- Home

- »

- Distribution & Utilities

- »

-

Transfer Case Market Size And Share, Industry Report, 2030GVR Report cover

![Transfer Case Market Size, Share & Trends Report]()

Transfer Case Market (2025 - 2030) Size, Share & Trends Analysis Report By Vehicle (ICE Vehicles, Hybrid Vehicles, Off Highway Vehicles), By Drive (Gear Driven, Chain Driven), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-519-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Transfer Case Market Size & Trends

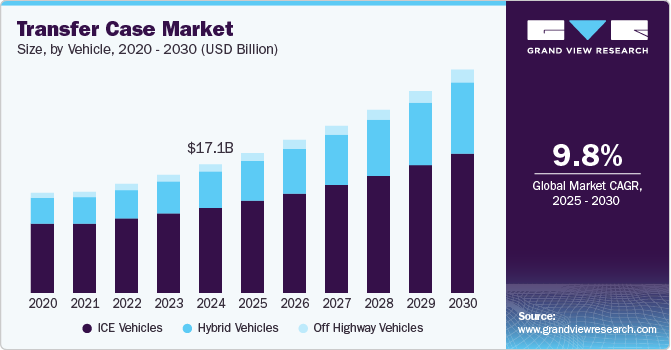

The global transfer case market was estimated at USD 17.08 billion in 2024 and is projected to grow at a CAGR of 9.8% from 2025 to 2030. As consumers demand higher performance and versatility from their vehicles, automakers are increasingly equipping vehicles with four-wheel-drive (4WD) and all-wheel-drive (AWD) systems to cater to various driving conditions. This demand for vehicles that can handle rough terrains, harsh weather, and off-road situations has directly contributed to the expansion of the transfer case industry, which is a critical component in transmitting power to all wheels.

Innovations such as electronic control systems and automatic transfer cases have enhanced their efficiency and reliability. These advancements allow for more seamless transitions between two and four-wheel drive, improving fuel economy and vehicle performance. Additionally, developing more compact and lightweight transfer cases enables manufacturers to design fuel-efficient vehicles capable of handling a wide range of driving conditions, further driving market growth.

The growing trend towards EVs has also spurred the transfer case industry. As EV manufacturers focus on producing all-wheel-drive EVs, the need for advanced transfer cases to manage power distribution between the front and rear axles becomes critical. Transfer cases in electric vehicles are particularly essential for optimizing torque delivery and ensuring efficient performance. The rise of electric vehicles, including those designed for off-road capabilities, has increased demand for specialized transfer case systems that cater to these new powertrain architectures, adding another layer of growth to the market.

The increasing popularity of sport utility vehicles (SUVs) and light trucks further proliferates the market. These vehicles, commonly used in urban and off-road environments, require reliable transfer case systems to provide the necessary power to all wheels. The preference for SUVs and light trucks has grown significantly across North America, Europe, and Asia, further fuelling the demand for transfer cases.

Lastly, consumer interest in adventure tourism and off-road activities has boosted the demand for vehicles equipped with advanced transfer case systems. Enthusiasts seeking vehicles capable of handling rough terrains, such as mountains, deserts, and forests, drive the demand for high-performance transfer cases. As more consumers seek vehicles that can handle extreme driving conditions, manufacturers are responding by designing transfer cases that offer increased durability, efficiency, and performance. This growing interest in off-road experiences is contributing to the overall expansion of the market.

Drivers, Opportunities & Restraints

With the rise in the production of vehicles, especially SUVs, pickup trucks, and off-road vehicles, the need for sophisticated 4WD and AWD systems is increasing. According to OICA, global car production reached 93,546,599 in 2023. The transfer case is a key component in these systems, transferring power to both the front and rear axles for better traction and performance. The rise of EVs and hybrid models also contributes to the market, as manufacturers are developing electric drivetrains with sophisticated transfer case mechanisms to improve energy efficiency and driving range. The increasing demand for vehicles with enhanced off-road capabilities and safety features also propels market growth.

The global trend toward vehicle electrification presents a unique opportunity for manufacturers to develop lighter, more efficient transfer cases tailored to the specific requirements of electric and hybrid vehicles. Moreover, the rising popularity of autonomous vehicles presents new opportunities for developing transfer cases compatible with autonomous driving systems, which require more advanced and reliable drivetrain components. Furthermore, expanding markets in regions like Asia-Pacific, particularly in countries such as China and India, present a growing customer base for vehicles requiring advanced drivetrain systems due to the increasing demand for SUVs, trucks, and off-road vehicles.

The high cost of advanced transfer case systems, especially those with specialized features like electronic control and torque distribution, can limit their adoption, particularly in budget vehicles or emerging markets with high price sensitivity. Additionally, the complexity of designing transfer cases compatible with a wide range of vehicle types, including electric and hybrid models, presents engineering challenges that can increase production costs.

Vehicle Insights

The global demand for Internal Combustion Engine (ICE) vehicles remains high due to their well-established infrastructure and affordability. Despite the rise of EVs, ICE vehicles dominate the automotive landscape, particularly in developing regions where EV infrastructure is less developed. As a result, the demand for transfer cases is set to grow as these vehicles remain a widespread alternative.

Hybrid vehicles is anticipated to register the fastest CAGR over the forecast period. Hybrid vehicles have seen significant advancements in battery technology, energy management systems, and electric motor efficiency. These enhancements have boosted both hybrid vehicles' performance and reliability while reducing their costs. The decrease in the price of hybrid components, such as batteries and electric drive systems, has made these vehicles more affordable and accessible to a broader range of consumers, further driving their market growth.

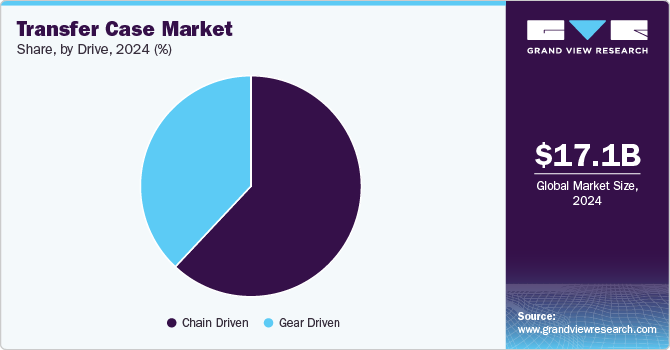

Drive Insights

Chain-driven transfer cases are typically used in these vehicles to distribute power to both the front and rear axles, offering superior handling and traction. The growing popularity of AWD and 4WD vehicles, driven by consumer demand for enhanced off-road capabilities, winter driving performance, and improved safety, is a significant factor contributing to the growth of the chain-driven segment.

Gear driven is anticipated to register the fastest CAGR over the forecast period. Gear driven transfer cases offer higher efficiency than their chain-driven counterparts, crucial in meeting the rising demand for fuel-efficient vehicles. Additionally, gear driven systems are typically more compact and lightweight, making them ideal for reducing overall vehicle weight and enhancing fuel economy.

Regional Insights

The consumers in North America are increasingly drawn to off-road capabilities for recreational purposes and utility in both urban and rural settings. Transfer cases enable vehicles to handle challenging terrains by distributing power to the front and rear axles. This growing interest in off-road vehicles, including pickup trucks and SUVs, has created a significant demand for high-performance transfer cases, fueling the market's expansion.

U.S. Transfer Case Market

The outdoor and adventure lifestyle is widely embraced in the U.S., with off-roading becoming a preferred pastime. As more consumers opt for vehicles capable of navigating rugged terrains, including SUVs and trucks designed for off-road use, the demand for durable, high-performance transfer cases has risen. These transfer cases are essential for off-road vehicles to deliver the torque and power required to tackle difficult surfaces, steep inclines, and rocky paths. The growth in off-road vehicle sales continues to be a significant driver for the transfer case industry in the U.S.

Asia Pacific Transfer Case Market

The Asia Pacific region is anticipated to register the fastest CAGR over the forecast period. With urbanization and rising disposable incomes, consumers in countries such as China, India, and Japan are opting for larger vehicles that provide higher driving comfort and off-road capabilities. These vehicles, especially those designed for rugged terrains, require efficient transfer case systems to manage power distribution between the front and rear axles.

Europe Transfer Case Market

Europe market held a significant market share in 2024. As European countries, especially those in the European Union, implement stricter environmental regulations and incentivize the adoption of electric and hybrid vehicles, the demand for transfer cases compatible with electric powertrains is rising. Manufacturers are now developing transfer cases that are efficient for traditional internal combustion engine vehicles and optimized for hybrid and electric drivetrains.

Central & South America Transfer Case Market

Central & South America market is anticipated to grow significantly over the forecast period. As vehicle ownership increases, particularly for off-road vehicles and trucks, there is an expanding need for replacement parts, including transfer cases. Many vehicle owners in the region are also seeking to enhance the performance of their vehicles, whether for off-roading, farming, or other specialized uses.

Middle East & Africa Transfer Case Market

The Middle East & Africa market held a significant market revenue share in 2024. The increasing demand for off-road and 4WD vehicles, especially in countries with vast desert landscapes and rugged terrains, such as Saudi Arabia, the UAE, and South Africa, proliferates the market. The harsh environment and challenging driving conditions equip vehicles with advanced transfer case systems for maintaining traction and vehicle control. Off-road vehicles are highly popular for recreational and utility purposes in the MEA region, leading to a steady demand for high-performance transfer cases that can handle extreme driving conditions.

Key Transfer Case Company Insights

Some of the key players operating in the market include BorgWarner Inc., Magna International Inc., and others.

-

BorgWarner Inc. is a global product leader with over 130 years of experience delivering innovative and sustainable mobility solutions, primarily focused on the automotive industry. The company provides advanced technologies and products that enhance vehicle performance, efficiency, and sustainability. Its key offerings are transfer cases and critical components in four-wheel drive systems.

-

Magna International Inc. is a leading global mobility technology company in the automotive industry, specializing in innovative solutions that enhance vehicle performance and efficiency. Among its diverse offerings, Magna provides advanced Transfer Case Control Modules (TCCM), which are integral to managing torque distribution between vehicles' front and rear wheels.

Key Transfer Case Companies:

The following are the leading companies in the transfer case market. These companies collectively hold the largest market share and dictate industry trends.

- BorgWarner Inc.

- Magna International Inc.

- American Axle & Manufacturing, Inc.

- JTEKT Corporation

- Schaeffler AG

- ZF Friedrichshafen AG

- Melrose Industries PLC (GKN Ltd)

- Aisin Corporation

- Dana Incorporated

- Divgi TorqTransfer Systems Limited

Transfer Case Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.59 billion

Revenue forecast in 2030

USD 29.63 billion

Growth rate

CAGR of 9.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Vehicle, drive, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Spain; UK; France; Italy; Russia; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Prysmian Group; Nexans; Fujikura; Southwire; Sumitomo Corporation; Belden; KEI Industries; Cords Cable Industries; Amphenol; Finolex Cables; Encore Wire CorpTop of Form

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Transfer Case Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global transfer case market report on the basis of vehicle, drive, and region.

-

Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

ICE Vehicles

-

Hybrid Vehicles

-

Off Highway Vehicles

-

-

Drive Outlook (Revenue, USD Million, 2018 - 2030)

-

Gear Driven

-

Chain Driven

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global transfer case market size was estimated at USD 17.08 billion in 2024 and is expected to reach USD 18.59 billion in 2025.

b. The global transfer case market is expected to grow at a compound annual growth rate of 9.8% from 2025 to 2030 to reach USD 29.63 billion by 2030.

b. Based on Vehicle Type, ICE vehicles held the largest market revenue share of over 66.0% in 2024. The global demand for Internal Combustion Engine (ICE) vehicles remains high due to their well-established infrastructure and affordability.

b. Some of the key players operating in the market include BorgWarner Inc., Magna International Inc., and others.

b. The growing trend towards EVs has also spurred the transfer case market. As EV manufacturers focus on producing all-wheel-drive EVs, the need for advanced transfer cases to manage power distribution between the front and rear axles becomes critical.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.