Tracheostomy Products Market Size, Share & Trends Analysis Report By Type (Tracheostomy Tubes, Ventilation Accessories), By Demographics (Adults, Pediatrics/Neonatal), By Technique, By End Use, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-934-3

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Tracheostomy Products Market Trends

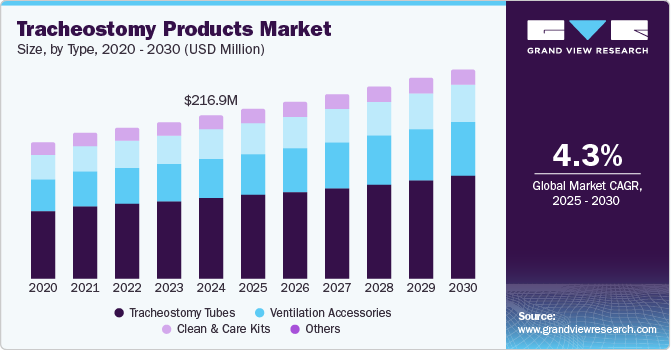

The global tracheostomy products market size was estimated at USD 216.9 million in 2024 and is expected to grow at a CAGR of 4.3% from 2025 to 2030. The market is primarily driven by several key factors, including the rising prevalence of respiratory disorders such as chronic obstructive pulmonary disease (COPD) and lung cancer. The aging population increases susceptibility to respiratory complications, significantly influencing the demand for tracheostomy products. In addition, technological advancements in tracheostomy devices are driving the market. A growing number of surgical procedures requiring temporary airway management also contribute to market growth. The rising prevalence of COPD in the U.S. significantly drives the market. For instance, according to the Centers for Disease Control and Prevention (CDC), an estimated 6.5% of U.S. adults, approximately 14.2 million individuals, had COPD in 2021.

The increasing adoption of tracheostomy is a major driver in market growth. Increasing tracheostomy procedures are closely linked to the global burden of COPD, a leading respiratory condition causing significant breathing difficulties. For instance, according to the World Health Organization (WHO), COPD claims over 3 million lives annually, with an estimated 392 million individuals currently living with the condition. Notably, three-quarters of these cases are in low- and middle-income countries, where household air pollution and tobacco smoking are primary risk factors. Tobacco smoking accounts for over 70% of COPD cases in high-income countries, while in low- and middle-income nations, it contributes to 30-40% of cases. This prevalence underscores the rising demand for tracheostomy procedures, which drives the market.

The increasing number of surgical procedures requiring temporary airway management has significantly contributed to the rise in the market. For instance, according to the article published in the British Journal of Anaesthesia in July 2020, an estimated 250,000 tracheostomies are performed annually in resource-rich countries, with approximately 10% of these procedures being conducted on children. This growing number of tracheostomies is driven by the increasing prevalence of respiratory conditions, surgical procedures requiring airway management, and the need for prolonged mechanical ventilation.

Technological advancements in tracheostomy devices drive market growth by improving patient comfort, safety, and clinical outcomes. For instance, in January 2020, Smiths Group plc, a leading global medical device manufacturer, launched a new Polyvinyl Chloride (PVC) tracheostomy tube portfolio. This new range offers a variety of options designed to meet the specific clinical needs of different patients. The introduction of advanced materials and designs, such as the ability to better manage airflow and reduce complications & risks, enhances long-term airway management's safety. In addition, developing more customizable tubes with integrated features such as cuff control, humidity regulation, and softer materials reflects ongoing innovation in the field, which supports improved patient care and encourages the widespread adoption of tracheostomy procedures.

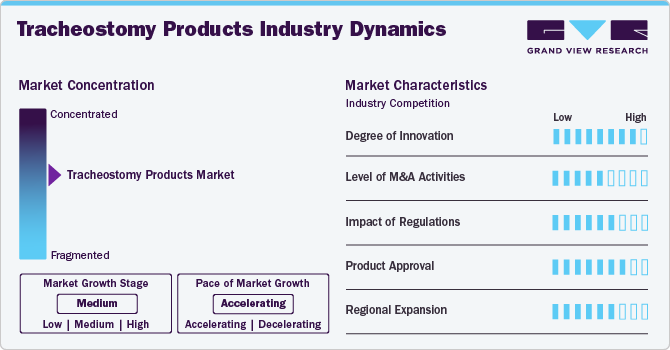

Market Concentration & Characteristics

The tracheostomy products industry is characterized by moderate to high market concentration, with several key players offering advanced products, including tracheostomy tubes and ventilator accessories. This market is primarily driven by the rising prevalence of respiratory disorders, minimally invasive surgical technique advancements, and an increasing preference for outpatient and home care solutions. Variations in healthcare infrastructure and regulatory frameworks across regions influence market dynamics. Emerging technologies, such as smart tracheostomy tubes with integrated sensors for real-time monitoring, are shaping competitive strategies, enhancing patient safety, and improving the overall effectiveness of tracheostomy procedures.

The tracheostomy products industry is highly concentrated and competitive. Key players in the market include Pulmodyne, Inc., Smiths Group plc, and others. Industry participants diligently pursue opportunities to enhance their global presence through strategic partnerships, collaborations, and acquisitions to enter new markets and regions. These tactics enable them to expand their type portfolios, access new technologies, and penetrate emerging markets with high growth potential.

The market is marked by a high degree of innovation, with continuous advancements focused on improving patient comfort, safety, and clinical outcomes. Innovations such as low-pressure, high-volume cuffs and cuffless tubes have reduced the risk of airway damage and enhanced ventilation, exemplified by products such as the Portex Blue Line Ultra Tracheostomy Tube, which minimizes tissue trauma. In addition, integrating smart technologies, such as sensors for real-time monitoring of airflow and pressure, provides healthcare professionals with valuable data to prevent complications. Emerging technologies such as robotic-assisted ligation systems are further shaping the market by automating tracheostomy procedures, improving accuracy, and accelerating recovery times, thereby improving both surgical efficiency and patient quality of life.

Mergers and acquisitions (M&A) activities within this market are increasingly shaping the competitive landscape as companies seek to expand their portfolios, enhance technological capabilities, and strengthen their market presence. Key players such as Medtronic and Smiths Medical have strategically acquired firms with complementary technologies in respiratory care and airway management. For instance, Medtronic’s acquisition of Mazor Robotics aligns with its goal to innovate within airway management, including tracheostomy products. Similarly, Smiths Medical has acquired smaller companies to diversify its respiratory and anesthesia management offerings. These M&A activities are driven by the need to integrate advanced technologies such as smart monitoring systems and minimally invasive surgical tools, positioning companies as leaders in the evolving tracheostomy products industry.

The market is significantly influenced by regulations, which vary across regions and play a crucial role in shaping type development, safety standards, and market access. In highly regulated markets such as the United States and Europe, products must comply with strict guidelines set by authorities such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), ensuring that tracheostomy devices meet high safety and efficacy standards. These regulations often drive innovation, as manufacturers must continually adapt to meet evolving requirements for patient safety, such as incorporating new materials or technologies. Adherence to regulations fosters trust in tracheostomy products, ensuring their safety and reliability while influencing pricing, market competition, and the overall pace of innovation.

In the tracheostomy products industry, various type substitutes, such as endotracheal tubes and non-invasive ventilation devices, present alternative options for airway management, potentially influencing market dynamics. In addition, non-invasive ventilation (NIV) devices, such as continuous positive airway pressure (CPAP) and bilevel positive airway pressure (BiPAP) machines, serve as alternatives for patients with chronic respiratory conditions such as COPD or obstructive sleep apnea, offering a non-invasive way to manage airflow without the need for a tracheostomy. While these substitutes can reduce the demand for tracheostomy procedures, they are typically limited to less severe cases or shorter-term interventions. As a result, the market remains driven by the need for long-term airway management solutions, particularly for patients with severe respiratory conditions, although substitutes play an important role in determining the course of treatment and influencing patient care strategies.

Regional expansion is driven by increasing healthcare needs, the rising prevalence of respiratory disorders, and advancements in healthcare infrastructure, particularly in emerging markets such as Asia Pacific and Latin America. In countries such as China and India, the growing focus on respiratory care, an aging population, and improved healthcare systems fuel demand for tracheostomy products. Meanwhile, in established markets such as North America and Europe, the market continues to expand due to the rising incidence of chronic respiratory diseases and advancements in surgical interventions. Companies are capitalizing on these growth opportunities by enhancing distribution networks, forming partnerships, and leveraging local healthcare innovations to meet the increasing demand for advanced respiratory care solutions. This regional expansion is expected to continue, offering significant opportunities for market growth.

Type Insights

The market is classified by type into tracheostomy tubes, ventilation accessories, clean & care kits, and others. The tracheostomy tubes segment dominated the market with a 49.35% share in 2024. This dominance can be attributed to their essential role in airway management for patients requiring long-term ventilation support. Tracheostomy tubes are commonly used in patients with chronic respiratory diseases, those undergoing prolonged mechanical ventilation, and individuals recovering from severe respiratory complications. Their widespread use in both hospital settings and homecare environments, where long-term airway management is necessary, contributes to their market leadership. The growing prevalence of respiratory conditions such as COPD, aging populations, and advancements in minimally invasive surgical techniques are key factors fueling the demand for tracheostomy tubes. In addition, innovations such as cuffed and cuffless designs, which offer enhanced comfort and safety, further boost the segment's market dominance.

The ventilation accessories segment is expected to grow exponentially over the forecast period, driven by the increasing demand for comprehensive respiratory care solutions and advancements in ventilation technology. In addition, the COVID-19 pandemic highlighted the critical role of ventilation in patient care, leading to a surge in the adoption of ventilators and related accessories. With the increasing number of patients requiring respiratory support, the demand for high-quality ventilation accessories is expected to continue to rise, further driving growth in this segment. Enhanced features, such as integrated humidification systems and smart monitoring tools, are also contributing to the expansion of the ventilation accessories market by improving patient outcomes and comfort.

Technique Insights

The market is classified by technique into percutaneous dilatational tracheostomy and surgical tracheostomy. The percutaneous dilatational tracheostomy (PDT) segment dominated the market with a market share of 53.87% in 2024 due to its increasing adoption in clinical settings. Percutaneous dilatational tracheostomy is preferred for its minimally invasive approach, which offers quicker recovery and fewer complications compared to traditional surgical methods. This technique, which involves creating a tracheal opening with a needle and dilator, is especially beneficial for critically ill patients or those requiring long-term ventilation. For instance, PDT is commonly used in intensive care units (ICUs) for patients with severe respiratory conditions, where it minimizes the risk of infection, reduces recovery time, and shortens hospital stays. These advantages contribute to lower healthcare costs and improved patient outcomes, further driving the growth of the PDT segment. The rising demand for long-term ventilation solutions and ongoing improvements in PDT procedures position this segment for continued dominance in the market.

The percutaneous dilatational tracheostomy segment is projected to experience exponential growth over the forecast period, driven by its increasing preference in critical care for its minimally invasive nature and faster recovery times. The growing number of patients requiring long-term ventilation and the reduced risks associated with PDT, such as infection and bleeding, further boost its adoption. In addition, advancements in PDT techniques and equipment are expected to improve patient outcomes and streamline procedures. As healthcare providers prioritize cost-effective and efficient solutions, the demand for PDT is expected to rise significantly.

End Use Insights

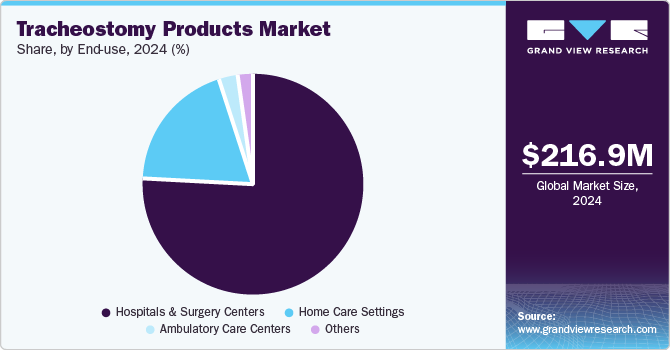

The market is classified by end use into hospitals & surgery centers, ambulatory care centers, home care settings, and others. The hospitals & surgery centers segment accounted for the largest share of 75.8% in 2024. This dominance can be attributed to the increasing volume of surgical procedures and the rising prevalence of conditions requiring airway management in critical care settings. For instance, WHO estimated that approximately 234 million major surgical procedures are performed annually, with a significant portion involving patients requiring temporary or permanent airway support. Hospitals and surgery centers are the primary settings for these procedures due to their access to advanced equipment, skilled professionals, and comprehensive post-operative care facilities. In addition, the growing adoption of minimally invasive surgeries, which often necessitate temporary tracheostomy placement, has further contributed to the segment's dominance. Increasing healthcare expenditure globally and ongoing investments in expanding and modernizing hospitals and surgical facilities are also key factors supporting this growth.

The home care settings segment is projected to register significant growth over the forecast period, driven by an increasing preference for home-based care and the rising prevalence of chronic respiratory conditions requiring long-term management. For instance, the global home healthcare market has been expanding rapidly, reflecting a shift toward patient-centered care outside traditional clinical settings. For instance, according to the World Health Organization, around 90% of chronic obstructive pulmonary disease cases require prolonged care, making home-based solutions essential. Advancements in portable and user-friendly tracheostomy devices have enabled patients to manage their conditions more effectively at home. In addition, the aging population, expected to exceed 1.4 billion individuals aged 60 years and above by 2030, is fueling demand for home care settings, as many older adults prefer to recover and manage health issues within the comfort of their homes. In addition, supportive reimbursement policies and government initiatives promoting home healthcare services are contributing to segment expansion.

Demographics Insights

The market is classified by demographics into adult patients and pediatric/neonatal patients. The adult patients segment held the largest market share at 84.10% in 2024. This substantial share can be attributed to the growing prevalence of chronic respiratory conditions such as chronic obstructive pulmonary disease and asthma, which are more common among adults. In addition, the rising incidence of neurological disorders, traumatic injuries, and cancers requiring airway management further contributed to the demand. For instance, according to an NIH study, chronic respiratory diseases affect approximately 545 million people globally, with adults accounting for a significant proportion of this demographic. In addition, advancements in tracheostomy products, such as more comfortable and efficient devices designed to cater to adult needs, have also driven market growth within this segment.

The adult patient segment is projected to experience rapid growth during the forecast period, supported by factors such as an aging population, increasing surgical interventions, and a growing focus on post-operative care. For instance, the global population aged 60 years and above is projected to reach over 1.4 billion by 2030, which is anticipated to drive the demand for tracheostomy procedures in managing age-related respiratory conditions. In addition, rising awareness of advanced healthcare solutions and improved access to emergency care facilities in emerging markets are expected to further accelerate growth in this segment. In addition, rising awareness of advanced healthcare solutions and improved access to emergency care facilities in emerging markets are expected to further accelerate growth in this segment.

Regional Insights

North America tracheostomy products market held the largest global market share at 36.71% in 2024. This dominance is largely driven by the region’s advanced healthcare infrastructure, high healthcare spending, and the growing prevalence of chronic respiratory diseases, such as COPD and asthma. For instance, the U.S. is experiencing an aging population, with the number of individuals aged 65 and older projected to exceed 70 million by 2030, according to the U.S. Census Bureau. Older adults are more prone to respiratory conditions, making the demand for tracheostomy products crucial. In addition, the U.S. healthcare system’s emphasis on critical care services and significant advancements in medical technology supports market growth. The region also benefits from well-established reimbursement policies for medical devices, ensuring accessibility for patients. With continuous innovation in these products and the presence of leading manufacturers, North America is expected to maintain its market leadership in the coming years.

U.S. Tracheostomy Products Market Trends

The tracheostomy products market in the U.S. held the largest share of the North American market in 2024, driven by several factors, including advanced healthcare infrastructure, high healthcare expenditure, and a rising prevalence of respiratory diseases such as COPD and asthma. In addition, the U.S. has seen significant technological advancements in medical devices, with innovations such as smart tracheostomy tubes that monitor patients' respiratory status in real-time. These advancements improve patient management and are expected to increase the adoption of these products. The U.S. also benefits from a well-established healthcare system that ensures access to cutting-edge medical technologies and supportive reimbursement policies, further stimulating market growth. In addition, the presence of leading manufacturers in the medical device industry in the U.S. strengthens its dominance.

Europe Tracheostomy Products Market Trends

The tracheostomy products market in Europe is experiencing growth driven by several key factors, including an aging population, increasing prevalence of chronic respiratory diseases, and advancements in medical technology. The European population is aging rapidly, with the number of people aged 65 and above expected to increase significantly in the coming decades, leading to a higher demand for healthcare services and respiratory support products. For instance, according to Eurostat, by 2030, one in three people in Europe are expected to be over the age of 60, which is expected to contribute to a rise in respiratory conditions that require tracheostomy procedures. In addition, the increasing incidence of chronic respiratory diseases, such as COPD and asthma, which affect millions across Europe, is driving demand for more advanced tracheostomy devices. Technological developments, such as the introduction of more comfortable, user-friendly, and minimally invasive tracheostomy tubes, are also supporting market growth by improving patient outcomes and facilitating easier management of respiratory conditions.

The UK tracheostomy products market is experiencing notable growth, driven by several factors, including an increasing burden of chronic respiratory diseases, advancements in medical technology, and the country’s aging population. The number of people in the UK aged 65 and over is projected to rise significantly in the coming years, reaching over 20 million by 2030, as reported by the Office for National Statistics. In addition, the growing availability of innovative tracheostomy products, such as those with improved safety features and enhanced comfort, is boosting adoption. The UK healthcare system’s focus on improving critical care services and expanding home care initiatives and favorable reimbursement policies is further accelerating the market’s growth. In addition, ongoing research into more efficient and less invasive tracheostomy procedures is expected to contribute to the increasing demand for these products in the UK.

The tracheostomy products market in France is experiencing growth, driven by factors such as the increasing prevalence of chronic respiratory diseases, an aging population, and ongoing advancements in medical technology. Chronic respiratory conditions, including COPD and asthma, are widespread in France, with COPD alone affecting over 3 million people in the country, according to the French Ministry of Health. As the population ages, with projections indicating that nearly one-quarter of France’s population is expected to be over 65 years old by 2030, the demand for respiratory support products, including tracheostomy devices, is expected to rise.

Germany tracheostomy products market is witnessing steady growth, driven by factors such as an aging population, rising prevalence of chronic respiratory diseases, and advancements in medical technology. Germany has one of the largest elderly populations in Europe, with those aged 65 and above expected to make up over 30% of the population by 2030, as the Federal Statistical Office of Germany reported. This demographic shift is contributing to an increased demand for respiratory support products, particularly among older adults who are more susceptible to conditions such as COPD and pulmonary fibrosis. In addition, Germany's well-established reimbursement policies for medical devices, combined with a focus on improving patient outcomes through cutting-edge technology, is expected to further drive the expansion of the market in the country.

Asia Pacific Tracheostomy Products Market Trends

The tracheostomy products market in Asia Pacific is anticipated to exhibit the fastest growth rate of 5.3% during the forecast period. This growth can be attributed to advancements in tracheostomy products are a key driver of market growth, particularly with the introduction of innovative devices that enhance patient safety, comfort, and usability. For instance, the development of minimally invasive tracheostomy tubes, such as the percutaneous dilatational tracheostomy (PDT) tubes, has significantly reduced complications and recovery times compared to traditional methods. These tubes are now preferred in many hospitals for their ability to minimize trauma and improve patient outcomes. In addition, the introduction of voice-assisted tracheostomy tubes has enabled patients to regain the ability to speak, which greatly enhances their quality of life. Another notable advancement is integrating smart technology into tracheostomy devices, such as tubes equipped with sensors that monitor respiratory conditions in real-time and alert healthcare providers to potential issues before they become critical. With the rise of home healthcare, portable and lightweight tracheostomy devices are allowing patients to manage their conditions more independently, reducing hospital stays and improving overall patient satisfaction.

China tracheostomy products market is experiencing notable growth, driven by factors such as the rising prevalence of chronic respiratory diseases and improvements in healthcare infrastructure. COPD and asthma are major health concerns in China, with air pollution exacerbating respiratory issues, leading to an increased demand for tracheostomy products. In addition, China's aging population, expected to surpass 300 million by 2025, is further fueling the market as elderly individuals are more prone to respiratory conditions requiring long-term management, including tracheostomy.

The tracheostomy products market in Japan is experiencing steady growth, driven by factors such as a rapidly aging population, and continuous advancements in medical technology. Japan has one of the world's oldest populations, with projections indicating that by 2030, over 30% of the population is expected to be aged 65 and older. This demographic shift is contributing to a rise in age-related respiratory conditions, such as COPD and pulmonary fibrosis, leading to greater demand for tracheostomy products. In addition, Japan’s advanced healthcare system is a key factor in the market’s growth, as it provides widespread access to high-quality respiratory care.

Latin America Tracheostomy Products Market Trends

The tracheostomy products market in Latin America is expected to witness significant growth, driven by factors such as the increasing investment in healthcare and improvements in healthcare access. Respiratory conditions such as COPD, asthma, and pneumonia are widespread in the region, exacerbated by factors such as high smoking rates and urban pollution, which are contributing to a rise in demand for tracheostomy products. In addition, the region's aging population, projected to exceed 100 million people aged 65 and older by 2030, is further fueling the need for respiratory support. Government initiatives to improve healthcare access and expand medical device coverage are helping increase the availability of advanced tracheostomy devices. As healthcare infrastructure improves across Latin America, the market is expected to expand, offering more innovative solutions to meet the region’s evolving healthcare needs.

Middle East & Africa Tracheostomy Products Market Trends

The tracheostomy products market in Middle East and Africa is anticipated to witness robust growth over the forecast period, driven by the increasing prevalence of chronic respiratory diseases, an aging population, and improvements in healthcare access. In addition, the aging population in Latin America, projected to surpass 100 million individuals aged 65 and older by 2030, is intensifying the need for respiratory support. Government initiatives focused on enhancing healthcare access and expanding medical device coverage are boosting the availability of advanced tracheostomy devices. In addition, the growing awareness of respiratory care and the shift toward home healthcare services are further driving the demand for portable, easy-to-use devices.

Key Tracheostomy Products Company Insights

The competitive scenario in the market is highly competitive, with key players such as Pulmodyne, Inc., Smiths Group plc, Medtronic and others. The major companies are undertaking various organic and inorganic strategies such as new device type development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Tracheostomy Products Companies:

The following are the leading companies in the tracheostomy products market. These companies collectively hold the largest market share and dictate industry trends.

- Pulmodyne, Inc.

- Smiths Group plc

- Medtronic

- TRACOE Medical GmbH

- Teleflex, Incorporated.

- Cook Group

- Convatec Group PLC

- Boston Medical Products Inc.

- Fisher & Paykel Healthcare Limited.

- ANGIPLAST PRIVATE LIMITED.

Recent Developments

-

In August 2024, Fisher & Paykel Healthcare Limited. introduced the F&P my820 System in the United States, designed for home respiratory humidification. This advanced humidifier supports invasive and noninvasive ventilation and high-flow therapies for both adults and children. It incorporates a built-in sensor that adapts to fluctuating home temperatures, reducing circuit condensation and simplifying the setup process.

-

In January 2022, British respiratory device manufacturer Intersurgical acquired Pulmodyne Inc., a company specializing in airway and respiratory products for prehospital, emergency, critical care, and home use. This acquisition enhances Intersurgical's presence in the U.S. market and leverages its global network to boost Pulmodyne's product sales.

-

In January 2020, Smiths Group plc, a prominent global manufacturer of medical devices, announced the introduction of a new portfolio of polyvinyl chloride (PVC) tracheostomy tubes. This addition expands its existing range of tracheostomy products. The newly launched tubes are designed to address the diverse clinical needs of patients with tracheostomies, offering options tailored to various patient requirements.

Tracheostomy Products Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 225.7 million |

|

Revenue forecast in 2030 |

USD 278.7 million |

|

Growth rate |

CAGR of 4.3% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, technique, demographics, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Pulmodyne, Inc.; Smiths Group plc; Medtronic; TRACOE Medical GmbH; Teleflex, Incorporated.; Cook Group; Convatec Group PLC; Boston Medical Products Inc.; Fisher & Paykel Healthcare Limited.; ANGIPLAST PRIVATE LIMITED. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Tracheostomy Products Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tracheostomy products market based on type, technique, demographics, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Tracheostomy Tubes

-

Ventilation Accessories

-

Clean & Care Kits

-

Others

-

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Percutaneous Dilatational Tracheostomy

-

Surgical Tracheostomy

-

-

Demographics Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult Patients

-

Pediatric/Neonatal Patients

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Surgery Centers

-

Ambulatory Care Centers

-

Home Care Settings

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global tracheostomy products market is expected to grow at a compound annual growth rate of 4.3% from 2025 to 2030 to reach USD 278.7 million by 2030.

b. North America dominated the tracheostomy products market with a share of 37.4% in 2024. This is attributable to the rapid development of innovative technologies and therapies for throat cancer

b. Some of the key market players operating in the tracheostomy products market are Pulmodyne Inc., Smiths Group plc, Medtronic, TRACOE Medical GmbH, Teleflex Incorporated, Cook Group, ConvaTec Group, Boston Medical, Fisher & Paykel Healthcare Ltd., Angiplast, Andreas Fahl Medizintechnik–Vertrieb GmbH, Biçakcilar A.S, Sterimed, Henan Tuoren Medical Device Co., Ltd., among others

b. Growing incidence rates of chronic respiratory disorders like cardiovascular diseases, diabetes, respiratory diseases, and cancer are driving the market. In addition, the growing number of surgeries performed worldwide is increasing the demand for tracheostomy accessories

b. The global tracheostomy products market size was estimated at USD 216.9 million in 2024 and is expected to reach USD 225.7 million in 2025.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."