasing utilization of transparent ceramics in the electronic industry about their property of high thermal conductivity

Germany transparent ceramics market held a substantial market share in 2023 owing to recent partnerships and acquisitions made by advanced manufacturers. For instance, in April 2021, the transparent ceramics division of CeramTec GmbH was acquired by the Fraunhofer Institute for Ceramic Technologies and Systems (IKTS). The institute is enhancing its capabilities in the development of transparent ceramics. The acquisition provided the technical infrastructure to set up a research and development center for transparent ceramics at the IKTS location in Hermsdorf.

Asia Pacific Transparent Ceramics Market Trends

Asia Pacific transparent ceramics market dominated the market with a share of 56.9% in 2023 due to the high demand for transparent ceramics in the region. Usage of advanced transparent ceramics in thermal imaging and personal protection equipment is expected to fuel the growth of the market. For instance, in September 2021, Indian researchers successfully developed transparent ceramics using colloidal processing, along with applying temperature and pressure, achieving theoretical transparency. The material is suitable for thermal imaging applications and personal protection equipment such as helmets, face shields, and goggles, especially in tough operating conditions.

Japan transparent ceramics market is expected to grow rapidly in the coming years due to growing demand in the semiconductor industry, fueled by technological advancements and increased electronic device production. Japan's emphasis on innovation and industrial growth, especially in high-tech sectors, further boosts the need for advanced materials such as transparent ceramics. This demand is also supported by the country's expanding manufacturing capabilities. For instance, in July 2022, CoorsTek KK announced that CoorsTek Inc.'s board of directors approved a capital expenditure plan to expand its semiconductor ceramics business due to strong market demand. The company invested in increasing manufacturing capabilities at Japan facilities, and the new capacity was planned to be operational in 2024.

China transparent ceramics market held a substantial market share in 2023 owing to the country's high utilization of transparent ceramics. Underway research studies for developing novel transparent ceramics are expected to drive the market. According to an article published by the Journal of Advanced Ceramics stated that Cerium-doped Y2O3 ceramics with excellent mechanical and thermal properties are suitable for UV protection in extreme environments. In this study, CeO2 was added to Y2O3 transparent ceramics as a UV absorber for UV protection. The results suggested that CeO2 acts as both a UV absorber and an efficient sintering aid for Y2O3 transparent ceramics.

Latin America Transparent Ceramics Market Trends

Latin America transparent ceramics market is expected to grow rapidly during the forecast period. Government spending on infrastructure development in the region has led to a surge in demand for transparent ceramics.

Brazil transparent ceramics market is expected to register significant growth in the coming years owing to the country's accessibility to advance and sustainable transparent ceramics and its increasing investment in infrastructure.

Middle East & Africa Transparent Ceramics Market Trends

The Middle East and Africa transparent ceramics market is expected to grow rapidly during the forecast period. The region's availability of low-cost, transparent ceramics is responsible for the market's growth.

Saudi Arabia transparent ceramics market is expected to grow exponentially during the forecast period due to recent collaborations between leading ceramic manufacturing companies.

Key Transparent Ceramics Company Insights

Some of the key companies in the transparent ceramics market include CoorsTek Inc.; Surmet.com; Schott AG and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

CoorsTek, Inc. produces parts made from sophisticated precision-machined metals, technical ceramics, and engineered plastics. The Company creates solutions that help its customers' products surpass technological obstacles and improve performance. CoorsTek serves various industries such as chemical processing, medical, mining and mineral, telecommunications, electronics, automotive, and more.

-

Surmet.com is a global frontrunner in surface metallurgy, engineered coatings, and advanced materials solutions. Surmet produces optically clear ceramics for various uses. Currently, the company produces ALON, Spinel, and Yttrium Oxide.

Key Transparent Ceramics Companies:

The following are the leading companies in the transparent ceramics market. These companies collectively hold the largest market share and dictate industry trends.

- CoorsTek Inc.

- Surmet.com

- Schott AG

- CILAS

- Brightcrystals Technology Inc.

- CeramTec GmbH

- Konoshima Chemical Co.,Ltd.

- Murata Manufacturing Co., Ltd.

- Ceranova

- KYOCERA Fineceramics Europe GmbH

Recent Developments

-

In September 2022, Surmet.com, in collaboration with Gilbane Building Company, announced the enhanced North Buffalo Facility at 699 Hertel Ave. This significant upgrade involved a USD 14.5 million financial commitment to renovate the premises, add bespoke areas, and acquire advanced manufacturing equipment dedicated to transparent ceramics production. The Gilbane Building Company expertly managed the expansion project.

-

In August 2022, Surmet.com announced an expansion in its manufacturing endeavors related to Aluminum Nitride (AlN). Aluminum nitride ceramics' advantageous characteristics, including their superior thermal conductivity, minimal dielectric constant and loss, high strength of insulation, and exceptional resistance against plasma erosion, facilitated their application across numerous domains.

Transparent Ceramics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 560.4 million

Revenue forecast in 2030

USD 1.26 billion

Growth rate

CAGR of 14.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Russia, Japan, China, India, South Korea, Brazil, Saudi Arabia, UAE

Key companies profiled

CoorsTek Inc.; Surmet.com; Schott AG; CILAS; Brightcrystals Technology Inc.; CeramTec GmbH; Konoshima Chemical Co.,Ltd.; Murata Manufacturing Co., Ltd.; Ceranova; KYOCERA Fineceramics Europe GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Transparent Ceramics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global transparent ceramics market report based on type, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Monocrystalline

-

Polycrystalline

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Optics & Optoelectronics

-

Aerospace Defense, & Security

-

Mechanical Goods

-

Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.