- Home

- »

- Homecare & Decor

- »

-

Toys And Games Market Size, Share & Growth Report, 2030GVR Report cover

![Toys And Games Market Size, Share & Trends Report]()

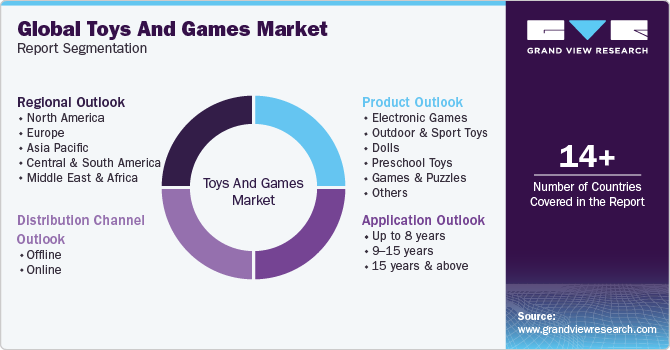

Toys And Games Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Up To 8 Years, 9-15 Years), By Distribution Channel (Online, Offline), By Product (Preschool Toys, Electronic Games), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-209-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Toys And Games Market Summary

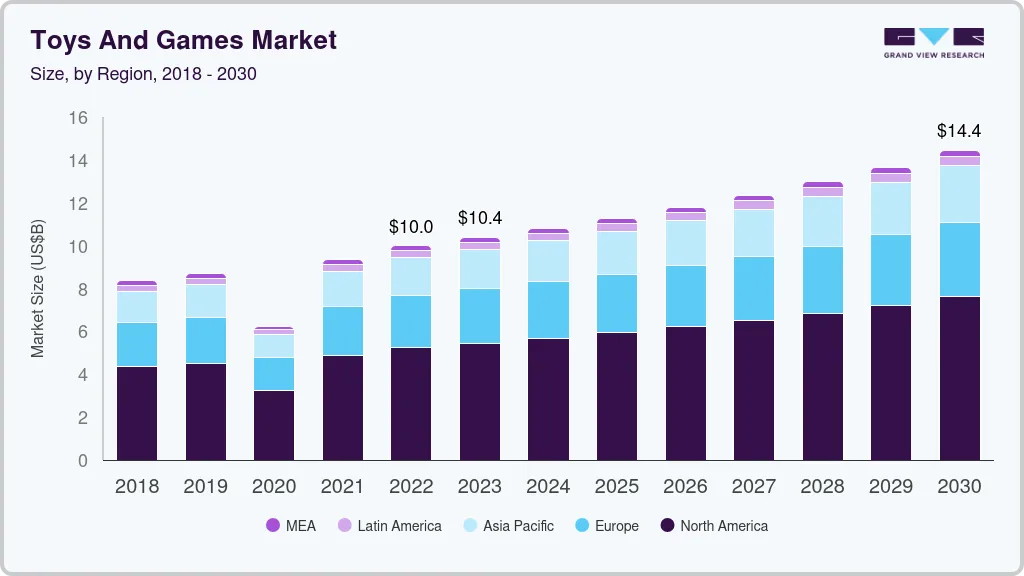

The global toys and games market size was estimated at USD 324.66 billion in 2023 and is projected to reach USD 439.91 billion by 2030, growing at a CAGR of 4.3% from 2024 to 2030. The toys and games industry is expanding due to various factors, such as parents’ increased interest in green toys, the resurgence of conventional toys & video games, awareness about the cognitive benefits of building toys, and the rising popularity of mobile-based gaming.

Key Market Trends & Insights

- The toys & games market in Asia Pacific accounted for 40% of the global revenue share in 2023.

- The India toys and games market is projected to grow at a CAGR of nearly 5.0% from 2024 to 2030.

- By product, the electronic games segment held the largest revenue share of over 52% in 2023.

- By application, the 15 years and above age group accounted for the market share of about 48% in 2023.

- By distribution channel, the offline sales of toys and games held a market share of 54% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 324.66 Billion

- 2030 Projected Market Size: USD 439.91 Billion

- CAGR (2024-2030): 4.3%

- Asia Pacific: Largest market in 2023

The growth of the traditional toys and games market is also expected to be driven by the increased popularity of traditional recreational activities such as construction sets and puzzles among younger generations. Millennials’ growing predilection for old-school games at social gatherings is likely to propel the market growth. Companies are actively shifting their product offerings by launching e-stores and retailing products through e-commerce platforms, such as Amazon, Walmart Online, and eBay.

This is largely because online platforms have emerged as a viable and cost-effective alternative to physical marketing and sales. People stayed at home owing to the lockdown and looked for indoor games online. Amazon sales of Curtis McGill and Scott Houdashell’s toy companies increased by 4,000% year over year in March 2020. Their in-store sales in Walmart increased by 100%. The demand for dolls remains high due to their appeal to children and collectors alike. Iconic dolls, like Barbie, play a significant role in driving this demand, as they have established a strong brand presence, diverse product lines, and cultural significance, capturing the imagination and preferences of generations of consumers.

Mattel, a U.S.-based toy manufacturer that also sells Barbies, reported sales of about USD 2.3 billion for its doll division. Barbie alone garnered sales of around USD 1.679 billion, or 73% of the dolls category, and about 27% of the whole revenue. Games and toys that incorporate STEM concepts and challenges provide a valuable learning experience for children while also being entertaining and enjoyable. This has led to an increase in the production and sales of STEM-related games and toys in the market. In April 2023, Ambessa Play, a social enterprise producing STEM products for children partnered with Pentagram to launch a DIY wind-up flashlight kit after gathering feedback from parents for “screen-free” toys. The product was launched on Kickstarter and was made available till the end of April.

Market Concentration & Characteristics

The toys & games market is fragmented, and is witnessing medium growth. The degree of innovation in the market is high. The market is witnessing a growth of tech-based toys. Sustainability and digitalization are among the key focus areas in the toys and games industry.

Companies in the market are increasingly undergoing mergers and collaborations. For instance, in May 2023, Mattel and Hasbro entered a multi-year licensing agreement to create co-branded toys and games. This collaboration will see Hasbro creating Barbie-branded Monopoly games, while Mattel will produce Transformers-branded UNO games and Hot Wheels vehicles. This will provide opportunity for both companies through broader reach and greater visibility.

The regulatory landscape of the market involves safety and material-related regulations. In the U.S., toymakers are required to adhere to mandatory safety regulations outlined in the Consumer Product Safety Act and the CPSIA. The CPSC's ASTMF963-17 sets the standard for toy safety, encompassing test methods, and chemical and material safety requirements. These regulations ensure that toys and games meet specific safety standards, ultimately safeguarding consumers, particularly children, from potential hazards associated with toys. Compliance with these regulations is crucial for manufacturers.

There is a growing shift in children's preferences from traditional toys and games to digital forms of entertainment such as video games, mobile apps, and virtual reality experiences. Digital entertainment has affected the traditional toys and games market.

End-users particularly include children and younger adults. However, retailers and manufacturers are currently tapping the demand for senior-friendly games. In June 2023, Hasbro partnered with Ageless Innovation to release senior-friendly versions of classic board games like Scrabble, Trivial Pursuit, and The Game of Life, aiming to promote intergenerational play.

Product Insights

The electronic games segment held the largest revenue share of over 52% in 2023. Consumer spending on video content, Virtual Reality (VR) items, and video game tournaments has increased significantly with technological developments. Due to reasons, such as the proliferation of mobile and online gaming, as well as the move from physical to digital software distribution, the market is seeing exponential growth. Many toymakers invest heavily in content production centered around their flagship products, use the content as lead generators, and create interactive play experiences to add value to their physical products because of the shift from products to a more service-oriented model that has transformed many industries.

The games and puzzles segment is projected to grow at a CAGR of 7.5% from 2024 to 2030. According to NDP, the popularity of board games has resulted in a 48% increase in sales year to date (2021). Board games have seen a renaissance at home, from chess to Chutes and Ladders and Exploding Kittens. Moreover, the launch of many innovative and unique puzzles has also been playing a crucial role in the segment’s growth. In January 2021, Theory11, in collaboration with Star Wars, launched ‘The Mandalorian’ playing cards. The premium deck features custom artwork on each card, illustrating Aces, Jokers, and court cards with characters from the show, like Mando, Baby Yoda, IG-11, Moff Gideon, and Cara Dune.

Application Insights

The 15 years and above age group accounted for the market share of about 48% in 2023. The growth of this segment is mainly driven by the emergence of the ‘kidult’ section in the toys & games industry. In order to appeal directly to the kidult market, players have been strategizing to control and leverage this market segment. For instance, in June 2023, Major League Soccer, adidas, and Marvel teamed up to launch a Super Hero-inspired collection featuring Avengers-themed warm-up jackets, pants, and match balls. This collaboration celebrates soccer in North America and offers fans unique ways to engage with their favorite teams and characters.

Key industry players are responding to this demand by launching innovative products that cater to children's developmental needs. A division of Candle Media called Moonbug Entertainment announced the global release of CoComelon HugMees in February 2023. It was a new line of plush toys named, Squishmallows from the renowned plush company, Jazwares. These goods provide a special method for kids to enjoy and engage with favorite characters as CoComelon is a popular show among toddlers all around the world. Characters in the collection include JJ, a crowd favorite, and his closest friends Cody, Nico, Nina, Cece, and Bella.

Distribution Channel Insights

The offline sales of toys and games held a market share of 54% in 2023. Consumers often prefer shopping for toys and games in physical stores as it allows them to see, touch, and interact with the products before making a purchase, providing a tangible and immersive experience that online shopping may not offer. Nintendo, a Japanese company, inaugurated its largest store to date in Osaka in November 2022. Following locations in Tokyo and New York, this was the company's third official store and its largest in Japan. The company's ambition to enter merchandising and diversify outside its traditional core of video game and console sales includes the opening of the store.

The online sales of toys and games is estimated to grow at a CAGR of 5.1% during the forecast period of 2024 to 2030. Aggregators and manufacturer-hosted e-commerce websites are part of the online segment. Manufacturers have recognized the channel’s potential and are hosting shopping websites to better serve customer demands while increasing profit margins. To accommodate the increased demand for e-commerce, companies, such as Hasbro and Mattel, extended their direct-to-consumer businesses. Similarly, FAO Schwarz and Hamley’s of London, two key players, are also pursuing digital opportunities. With an eBay shop, Hamley’s of London increased its online footprint, giving its whole variety of toys and games to eBay’s 28 million UK users.

Regional Insights

The toys and games market in North America is expected to grow at a CAGR of about 3.6% during the forecast period. Teenagers in this region spend a lot of their free time bonding with family or friends over social media by playing innovative board games, Xbox, and the games available on the Facebook gaming deck. Product manufacturers have recognized the market potential and launched products specifically targeting the masses.

U.S. Toys And Games Market Trends

The toys and games market in the U.S. accounted for nearly 74% revenue share of North America in 2023 and is projected to witness growth over the forecast period, owing to the increasing popularity of educational toys and STEM-focused games that parents seek to provide their children with entertainment and learning opportunities. Popular media and entertainment franchises, with licensed toys and games based on movies, TV shows, and video games are becoming increasingly popular among consumers. This is anticipated to fuel the regional market growth.

Asia Pacific Toys And Games Market Trends

The toys & games market in Asia Pacific accounted for 40% of the global revenue share in 2023. With the presence of more than half of the world's population and the economies of nations like China and India expanding, there are abundant chances for market expansion in this area. The world's greatest producer and exporter of children's items and toys is China. The Associated Press described China's heightened industry activity post-lockdown in a March 2023 report. The indexes for output, export, and new orders all rose, and the official China Federation of Logistics & Purchasing returned to levels that suggest expanding activity.

The India toys and games market is projected to grow at a CAGR of nearly 5.0% from 2024 to 2030 on account of the launch of platforms with diversified toys and games. In August 2022, Amazon launched a Made in India toy store, which includes traditional toys, handmade toys, and educational toys. This initiative by the e-commerce platform will enable Indian sellers to sell locally produced toys. In October 2023, Hasbro launched a new board game, Monopoly Cricket. These product launches are projected to support the growth of the board games market in India.

Middle East & Africa Toys And Games Market Trends

The toys & games market in Middle East & Africa is projected to grow at a CAGR of around 3.2% from 2024 to 2030. Market players are responding to the rising demand for toys and games by expanding their product offerings and establishing a stronger presence in the region. They are increasing their distribution networks, collaborating with local retailers, and introducing culturally relevant toys to cater to the specific preferences and needs of consumers in these markets. For instance, in October 2022, LEGO Group opened its new store in the Mall of Africa located in South Africa. The Great Yellow Brick Company, the South African licensee for the Lego Certified Store concept, established the initial four locations in 2018 and 2019 and is currently looking to expand its physical retail footprint to further the reach of the Lego brand. With its vibrant colors, digital displays, and distinctive Lego pieces, this new store is intended to provide a more sophisticated and engaging shopping experience.

The South Africa toys and games market is witnessing growth, with a wide variety of products available to cater to the diverse needs and interests of children. The market is mainly focused on educational and interactive toys that offer both fun and learning experiences for children and younger adults. The South Africa toys & games market is projected to grow at a CAGR of over 4.1% during the forecast period.

Key Toys And Games Company Insights

The global toys market is highly competitive, marked by the presence of numerous small-scale regional companies as well as multinational players such as BANDAI NAMCO Entertainment Europe S.A.S; LEGO System A/S; Hasbro; Mattel; JAKKS Pacific, Inc.; Sony Interactive Entertainment Inc.; Nintendo; Microsoft; and NetEase, Inc.

The presence of small-scale manufacturers across geographies acts as a counterbalance to multinational enterprises, therefore driving entrepreneurship and value-based product development. Since customers have an option of choosing between different brands, pricing also plays an important role in a manufacturer’s pursuit of higher sales. Strong partnerships with distributors and the establishment of exclusive retail agreements are the go-to policies of most toy and game manufacturers.

Key Toys And Games Companies:

The following are the leading companies in the toys and games market. These companies collectively hold the largest market share and dictate industry trends.

- Spin Master

- The LEGO Group

- SANRIO CO., LTD.

- Playmates Toys Limited

- JAKKS Pacific, Inc.

- Mattel

- Hasbro

- Schylling

- Bandai Namco Holdings Inc.

- Dream International Limited

Recent Developments

-

In February 2024, Rollic, a Zynga-owned company, and toy titan Mattel partnered to develop a Barbie game slated for release later this year. Mattel has highlighted this collaboration as a part of the continued growth of its licensed digital games portfolio.

-

In June 2023, Mattel, Inc. announced a new collection of Barbie dolls inspired by the highly anticipated film release, Barbie. Barbie the Movie dolls have looks that fans will recognize from the film, representing the distinctive fashions of Barbie, Ken, and new characters. From their first-look costumes to the matching sets they wore in the movie; the collection recreates the Barbiecore and Ken-ergy persona from the feature film.

-

In January 2023, Buffalo Games partnered with London-based indie games company Big Potato to distribute each other’s products in the UK and the U.S. Buffalo Games’ Chuckle & Roar line of toys and games will debut in the UK through Big Potato on Amazon and with a few select retail partners.

Toys And Games Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 341.12 billion

Revenue forecast in 2030

USD 439.91 billion

Growth rate

CAGR of 4.3% from 2024 to 2030

Actuals

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Germany; Spain; Italy; China; India; Japan; Australia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Spin Master; The LEGO Group; SANRIO CO., LTD.; Playmates Toys Limited; JAKKS Pacific, Inc.; Mattel; Hasbro; Schylling; Bandai Namco Holdings Inc.; Dream International Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Toys And Games Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global toys and games market report based on product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Electronic Games

-

Outdoor & Sport Toys

-

Dolls

-

Preschool Toys

-

Games & Puzzles

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Up to 8 years

-

9-15 years

-

15 years & above

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global toys and games market size was estimated at USD 324.66 billion in 2023 and is expected to reach USD 341.12 billion in 2024.

b. The global toys and games market is expected to grow at a compound annual growth rate of 4.3% from 2024 to 2030 to reach USD 439.91 billion by 2030.

b. The offline distribution channel dominated the global toys and games market with a share of 54.7% in 2023. This is attributable to the increase in product visibility at physical stores and flexible working hours where supermarkets or hypermarkets thereby ensuring maximum access.

b. Some key players in the global toys and games market include Lego; Mattel Inc.; Namco Bandai; Hasbro; Toy Quest, Sanrio Company Ltd., Konami Corporation, Integrity Toys, Inc., and Jakks Pacific.

b. Key factors that are driving the toys and games market growth include increasing launch of educational games, commercialization of favorite movies and cartoon characters, and an increasing number of video game tournaments and spending on video games.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.