- Home

- »

- Plastics, Polymers & Resins

- »

-

Thermoplastic Polyurethane Films Market, Industry Report 2033GVR Report cover

![Thermoplastic Polyurethane Films Market Size, Share & Trends Report]()

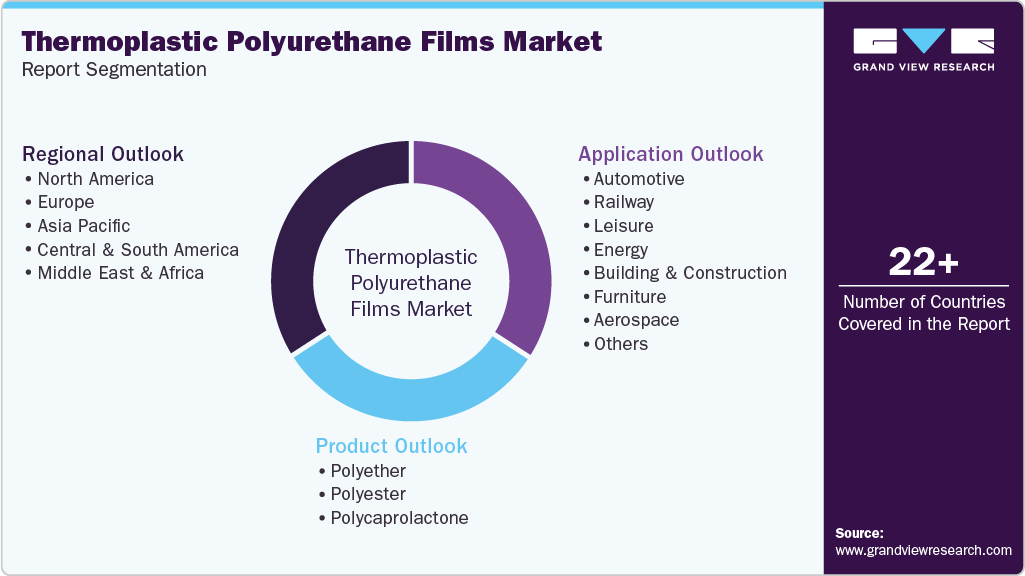

Thermoplastic Polyurethane Films Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Polyether, Polyester, Polycaprolactone), By Application (Automotive, Railway, Leisure, Energy, Building & Construction, Furniture, Aerospace), By Regions, And Segment Forecasts

- Report ID: 978-1-68038-003-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Thermoplastic Polyurethane Films Market Summary

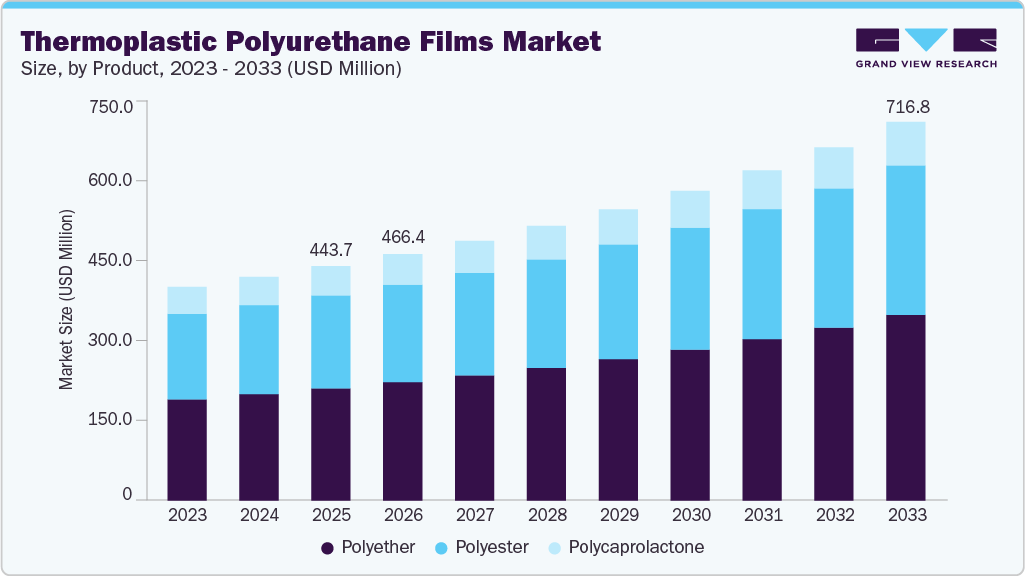

The global thermoplastic polyurethane films market size was estimated at USD 443.69 million in 2025 and is projected to reach USD 716.82 million by 2033, growing at a CAGR of 6.3% from 2026 to 2033. Thermoplastic polyurethane film is a versatile substrate that is custom-made for performance applications.

Key Market Trends & Insights

- Asia Pacific dominated the thermoplastic polyurethane films market with the largest revenue share of 33.61% in 2025.

- The China thermoplastic polyurethane films industry leads the Asia Pacific market, driven by robust growth in the automotive, electronics, and medical sectors.

- By product, the polyether segment accounted for the largest share with 47.83% of the global market in 2025.

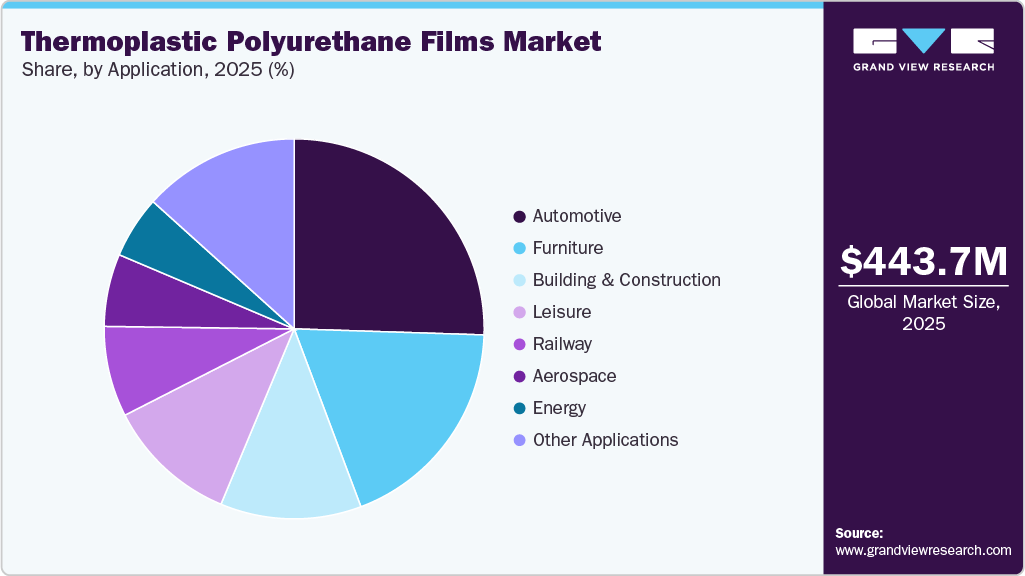

- By application, the automotive segment accounted for the largest share of the market at 25.51% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 443.69 million

- 2033 Projected Market Size: USD 716.82 million

- CAGR (2026-2033): 6.3%

- Asia Pacific: Largest market in 2025

Its adaptability is partly due to the wide range of base chemical classes. It can be extruded with polyester, polyether, or polycaprolactone. The global demand for TPU films has increased over the last two years, driven by a period of stability in the automotive industry. Key automotive applications of TPU films include exterior applications such as paint protection, scratch protection, anti-stone chipping, cowl protection, and rear bumper protection.The TPU film market is gaining momentum globally due to its unique combination of properties, including flexibility, durability, abrasion resistance, and chemical stability. These films are widely used across various industries, including automotive, medical, construction, textiles, and electronics. Their ability to be customized for specific performance requirements, including UV resistance, antimicrobial properties, and breathability, makes them a preferred choice over traditional polymers. The market is segmented by chemical class (polyether, polyester, polycaprolactone), each offering distinct advantages for different applications.

The leisure sports industry in North America and Europe has reached a state of maturity. However, strong economic development in the Asia-Pacific region has led to an increase in disposable income. This is expected to lead to growth in the leisure sports industry in the region, which in turn is anticipated to drive demand for TPU films.

Drivers, Opportunities & Restraints

One of the primary drivers of the thermoplastic polyurethane (TPU) film market is the automotive industry's shift toward lightweight, high-performance materials. TPU films are increasingly used in interior trims, seat upholstery, and protective coatings due to their superior abrasion resistance and flexibility. As electric vehicle adoption accelerates, manufacturers are turning to TPU films to reduce vehicle weight and improve energy efficiency, especially in battery insulation and lightweight components.

Furthermore, the growing emphasis on sustainability presents a significant opportunity for TPU film manufacturers. Bio-based TPU films, derived from renewable resources, are gaining traction as industries seek eco-friendly alternatives to PVC and other non-recyclable materials. These films offer comparable performance while reducing environmental impact, aligning with global regulatory trends and consumer preferences for green products.

Despite its advantages, the TPU film market faces challenges related to raw material price volatility. TPU production relies on petrochemical derivatives, and fluctuations in crude oil prices can significantly impact manufacturing costs. This unpredictability affects profit margins and makes long-term pricing strategies difficult for suppliers and buyers alike.

Market Concentration & Characteristics

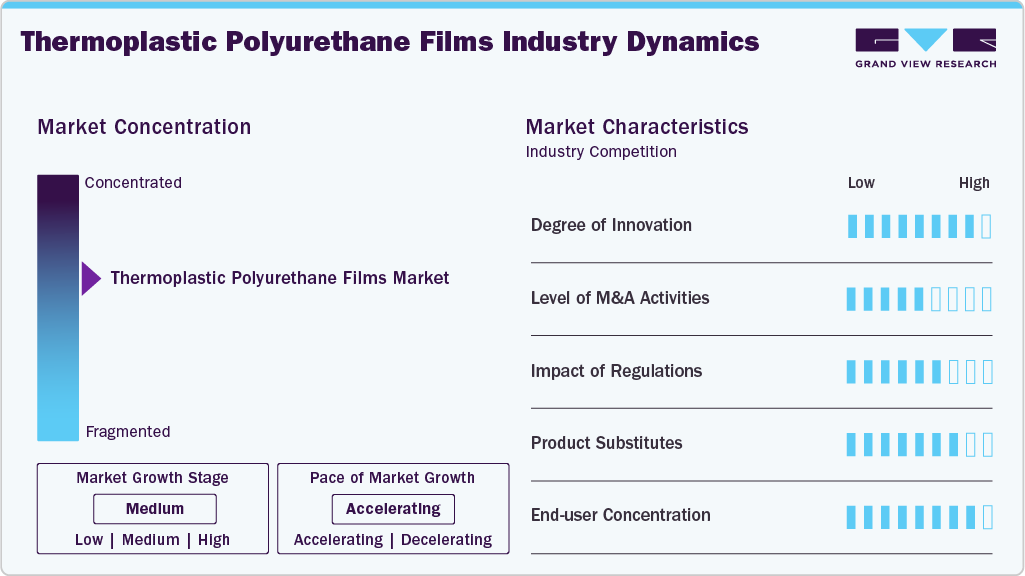

The market growth stage of the thermoplastic polyurethane films market is high, and the pace is accelerating. The market is characterized by a high degree of innovation, with manufacturers integrating advanced technologies like nanotechnology and hybrid polymer systems. Innovations include antimicrobial TPU films for healthcare, breathable membranes for sportswear, and recyclable formulations for packaging. Companies are also exploring biodegradable TPU variants and smart films with embedded sensors, reflecting a shift toward multifunctional and sustainable solutions.

Mergers and acquisitions in the TPU film industry are moderate but strategic, often aimed at expanding geographic reach or enhancing product portfolios. Key players have engaged in partnerships and acquisitions to strengthen their position in high-growth regions, such as the Asia Pacific. These activities are driven by the need to consolidate capabilities, access new technologies, and respond to evolving customer demands.

Regulatory frameworks play a pivotal role in shaping the market. In Europe, REACH regulations mandate the elimination of hazardous substances, prompting innovation in bio-based TPU formulations. In North America, compliance with FDA and Proposition 65 standards influences product design and sourcing strategies.

TPU films face competition from materials like PVC, polyethylene, and polypropylene, which are often cheaper and more widely available. However, TPU films outperform these substitutes in terms of flexibility, abrasion resistance, and environmental durability. The emergence of bio-based TPU films further strengthens their position by offering a sustainable alternative to traditional plastics, especially in premium applications.

The end-user concentration in the market for TPU film is notably high in automotive, medical, and construction sectors. The automotive sector accounts for over 35% of global demand, followed by medical at 28% and construction at 18%. These industries require materials with specific performance attributes, making TPU films a critical component. The concentration is expected to deepen as these sectors evolve toward lightweight, sustainable, and multifunctional materials.

Product Insights

Based on product, the global market is bifurcated into polyether, polyester, and polycaprolactone. Among these, the polyether segment accounted for the largest share with 47.83% of the global market in 2025. It is anticipated that it will maintain its appeal during the forecast period. Compared to polyester or polycaprolactone films, polyether TPU films have the lowest specific gravity and are gentler to the touch. These films are frequently employed in a wide range of products, including blood pressure cuffs, infusion bags, and surgical gowns. High UV stability, low-temperature flexibility, body oil resistance, and moisture resistance are all key characteristics of polyether TPU films.

Polyester TPU films are suitable for a range of laminates because they work well with polar plastics, such as polyvinyl chloride (PVC). Industrial aprons, conveyor belts, fabric laminates, gel pads, and medical packaging are common places to find these films. Excellent fungus resistance, abrasion resistance, strength, and durability, and oil and chemical resistance are all characteristics of polyester TPU film.

Application Insights

On the basis of application, the market is segment into automotive, railways, leisure & sports, energy, building & construction, furniture, aerospace, and other applications. The automotive segment accounted for the largest share of the market at 25.51% in 2025. The increasing use of TPU films in automotive components, such as instrument panels, levers, and sensors, is expected to drive market growth in automotive applications.

TPU films are widely used in the aerospace industry for armrest surfaces, interior panels, seat cushions, masks, and aircraft wire & cable jacketing. The growing aviation sector, driven by technological advancements and the increasing use of thermoplastics in aircraft, is expected to propel the TPU films market over the forecast period.

Polyester-based TPU film can withstand higher temperatures and is, therefore, a better choice for applications used in hot climates or high-heat conditions. The use of TPU films provides excellent surface protection for solar panels and windmill blades. The future demand for TPU films in energy applications is expected to stem from an increase in the installation of windmills and solar panels across the globe.

Low temperature flexibility refers to the ability to withstand the harshness of subzero environments, where materials often become brittle and crack. For extremely low temperatures, polyether-based TPU films offer a superior solution compared to polyester-based TPU films. The use of TPU films on the surfaces of airplanes and helicopters makes them resistant to wear and tear from adverse weather conditions.

Regional Insights

The thermoplastic polyurethane films industry in the Asia Pacific held the largest share of 33.61% in 2025. It is driven by rapid industrialization, expanding automotive production, and rising demand for high-performance materials in textiles and electronics. Countries such as China, India, Japan, and South Korea are investing heavily in infrastructure and consumer goods, driving demand for durable, flexible, and lightweight films. The region also benefits from cost-effective manufacturing and a growing shift toward sustainable TPU variants, making it the fastest-growing market globally.

China Thermoplastic Polyurethane Films Market Trends

The China thermoplastic polyurethane films industry leads the Asia Pacific market, driven by robust growth in the automotive, electronics, and medical sectors. The country’s push for electric vehicles and smart manufacturing has accelerated the adoption of TPU films in battery insulation, protective coatings, and flexible electronics. Domestic innovation, coupled with government incentives for sustainable materials, is propelling the development of bio-based TPU films and advanced multilayer variants tailored for harsh environmental conditions.

The thermoplastic polyurethane films industry in India is expanding steadily, supported by growth in technical textiles, healthcare, and consumer electronics. The rise of the medical devices industry and increased demand for breathable, biocompatible films in wound care and surgical applications are key drivers. In addition, India’s booming e-commerce and packaging sectors are creating new opportunities for TPU films in flexible, durable, and recyclable packaging solutions.

North America Thermoplastic Polyurethane Films Market Trends

The thermoplastic polyurethane films industry in North America remains a key contributor to the global market, with strong demand from automotive, aerospace, and healthcare industries. The region is witnessing increased adoption of TPU films in electric vehicles, wearable technology, and medical devices due to their superior abrasion resistance and biocompatibility. Innovation in bio-based TPU and regulatory support for sustainable materials are further enhancing market growth across the U.S., Canada, and Mexico.

The U.S. thermoplastic polyurethane films industryisdriven by its advanced healthcare infrastructure and leadership in automotive innovation. TPU films are widely used in medical-grade applications, flexible electronics, and protective coatings. The country’s focus on sustainability has led to increased investment in recyclable and bio-based TPU films, with manufacturers prioritizing eco-friendly formulations to meet evolving regulatory standards.

Europe Thermoplastic Polyurethane Films Market Trends

The thermoplastic polyurethane films industry in Europeis characterized by high regulatory standards, strong environmental policies, and a mature industrial base. Demand is concentrated in automotive, construction, and sportswear sectors, where TPU films offer lightweight, durable, and recyclable alternatives to traditional materials. The EU’s Circular Economy Action Plan is accelerating the shift toward bio-based TPU films, with countries such as Germany and France leading the way in R&D and innovation.

The Germany thermoplastic polyurethane films industry stands out as Europe’s fastest-growing TPU film market, thanks to its robust automotive and electronics manufacturing sectors. The country’s emphasis on precision engineering and sustainability has driven demand for high-performance TPU films in EV components, smart textiles, and industrial coatings. German manufacturers are also pioneering advancements in antimicrobial and breathable TPU films for healthcare and consumer applications.

Central & South America Thermoplastic Polyurethane Films Market Trends

The thermoplastic polyurethane films industry in Central & South America is gaining traction, particularly in Brazil, Argentina, and Chile, where automotive and construction sectors are expanding. The region is seeing increased use of TPU films in waterproofing membranes, protective gear, and flexible packaging. While the market is still developing, rising awareness of sustainable materials and growing demand for durable consumer goods are expected to boost adoption in the coming years.

The Brazil thermoplastic polyurethane films industry isfueled by its large automotive base and growing demand for medical and consumer applications. TPU films are increasingly used in footwear, flexible electronics, and protective coatings. The country’s shift toward locally sourced and recyclable materials is encouraging manufacturers to invest in bio-based TPU production, aligning with global sustainability trends.

Middle East & Africa Thermoplastic Polyurethane Films Market Trends

The thermoplastic polyurethane films industry in the Middle East & Africa region is emerging as a promising market for TPU films, driven by infrastructure development, healthcare modernization, and rising demand for durable materials in harsh climates. Applications in construction, medical packaging, and automotive interiors are expanding, with countries, including the UAE and South Africa, investing in advanced manufacturing and sustainable technologies.

The Saudi Arabia thermoplastic polyurethane films industry is the fastest-growing TPU film market in the Middle East, supported by Vision 2030 initiatives and diversification of its industrial base. The country is experiencing a growing demand for TPU films in the construction, automotive, and healthcare sectors. Investments in smart cities, renewable energy, and medical infrastructure are creating new opportunities for high-performance and eco-friendly TPU film applications.

Key Thermoplastic Polyurethane Films Company Insights

The market is fragmented across the globe, as many small manufacturers are trying to enter the market with new production technology. Competition between companies is largely based on the quality of the products offered and the latest technology & innovation implemented in film production. The production base for most thermoplastic polyurethane films is primarily concentrated in North America and the Asia Pacific region. Thus, manufacturers from Europe must plan and optimize their raw material procurement, taking into account both financial and regional viability. Companies are investing substantial amounts in new product launches, mergers & acquisitions, and R&D activities and innovation to gain a competitive advantage.

Key Thermoplastic Polyurethane Films Companies:

The following are the leading companies in the thermoplastic polyurethane films market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Covestro AG

- Huntsman International LLC

- 3M

- AVERY DENNISON CORPORATION

- ARGOTEC (a Mativ brand)

- AMERICAN POLYFILM, INC.

- Dongguan Xionglin New Material Technology Co., Ltd.

- Permali Gloucester Ltd.

Recent Developments

-

In December 2025, BASF, San Fang Chemical Industrial Co., Ltd., and Nichetech Advanced Materials Co., Ltd. signed an MoU to develop sustainable TPU solutions for the footwear industry, aligned with net-zero carbon targets by 2050. The collaboration’s first milestone is the launch of GRS-certified TPU films that incorporate recycled materials, while maintaining high performance, durability, and flexibility. This supports circular economy goals through the combined expertise in TPU technology, recycled polyols, and film manufacturing.

-

In October 2025, Huntsman International LLC expanded its thermoplastic polyurethane (TPU) distribution partnership with WOBATEK GmbH, a specialist in engineering plastics for Central and Eastern Europe. Under the new agreement, WOBATEK will distribute Huntsman's AVALON, IROGRAN, and IROSTIC TPU products across Austria, Poland, Southern Germany, the Czech Republic, and Switzerland. This collaboration leverages WOBATEK’s expertise in injection molding and technical applications, broadening access to Huntsman’s durable, flexible, and sustainable TPU solutions for innovative product designs.

Thermoplastic Polyurethane Films Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 466.36 million

Revenue forecast in 2033

USD 716.82 million

Growth rate

CAGR of 6.3% from 2026 to 2033

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Report Segmentation

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; South Korea, Australia; Southeast Asia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

BASF SE; Covestro AG; American Polyfilm Inc.; 3M; Avery Dennison; Permali Gloucester Limited; Huntsman Corporation; ARGOTEC (a Mativ brand); Dongguan Xionglin New Material Technology Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Thermoplastic Polyurethane Films Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global thermoplastic polyurethane films market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Polyether

-

Polyester

-

Polycaprolactone

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Railway

-

Leisure

-

Energy

-

Building & Construction

-

Furniture

-

Aerospace

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the TPU films market include: PAR Group, BASF SE, The Lubrizol Corporation, American Polyfilm Inc., 3M, Avery Dennison, MH&W International Corporation, Plastic Film Corporation, Perfectex Plus LLC., Permali Gloucester Limited, Bayer MaterialScience, and Huntsman Corporation.

b. Key factors driving the TPU films market growth include the booming automobile industry in the Asia Pacific and rising demand for films for making waterproof gloves and costumes, breathable socks, footwear and hats.

b. The global thermoplastic polyurethane films market size was estimated at USD 443.69 million in 2025 and is expected to reach USD 466.36 million in 2026.

b. The global thermoplastic polyurethane films market is projected to grow at a compound annual growth rate (CAGR) of 6.3% from 2026 to 2033, reaching USD 716.82 million by 2033.

b. Automotive dominated the thermoplastic polyurethane film market, accounting for 25.51% in 2024. This is attributable to rising applications for airbags, acoustic panels, door panels, and anti-vibration panels.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.