- Home

- »

- Medical Devices

- »

-

Transdermal Skin Patches Market Size, Industry Report 2030GVR Report cover

![Transdermal Skin Patches Market Size, Share & Trends Report]()

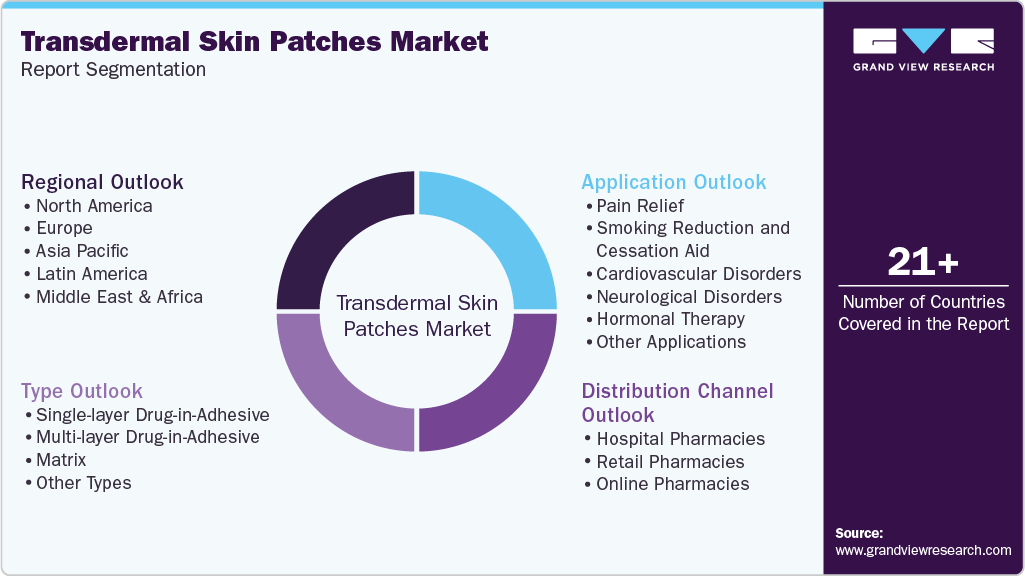

Transdermal Skin Patches Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Multi-layer Drug-in-Adhesive), By Application (Pain Relief), By Distribution Channel (Hospital Pharmacies), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-361-1

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Transdermal Skin Patches Market Summary

The global transdermal skin patches market size was valued at USD 6.20 billion in 2024 and is projected to reach USD 9.55 billion by 2030, growing at a CAGR of 7.6% from 2025 to 2030. The market is increasing due to the growing incidence of chronic diseases such as cardiovascular disease, diabetes, chronic pain, etc., the enhanced preference of consumers for less-invasive treatment options, an aging population worldwide, and the technological advancement in transdermal drug delivery methods.

Key Market Trends & Insights

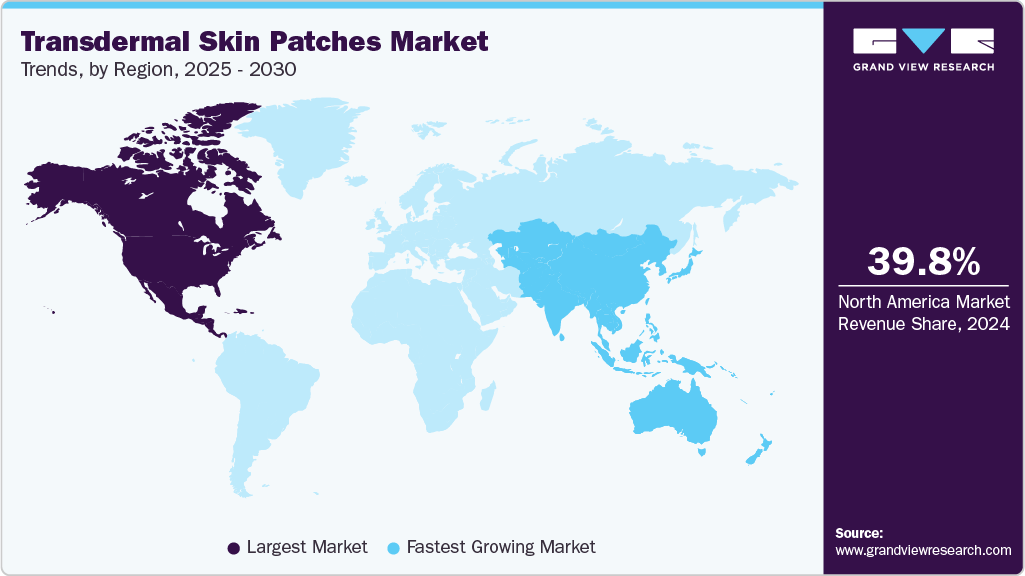

- North America's transdermal skin patches market held the largest share of 39.8% of the global market in 2024.

- The U.S. transdermal skin patches industry is expected to grow significantly over the forecast period.

- By type, the multi-layer drug-in-adhesives segment held the highest market share of 36.8% in 2024.

- By application, the pain relief segment held a leading market share in 2024.

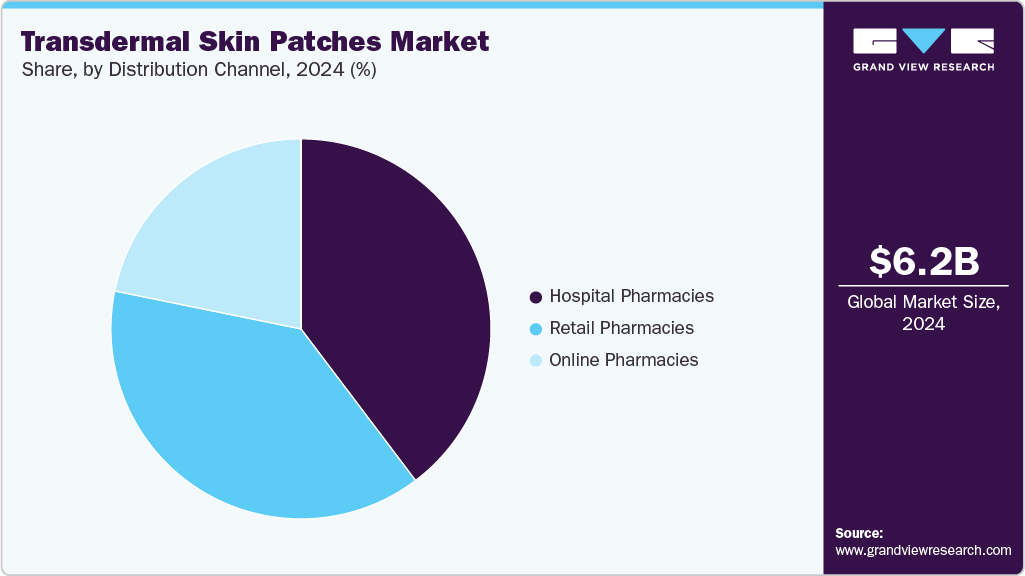

- By distribution channel, the hospital pharmacies segment held a leading market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.20 Billion

- 2030 Projected Market Size: USD 9.55 Billion

- CAGR (2025-2030): 7.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Transdermal patches offer a non-invasive and convenient approach to managing drugs through oral and injectable formulations; therefore, patients are more likely to take their medications as prescribed and experience lower gastrointestinal side effects than oral medications. Due to their ease of use and consistent drug-release rates over long periods, transdermal patches are especially appealing in chronic disease state management.

The industry is experiencing notable growth because of the rise of chronic diseases across the globe. In February 2024, the Centers for Disease Control and Prevention (CDC) estimates there are 129 million people in the United States with at least one key chronic disease, such as cancer, heart disease, obesity, diabetes, and hypertension. The most common treatment for chronic pain is to have the patient take pain relief medication daily, which is not only tedious, but oral or injectable forms often have bothersome side effects and burdensome frequency of administration. Transdermal patches can show efficacy in these scenarios as they improve adherence to medication therapy through regulated medication delivery over a longer period. For example, fentanyl transdermal patches have been approved for chronic pain management and will continuously release fentanyl over 72 hours, providing low-dose relief and reducing the frequency of administration.

Innovations like microneedles, iontophoresis, and permeation enhancers have broadened the transdermal drug delivery landscape, creating new possibilities for administering large molecules and biologics. Microneedle patches generate tiny channels to the skin to enhance the delivery of large-molecule drugs that are too large to administer transdermally. For instance, a microneedle patch containing insulin allows for a pain-free way of taking insulin rather than daily needles, which may optimize control of glycemic levels. Iontophoresis is a newer, innovative delivery strategy that utilizes a small electric charge to help push drugs through the skin.

The industry is driven by increasing consumer preference for less invasive options. Patients and healthcare providers opt for these patches because of decreased pain, less risk for developing an infection, and reduced side effects compared to oral or injected medications. For example, hormone replacement therapy patches, such as Estraderm Mx Patch by Biochemie Novartis, provide continuous release of hormones to avoid the side effects of the fluctuating hormone levels associated with oral HRT. Patches for smoking cessation, pain, and neurological disorders offer non-invasive, discreet, and convenient drug delivery to patients. These non-invasive routes improve patient comfort and compliance to treatment, which translates to growth in the market as consumers become more familiar with the potential benefits.

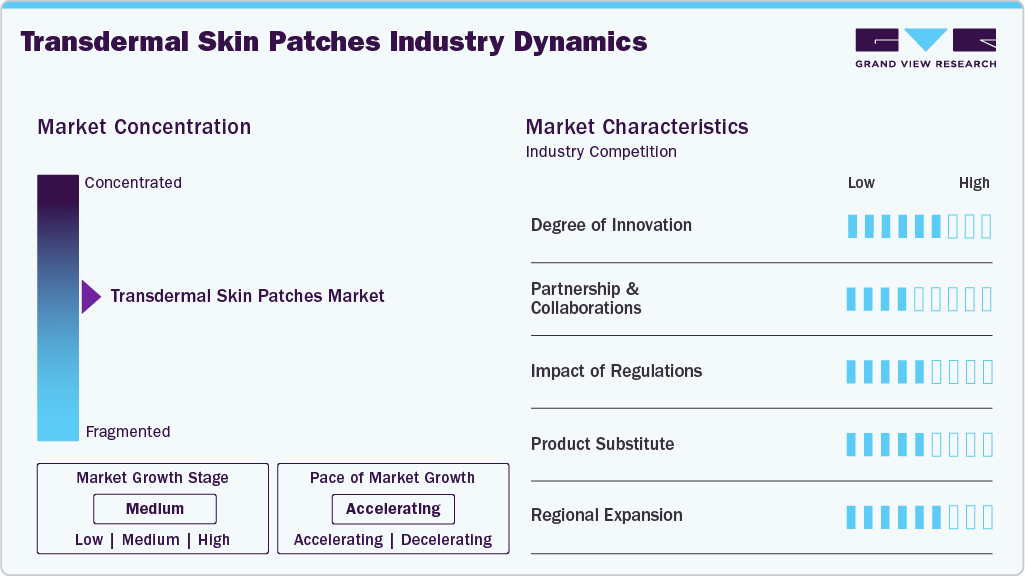

Market Concentration & Characteristics

The industry is experiencing steady and balanced growth, fueled by innovations in smart and microneedle technologies that improve drug delivery and patient adherence. Leading companies like Teva Pharmaceuticals, Transdermal Therapeutics, Inc., Novartis AG, and Medherant sustain robust market positions through ongoing R&D efforts and international expansion.

Recent improvements within transdermal drug delivery, such as microneedles, iontophoresis, and permeation enhancers, have broadened the types of medications that can now be administered, including large molecules and biologics. These methods provide more precise and pain-free drug delivery, and progress in patch technology and controlled-release systems ensures effectiveness and patient outcomes. The transdermal drug delivery field is progressing rapidly and improving patient or resident care.

Partnerships and collaborations accelerate advancement by introducing innovative drug delivery solutions in the transdermal patch market. Collaborations like Medherant’s with Bayer focus on developing new transdermal patches, combining expertise to improve efficiency and patient outcomes. Similarly, in January 2024, LTS Lohmann Therapie-Systeme AG and Micron have partnered to commercialize Micro Array Patch (MAP) technology, supporting scale-up and global distribution. These collaborations allow companies to leverage technical expertise to develop innovative therapies, expand production capabilities, and accelerate the availability of innovative treatments. Strategic partnerships enhance technological development and market growth in the transdermal drug delivery sector.

Transdermal skin patches are strictly regulated to safeguard against risks and ensure safety, effectiveness, and quality. In the U.S., the FDA regulates patches as combination drugs that are assigned a Primary Mode of Action (PMOA) that determines whether the FDA drug branch under the Center for Drug Evaluation and Research (CDER) or the device branch under the Center for Devices and Radiological Health (CDRH) will review the patch, while following cGMP and design controls. In the European Union, transdermal patches are regulated under the Medical Device Regulation (MDR) or the Medicinal Products Directive, depending on the primary function of the patch. In India, the CDSCO will evaluate a patch case-by-case basis, ensuring it is approved under frameworks including drug and device components.

Tablets and therapeutic injections are effective alternatives to transdermal skin patches. Tablets provide accurate dosing, a long shelf life, easy-to-use formats, and controlled or sustained-release options. Therapeutic injections allow for rapid, targeted, and precise drug delivery. Together, tablets and therapeutic injections provide flexible, patient-friendly, and effective solutions for various treatments.

The industry is a result of strong growth across the different regional markets, paired with improved access to sophisticated drug delivery technologies. Given vast healthcare expenditures, R&D capacity, and healthcare infrastructure support, North America and Europe lead the transdermal skin patches market. The Asia-Pacific region is accelerating due to the increasing prevalence of chronic diseases and awareness of new health care opportunities. The consolidation of prime factors during this time will continue to drive growth, including the government's continued efforts, improved drug delivery technology, and pharmaceutical agreement partnerships across all targeted markets.

Type Insights

The multi-layer drug-in-adhesive transdermal patches accounted for the largest market share of 36.8% in 2024, driven by their superior drug delivery efficiency and versatility across various applications. These innovative patches consist of several adhesive layers containing the active pharmaceutical ingredient (API), allowing for slow and sustained drug diffusion over time. This protects against dose dumping while also establishing a sustained therapeutic effect instead. For instance, the fentanyl transdermal patch, utilized for chronic pain management, is a multi-layer patch whose active principle provides continuous pain relief over a duration of 72 hours. It improves patient comfort and adherence to treatment more than oral painkillers, which need to be dosed regularly throughout the day. The long-lasting medication with less frequent dosing appropriate for these patches is often more suitable for patients managing chronic diseases.

The matrix segment is expected to witness significant growth at a CAGR of 8.1% during the forecast period. This expansion has been facilitated by improved formulation flexibility and greater cost-effectiveness of manufacturing. A matrix patch mixes the active pharmaceutical ingredient (API) within the polymer matrix to achieve a consistent dispersion and predictable release. The matrix design provides considerable formulation flexibility with respect to a range of APIs, such that it is possible to create patches that can be used therapeutically, like the Nicotine transdermal patch, which is a commonly used product to aid smoking cessation. For example, Nicoderm CQ is a matrix patch product that achieves a steady-state release of nicotine, reducing withdrawal symptoms and cravings, thereby significantly enhancing participants’ likelihood of successfully quitting smoking through nicotine replacement therapy.

Application Insights

The pain relief segment held the largest market share of 23.0% in 2024 due to the increasing prevalence of chronic pain conditions. Chronic pain, stemming from conditions like arthritis, fibromyalgia, and lower back pain, affects millions globally, driving demand for effective and manageable pain relief solutions. For instance, the Institute for Health Metrics and Evaluation published a report in August 2023, which predicts that 1 billion people will be affected by osteoarthritis by 2050, with 15% of individuals aged 30 and older currently experiencing it. Transdermal patches provide a continuous and controlled release of analgesics, ensuring sustained pain relief without the peaks and troughs associated with oral medications. They eliminate the need for multiple daily doses, injections, or complex medication regimens, making them particularly suitable for patients with chronic pain who require long-term treatment. These patches' discreet nature and ease of application further contribute to their popularity among patients and healthcare providers.

The smoking reduction segment is expected to witness significant growth at a CAGR of 9.2% in the transdermal skin patches market, driven by the increasing awareness of the health risks associated with smoking. As reported by the World Health Organization (WHO) in July 2023, smoking tobacco results in visits to more than 8 million people worldwide every year. Public health campaigns and resulting tighter restrictions around tobacco use have created a heightened level of awareness around the negative consequences of smoking, including lung cancer, heart disease, and respiratory disease. Nicotine transdermal patches provide evidence-based, non-invasive treatment of smoking cessation, as they adhere to the skin and gradually deliver an alleviation of withdrawal symptoms and cravings in a controlled dose of nicotine. For example, in April 2023, Rusan Pharma commenced a campaign to support smoking cessation with their brand '2baconil', which is a nicotine transdermal patch serving a 24-hour dose.

Distribution Channel Insights

The hospital pharmacies segment held the largest market share of 40% in 2024, driven by the high patient traffic and trust associated with hospitals. Hospitals cater to many patients daily, providing a steady demand for various medications, including transdermal patches. Patients often rely on hospital pharmacies for their prescriptions following hospital visits or stays, ensuring a consistent and reliable distribution channel for these products. Moreover, hospital pharmacists' professional guidance and support are crucial in educating patients about the correct use of transdermal patches, their benefits, and potential side effects. This expert advice is particularly important for first-time users or for those using patches for complex treatments, such as hormone replacement therapy or pain management.

Online pharmacies are expected to grow at the fastest CAGR of 8.1% during the forecast period. The increasing adoption of e-commerce and online shopping has significantly broadened the availability of healthcare products, including transdermal patches. Platforms like Amazon and Walgreens offer a diverse range of transdermal patches, catering to patients managing chronic conditions with enhanced convenience and accessibility.

Regional Insights

North America transdermal skin patches industry dominated the global market with a revenue share of over 39.8% in 2024 due to the advanced healthcare infrastructure and regulatory frameworks that facilitate developing and approving innovative transdermal patch technologies. In addition, the high rates of chronic illnesses, including diabetes, cardiovascular disease, and chronic pain conditions, in North America contribute to the need for convenient and effective treatment options such as transdermal patches. According to CDC data, cigarette smoking is the leading preventable cause of disease, disability, and death in the United States, accounting for more than 480,000 deaths each year.

U.S. Transdermal Skin Patches Market Trends

The transdermal skin patches market in the U.S is witnessing strong growth, driven by the rising prevalence of chronic diseases and the growing need for advanced and innovative drug delivery solutions. Additionally, stringent regulatory guidelines are important to the market's growth. In the U.S., the FDA considers transdermal patches to be combination products that must satisfy requirements for both therapeutic products and medical devices. Regulators review each patch's life cycle to ensure safety, efficacy, and quality. As chronic diseases become more prevalent, the demand for Transdermal Skin Patches that provide efficient, reliable, controlled, and minimally invasive drug delivery is expected to increase.

Europe Transdermal Skin Patches Market Trends

The transdermal skin patches market in Europe is characterized by stringent regulations, high disease prevalence driving demand, a focus on innovation, and increasing acceptance of non-invasive treatment options. Authorities like the European Medicines Agency (EMA) are essential for ensuring these products receive approval and that patients can trust that these agencies also have an ongoing surveillance and monitoring function. Medicine manufacturers and research organizations based in countries including Germany, the UK, and France are leading the way in innovating transdermal drug delivery systems, studying new types of materials, formulations, and/or delivery technologies to achieve improved therapeutic outcomes and patient convenience.

The UK transdermal skin patches market is witnessing rapid growth. This growth is driven by noninvasive and pain-free drug administration, which increases patient comfort and adherence. The rising prevalence of chronic diseases is also a key driver for the rise in the market, boosting the demand for convenient and effective medication delivery methods.

The market for transdermal skin patches in Germany is expanding progressively because of the growing attention towards chronic disease management and technological advancements. Developments in microneedle patches for better delivery penetration and single-layer and multi-layer drug-in-adhesive patches for improved treatment effectiveness and patient comfort continue contributing to the growing demand. These innovative concepts increase the precision, efficacy, and ease of use in drug delivery, further solidifying Germany's status as a global leader in innovative health care solutions.

Asia Pacific Transdermal Skin Patches Market Trends

The transdermal skin patches market in Asia Pacific is anticipated to witness fastest growth over the forecast period owing to the region's large and rapidly growing population, rising disposable incomes and urbanization, and increasing healthcare spending and demand for advanced medical treatments. As awareness of chronic diseases such as diabetes, cardiovascular disorders, and pain management grows, there is a corresponding rise in demand for effective and convenient drug delivery systems like transdermal patches. According to the report published by the Shanghai Municipal People's Government in July 2023, China's elderly population, comprising 190 million, faces a significant public health issue due to chronic diseases. The National Health Commission reports that 75% of those over 60 have one chronic disease and 43% have at least two. Chronic diseases are the leading cause of death for Chinese people, accounting for 86.6% of all deaths.

Japan's transdermal skin patches market is witnessing significant growth, driven by an aging population; in 2024, there were over 36.25 million 65+ citizens, almost one-third of the population. Non-invasive and pain-free patch delivery, offering easier and more comfortable treatment, becomes especially attractive in this demographic. Additionally, increasing rates of chronic disease in older individuals make convenient drug delivery even more attractive.

The transdermal skin patches market in China is growing steadily, driven by the increased number of chronic diseases. A study published by ScienceDirect in 2023 reported that the national prevalence of chronic diseases among adults age 60 and above is 81.1%, while 36.3% of this population experiences cardiovascular disease. This prevalent condition underscores the increasing demand for effective health care options and access to care. Noninvasive and simple-to-use transdermal patches are becoming a convenient and effective option to discontinue oral and injectable medications. Convenient, simple-to-use and effective transdermal patches are especially vital for the aging population managing chronic health conditions.

Latin America Transdermal Skin Patches Market Trends

The transdermal skin patches market in Latin America is anticipated to grow because of improvements in healthcare infrastructure and a growing demand for advanced drug delivery systems. Countries like Brazil, Mexico, and Argentina are increasing healthcare service access and improving the quality of care, leading to the adoption of new therapies. There is a rising interest in using advanced drug delivery systems, such as transdermal patches, as a noninvasive and patient-friendly alternative to traditional medication routes.

Brazil's transdermal skin patches market is expanding gradually because of the increasing incidence of chronic illnesses, particularly in the older population. Transdermal systems provide a non-invasive, convenient, and patient-friendly option compared to oral medications and injections. Transdermal systems are easy to use, provide consistent drug delivery, and are suitable for long-term therapy; thereby, they are becoming more appealing for treating chronic diseases. Due to the increasing burden of chronic diseases, the demand for novel and efficient drug delivery systems is expected to increase in Brazil.

Middle East & Africa Transdermal Skin Patches Market Trends

The transdermal skin patches market in the Middle East & Africa is witnessing a rise in chronic diseases, driven by an aging population and evolving lifestyle factors. The estimated prevalence of multimorbidity in the region is 21.8%, with hypertension, diabetes, and cardiovascular disease being the leading conditions. This demographic shift places increased pressure on healthcare systems, necessitating new and efficient treatment approaches.

Saudi Arabia transdermal skin patches market is expanding as chronic disease cases and the aging population continue to rise. The rise in multimorbidity is becoming increasingly common, increasing the necessity of patient-friendly and efficient treatment options. Transdermal patches offer non-invasive, continuous, and patient-friendly drug delivery for treating chronic diseases.

The transdermal skin patches market in Kuwait is growing because of the rise of chronic diseases and an aging population. Multimorbidity is very common among the elderly, particularly women and Kuwaiti nationals. Elderly individuals report higher incidences of chronic disease, including heart disease, diabetes, and hypertension. Transdermal pharmaceutical patches provide advantages to patients as a non-invasive, tractable, and decentralized way to administer therapeutics or to manage chronic disease conditions, aligning with the growing demand for effective and accessible healthcare solutions.

Key Transdermal Skin Patches Company Insights

Key players operating in the transdermal skin patches market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Transdermal Skin Patches Companies:

The following are the leading companies in the transdermal skin patches market. These companies collectively hold the largest market share and dictate industry trends.

- Teva Pharmaceutical Industries Ltd

- Novartis AG

- Teikoku Pharma USA Inc.

- Viatris Inc.

- Johnson & Johnson

- Luye Pharma Group

- Purdue Pharma Manufacturing LP

- Henan Lingrui Pharmaceutical Ltd

- Samyang Biopharmaceuticals Corp.

- Hisamitsu Pharmaceutical Co, Inc.

Recent Developments

-

In August 2024, Zydus Lifesciences received final approval from the U.S. Food and Drug Administration (FDA) to market its Scopolamine Transdermal System (1 mg/3 days).

-

In September 2023, Corium, LLC, a biopharmaceutical company, released data confirming the success of its donepezil transdermal system, ADLARITY, in a placebo-controlled trial with healthy volunteers. It is the first U.S. FDA-approved donepezil transdermal system for patients with mild, moderate, and severe Alzheimer's dementia.

-

In September 2023, Zydus Lifesciences Ltd announced the final approval from the U.S. Food and Drug Administration (USFDA) for its Norelgestromin and Ethinyl Estradiol Transdermal System. This skin patch delivers a combination of hormone medications designed to prevent pregnancy effectively.

-

In August 2023, Yaral Pharma, the U.S. generics subsidiary of IBSA, introduced the Lidocaine Patch 5%, positioned as an AB-rated equivalent to Lidoderm. This prescription-strength lidocaine patch is a significant addition to Yaral Pharma's lineup of non-opioid prescription products designed to alleviate pain and inflammation effectively.

Transdermal Skin Patches Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.61 billion

Revenue forecast in 2030

USD 9.55 billion

Growth rate

CAGR of 7.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, clinical trials outlook, volume analysis

Segments covered

Type, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Teva Pharmaceutical Industries Ltd; Novartis AG; Teikoku Pharma USA Inc.; Viatris Inc.; Johnson & Johnson; Luye Pharma Group; Purdue Pharma Manufacturing LP; Henan Lingrui Pharmaceutical Ltd; Samyang Biopharmaceuticals Corp.; Hisamitsu Pharmaceutical Co, Inc.

Customization scope

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Transdermal Skin Patches Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global transdermal skin patches market report by type, application, distribution channel, and region:

-

Type Outlook (Revenue, USD Unit, 2018 - 2030)

-

Single-layer Drug-in-Adhesive

-

Multi-layer Drug-in-Adhesive

-

Matrix

-

Other Types

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pain Relief

-

Smoking Reduction and Cessation Aid

-

Cardiovascular Disorders

-

Neurological Disorders

-

Hormonal Therapy

-

Other Applications

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global transdermal skin patches market size was estimated at USD 6.20 billion in 2024 and is expected to reach USD 6.61 billion in 2025.

b. The global transdermal skin patches market is expected to grow at a compound annual growth rate of 7.6% from 2025 to 2030 to reach USD 9.55 billion by 2030.

b. North America dominated the transdermal skin patches market, with a share of 39.8% in 2024. This is attributable to huge investments undertaken by prominent companies and new market entrants.

b. Some key players operating in the transdermal skin patches market include Teva Pharmaceutical Industries Ltd; Novartis AG; Teikoku Pharma USA Inc.; Viatris Inc.; Johnson & Johnson; Luye Pharma Group; Purdue Pharma Manufacturing LP; Henan Lingrui Pharmaceutical Ltd; Samyang Biopharmaceuticals Corp.; Hisamitsu Pharmaceutical Co, Inc.

b. Key factors that are driving the market growth include increasing prevalence of chronic diseases, where conventional drug delivery systems, such as oral drugs have lower potency due to the hepatic first-pass metabolism.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.