Toxicity Testing Outsourcing Market Size, Share & Trends Analysis Report By Method (In Vitro, In Vivo), By GLP (GLP, Non GLP), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-978-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Toxicity Testing Outsourcing Market Trends

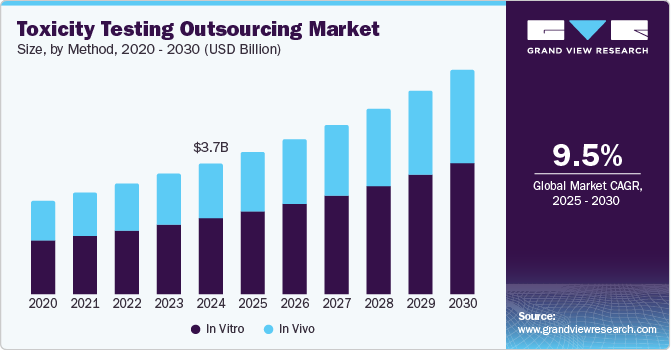

The global toxicity testing outsourcing market size was estimated at USD 3.71 billion in 2024 and is projected to grow at a CAGR of 9.52% from 2025 to 2030. There has also been a rise in demand for toxicity testing services due to increasing R&D spending by biopharmaceutical and pharmaceutical firms, and there has also been a rise in the number of innovative drugs, entering the preclinical stage of development. In addition, the COVID-19 pandemic has caused the market for outsourcing toxicity services to grow. This is due to the large number of research studies being performed on drugs, vaccines, and medical devices intended to treat and prevent coronavirus. This is anticipated to increase the use of toxicity testing services. There has been a significant increase in the demand for biologics as they treat complex conditions.

In addition, pharmaceutical and biopharmaceutical firms are operating in environments that are becoming increasingly difficult to navigate. Improvements in many therapeutic areas and the emergence of new types of therapies such as genetically targeted therapies, biologics, stem cell therapies, and other treatment modalities have resulted in more complex development and regulatory pathways. To develop a treatment that is secure and efficient, it is necessary to do toxicity testing at each stage, which is boosting the market's growth.

This has led notable trend of outsourcing toxicity testing to CROs in emerging nations to reduce costs and increase focus on core R&D functions. This is especially common among small- and mid-size pharmaceutical/biopharmaceutical companies that do not have an established R&D facility. These companies outsource toxicity testing activities to small- and mid-size outsourcing companies to focus more on the drug development process. Such factors are anticipated to drive the market.

Method Insights

On the basis of method segment, the market is segregated into In vitro, and In vivo. In 2024, the in vitro segment dominated the market, accounting for a revenue share of 57.97%. This growth is anticipated to be fueled by several factors, including increased product development activities, rising R&D spending, growing toxicological awareness, and an increasing preclinical pipeline. Furthermore, socio-ethical issues related to animal tests and the rising prices associated with traditional animal tests are expected to propel the market's growth for in-vitro toxicology testing. Moreover, in-vitro toxicity testing supports rapidly assessing therapeutic potential for drug-drug interactions. The test supports to identify potential toxicity at an early stage during drug discovery saves both time & development costs, further reducing late-stage failure. Such advancements in the in-vitro toxicity testing help to assess the safety of pharmaceuticals and the potential effects of those drugs on cells and tissues are anticipated to support market expansion.

The in-vivo segment is expected to register CAGR of 9.20% during the forecast period. The growth is due to increased preclinical studies and a focus on potential drug safety. The in vivo toxicity study supports evaluating a substance's effects, assessing its potential effect, and establishing the toxicological profiles of materials posing a significant human health risk via environmental exposure. Such factors are anticipated to drive the segment.

GLP Insights

On the basis of the GLP segment, the market is segmented to GLP, and Non GLP. GLP segment accounted for the larger market share in 2024. Clinical studies, including safety pharmacology, genotoxicity, and repeated toxicity, are mandatory for safe exposure to humans and must be performed as per the standards of GLP. These studies are required to be conducted prior to the IND application. After IND approval, other experiments of GLP are performed to evaluate chronic toxicity, developmental & reproductive toxicity, carcinogenicity, and genotoxicity must be carried out during the clinical phase of development.

The non-GLP segment is expected to register CAGR of 9.14% during the forecast period. In non-GLP the drug is required to undergo several steps, such as Absorption, Distribution, Metabolism, and Elimination (ADME); determination of drug availability and different preliminary studies that investigate the candidate’s safety, including safety pharmacology, general toxicology, mutagenicity, and genotoxicity. These preliminary studies are aimed at investigating the safety of drug candidates to obtain preliminary information on their tolerability in various systems and do not necessarily comply with GLP regulations. Besides, the test is performed to high standards of quality to ensure accurate & reliable study data that are needed to evaluate drugs.

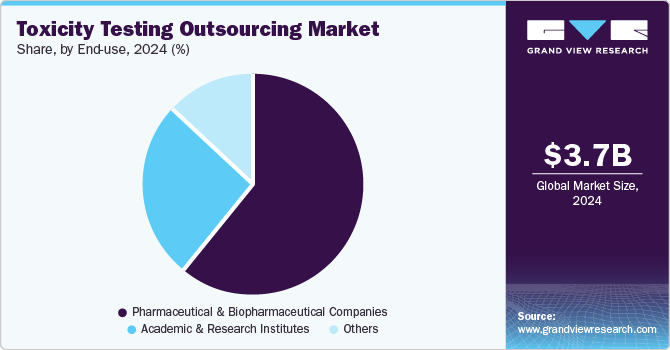

End-use Insights

On the basis of end-use segment, the market includes Pharmaceutical and Biopharmaceutical Companies, Academic and Research Institutes, and Others. In 2024, the pharmaceutical and biopharmaceutical companies segment dominated the market, accounting for a revenue share of 61.41%. This growth can be attributed to factors such as increasing trends of outsourcing end-to-end services, especially among small- and mid-size pharmaceutical companies that lack expertise in the preclinical toxicity testing phase of drug development. Moreover, the outsourcing services among pharmaceutical and biopharmaceutical companies is driven by increasing healthcare expenditure, rising demand for various therapeutics, R&D investments, and technological advancements. In addition, the growing number of drug pipelines among pharmaceutical and biopharmaceutical is expected to drive the growth of this segment throughout the forecast period.

The academic and research institutes segment is anticipated to register the fastest CAGR of 9.63% during the forecast period. The growing trends among academic organizations and government bodies outsourcing services to CROs, CDMOs and CMOs are anticipated to drive the segment growth. The toxicity testing outsourcing services certainly support the academic and research institute to accelerate research & approval of medicines with the potential to save lives. Moreover, market players offer a range of specialized services, including pharmacokinetics, formulation development, and toxicological research. Such factors are anticipated to drive the segment growth over the estimated time period.

Regional Insights

North America toxicity testing outsourcing market dominated the global market in 2024 with the largest share of 43.13%. This can be attributed to the growth of the pharmaceutical industries in the U.S. and Canada. In addition, the market players are increasingly focusing on expanding their product portfolio, enabling them to advance discoveries and deliver groundbreaking treatments to patients. In addition, increased focus on drug discovery by governmental organizations, increased healthcare spending, and the availability of well-established infrastructure are anticipated to drive the market. Besides, the presence of major players in this region is expected to contribute significantly to its growth. Furthermore, strict regulatory restrictions and the growing focus of pharmaceutical companies in the region to outsource toxicity testing further support the region’s growth.

U.S. Toxicity Testing Outsourcing Market Trends

The U.S. accounts for the highest share of the North America toxicity testing outsourcing market owing to the presence of established market players and increased concerns over illicit drug use. The significant presence of market players offering contract manufacturing services contributes to innovation and product launches of drugs across the U.S. market. In addition, pharmaceutical and biopharmaceutical companies must comply with strict & complex regulations and guidelines, which further increase the requirement for toxicity testing outsourcing services. For instance, in February 2023, the GLP test facility of the Fraunhofer Institute for Cell Therapy and Immunology mentioned that it has been certified for testing category 9, "Safety testing of ATMPs - immunogenicity/ immunotoxicity, biodistribution & tumorigenicity in vitro / in vivo" since 2009. Additionally, since January 2023, the testing category 2 "Toxicity studies," is now part of the portfolio. Such factors drive the U.S. market.

The toxicity testing outsourcing market in Canada is driven by increasing pressure to expedite the development of new therapies and the growing expansion of toxicity testing to innovate drugs with safety studies and quality assurance, further assessing the stability of the drug. For instance, Omega Laboratories mentioned the launch of urine drug of abuse testing services in its Canadian laboratory. In addition, in January 2023, the laboratory offered urine drug testing to complement molecular testing. The expansion of toxicology services will provide clients with an alternative to the limited testing options present in Canada. Such factors are expected to drive the country’s growth.

Europe Toxicity Testing Outsourcing Market Trends

The increasing demand for a range of pharmaceutical and biopharmaceutical drugs and a growing number of toxicological studies for different therapeutic applications drive Europe toxicity testing in the outsourcing market. Besides, toxicity testing outsourcing supports majorly the initial approval of a novel excipient in drug formulation. In addition, the rising expansion of new facilities and emerging R&D activities are changing market scenarios rapidly. Such factors are anticipated to drive the region’s growth.

Germany accounts for the highest share of the European toxicity testing outsourcing market owing to the growing number of clinical trials in the country, rising R&D investment, and growing continuous demand for pharmaceutical products. Additionally, emerging outsourcing service providers majorly help biopharmaceutical/ pharmaceutical companies reduce their setup costs for new drug manufacturing units.

The toxicity testing outsourcing market in the UK is driven by the increasing trend of outsourcing among pharmaceutical companies; technological advancements and expanding innovation among pharmaceutical and outsourcing companies have benefited the market growth. Hence, toxicity testing outsourcing services has emerged as a requirement among pharmaceutical companies in the country.

Asia Pacific Toxicity Testing Outsourcing Market Trends

Asia Pacific toxicity testing outsourcing market is expected to grow at a CAGR of 11.35% during the forecast period owing to the changing business model of outsourcing and rising costs of R&D, which is expected to increase toxicity testing outsourcing in the Asia Pacific, owing to the cost efficiency offered by CROs and CDMOs in countries such as India and China.

Japan's toxicity testing outsourcing market is driven by an increasing focus on developing pharmaceutical/biopharmaceutical drugs and growing strategic alliances with research organizations & universities. In addition, increasing demand for specialized studies to evaluate the safety & toxicity of new pharmaceutical compounds is anticipated to drive the market.

The toxicity testing outsourcing market in China is driven by a growing number of clinical trials, increasing the burden of diseases, growing adoption of cutting-edge technologies, and developing clinical research infrastructure. Besides, the market in the country is expected to witness rising demand for toxicity testing due to increasing focus on assessing drug safety in the discovery process. Besides, the availability of medical practitioners is further boosting the growth of the Asia Pacific market

The increasing presence of pharmaceutical and biopharmaceutical companies drives India's toxicity testing outsourcing market. The growing presence of CDMOs and CMOs has led to a rise in the demand for toxicity testing outsourcing market services. In addition, growing research activities to identify potential toxicity in drug development have fueled market growth.

Key Toxicity Testing Outsourcing Company Insights

The market players operating across the toxicity testing outsourcing are seeking to enhance their customer base, production capacities, and market presence with the adoption of in-organic strategic initiatives such as service launches, partnerships & agreements, expansions, mergers & acquisitions, and others to increase market presence & revenue and gain a competitive edge drives the market growth. Hence, growing strategic initiatives are expected to boost the market share of prominent players operating across the market. For instance, in November 2023, Scantox A/S, a leading Nordic preclinical Contract Research Organization (CRO), acquired Solural Pharma in Denmark. This acquisition strengthens Scantox's ability to meet customer demand and offers a full-service solution for pharmaceutical, biotech, and medical device companies.

Key Toxicity Testing Outsourcing Companies:

The following are the leading companies in the toxicity testing outsourcing market. These companies collectively hold the largest market share and dictate industry trends.

- Eurofins Scientific

- SGS SA

- Charles River Laboratories

- Thermo Fisher Scientific, Inc

- Intertek Group plc

- Catalent, Inc

- ICON plc

- Med pace

- Wuxi AppTec

- Labcorp Drug Development

Recent Developments

-

In February 2024, Danaher Corporation & Cincinnati Children's Hospital Medical Center mentioned a collaboration for patient safety by addressing a cause of failure in clinical trials. The collaboration will further strengthen liver organoid technology as a drug toxicity screening solution for patients' safety and accelerate the development of new therapies.

-

In July 2023, Broughton launched an Extractables & Leachables testing service with a integrated approach combining technical & analytical services, in-house toxicology consultancy, and regulatory compliance support.

Toxicity Testing Outsourcing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 4.04 billion |

|

Revenue forecast in 2030 |

USD 6.36 billion |

|

Growth rate |

CAGR of 9.52% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Method, GLP, end-use, region |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Eurofins Scientific; SGS SA; Charles River Laboratories; Thermo Fisher Scientific, Inc; Intertek Group plc; Catalent, Inc; ICON plc; Med pace; Wuxi AppTec; Labcorp Drug Development |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

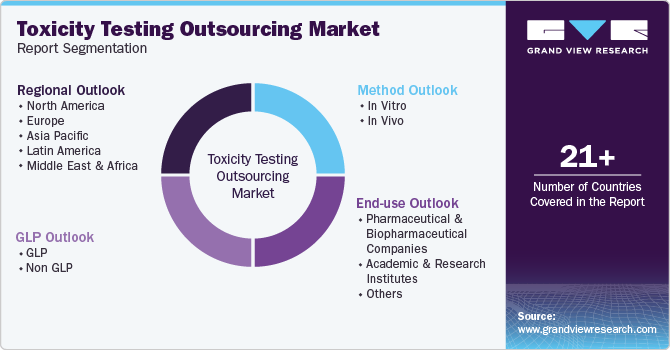

Global Toxicity Testing Outsourcing Market Report Segmentation

This report forecasts revenue growth at the regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the toxicity testing outsourcing market report on the basis of method, GLP, end-use and region:

-

Method Outlook (Revenue, USD Million, 2018 - 2030)

-

In vitro

-

In vivo

-

-

GLP Type Outlook (Revenue, USD Million, 2018 - 2030)

-

GLP

-

Non GLP

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical And Biopharmaceutical Companies

-

Academic And Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

China

-

India

-

Japan

-

Thailand

-

South Korea

-

Australia

-

Latin America

-

Brazil

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. The global toxicity testing outsourcing market size was estimated at USD 3.71 billion in 2024 and is expected to reach USD 4.04 billion in 2025.

b. The global toxicity testing outsourcing market is expected to grow at a compound annual growth rate of 9.52% from 2025 to 2030 to reach USD 6.36 billion by 2030.

b. North America dominated the toxicity testing outsourcing with a share of 43.13% in 2024. This can be attributed to the growth of the pharmaceutical industries in the U.S. and Canada. In addition, the market players are increasingly focusing on expanding their product portfolio, enabling them to advance discoveries and deliver groundbreaking treatments to patients.

b. Some of the key market players include Eurofins Scientific, SGS SA, Charles River Laboratories, Thermo Fisher Scientific, Inc, Intertek Group plc, Catalent, Inc, ICON plc, Med pace, Wuxi AppTec, Labcorp Drug Development

b. Key factors that are driving the market growth include the growing number of biologics in the preclinical pipeline coupled with increasing trend of outsourcing in biopharmaceutical companies and increasing R&D spending by biopharmaceutical and pharmaceutical companies.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."