Transformer Monitoring System Market Size, Share & Trends Analysis Report, By Component (Hardware Solutions, Software Solutions), By Type (Oil-immersed, Cast-resin), By Services, By Voltage, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-371-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Market Size & Trends

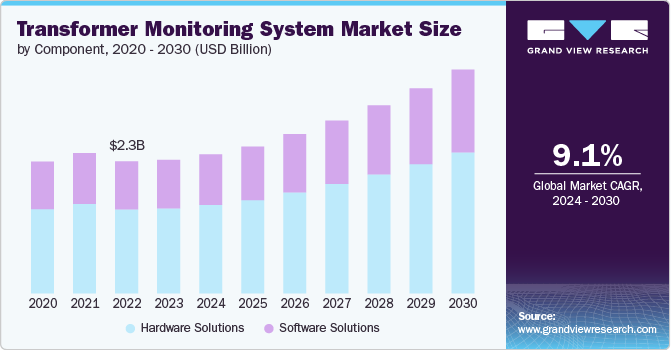

The global transformer monitoring system market size was estimated at USD 2.48 billion in 2023 and expected to grow at a CAGR of 9.1% from 2024 to 2030. The growing demand for reliable and efficient power distribution is a major driver of the market. Transformers are critical assets in the power grid, and unexpected transformer failures can be costly, both in terms of property damage and unplanned outages. Transformer monitoring solutions play a crucial role in reducing the risk of such failures by providing real-time insights into the health and performance of transformers. The increasing adoption of smart grid technologies, which rely on advanced monitoring and control systems, is another key driver.

As renewable energy sources become more prevalent, the need for accurate demand forecasting and proactive maintenance of transformers becomes even more important. Additionally, stringent regulations and safety standards are pushing utilities and industrial facilities to invest in transformer monitoring solutions that can detect issues early and prevent catastrophic failures. The availability of cost-effective, IoT-enabled monitoring technologies has further accelerated the growth of this market, as companies seek to optimize their transformer asset management and improve overall grid reliability and efficiency.

Drivers, Opportunities & Restraints

The key drivers of the transformer monitoring systems market include the growing demand for reliable and uninterrupted power supply, the need to detect and prevent transformer failures, the adoption of smart grid technologies, the focus on renewable energy sources, and the availability of cost-effective IoT-enabled monitoring solutions that optimize asset management and improve grid efficiency.

The key opportunities in the market include the growing demand for reliable and efficient power distribution, the adoption of smart grid technologies, the focus on renewable energy sources, the need to detect and prevent transformer failures, and the availability of cost-effective IoT-enabled monitoring solutions that optimize asset management and improve grid efficiency.

The key restraints of the market include the high initial installation and integration costs, the complexity of integrating new monitoring systems with existing legacy infrastructure, and the lack of standardization in monitoring protocols and data formats across the industry.

Component Insights

Hardware solutions held the market with the largest revenue share of 63.49% in 2023. The segment is driven by the growing demand for reliable power supply, adoption of smart grid technologies, and focus on renewable energy sources. However, high upfront costs and integration complexities with legacy systems are key restraints.

The software solutions segment is driven by the growing demand for predictive maintenance, integration with smart grid technologies, and the adoption of advanced analytics powered by AI and machine learning. However, the high costs and complexity of integrating these software solutions with existing legacy systems remain key restraints, as utilities and companies must carefully evaluate the return on investment before implementing new software-based transformer monitoring capabilities.

Services Insights

Oil monitoring segment held the largest revenue share of 34.45% in 2023. The segment is driven by the need for real-time monitoring of transformer health, enabling early detection of issues and supporting proactive maintenance. This segment is critical for assessing transformer health by analyzing oil parameters such as temperature and chemical composition.

Partial discharge monitoring helps detect and analyze electrical discharges within the transformer, which can indicate insulation degradation and potential failures. This allows utilities and industrial facilities to take proactive maintenance measures to prevent costly and disruptive transformer breakdowns. Oil monitoring, on the other hand, involves analyzing the transformer's insulating oil to identify changes in parameters like temperature, acidity, and moisture content. This provides valuable insights into the transformer's condition and enables predictive maintenance strategies.

Type Insights

Oil-immersed segment held the largest revenue share of 75.59% in 2023. The segment is driven by the growing demand for reliable and efficient power distribution, the need to detect and prevent transformer failures, and the adoption of smart grid technologies. Factors like the focus on renewable energy sources and the availability of cost-effective IoT-enabled monitoring solutions are also fueling market growth.

The cast-resin segment is driven by the growing demand for reliable power supply, the need for predictive maintenance, and the adoption of smart grid technologies. However, high upfront costs and integration complexities are expected to restrain the growth of the segment.

Voltage Insights

The medium voltage segment held the largest revenue share of 50.21% in 2023. Medium voltage transformers, operating in the 1 kV to 72.5 kV range, are essential components of electrical distribution networks, facilitating the safe and efficient transmission and utilization of power.

The adoption of IoT-enabled monitoring technologies, combined with the integration of data analytics and AI, has further enhanced the capabilities of high and extra high voltage transformer monitoring systems. These advanced solutions provide valuable insights into transformer health, enabling early detection of issues and facilitating proactive maintenance strategies. This, in turn, helps to improve overall grid reliability, reduce operational costs, and extend the lifespan of these critical power assets.

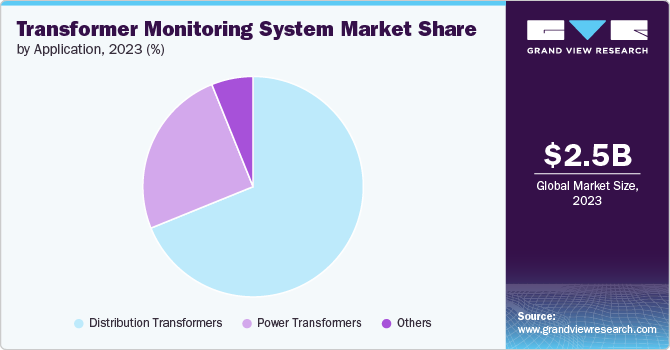

Application Insights

Distribution transformers held the market with the largest revenue share of 68.87% in 2023. Distribution transformers, which step down high-voltage electricity to lower voltages suitable for residential and commercial use, play a vital role in the reliable and efficient delivery of power to end consumers.

Factors such as grid modernization, renewable energy integration, and the adoption of smart grid technologies further contribute to the demand for advanced monitoring solutions. These enable real-time monitoring of parameters like partial discharge, oil condition, and load tap changer performance, facilitating predictive maintenance and optimized asset management.

Regional Insights

The North America market is driven by the need for reliable power supply, grid modernization initiatives, and the integration of renewable energy sources. Key factors include aging infrastructure, focus on preventive maintenance, and the adoption of IoT and AI technologies. The market is expected to grow significantly, with the US and Canada being the major contributors. However, high initial costs and integration complexities remain as restraints.

U.S. Transformer Monitoring Systems Market Trends

The U.S. market is a key segment of the North American market, driven by the need for reliable power supply, grid modernization initiatives, and the integration of renewable energy sources. Aging infrastructure, focus on preventive maintenance, and the adoption of IoT and AI technologies are major factors driving growth. Key players in the U.S. market include GE, ABB, Siemens, and Schneider Electric. However, high initial costs and integration complexities with legacy systems remain as restraints. The U.S. market is expected to continue its upward trajectory as utilities prioritize reliability, efficiency, and sustainability in power distribution networks.

Europe Transformer Monitoring Systems Market Trends

Germany, the UK, and France are the major contributors to the European market, collectively accounting for a significant share of the regional market. However, high initial costs and integration complexities with legacy systems remain as key restraints, particularly for smaller utilities and industrial facilities.

The UK government's commitment to achieving net-zero emissions by 2050 has further accelerated the integration of renewable energy sources, which has increased the importance of transformer health monitoring. Utilities in the UK are increasingly investing in IoT-enabled monitoring technologies, data analytics, and AI-powered algorithms to gain real-time insights into transformer performance and optimize asset management.

Key factors driving the Germany market include the need for predictive maintenance, the focus on reducing operational costs, and the integration of smart grid technologies. Leading players in the market, such as Siemens, ABB, and Schneider Electric, are offering comprehensive monitoring solutions tailored to the specific requirements of German utilities and industrial customers.

Asia Pacific Transformer Monitoring Systems Market Trends

The Asia Pacific market is expected to grow at a CAGR of 8.71% from 2024 to 2030, driven by rapid urbanization and industrialization, and the increasing reliance on renewable energy sources.

The country's rapid urbanization and industrialization, coupled with the growing reliance on renewable energy sources, are key factors fueling the market's growth. China is the largest and fastest-growing market in the Asia Pacific region, with a significant demand for advanced monitoring solutions to ensure reliable power supply and prevent costly outages

The market in India is experiencing significant growth, driven by increasing demand for reliable and efficient power infrastructure. Advancements in IoT and AI technologies are enhancing real-time monitoring and predictive maintenance capabilities, thereby reducing downtime and operational costs. The government's focus on upgrading the power grid and promoting smart grid initiatives further fuels market expansion. Key players are investing in innovative solutions to improve transformer performance and longevity, positioning India as a dynamic hub for transformer monitoring advancements.

Central & South America Transformer Monitoring Systems Market Trends

Central and South America are actively pursuing renewable energy targets, with countries like Brazil, Chile, and Argentina leading the way. The integration of renewable energy sources, such as solar and wind, requires flexible and adaptive transformer monitoring solutions to manage bidirectional power flows and voltage fluctuations.

Middle East & Africa Transformer Monitoring Systems Market Trends

The Middle East and Africa market presents significant growth opportunities driven by the region's rapid industrialization and infrastructure development, Countries like South Africa, Saudi Arabia, and the UAE, with well-established power infrastructure and manufacturing capabilities, are poised to drive the market's expansion.

KeyTransformer Monitoring Systems Company Insights

The market is a highly competitive industry with several key players operating globally. Established players are acquiring smaller companies or startups with specialized technologies or market reach. This helps them expand product offerings and geographical presence. The market is witnessing consolidation as major players acquire smaller competitors to strengthen their market position. This reduces competition and allows for more streamlined operations and better resource utilization.

Key Transformer Monitoring Systems Companies:

The following are the leading companies in the transformer monitoring systems market. These companies collectively hold the largest market share and dictate industry trends.

- GE

- ABB

- Siemens Energy AG

- Schneider Electric

- Eaton

- Mistras Group

- Mitsubishi Electrical Corporation

- Hitachi Energy Ltd

- KJ Dynatech Inc

- Maschinenfabrik Reinhausen GmbH

Recent Developments

-

In February 2024,Ubicquia launched an electronic transformer fault detector which is designed to remotely detect transformers faults and eliminate needless replacements. The system can be installed in a warehouse, factory or on the field in an energized transformer in less than 10 minutes.

-

In February 2023, Itron launched transformer monitoring solution for monitoring transformer load and voltage. The solution is designed to optimize capacity and operational life of the transformers.

Transformer Monitoring Systems Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.69 billion |

|

Revenue forecast in 2030 |

USD 4.52 billion |

|

Growth rate |

CAGR of 9.1% from 2024 to 2030 |

|

Historical data |

2018 - 2022 |

|

Base Year |

2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Component,type, services, voltage, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Russia; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE |

|

Key companies profiled |

GE; ABB; Siemens Energy AG; Schneider Electric; Eaton; Mistras Group; Mitsubishi Electrical Corporation; Hitachi Energy Ltd; KJ Dynatech Inc; Maschinenfabrik Reinhausen GmbH |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Transformer Monitoring System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented global transformer monitoring systems market report based on component, type, services, voltage, application, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware Solutions

-

Software Solutions

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil-immersed

-

Cast-resin

-

Others

-

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil Monitoring

-

Bushing Monitoring

-

Partial Discharge Monitoring

-

OLTC Monitoring

-

Others

-

-

Voltage Outlook (Revenue, USD Million, 2018 - 2030)

-

Low Voltage

-

Medium Voltage

-

High & Extra High voltage

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Distribution Transformers

-

Power Transformers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global transformer monitoring system market size was estimated at USD 2.48 billion in 2023 and is expected to reach USD 2.69 billion in 2024

b. The global transformer monitoring system market is expected to grow at a compounded annual growth rate of 9.1% from 2024 to 2030 to reach USD 4.52 billion by 2030.

b. Hardware Solutions dominated the transformer monitoring system market with the highest share of 63.49% in 2023. Hardware Solutions segment is driven by rising demand for reliable and efficient power systems, necessitating advanced monitoring solutions to prevent failures and minimize downtime.

b. Some key players operating in the battery market include GE, ABB , Siemens Energy AG, Schneider Electric, Eaton , Mistras Group, Mitsubishi Electrical Corporation, Hitachi Energy Ltd and, KJ Dynatech Inc

b. Growing energy consumption and the expansion of power grids necessitate reliable transformer performance and monitoring to prevent failures and ensure efficient operations are the key factors driving the Transformer Monitoring System market over the forecast period

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."