Transcatheter Embolization And Occlusion Devices Market Size, Share & Trends Analysis Report By Product (Coil, Non-coil),By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-670-7

- Number of Report Pages: 210

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

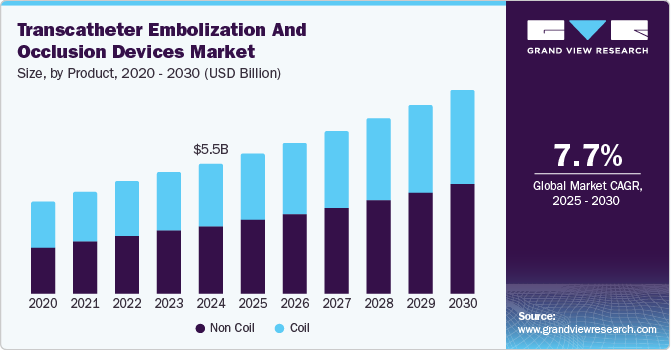

The global transcatheter embolization and occlusion devices market size was valued at USD 5.48 billion in 2024 and is anticipated to grow at a CAGR of 7.7% from 2025 to 2030.These devices help treat malignancies in the kidneys, lungs, liver, and other body parts. The paradigm shift from clipping to coiling has stimulated the demand for transcatheter embolization devices. In addition, they are used to cure aneurysms, erase aberrant connections between arteries and veins, stop blood vessels from supplying a tumor, and regulate or avoid irregular bleeding. The growing prevalence of vascular diseases worldwide is driving the demand for transcatheter embolization and occlusion devices.

These conditions, including peripheral artery disease and aneurysms, have led to an increased need for effective treatment options. In addition, the rising adoption of minimally invasive procedures, offering reduced recovery time and lower complication rates, is further fueling market growth. Patients and healthcare providers are increasingly opting for these advanced techniques, contributing to the expanding market size of transcatheter embolization and occlusion devices, which are considered crucial for achieving targeted vascular treatments.

The increasing adoption of interventional radiology procedures impels the demand for the devices. These minimally invasive treatments, used for conditions such as cancer, liver disease, and uterine fibroids, are becoming more popular due to their precision and reduced recovery times. Furthermore, growing awareness and demand for cancer treatments drive the need for effective therapeutic options. Hence, the rising incidence of cancer and the shift toward less invasive procedures are expected to expand the transcatheter embolization and occlusion devices industry globally.

According to a report by Cleveland Clinic in 2022, around 76,000 people in the U.S. are diagnosed with malignant kidney tumors. Moreover, a report by the National Library of Medicine (NLM) highlighted that over 250 million people have unruptured aneurysms. Transcatheter embolization devices restrict blood flow in these valves and prevent them from rupturing.

Product Insights

The non-coil segment dominated the market with the largest revenue share of 52.3% in 2024, propelled byits versatility and effectiveness in a wide range of clinical applications. Non coil devices, including liquid embolic agents and particle embolization products, offer precise and controlled embolization, which is ideal for treating complex vascular conditions. Their ability to navigate challenging anatomy and provide superior outcomes with minimal complications has made them highly favored among interventional radiologists and surgeons. This growing preference has driven the dominance of this segment in the market.

The coil segment is anticipated to grow at a significant CAGR of 7.0% from 2025 to 2030, driven byits growing application in treating various vascular conditions. Coils provide excellent occlusion capabilities, offering minimal invasiveness, reduced complication risks, and faster recovery for patients. Technological advancements, including enhanced biocompatibility and improved coil delivery systems, are further driving the segment growth. Rising demand for less invasive treatments and the increasing prevalence of diseases such as cancer and vascular malformations are expected to fuel the market expansion of the segment in the coming years.

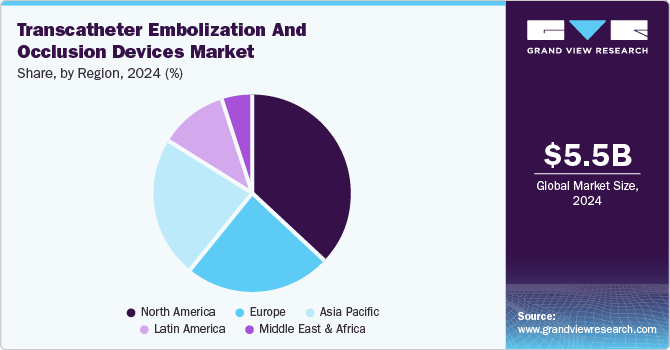

Regional Insights

North America transcatheter embolization and occlusion devices market dominated the global market with the largest revenue share of 36.6% in 2024. This is attributable to the increased adoption of Interventional Radiology (IR) procedures. Uterine Fibroid Embolization (UFE), a minimally invasive IR procedure, has gained popularity as a preferred treatment option for symptomatic uterine fibroids. This nonsurgical approach enables faster recovery and helps avoid the need for hysterectomy. Rising patient demand for less invasive treatments, combined with growing awareness among healthcare providers, is boosting the utilization of embolization devices and further expanding the market for these innovative solutions.These devices are also used for the treatment of atrial fibrillation and varicose veins.As per Centers for Disease Control and Prevention (CDC) data in 2024, around 454,000 people are admitted with atrial fibrillation annually in the U.S. According to Circulation, 23% of the U.S. population is diagnosed with varicose veins.

U.S. Transcatheter Embolization and Occlusion Devices Market Trends

The U.S. transcatheter embolization and occlusion devices market accounted for the largest share in 2024. The aging population in the U.S. contributes to a higher incidence of conditions, particularly cancer and vascular diseases, which require transcatheter embolization and occlusion procedures. These devices are becoming crucial in providing effective treatment for elderly patients. In addition, the shift toward outpatient treatments drives the adoption of minimally invasive procedures that offer quicker recovery time and shorter hospital stays. This trend is encouraging healthcare providers to utilize transcatheter embolization and occlusion devices more frequently, thereby driving the growth of the U.S. transcatheter embolization and occlusion devices industry.

Europe Transcatheter Embolization and Occlusion Devices Market Trends

Europe transcatheter embolization and occlusion devices market is anticipated to experience significant expansion over the forecast period. Ongoing advancements in embolization devices are significantly enhancing the precision, efficiency, and safety of procedures, which is expected to drive the growth of the transcatheter embolization and occlusion devices industry in the region. These innovations, including the development of more effective non-coil embolic agents and particle-based devices, enable better patient outcomes and reduce procedural complications. The shift toward minimally invasive procedures is also contributing to this market expansion, as patients and healthcare providers increasingly prefer options that offer shorter recovery times, reduced risks, and improved overall effectiveness in treating complex conditions.

Asia Pacific Transcatheter Embolization and Occlusion Devices Market Trends

Asia Pacific transcatheter embolization and occlusion devices market is set to be the fastest-growing region with a CAGR of 8.4% from 2025 to 2030. The growing prevalence of cancer in the region is propelling the demand for these devices. They offer effective treatment options for various types of cancer, such as liver and lung cancer, where embolization plays a key role in managing tumors. Rising healthcare investments are further accelerating market growth by improving access to advanced medical technologies and enhancing healthcare infrastructure. This synergy of increasing cancer cases and expanding healthcare capabilities is set to drive the transcatheter embolization and occlusion devices industry expansion across the region.

Japan transcatheter embolization and occlusion devices market is projected to witness the fastest growth during the forecast period due to improved patient awareness and advancements in diagnostic techniques. Early detection of vascular diseases such as aneurysms and liver cancer leads to increased adoption of effective treatments. Furthermore, the growing focus of the healthcare sector on clinical outcomes and cost-effectiveness impels the demand for minimally invasive embolization procedures. These treatments offer precise results with shorter recovery times, making them an attractive option for both patients and healthcare providers, thus expanding the market for these devices in the country.According to a report by the WHO, 414 million people in the Asia Pacific are above 60 years of age. It is predicted that by 2050, 40% of the population of Hong Kong and Japan will be aged above 65. This population is more prone to cardiovascular diseases (CVDs), for which transcatheter embolization is a minimally invasive treatment option.

Key Transcatheter Embolization And Occlusion Devices Company Insights

Some of the key companies in the transcatheter embolization and occlusion devices industry includeBoston Scientific Corporation;Medtronic; Stryker; Abbott; and Pfizer Inc.

-

Abbott offers a wide range of medical devices, diagnostics, nutritional products, and branded generic medicines. Its innovations span cardiovascular treatments, diabetes care, diagnostics, and neuromodulation, and the company aims to improve patient outcomes and enhance overall healthcare.

-

Medtronic provides innovative products and solutions across various sectors, including cardiovascular, diabetes, neurological, and orthopedic care. It focuses on improving patient outcomes through advanced medical devices and therapies.

Key Transcatheter Embolization And Occlusion Devices Companies:

The following are the leading companies in the transcatheter embolization and occlusion devices market. These companies collectively hold the largest market share and dictate industry trends.

- Boston Scientific Corporation

- Terumo Corporation

- Medtronic

- DePuy Synthes (Johnson & Johnson)

- Stryker

- Cordis

- Abbott

- Pfizer Inc.

- Sirtex SIR-Spheres Pty Ltd.

- Nordion (Canada) Inc.

Recent Developments

-

In June 2022,Boston Scientific Corporation obtained FDA 510(k) clearance for its EMBOLD Fibered Detachable Coil. This device is specifically designed to block or reduce blood flow in the peripheral vasculature, offering a minimally invasive solution for vascular procedures.

-

In July 2021,Terumo Medical Corporation introduced the AZUR Vascular Plug, the first groundbreaking device suitable for use with a microcatheter for blocking arteries up to 8mm in diameter. This innovative plug is designed to effectively reduce or block blood flow in peripheral arteries, improving vascular procedures.

Transcatheter Embolization & Occlusion Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 5.89 billion |

|

Revenue forecast in 2030 |

USD 8.54 billion |

|

Growth rate |

CAGR of 7.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

Boston Scientific Corporation;Terumo Corporation; Medtronic; DePuy Synthes (Johnson & Johnson); Stryker; Cordis; Abbott; Pfizer Inc.; Sirtex SIR-Spheres Pty Ltd.; and Nordion (Canada) Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Transcatheter Embolization & Occlusion Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global transcatheter embolization and occlusion devices market report on the basis of product, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Coil

-

Pushable Coils

-

Detachable Coils

-

-

Non Coil

-

Flow Diverting Devices

-

Embolization Particles

-

Liquid Embolics

-

Other Embolization and Occlusion Devices

-

Accessories

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."