Transcatheter Heart Valve Market Size, Share & Trends Analysis Report Application (Transcatheter Aortic Valve, Transcatheter Pulmonary Valve, Transcatheter Mitral Valve), By Technology (Self-Expanded), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-096-5

- Number of Report Pages: 105

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Transcatheter Heart Valve Market Trends

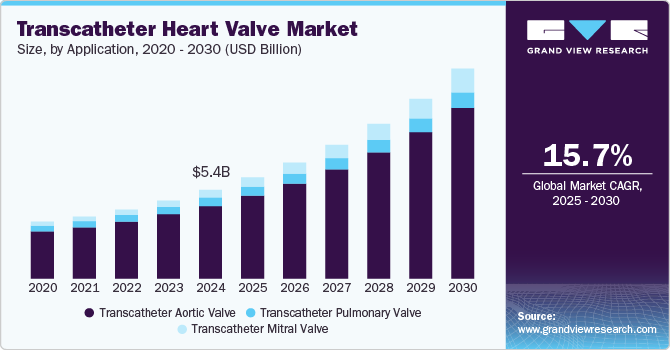

The global transcatheter heart valve market size was estimated at USD 5.4 billion in 2024 and is projected to grow at a CAGR of 15.7% from 2025 to 2030. The rising prevalence of heart valve diseases, particularly in the aging population, is driving the demand for transcatheter heart valve (THV) procedures, such as TAVR, especially for conditions like aortic stenosis and mitral regurgitation. Key factors propelling this market include continuous improvements in THV design, advancements in imaging and delivery systems, and the growing preference for minimally invasive surgeries, which offer shorter recovery times, reduced complications, and lower healthcare costs compared to traditional open-heart surgery.

The growing prevalence of heart valve diseases, particularly in the aging population, significantly drives the demand for transcatheter heart valve (THV) procedures. Conditions like aortic stenosis and mitral regurgitation are becoming more common, necessitating advanced treatment solutions like THVs. In September 2024, the CDC reported that 75% of adults in the U.S. have limited knowledge about heart valve disease. This lack of awareness extends to high-risk groups, particularly individuals aged 65 and older. Each year, over 5 million people in the U.S. receive a diagnosis of heart valve disease, contributing to more than 25,000 fatalities attributed to this condition annually.

Continuous improvements in THV design, such as enhanced valve durability, ease of implantation, and better patient outcomes, are crucial drivers. Advancements in imaging techniques and valve delivery systems also significantly improve procedural success and expand the patient pool eligible for THV procedures. In August 2024, Boston Scientific announced that its ACURATE Prime Aortic Valve System has received CE mark approval. This state-of-the-art transcatheter aortic valve replacement system features a new valve size to serve patients with larger anatomies and is indicated for individuals at low, intermediate, and high risk experiencing severe aortic stenosis. The system incorporates a self-expanding design and a refined deployment mechanism, which enhances the accuracy of valve positioning to improve overall patient outcomes.

There is an increasing demand for minimally invasive surgeries, including transcatheter valve replacement (TAVR), due to their shorter recovery times, reduced complication risks, and lower overall healthcare costs compared to traditional open-heart surgery. This shift towards non-invasive procedures is a critical factor propelling the market growth. In April 2024, Abbott announced FDA approval for its TriClip system, a transcatheter edge-to-edge repair technology for treating tricuspid regurgitation (TR). This first-of-its-kind device allows for less invasive treatment, improving patient outcomes without the need for high-risk open-heart surgery. Clinical trials showed significant improvements in TR severity and quality of life for patients treated with TriClip.

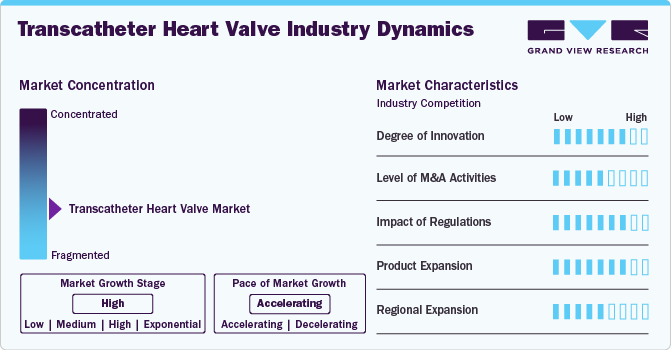

Market Concentration & Characteristics

The degree of innovation in the transcatheter heart valve industry is currently high, driven by continuous advancements in valve design, materials, and delivery mechanisms. Companies focus on improving valve durability, reducing procedural complications, and enhancing patient outcomes through cutting-edge technologies, such as advanced imaging systems and robotic-assisted surgery. In April 2024, Foldax, Inc. announced that its TRIA heart valves had exceeded 200 patient life years in human recipients. Designed to improve the management of heart valve disease, these valves utilize a proprietary polymer, LifePolymer, which enhances durability and minimizes calcification.

The level of merger and acquisition activities in the transcatheter heart valve industry is considered medium. Key players in the medical device industry are acquiring or merging with smaller companies that have innovative technologies or a strong market presence in the cardiovascular space. These acquisitions allow larger companies to enhance their product portfolios and expand into new market segments. However, consolidation is not as rapid as in other sectors due to regulatory hurdles and the high cost of developing THV technologies.

The impact of regulations on the transcatheter heart valve industry is rated as high, with strict oversight from bodies such as the U.S. FDA and the European Medicines Agency (EMA). Regulatory approval processes can significantly influence market entry and product development timelines. The requirement for clinical trials, safety evaluations, and adherence to international standards can delay product launches. Still, these regulations also ensure that the devices are safe and effective for patient use, ultimately boosting market credibility and patient trust.

Product expansion within the transcatheter heart valve industry is high, with companies constantly expanding their product lines to address different types of heart valve diseases and patient needs. This includes the development of new valve sizes, materials, and designs, along with exploring novel delivery systems. The focus on expanding into new therapeutic areas, such as mitral and tricuspid valve interventions, is also contributing to the growth and diversification of THV offerings.

The transcatheter heart valve industry's regional expansion is classified as medium. Companies are increasingly focusing on penetrating emerging markets in Asia-Pacific, Latin America, and the Middle East. While these regions present significant growth opportunities due to rising healthcare demands and improving healthcare infrastructure, they also face challenges, such as regulatory hurdles, cultural differences, and cost barriers, which slow down the pace of market penetration compared to more established markets like North America and Europe. However, growing awareness and investments in healthcare are expected to accelerate expansion over time.

Application Insights

The transcatheter aortic valve segment holds the largest market share of 84.0% in 2024. The market is divided into transcatheter aortic, pulmonary, and mitral valves. The transcatheter aortic valve segment dominates the market share in 2024, driven by rising healthcare expenditures, a higher prevalence of chronic heart diseases, and more cases of severe aortic stenosis. Advancements in tricuspid valve interventions and neochord systems will likely increase usage rates during the forecast period. In May 2024, MicroPort CardioFlow's VitaFlow Liberty Transcatheter Aortic Valve received CE certification, marking it as the first Chinese TAVI solution approved in the EU. With over 47 million patients worldwide suffering from aortic valve diseases, this second-generation product enhances design features for better performance and safety. It has been introduced in nearly 700 hospitals across various countries, addressing the growing demand for TAVI treatments.

The transcatheter mitral valve (TMV) segment is anticipated to grow at the fastest CAGR over the forecast period due to the demand for less invasive treatments for mitral valve diseases. TMV procedures provide significant advantages over traditional open-heart surgery, offering faster recovery times and reducing patient risks. As innovation progresses, TMV devices are becoming more refined, enhancing patient outcomes. In July 2024, Edwards Lifesciences announced its acquisition of Innovalve Bio Medical Ltd., enhancing its transcatheter mitral valve replacement technologies. This acquisition follows an initial investment in 2017 and aims to address significant unmet needs in structural heart treatment. Innovalve will join Edwards’ transcatheter mitral and tricuspid therapies group, with the closing expected by the end of 2024.

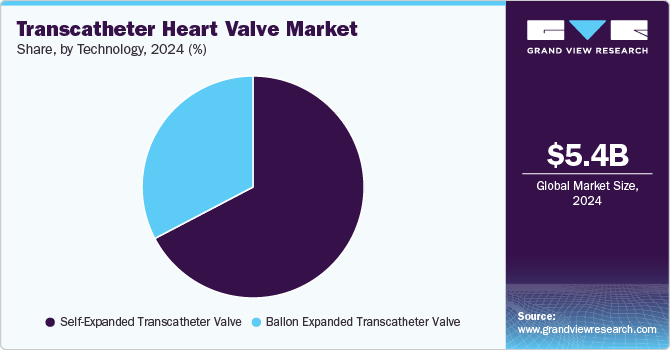

Technology Insights

The market is categorized by technology into balloon-expanded transcatheter valves and self-expanded transcatheter valves. In 2024, the self-expanded transcatheter valve segment held the largest market share of 66.5%. This segment predominantly consists of first- and second-generation transcatheter heart valves, contributing to its significant market presence. In April 2024, Allegheny General Hospital led an international clinical trial on transcatheter aortic valve replacements (TAVRs), comparing self-expanding and balloon-expandable valves in patients with aortic stenosis. The study found that self-expanding valves demonstrated superior blood flow results after one year. Notably, nearly 90% of participants were women, addressing historical underrepresentation in cardiovascular trials. Aortic stenosis affects over 20% of older Americans, posing significant health risks if untreated.

Advancements in technology, increased awareness of balloon-expandable valve systems, and improved clinical outcomes drive rapid growth in the balloon-expanded transcatheter valve segment, which is projected to experience the fastest CAGR of 16.5% during the forecast period. Innovations in techniques and technology now allow valve repairs and replacements through mini-sternotomies and mini-thoracotomies. These methods utilize smaller incisions and longer surgical instruments, resulting in faster wound healing, reduced pain, quicker recovery, and earlier hospital discharge than traditional incisions. In September 2024, a significant advancement in transcatheter aortic valve replacement technology was made by Venus Medtech. The company achieved a milestone by executing the first two procedures of its newly designed balloon-expandable valve system, Venus-Vitae, during an international clinical trial named Venus-Vitae SMART-ALIGN at Prince of Wales Hospital in Hong Kong, China.

Regional Insights

The North America transcatheter heart valve market dominated globally with a 48.3% market share in 2024, driven by advanced healthcare infrastructure, high awareness levels, and strong healthcare spending. The region benefits from cutting-edge medical technologies and a significant demand for minimally invasive procedures. The U.S. leads the market in the adoption of THV technologies, largely due to key industry players, favorable reimbursement policies, and robust healthcare systems. In October 2024, Edwards Lifesciences announced results from the EARLY TAVR Trial, which studied asymptomatic severe aortic stenosis (AS). The trial found that patients undergoing early intervention with transcatheter aortic valve replacement (TAVR) had significantly better outcomes than those receiving clinical surveillance, with 26.8% of TAVR patients experiencing adverse events compared to 45.3% in the surveillance group over a median follow-up of 3.8 years. The findings were presented at the TCT symposium and published in The New England Journal of Medicine.

U.S. Transcatheter Heart Valve Market Trends

The U.S. transcatheter heart valve market is characterized by the country’s strong healthcare system, a high incidence of heart valve diseases, and significant research and development in the medical device sector. Regulatory bodies such as the FDA have proactively approved transcatheter valve technologies promoting market growth. In May 2024, 4C Medical Technologies, Inc. received Breakthrough Device designation from the U.S. FDA for its AltaValve System, a transcatheter mitral valve replacement device. This designation helps speed up the review process, allowing quicker access to the technology for patients if approved.

Europe Heart Valve Market Trends

The Europe transcatheter heart valve market is anticipated to grow significantly over the forecast period. Europe represents a key market for THV devices, with countries like Germany, France, and the UK seeing rapid adoption of these technologies. The region’s healthcare infrastructure is well-developed, with strong government and private sector investment in cardiovascular health. Europe's favorable regulatory environment, including approving THVs under the EU Medical Device Regulation (MDR), enables quicker product launches. In May 2024, Edwards Lifesciences announced the European release of the SAPIEN 3 Ultra RESILIA valve, the first transcatheter aortic valve to use their innovative RESILIA tissue technology for enhanced durability. This valve has been granted CE Mark certification for patients with heart valve disease resulting from native calcific aortic stenosis or those facing high risk due to the failure of a previous bioprosthetic valve, regardless of their surgical risk level.

The transcatheter heart valve market in the UK has witnessed significant growth in the THV market, particularly with transcatheter aortic valve replacement (TAVR) for aortic stenosis. The National Health Service (NHS) has played a crucial role in adopting THV devices by integrating them into its treatment protocols. In July 2024, Abbott launched the Navitor Vision valve in the UK and Ireland, a minimally invasive device for transcatheter aortic valve implantation (TAVI). Designed for patients with severe aortic stenosis at high surgical risk, it enhanced visualization during the procedure to ensure precise implantation. TAVI served as a less invasive alternative to open-heart surgery, providing an effective treatment option for nearly 300,000 affected individuals in the UK.

The France transcatheter heart valve market is characterized by its advanced healthcare infrastructure, high incidence of heart valve diseases, and strong government support for cardiovascular treatment innovation. The adoption of THVs, particularly TAVR, has been significant, driven by the positive clinical outcomes and cost-effectiveness of these procedures. France's healthcare system provides excellent access to high-quality medical services, facilitating the widespread use of advanced devices like THVs.

Asia Pacific Transcatheter Heart Valve Market Trends

The Asia Pacific transcatheter heart valve market is experiencing significant growth driven by an increasing number of patients diagnosed with cardiovascular diseases due to changing lifestyles, urbanization, and an aging population. While the market is still in the early stages of adoption compared to North America and Europe, it is growing rapidly. In December 2024, the VitaFlow Liberty Transcatheter Aortic Valve and Retrievable Delivery System received marketing approval from the Korean Ministry of Food and Drug Safety. This electric retrievable TAVI system features a hybrid-density self-expanding stent and advanced design elements that enhance support and reduce paravalvular leaks. Its innovative delivery system allows for precise valve release and retrieval while offering 360° flexibility for improved surgical precision.

The Japan transcatheter heart valve market is experiencing significant growth driven by the country's high incidence of heart valve diseases, particularly in its elderly population. Japan's advanced healthcare infrastructure and strong regulatory framework have contributed to adopting THV procedures. In November 2023, Meril Life Sciences announced a partnership with Japan Lifeline to promote its Myval Octacor transcatheter heart valve in Japan, pending regulatory approval. The valve is designed for aortic replacements, offering a wider size range and better placement accuracy. Japan Lifeline, which exited the heart valve market in 2019, is eager to re-enter with this next-generation technology.

The transcatheter heart valve market in India is witnessing robust growth because India is one of the fastest-growing markets for transcatheter heart valves in Asia, driven by a rapidly increasing burden of cardiovascular diseases, rising healthcare awareness, and improving healthcare access. In October 2024, the Sree Chitra Tirunal Institute inaugurated a Centre of Excellence for minimally invasive cardiovascular devices, including transcatheter aortic valves. The center aims to improve patient outcomes for high-risk individuals and support India's 'Make in India' initiatives through collaboration with the medical device industry.

Latin America Transcatheter Heart Valve Market Trends

The transcatheter heart valve market in Latin America is experiencing a notable shift driven by an emerging market for transcatheter heart valves, with Brazil and Argentina representing the largest markets. The region is witnessing increasing demand for advanced medical devices, particularly in countries with improving healthcare systems and rising cardiovascular disease rates. In November 2022, Venus Medtech advanced its First-in-Man (FIM) studies for the Venus PowerX transcatheter aortic valve replacement system, completing three procedures in Argentina. This marks the device's earliest clinical use outside China, demonstrating its potential value in addressing clinical demand.

The Brazil transcatheter heart valve market is characterized by the country's significant burden of cardiovascular diseases, particularly in its aging population. Brazil's healthcare system has increasingly adopted minimally invasive techniques like TAVR. Despite challenges related to healthcare disparities and high treatment costs, Brazil is expected to see continued growth in the adoption of THV technologies, particularly in large urban centers, with increasing government and private sector support for cardiovascular health.

Middle East & Africa Transcatheter Heart Valve Market Trends

The transcatheter heart valve market in the Middle East and Africa is relatively small but growing, driven by increasing healthcare investments, rising awareness of cardiovascular diseases, and improving medical infrastructure. Countries such as Saudi Arabia, the UAE, and South Africa are leading the way in adopting advanced cardiovascular treatments, including THV procedures. In October 2024, Cleveland Clinic Abu Dhabi achieved a significant milestone by completing 500 Transcatheter Aortic Valve Implantation (TAVI) procedures. Since introducing TAVI in the UAE in 2015, the Heart, Vascular & Thoracic Institute has transformed the treatment of aortic stenosis, offering a minimally invasive alternative to open-heart surgery and enhancing outcomes for higher-risk patients.

The transcatheter heart valve market in Saudi Arabia is witnessing robust growth fueled by investments in healthcare and the adoption of advanced medical technologies. The country has a high prevalence of cardiovascular diseases, and the healthcare system is actively adopting minimally invasive treatments like TAVR. In January 2024, MicroPort CardioFlow progressed in registering the VitaFlow Liberty Transcatheter Aortic Valve and Retrievable Delivery System in Saudi Arabia. This milestone was a key step towards enhancing cardiac care in the region.

Key Transcatheter Heart Valve Company Insights

Key companies in the transcatheter heart valve industry are actively pursuing various strategic initiatives to enhance their market presence. These initiatives include investing in research and development to innovate and improve the properties of transcatheter heart valves, which aims to achieve better clinical outcomes and enhance patient comfort. To meet the global market's diverse needs, these players focus on product diversification, offering various types of valves suitable for different heart procedures.

Key Transcatheter Heart Valve Companies:

The following are the leading companies in the transcatheter heart valve market. These companies collectively hold the largest market share and dictate industry trends.

- Boston Scientific Corporation

- Bracco Group

- Braile Biomedica

- Direct Flow Medical

- Edwards Lifesciences

- JenaValve,

- Abbott (St. Jude Medical)

- Symetis

- ValveXchange, Inc

View a comprehensive list of companies in the Transcatheter Heart Valve Market

Recent Developments

-

In November 2024, Meril Life Sciences unveiled its Myval Octapro Transcatheter Heart Valve (THV) at major cardiology conferences, highlighting its advancements in valve replacement technology. The new valve is designed to improve procedural outcomes and patient compatibility. Meril’s ongoing research and innovation reflect its dedication to enhancing care in structural heart disease.

-

In November 2024, Abbott introduced its experimental balloon-expandable transcatheter aortic valve implantation (TAVI) system for patients with severe aortic stenosis. This new system seeks to enable AI-assisted procedures and offers a less invasive treatment option for those at high risk for open-heart surgery. Using a balloon, the TAVI device expands a new valve inside the narrowed aortic valve, serving as a modern alternative to conventional methods.

-

In March 2024, Medtronic revealed that the FDA has approved its Evolut FX+ transcatheter aortic valve replacement (TAVR) system for patients with symptomatic severe aortic stenosis. This updated system features a diamond-shaped frame that offers enhanced coronary access while maintaining the high valve performance the Evolut platform is known for. If left untreated, severe aortic stenosis can severely impact patient health and lead to heart failure within two years.

Transcatheter Heart Valve Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 6.3 billion |

|

Revenue forecast in 2030 |

USD 13.0 billion |

|

Growth rate |

CAGR of 15.7% from 2025 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, technology, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Sweden, Denmark, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, Saudi Arabia, South Africa, UAE, Kuwait |

|

Key companies profiled |

Boston Scientific Corporation; Bracco Group; Braile Biomedica; Direct Flow Medical; Edwards Lifesciences; JenaValve; Abbott (St. Jude Medical); Symetis; ValveXchange; Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Transcatheter Heart Valve Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global transcatheter heart valve market report based on application, technology, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Transcatheter Aortic Valve

-

Transcatheter Pulmonary Valve

-

Transcatheter Mitral Valve

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Balloon Expanded Transcatheter Valve

-

Self-Expanded Transcatheter Valve

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global transcatheter heart valve market size was estimated at USD 5.4 billion in 2024 and is expected to reach USD 6.2 billion in 2025.

b. The global transcatheter heart valve market is expected to grow at a compound annual growth rate of 15.7% from 2025 to 2030 to reach USD 13.0 billion by 2030.

b. Transcatheter aortic valve application dominated the transcatheter heart valve market with a share of 84.0% in 2024. This is attributable to increasing healthcare expenditure, growing prevalence of chronic heart diseases, and a rise in the number of people with severe aortic stenosis.

b. Some key players operating in the transcatheter heart valve market include Boston Scientific Corporation, Bracco Group, Braile Biomedica, Direct Flow Medical, Edwards Lifesciences, JenaValve, St. Jude Medical, Symetis, and ValveXchange, Inc.

b. Key factors that are driving the market growth include increasing prevalence of valvular heart diseases, the introduction of third-generation transcatheter heart valves, and favorable reimbursement policies in the U.S. and European Union (EU) nations.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."