- Home

- »

- Biotechnology

- »

-

Transfection Reagents & Equipment Market Report, 2030GVR Report cover

![Transfection Reagents & Equipment Market Size, Share & Trends Report]()

Transfection Reagents & Equipment Market Size, Share & Trends Analysis Report, By Product, By Method (Electroporation), By Application (Transgenic Models), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-715-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

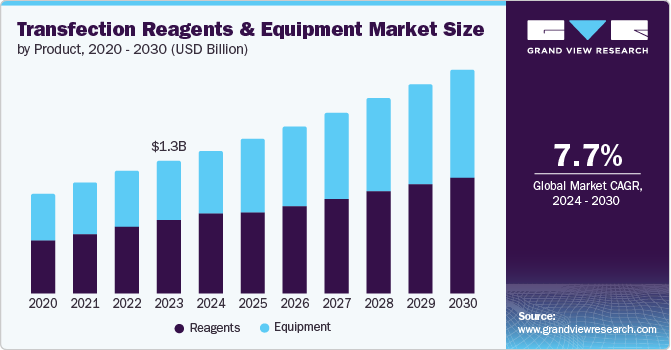

The global transfection reagents & equipment market size was valued at USD 1.30 billion in 2023 and is expected to grow at a CAGR of 7.7% from 2024 to 2030. Advancements in recombinant technology and proteomics, along with the increasing use of transfection techniques by academic researchers, are essential factors expected to drive the expansion of the transfection reagents and equipment market. Continuous progress in creating new methods for temporary and long-lasting gene transfer with minimal unintended effects has drawn interest from different industry participants to invest in new product development.

Recent collaborations between major companies are driving the market. The availability of highly efficient transfection reagents has led to an increase in demand for transfection reagents, which is responsible for the market's rapid growth. For instance, TransIT-CRISPR, a highly efficient non-liposomal polymeric transfection reagent from Sigma-Aldrich, facilitates the quick and effective delivery of CRISPR DNA, guide RNA, and Cas9-gRNA RNP complexes to various cell types, including primary cells.

The routine practice of research labs includes delivering plasmid DNA or siRNA in insect and mammal cells. This has encouraged manufacturers to introduce new reagents and systems to achieve effective transfection in all cell types. For instance, Invitrogen’s Neon NxT Electroporation System is an advanced electroporation tool with a cutting-edge design that simplifies the transfecting of mammalian cells. The biocompatible pipette tip and buffer tube electrodes produce a more consistent electric field than standard electroporation devices, substantially improving transfection efficiency and cell survival.

Over the last few years, the availability of reagents and equipment designed for the large-scale transient transfection of suspension cell lines grown in chemically defined media has significantly increased. This has led to a broader use of transfection reagents and equipment in proteomic and genomic studies.

More cancer studies focused on managing cancer are projected to boost the market for transfection reagents and equipment in the upcoming years. Oncological research shows significant use of transfection techniques in advancing stem cell treatment and genetic therapy. For instance, Lonza's Nucleofector technology and Promega Corporation's FuGENE HD Transfection aid in efficiently transfecting cancer cell lines.

The market is fueled by the nano-technological advancements in transfection reagents used for delivery of intended material inside the cell. For instance, In August 2023, Altogen Biosystems introduced a new targeted reagent for treating pulmonary diseases by delivering biomolecules directly to the lungs. This medication safely and efficiently delivers small molecules, DNA, RNA, and proteins, making it a unique tool for addressing conditions such as cystic fibrosis and lung cancer.

Product Insights

Based on the product, the reagents segment dominated the transfection reagents and equipment market, with the largest revenue share of 55.4% in 2023. The segment is anticipated to dominate in the forecast period due to many launches by major players looking to expand their range of reagents. For instance, in June 2024, Amerigo Scientific announced a new transfection reagent suitable for efficiently delivering DNA, siRNA, RNA, and protein in the cell. In addition to the regular use of reagents and kits in various experimental procedures, companies that provide affordable reagents are expected to lead the market for transfection reagents and equipment.

The equipment segment is expected to experience expansion over the forecast period. The driving factors for the equipment segment in the transfection reagents and equipment market include the increasing demand for advanced treatments, technological advancements in transfection methods, rising research and development activities in the biotechnology and pharmaceutical industries, and the growing prevalence of chronic diseases requiring gene therapy and molecular diagnostics. For instance, in April 2024, Asimov, Inc. launched the LV Edge Packaging System, which allows for single plasmid transfection and achieves E8 TU/mL. In addition, the new, fully stable LV Edge Producer cell line development service generates clones reaching E9 TU/mL without needing transient transfection.

Method Insights

The electroporation segment dominated the market in 2023. The broad selection of electroporation solutions from well-known and up-and-coming companies is driving growth in the segment. The market is expected to grow exponentially in the forecast period due to technological advancements. For instance, in March 2022, Thermo Fisher Scientific Inc. launched a novel high-capacity electroporation system to facilitate the transition of cell therapy developers from clinical testing to commercial production. The Gibco CTS Xenon Electroporation System uses a closed, adaptable construction to enable genetic alterations without relying on conventional viral carriers.

The particle bombardment segment is expected to be the fastest-growing segment during the forecast period. The market is growing due to the expansion of the applications of particle bombardment methods. For instance, according to a study published in Frontiers Journal in January 2022, particle bombardment is a popular method for transforming plants resistant to agrobacterium infection. It depends on using gold or tungsten microprojectiles coated with biomolecules accelerated to high speeds to breach both the plant cell wall and membrane. It allows the transporting of various materials such as plasmid DNA, ssDNA, RNA, or RNPs made from IVTs and recombinant proteins.

Application Insights

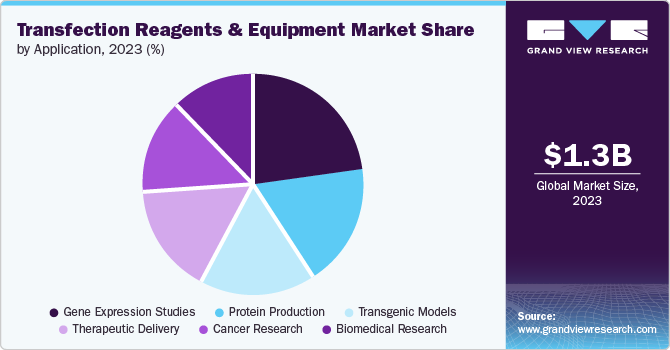

The gene expression studies segment accounted for the largest market revenue share in 2023. This is due to the increased genomic data and the growing focus on translating genomic information in clinical settings. Furthermore, numerous research projects currently underway center on gene expression to detect chromosomal abnormalities, which are expected to drive growth in this sector.

The biomedical research segment is expected to register the fastest CAGR over the forecast period. In recent times, there has been a significant focus on the use of lentivirus for transfection in biomedical research. For instance, the Gibco LV-MAX Lentiviral Production system by Thermo-Fisher Scientific Inc. is a scalable, high-yield platform optimized for lentiviral vector production. It uses HEK 293-derived cells in a unique serum-free, protein-free medium, achieving high-density cultures. Advanced lipid nanoparticle transfection reagents and a specialized lentiviral enhancer and supplement ensure the highest viral titer yield.

End-use Insights

The pharmaceutical and biotechnological companies segment dominated in 2023. An increase in collaboration between major players in the market is responsible for the rapid growth of the market. For instance, in April 2023, Sartorius and its subsidiary Sartorius Stedim Biotech purchased Polyplus from private investors for around USD 2.6 billion. This France-based drug manufacturer offers cutting-edge upstream technologies for cell and gene therapies, including transfection, high-quality GMP-grade DNA/RNA delivery reagents, and plasmid DNA.

The academic and Research Institutes segment is expected to witness the fastest CAGR over the forecast period. The market is expected to witness exponential growth owing to surge in funding from central agencies for academic and research institutes. For instance, in May 2023, National Institute of Health (NIH) launched the Common Fund’s Somatic Mosaicism Across Human Tissues (SMaHT). With a budget of USD 140 million, the initiative aims to research genetic differences in human cells and tissues rapidly. It emphasizes studying normal cells to gain insights into human development, aging, and illness.

Regional Insights

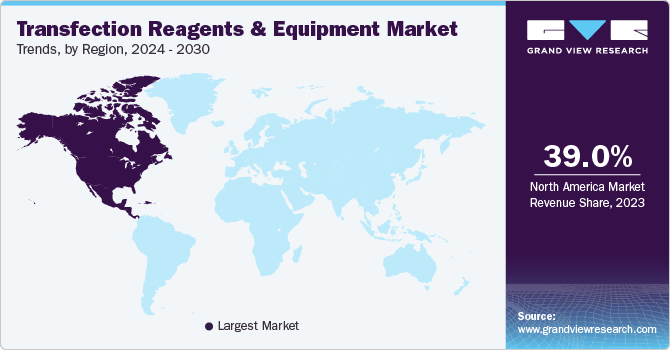

North America dominated with largest revenue share of 39.0% in the transfection reagents and equipment market in 2023. The region is expected to continue this pattern in the forecast time frame. This is due to the existence of established manufacturers and strong funding to support research and development in cancer treatments, precision medicine, and advanced cytology studies. For instance, in May 2024, MilliporeSigma (Merck KGaA) agreed to acquire Mirus Bio for USD 600 million. Mirus Bio, part of Gamma Biosciences, develops and commercializes transfection reagents such as TransIT-VirusGEN, which are essential for producing viral vector-based gene therapies.

U.S. Transfection Reagents & Equipment Market Trends

The US transfection reagent and equipment market dominated, with a share of 86.7% in 2023. The U.S. transfection reagent and equipment market is considered lucrative due to recent investments in the country.

Europe Transfection Reagents & Equipment Market Trends

Europe's transfection reagents and equipment market is anticipated to witness significant growth in the Transfection Reagents and Equipment market. This growth owes to the significantly increasing investments in gene therapy and gene editing across the region. For instance, in March 2021, LifeArc and the Medical Research Council (MRC), with support from the Biotechnology Sciences Research Council (BBSRC), announced an USD 22.91 million plan to establish a network of national innovation hubs dedicated to gene therapies. These three top-notch facilities support researchers from all over the UK in advancing their gene therapy studies, offering access to quality viral vectors, necessary translational assistance, and regulatory guidance.

The UK transfection reagents and equipment market is expected to grow rapidly in the coming years due to the rise in funding support from the UK Government. For instance, in May 2024, Cellular Origins and Cell and Gene Therapy Catapult partnered to showcase the benefits of automating cell and gene therapy manufacturing. Using Cellular Origin’s Constellation robotic automation platform at CGT Catapult’s Stevenage Manufacturing Innovation Centre, this collaboration aims to overcome scalability challenges and advance the field.

Asia Pacific Transfection Reagents & Equipment Market Trends

In the Asia Pacific, an increasing number of patients and the resulting market potential, combined with rising healthcare spending, are predicted to offer a beneficial opportunity for established global companies seeking to grow their operations in transfection reagents and equipment.

Japan transfection reagents and equipment market is expected to grow rapidly in the coming years due to rise in investment in the region. For instance, in December 2022, Synplogen Co., Ltd., a startup from Kobe University's Graduate School of Science, Technology, and Innovation, and Merck KGaA agreed to a non-binding Memorandum of Understanding (MoU); the partnership aims to leverage their combined expertise to enhance the development, production, and testing of viral vector gene therapies in Japan.

The transfection reagents and equipment market in China is driven by the rising incidence of chronic diseases such as cancer, cardiovascular disorders, and genetic disorders that necessitate advanced gene therapy solutions. For instance, in 2022, an estimated 2,574,200 deaths from cancer occurred in China, comprising 1,629,300 deaths in males and 944,900 in females. The age-standardized mortality rate (ASMR) for the Chinese population was 97.08 per 100,000, with rates of 127.70 per 100,000 in males and 68.67 per 100,000 in females. These figures underscore the significant burden of cancer in China, highlighting the need for effective healthcare strategies and interventions to address this public health challenge.

Latin America Transfection Reagents & Equipment Market Trends

Rising investments in biotechnology research propel Latin America's transfection reagents and equipment market. These investments are driven by a growing recognition of the potential of gene therapy and genetic engineering in addressing prevalent health challenges across the region.

Brazil's Transfection Reagents and Equipment Market held a substantial market share in 2023, and recent collaborations between various foundations for research on CAR-T Cell Therapy are responsible for the surge of the market in the region. For instance, in March 2024, Fiocruz and Caring Cross announced a partnership to facilitate affordable CAR-T Therapy access in Brazil and Latin America.

Middle East & Africa Transfection Reagents & Equipment Market Trends

The Middle East and Africa transfection reagents and equipment market is anticipated to grow significantly over the forecast period. The market in the region is on the rise owing to ongoing advancements in developing both short-term and permanent gene transfer methods with limited unintended consequences, which have attracted attention from various stakeholders for investing in new product innovation. For instance, at the BIO 2024 International Convention, Opus Genetics, a clinical-stage gene therapy company focused on patient-centric approaches, entered into a Memorandum of Understanding (MoU) with the Department of Health - Abu Dhabi (DoH). This partnership aims to expedite the advancement of innovative gene therapies tailored for individuals suffering from rare inherited retinal diseases (IRDs) in the UAE.

The South Africa transfection reagents and equipment market is expected to grow rapidly in the forecast period owing to the rise in investment in m-RNA-based vaccines in the region. For instance, in October 2023, the Bill & Melinda Gates Foundation announced additional funding to enhance accessibility to mRNA research and vaccine manufacturing technology. This initiative aims to support low-and middle-income countries (LMICs) in scaling up the production of high-quality vaccines. By empowering LMICs to produce vaccines in significant quantities independently, the foundation aims to bolster global health efforts.

Key Transfection Reagents & Equipment Company Insights

Vendors in the market are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Thermo Fisher Scientific Inc. is a provider in the transfection reagents and equipment market, offering a comprehensive range of products and solutions. The company's offerings support advancements in biotechnology, pharmaceuticals, and academic research, ensuring efficient and effective delivery of genetic materials worldwide for gene therapy, cell biology, and molecular biology applications.

-

Merck KGaA is a player in the transfection reagents and equipment market, offering a comprehensive portfolio of products for various research applications. They cater to scientists by providing tools for efficiently delivering genetic material into cells, a crucial step in gene function studies and genetic engineering.

Key Transfection Reagents & Equipment Companies:

The following are the leading companies in the transfection reagent & equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Promega Corporation

- Lonza

- QIAGEN

- F. Hoffmann-La Roche Ltd.

- Bio-Rad Laboratories, Inc.

- Merck KGaA

- OriGene Technologies, Inc.

- MaxCyte

- Polyplus

Recent Developments

-

In November 2023, MaxCyte, a cell-engineering technology company, partnered with the Alliance for mRNA Medicines (AMM). AMM promotes next-generation encoding RNA and mRNA therapeutics and vaccines, aiming to improve global patient outcomes and public health.

-

In November 2022, Thermo Fisher Scientific launched the Gibco CTS adeno-associated virus (AAV) MAX Helper Free production system. The Gibco CTS AAV-MAX Transfection Kit is an essential component of this production system.

-

In December 2021, Thermo Fisher Scientific Inc. purchased PeproTech, Inc., a U.S. company that creates and produces recombinant proteins, for USD 1.86 billion in cash, as part of its Life Sciences Solutions division acquisition. PeproTech offers recombinant proteins, such as cytokines and growth factors, for use in bioscience research. The purchase broadens the department's bioscience products.

Transfection Reagents & Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.40 billion

Revenue forecast in 2030

USD 2.19 billion

Growth Rate

CAGR of 7.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, method, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Promega Corporation; Lonza; QIAGEN; F. Hoffmann-La Roche Ltd.; Bio-Rad Laboratories, Inc.; Merck KGaA; OriGene Technologies, Inc.; MaxCyte; Polyplus

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Transfection Reagents & Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global transfection reagents & equipment market report on the basis of product, method, application, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Reagents

-

Equipment

-

-

Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Electroporation

-

Liposomes

-

Particle Bombardment

-

Microinjection

-

Adenoviral Vectors

-

Calcium Phosphate

-

DEAE-dextran

-

Magnetic Beads

-

Activated Dendrimers

-

Laserfection

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Gene Expression Studies

-

Protein Production

-

Transgenic Models

-

Therapeutic Delivery

-

Cancer Research

-

Biomedical Research

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic And Research Institutes

-

Pharmaceutical And Biotechnology Companies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global transfection reagents & equipment market was estimated at USD 871.95 million in 2019 and is expected to reach USD 937.22 million in 2020.

b. The global transfection reagents & equipment market is expected to grow at a compound annual growth rate of 7.8% from 2020 to 2025 to reach USD 1,366.0 million by 2025.

b. North America dominated the transfection reagents & equipment market with a share of 39.5% in 2019. This is attributable to the presence of well-established biopharmaceutical and genomic industries in the region.

b. Some key players operating in the transfection reagents & equipment market include Thermo Fisher Scientific Inc.; Promega Corporation; QIAGEN; Mirus Bio LLC; Merck KGaA; and Bio-Rad Laboratories, Inc.

b. Key factors that are driving the transfection reagents & equipment market growth include ongoing R&D in cancer management, implementation of favorable government initiatives & external funding for R&D exercises, development of nanotechnology & drug delivery systems, and development in transfection technologies such as nucleofection and magnetofection.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."