- Home

- »

- Medical Devices

- »

-

Transcatheter Pulmonary Valve Market Size Report, 2030GVR Report cover

![Transcatheter Pulmonary Valve Market Size, Share & Trends Report]()

Transcatheter Pulmonary Valve Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Pulmonary Stenosis, Pulmonary Regurgitation), By Technology, By End-use, By Raw Material, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-702-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

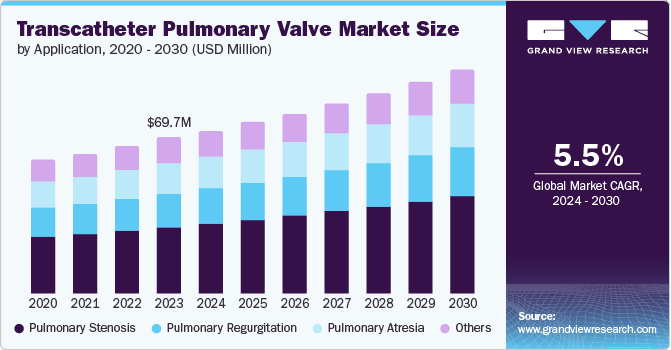

The global transcatheter pulmonary valve market size was valued at USD 69.7 million in 2023 and is projected to grow at a CAGR of 5.5% from 2024 to 2030. The rising geriatric population worldwide, the increasing prevalence of cardiovascular diseases such as coronary heart disease, rheumatic heart disorders, cerebrovascular diseases, hypertensive heart diseases, and various other inflammatory heart diseases have contributed to the market growth.

Integrating and utilizing various imaging techniques, such as CT angiography, 3D echocardiography, and MRI, with procedural planning and device selection has boosted the transcatheter pulmonary valve market. For instance, in January 2023, according to a report of the American College of Cardiology, the Harmony transcatheter pulmonary valve and Alterra Adaptive Prestent System received FDA approval in 2021. These devices are part of a revolution in the treatment of children and adults with congenital heart diseases (CHD).

In the last 50 years, there have been advancements in cardiovascular medicine, and according to a report of the World Heart Federation, in 2023, about 20.5 million deaths occurred in 2021 due to cardiovascular diseases. The high prevalence of heart diseases has raised concern amongst people, and adoption and acceptance of transcatheter pulmonary valves have spurred, thereby impacting the market growth positively.

Government initiatives and patient awareness programs are also expected to add to the growth of the transcatheter pulmonary valve market. For instance- in September 2023, the Ministry of Health of the government of India introduced a public campaign about heart health aiming to raise awareness regarding hypertension risk factors that can lead to premature death and morbidity due to cardiovascular disease.

Application Insights

Pulmonary stenosis dominated the market and accounted for a market share of 43.1% in 2023. TPV operations are less invasive in nature compared to open-heart surgery. This leads to faster recovery times and lower medical expenses, making TPV a preferred treatment option for patients with pulmonary stenosis, thereby fueling the market growth. For instance, in 2023, according to the American College of Cardiology, pulmonary stenosis accounted for about 7-12% of all congenital heart diseases. Thus, awareness regarding this disease and concern for health has widened the scope for TPV operations, driving the market growth.

The pulmonary regurgitation segment is expected to grow at a significant CAGR during the forecast period. Advancements in delivery catheters are enabling less invasive access routes for TPV implantation, leading to reduced procedural times and patient recovery periods. Thereby fueling the market growth. For instance, in June 2021, Michigan Medicine teams performed their first procedures with new self-expanding heart valves for chronic pulmonary regurgitation, which is expected to help reduce the risk of open heart surgery.

Technology Insights

Ballon expanded transcatheter valve accounted for the largest market revenue share of 61.5% in 2023. It is attributed to the increasing development of new products and consumer adoption and acceptance of such products. The high accuracy rate of results and the adoption of new technology for treating CHD are expected to drive market growth. For instance, according to the information published in the JACC journal in April 2024, the development of the latest iteration of balloon-expandable THV technology, led to the prominence of the SAPIEN 3 Ultra Resilia (S3UR) valve, which is a fifth-generation device.

Self-expanded transcatheter valve is expected to register the fastest CAGR during the forecast period. It can be attributed to its larger available sizes, easier placement in tortous vessels, smaller delivery sheaths, and excellent short-term outcomes. Thus, contributing to their increasing use in the treatment of severe pulmonary regurgitation in patients with congenital heart disease.

End-use Insights

Adults accounted for the largest market revenue share of 66.4% in 2023. It can be attributed to the rising prevalence of cardiac abnormalities, pulmonary stenosis, and other cardiovascular diseases. This is further expected to increase the demand for medical devices and foster market growth. For instance, according to the PCR journal, around 620 million people suffer from heart and circulatory diseases across the world. An estimated 20.5 million deaths occurred in 2021 due to heart and circulatory diseases.

Pediatric is expected to register the fastest CAGR during the forecast period. It is attributed to the rise in the pediatric population affected by cardiovascular diseases. This increases the demand for effective treatment with advanced technologies. Common CVDs in children are rheumatic heart disease and Kawasaki disease. The adoption and acceptance of TPVs are expected to drive the market in the forecast period. For instance- according to a report of the Center for Disease Control and Prevention (CDC) in 2018, an estimated 900,000 U.S. children had heart-related disorders.

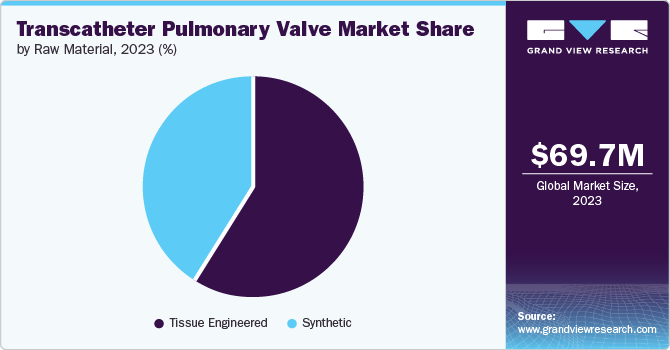

Raw Material Insights

Tissue engineered accounted for the largest market revenue share of 59.1% in 2023. It can be attributed to the huge demand for tissue-engineered heart valves and the limitations of using synthetic heart valves. For instance, according to the journal of the American College of Cardiology in 2023, research was conducted where biocompatible tissue-engineered heart valves were designed in situ. It has proven to be capable of improving freedom from valve dysfunction. The feasibility and safety have helped to integrate these TPVs into the clinical sphere.

Synthetic is expected to register the fastest CAGR during the forecast period. It is attributed to the expansion of the patient pool. It delays or reduces the number of open-heart surgeries needed to maintain heart health in patients with congenital heart disease and helps improve the long-term prognosis for these patients.

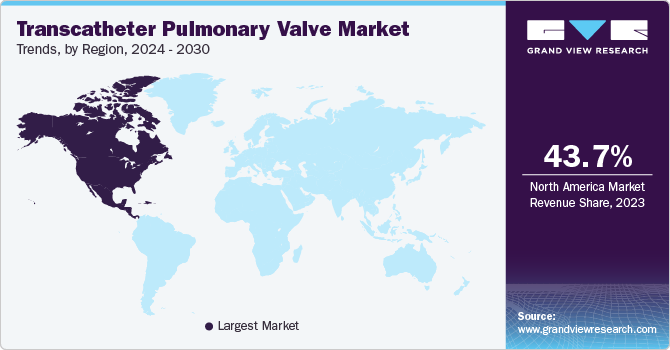

Regional Insights

North America transcatheter pulmonary valve market dominated the global market in 2023. The growth of this market can be attributed to the increasing prevalence of heart and circulatory diseases in this region. The well-established healthcare sector and the funding/investment done by governments have contributed to driving the market growth. In addition, the rising awareness and the demand for innovative heart valves plays a significant role. The government of North America has been involved in creating awareness about the importance of treating cardiovascular diseases and the available treatment options.

U.S. Transcatheter Pulmonary Valve Market Trends

The U.S. transcatheter pulmonary valve market dominated the global market with a share of 38.4% in 2023 owing to the increasing expenditure and increasing geriatric population leading to various cardiovascular diseases. For instance- in 2023, according to the American Heart Association, an estimated 928,741 deaths occurred in 2020 in the U.S. due to cardiovascular diseases. In addition, 42% died of coronary heart disease, and 17.3%, 12.9%, 9.2%, and 2.6% died of stroke, high blood pressure, heart failure, and diseases of the arteries, respectively. In 2023, CDC awarded about USD 114 million to all 50 states to increase healthcare spending for heart-related disorders. Heart Truth is a national education program launched by the U.S. government and is still in progress to create awareness among people to live a heart-healthy lifestyle.

Europe Transcatheter Pulmonary Valve Market Trends

Europe transcatheter pulmonary valve market was identified as a lucrative region in 2023. It can be attributed to the technological advancements in this region and the prevalence of heart and circulatory diseases. For instance- according to the Eurostat report of 2024, about 32.7% of deaths occurred in the European Union (EU) in 2020 due to various circulatory diseases. It demands better treatment options, and with the help of advancements in science and technology, heart diseases can be cured with transcatheter pulmonary valves, thereby driving the market growth. For instance, in 2023, according to the German Heart Surgery Report, in 2022, a total of 20,297 transferred procedures were performed in Germany with the help of transcatheter pulmonary valves.

Asia Pacific Transcatheter Pulmonary Valve Market Trends

Asia Pacific transcatheter pulmonary valve market is anticipated to witness significant growth in the transcatheter pulmonary valve market. The rising burden of congenital heart diseases is leading to increased demand for innovative and minimally invasive treatment options such as TPV. Increased awareness among healthcare providers and patients about the benefits of TPV procedures, such as reduced invasiveness and faster recovery times, is fueling the market growth in Asia-Pacific. About 3.9 million deaths occur in the WHO South-East Asia Region every year due to cardiovascular diseases. Thus, SEAHEARTS initiative by countries across the region to reduce the burden of cardiovascular diseases is creating awareness and helping people accept and adopt treatment procedures such as transcatheter pulmonary valves, boosting the market’s growth.

MEA Transcatheter Pulmonary Valve Market Trends

MEA transcatheter pulmonary valve market is anticipated to witness significant growth in the transcatheter pulmonary valve market. Demographic shifts in the Middle East and Africa, such as urbanization and lifestyle changes, may also contribute to the growing demand for transcatheter pulmonary valves, thereby increasing the market growth in this region. For instance, in 2023, according to the American College of Cardiology, an estimated one-third of all deaths in MEA occur due to cardiovascular diseases.

Key Transcatheter Pulmonary Valve Company Insights

Some of the key companies in the transcatheter pulmonary valve market include Boston Scientific Corporation, Artivion, Inc, Edwards Lifesciences Corporation, and Braile Biomedica. These companies are growing their market revenue by launching new products, collaborations, and adopting various other strategies.

-

Boston Scientific Corporation is a global company engaged in the development and manufacturing of medical devices. The company offers a range of transcatheter heart valve therapies and a range of other structural heart products and procedures, thereby increasing the market share revenue.

-

Braile Biomedica is a Brazilian medical device company that develops transcatheter heart valve technologies. It has developed the INOVARE Biological Valve Prosthesis, which is a transcatheter aortic valve that can also be used for the pulmonary valve position. It appears to be an innovative medical device company that has been working for the last 40 years in this field.

Key Transcatheter Pulmonary Valve Companies:

The following are the leading companies in the transcatheter pulmonary valve market. These companies collectively hold the largest market share and dictate industry trends.

- Boston Scientific Corporation

- Braile Biomedica

- Artivion, Inc

- Edwards Lifesciences Corporation

- JenaValve Technology, Inc

- LivaNova PLC

- Medtronic

- Venus Medtech

- Lepu Medical Technology

- Jude Medical Inc

Recent Developments

-

In June 2024, Venus Medtech Inc. implanted its VenusP-Valve transcatheter pulmonic valve replacement system in the pivotal clinical study of PROTEUS investigational device exemption.

-

In February 2023, Medtronic relaunched Harmony Transcatheter Pulmonary Valve System for treating congenital heart disease. It has also now received regulatory approval in Japan.

Transcatheter Pulmonary Valve Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 73.1 million

Revenue forecast in 2030

USD 100.6 million

Growth Rate

CAGR of 5.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, technology, end-use, raw material, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; KSA; UAE; South Africa; Kuwait

Key companies profiled

Boston Scientific Corporation; Braile Biomedica; Artivion, Inc; Edwards Lifesciences Corporation; JenaValve Technology, Inc; LivaNova PLC; Medtronic; Venus Medtech; Lepu Medical Technology; Jude Medical Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Transcatheter Pulmonary Valve Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global transcatheter pulmonary valve market report based on application, technology, end-use, raw material, and region:

- Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pulmonary Stenosis

-

Pulmonary Regurgitation

-

Pulmonary Atresia

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Ballon Expanded Transcatheter Valve

-

Self Expanded Transcatheter Valve

-

- End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult

-

Pediatric

-

- Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Synthetic

-

Tissue Engineered

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.