Transcritical CO2 Systems Market Size, Share & Trends Analysis Report By Function (Refrigeration, Heating, Air Conditioning), By Application (Retail, Heat Pumps), By Region And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-609-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Transcritical CO2 Systems Market Trends

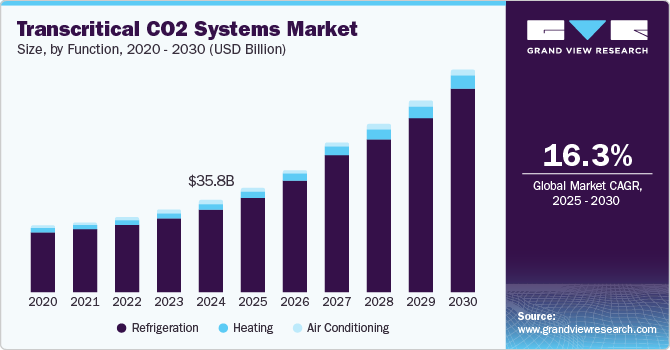

The global transcritical CO2 systems market size was valued at USD 35.8 billion in 2024 and is expected to grow at a CAGR of 16.3% from 2025 to 2030. This growth can be attributed to the increasing demand for energy-efficient refrigeration and air conditioning, coupled with stringent environmental regulations phasing out harmful refrigerants such as HCFCs and HFCs, is propelling market growth. The low operational costs and minimal environmental impact of transcritical CO2 systems enhance their appeal. In addition, the rising awareness of global warming and the need for sustainable solutions further support the adoption of these systems, which are recognized for their high energy performance and reliability in various applications.

Transcritical CO2 systems utilize carbon dioxide as a refrigerant in a supercritical state, making them an eco-friendly alternative for refrigeration and air conditioning applications. The rising demand for these systems is largely attributed to the implementation of stringent environmental regulations to curb greenhouse gas emissions. Traditional refrigerants such as hydrofluorocarbons (HFCs) have high global warming potential, prompting governments worldwide to enforce policies that phase out such substances.

In addition, government incentives and subsidies supporting green technologies further facilitate the transition to transcritical CO2 systems, making them more accessible and affordable. These initiatives help companies comply with regulations and offer benefits such as enhanced energy efficiency and reduced operational costs. Furthermore, technological advancements have also played a crucial role in driving market growth. Innovations in system components, including variable-speed compressors and advanced heat exchangers, have improved the efficiency and reliability of CO2 systems, addressing previous challenges related to their adoption.

Moreover, integrating smart controls and IoT technologies enhances the management of these systems, enabling real-time monitoring and predictive maintenance. This reduces downtime and optimizes performance, making transcritical CO2 systems increasingly attractive for industrial applications. As awareness of climate change grows, businesses are motivated to invest in environmentally friendly technologies that align with sustainability goals.

Function Insights

Refrigeration functions led the market and accounted for the largest revenue share of 90.2% in 2024. This growth can be attributed to the increasing regulatory pressures to phase out high-GWP refrigerants. These regulations encourage industries to adopt natural refrigerants such as CO2, which have minimal environmental impact. In addition, the rising demand for energy-efficient refrigeration solutions in sectors such as food processing and retail further fuels market expansion. Furthermore, the cost-effectiveness and operational efficiency of transcritical CO2 systems make them an attractive option for businesses aiming to reduce their carbon footprint while complying with environmental standards.

The heating function is expected to grow at a CAGR of 15.1% over the forecast period, owing to technological advancements that enhance system performance and reliability. In addition, the integration of variable-speed compressors and improved heat exchangers has made these systems more efficient, catering to a growing need for sustainable heating solutions. Furthermore, increasing energy costs prompt industries to seek cost-effective alternatives for better long-term savings. Moreover, as awareness of the benefits of CO2 heating systems grows, their adoption is expected to rise, driven by both regulatory compliance and the pursuit of energy efficiency across various applications.

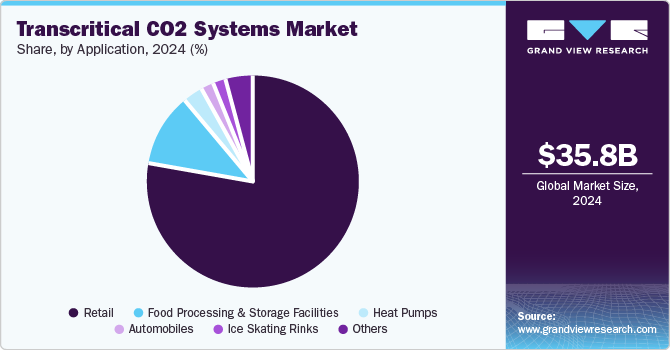

Application Insights

The retail sector dominated the market and accounted for the largest revenue share of 77.4% in 2024, primarily driven by the increasing demand for energy-efficient and environmentally friendly refrigeration solutions. In addition, retail establishments, particularly supermarkets and convenience stores, adopt these systems to comply with stringent environmental regulations and reduce greenhouse gas emissions. Furthermore, the superior energy efficiency of transcritical CO2 systems not only lowers operational costs but also enhances the overall sustainability profile of retailers, making them more attractive to environmentally conscious consumers.

Food processing and storage facilities are expected to grow at a CAGR of 15.6% from 2025 to 2030, owing to the need for reliable and efficient refrigeration methods that meet regulatory standards. In addition, these systems offer high energy efficiency and low global warming potential, making them a preferred choice for food safety and preservation. Furthermore, the rising emphasis on sustainable practices within the food industry drives demand for innovative refrigerants such as CO2 as companies strive to minimize their environmental impact while ensuring optimal storage conditions for perishable goods.

Regional Insights

The transcritical CO2 systems market in Europe dominated the market and accounted for the largest revenue share of 77.0% in 2024. This growth can be attributed to stringent environmental regulations to reduce greenhouse gas emissions. The European Union's F-Gas regulations mandate a significant reduction in the use of high-GWP refrigerants, prompting industries to adopt CO2 systems as a sustainable alternative. Furthermore, the increasing demand for energy-efficient refrigeration solutions in supermarkets and convenience stores enhances market expansion. Moreover, the rising number of cold storage facilities further supports this growth as businesses seek to comply with regulations while ensuring product safety and sustainability.

Denmark Transcritical CO2 Systems Market Trends

Denmark transcritical CO2 systems market is dominated the European market and accounted for the largest revenue share in 2024, driven by the country’s commitment to sustainability and climate goals. Denmark's ambitious targets for reducing carbon emissions have led to increased investments in green technologies, including refrigeration systems. In addition, the Danish government provides incentives for businesses to adopt environmentally friendly practices, making transcritical CO2 systems an attractive option for retailers and food processing facilities. Furthermore, consumers' growing awareness of climate change drives demand for sustainable refrigeration solutions in the retail sector.

Asia Pacific Transcritical CO2 Systems Market Trends

The transcritical CO2 systems market in Asia Pacific is expected to grow at a CAGR of 21.3% over the forecast period, owing to rapid urbanization and increasing industrial activities. Countries such as China and India are focusing on modernizing their refrigeration infrastructure to meet rising food storage and preservation demand. In addition, supportive government policies aimed at phasing out harmful refrigerants encourage the adoption of eco-friendly alternatives such as CO2 systems. Moreover, the increasing emphasis on energy efficiency and sustainability in commercial refrigeration applications further propels market growth across this diverse region.

Japan transcritical CO2 systems market led the Asia Pacific market and accounted for the largest revenue share in 2024, primarily driven by technological advancements and a strong focus on energy efficiency. In addition, Japanese manufacturers are investing in innovative refrigeration technologies that utilize CO2 as a refrigerant, aligning with national policies promoting environmental sustainability. Furthermore, the demand for energy-efficient solutions in supermarkets and convenience stores is also rising as businesses seek to reduce operational costs while complying with stringent regulations. Moreover, Japan's commitment to reducing greenhouse gas emissions supports the growing adoption of transcritical CO2 systems.

North America Transcritical CO2 Systems Market Trends

The transcritical CO2 systems market in North America is expected to grow significantly over the forecast period. This growth can be attributed to increasing regulatory pressures to phase out high-GWP refrigerants. In addition, the rising demand for energy-efficient refrigeration solutions in various sectors, including retail and food processing, drives market growth. Furthermore, consumers' growing awareness of environmental issues further supports the shift toward sustainable refrigeration technologies.

The growth of the U.S. transcritical CO2 systems market is expected to be driven by significant investment by major retailers to reduce their carbon footprint while achieving substantial cost savings on energy bills. Furthermore, technological innovations that improve the performance and reliability of CO2 systems make them attractive for businesses aiming to meet sustainability goals while maintaining operational efficiency in their refrigeration processes.

Key Transcritical CO2 Systems Company Insights

Key companies in the global transcritical CO2systems industry include Advansor, Teko GmbH, Hillphoenix, Inc., and others. These companies focus on innovation to enhance system efficiency and reliability. They also invest in research and development to improve critical components, ensuring optimal performance and maintaining a competitive edge in sustainable refrigeration solutions.

-

Advansor specializes in designing and manufacturing sustainable CO2 refrigeration systems, particularly transcritical CO2 booster systems. These systems provide efficient low- and medium-temperature refrigeration solutions for various applications, including supermarkets and food retail environments.

-

Hillphoenix, Inc. offers innovative products designed for commercial applications, such as display cases and walk-in coolers, utilizing CO2 as a natural refrigerant. Operating within the food retail and industrial refrigeration segments, the company emphasizes energy efficiency and environmental compliance in its offerings.

Key Transcritical CO2 Systems Companies:

The following are the leading companies in the transcritical CO2 systems market. These companies collectively hold the largest market share and dictate industry trends.

- Advansor

- Teko GmbH

- Carrier Commercial Refrigeration

- Green & Cool World Refrigeration AB

- Hillphoenix, Inc.

- Danfoss

- Bitzer

- Carnot Refrigeration

- SCM Frigo S.P.A.

- Emerson Climate Technologies

- Panasonic Corporation

- Baltimore Aircoil Company, Inc.

- Henry Technologies, Inc.

- Strategic Initiatives

- Systemes LMP, Inc.

- Mayekawa MFG. Co., Ltd.

Recent Developments

- In March 2023, Emerson announced the launch of its Copeland transcritical CO2 semi-hermetic reciprocating compressor, model 4MTLS28ME, which boasts the largest displacement in its range. This versatile compressor is a standard medium-temperature and a parallel compressor in transcritical CO2 booster systems. A 303 kBTU/hour capacity enhances design flexibility and may reduce the number of compressors needed in transcritical CO2 racks.

Transcritical CO2 Systems Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 40.8 billion |

|

Revenue forecast in 2030 |

USD 87.0 billion |

|

Growth Rate |

CAGR of 16.3% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Function, application, region |

|

Regional scope |

North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

|

Country scope |

U.S., Canada, China, Australia & New Zealand, Japan, Indonesia, Germany, the UK, Switzerland, Norway, Brazil, Argentina, South Africa |

|

Key companies profiled |

Advansor; Teko GmbH; Carrier Commercial Refrigeration; Green & Cool World Refrigeration AB; Hillphoenix, Inc.; Danfoss; Bitzer; Carnot Refrigeration; SCM Frigo S.P.A.; Emerson Climate Technologies; Panasonic Corporation; Baltimore Aircoil Company, Inc.; Henry Technologies, Inc.; Strategic Initiatives; Systemes LMP, Inc.; Mayekawa MFG. Co., Ltd. |

|

Customization scope |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

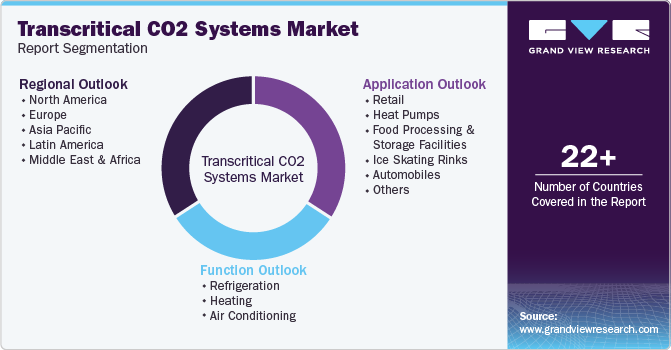

Global Transcritical CO2 Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the transcritical CO2 systems market report based on function, application, and region.

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Refrigeration

-

Heating

-

Air Conditioning

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

Heat Pumps

-

Food Processing and Storage Facilities

-

Ice Skating Rinks

-

Automobiles

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Denmark

-

Germany

-

UK

-

Switzerland

-

Norway

-

-

Asia Pacific

-

Japan

-

Australia & New Zealand

-

China

-

Indonesia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."